Oklahoma Sample Letter for Official Notice of Intent to Administratively Dissolve or Revoke

Description

How to fill out Sample Letter For Official Notice Of Intent To Administratively Dissolve Or Revoke?

Are you in the placement that you need files for possibly business or personal reasons virtually every day time? There are a lot of legitimate papers templates available online, but getting types you can trust is not simple. US Legal Forms delivers a huge number of form templates, like the Oklahoma Sample Letter for Official Notice of Intent to Administratively Dissolve or Revoke, which are composed to meet state and federal requirements.

If you are currently acquainted with US Legal Forms website and possess a merchant account, simply log in. Following that, you are able to obtain the Oklahoma Sample Letter for Official Notice of Intent to Administratively Dissolve or Revoke format.

Should you not offer an profile and wish to begin using US Legal Forms, follow these steps:

- Discover the form you require and ensure it is to the correct town/state.

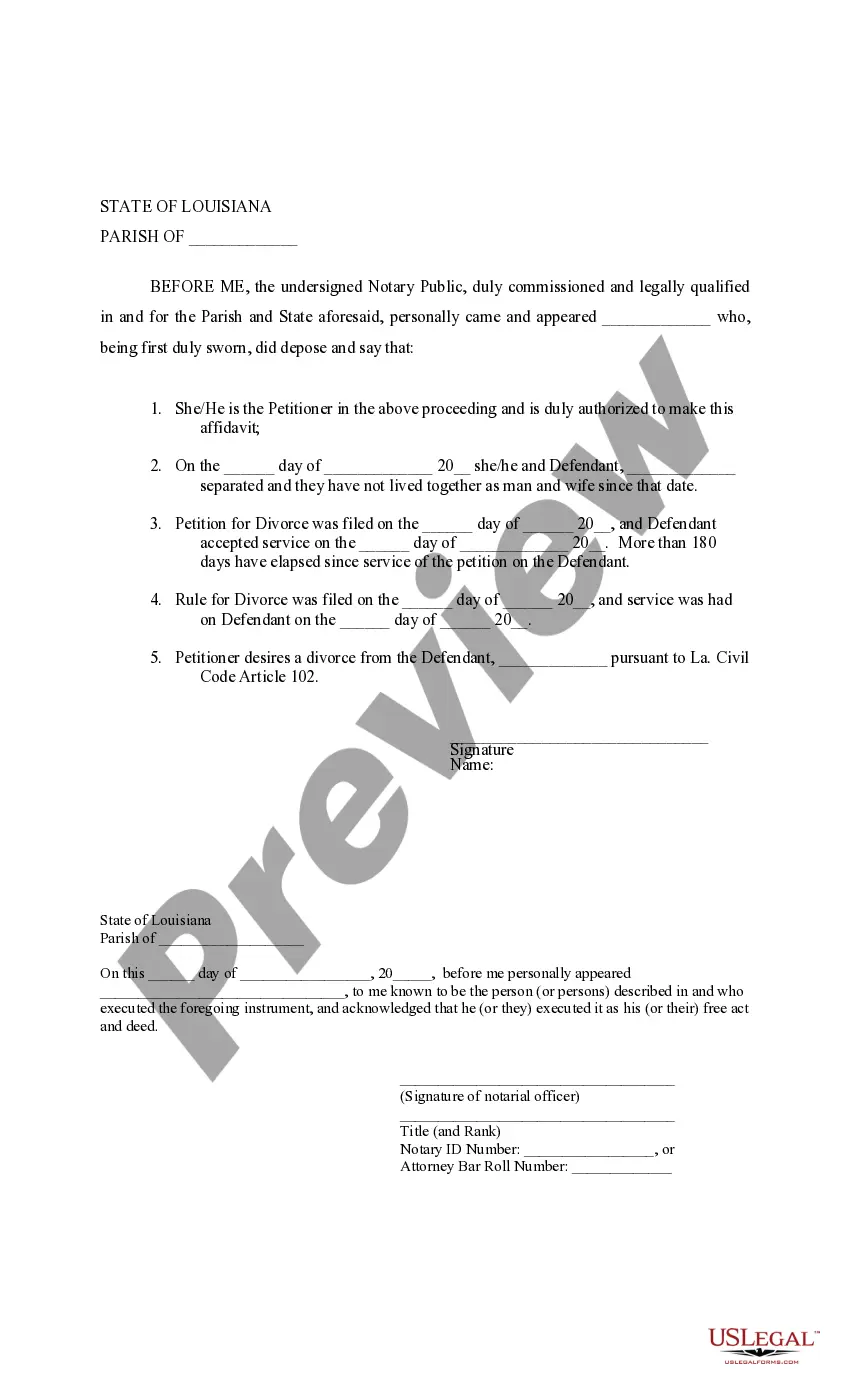

- Utilize the Preview key to review the form.

- Browse the information to ensure that you have selected the proper form.

- When the form is not what you are trying to find, use the Research area to obtain the form that meets your requirements and requirements.

- Once you find the correct form, click on Get now.

- Pick the prices program you want, complete the necessary information and facts to create your account, and purchase the order making use of your PayPal or Visa or Mastercard.

- Select a handy file format and obtain your copy.

Locate every one of the papers templates you may have purchased in the My Forms menus. You can get a further copy of Oklahoma Sample Letter for Official Notice of Intent to Administratively Dissolve or Revoke any time, if necessary. Just click on the required form to obtain or print the papers format.

Use US Legal Forms, the most substantial variety of legitimate varieties, to save lots of time and avoid errors. The support delivers skillfully created legitimate papers templates which you can use for a selection of reasons. Create a merchant account on US Legal Forms and start generating your way of life easier.

Form popularity

FAQ

What is a business dissolution? A business dissolution is a formal closure of a business with the state. A small business cannot hang up a ?closed? or ?out of business? sign outside their storefront, turn off the lights, and lock their doors to be considered a dissolved business.

Administrative dissolution is the taking away of the rights, powers, and authority of a domestic corporation, LLC, or other statutory business entity by the state administrator overseeing business entities, due to the entity's failure to comply with certain obligations of the business entity statute.

People who continue to operate a business that has been dissolved, are taking a serious risk. That's because once the company dissolves, the corporate protections no longer exist. That means that someone who operates the dissolved business, can be sued personally for anything the (dissolved) company does.

Once a company is dissolved, it no longer exists as a legal entity and cannot conduct business or enter into contracts. Dissolution may also trigger a number of certain legal obligations, such as the distribution of remaining assets to creditors or shareholders. It also might involve the filing of final tax returns.

This is often known as ?revocation? for foreign registrations and ?administrative dissolution? for domestic entities. If a corporation or LLC is inactive by means of revocation or administrative dissolution, it cannot legally transact business in a state.