Oklahoma Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust

Description

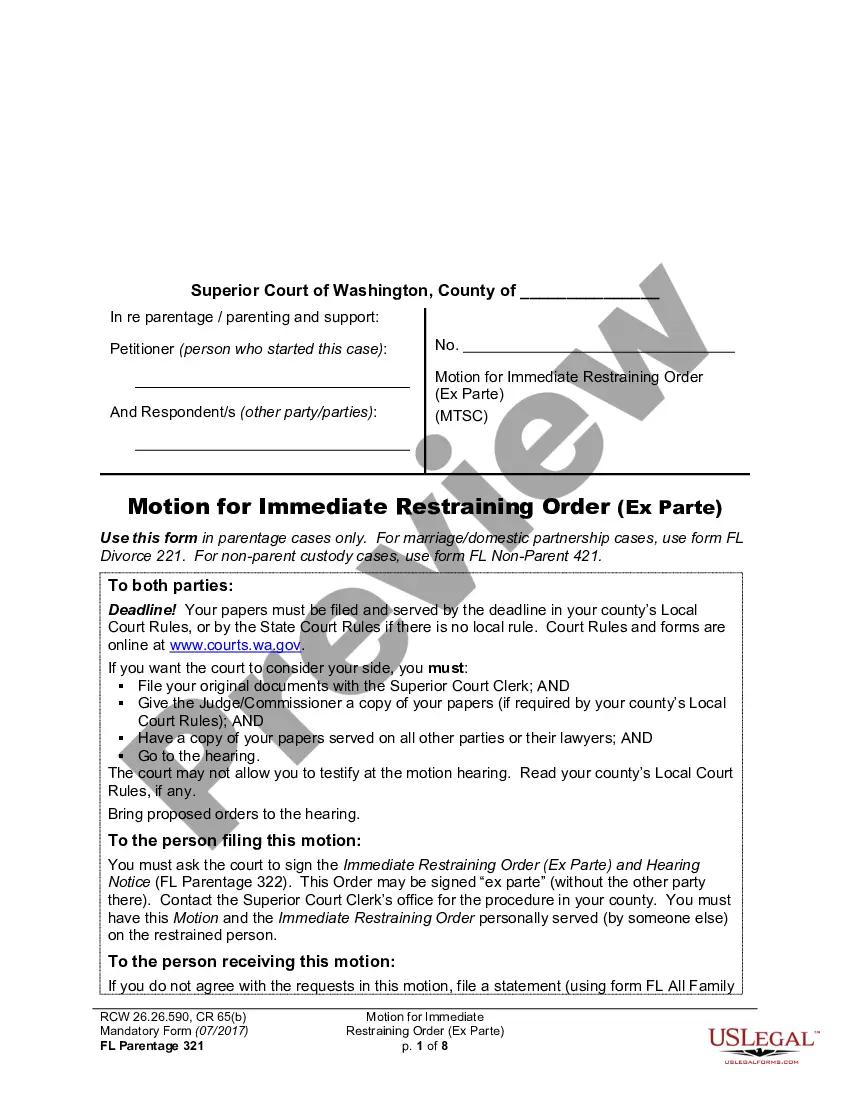

How to fill out Disclaimer Of Right To Inherit Or Inheritance - All Property From Estate Or Trust?

If you wish to comprehensive, download, or printing lawful file layouts, use US Legal Forms, the greatest selection of lawful kinds, which can be found on the Internet. Utilize the site`s simple and easy convenient search to discover the documents you require. Different layouts for organization and person reasons are categorized by classes and says, or search phrases. Use US Legal Forms to discover the Oklahoma Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust within a couple of click throughs.

When you are previously a US Legal Forms consumer, log in in your profile and click the Acquire button to obtain the Oklahoma Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust. You can even access kinds you formerly delivered electronically from the My Forms tab of your respective profile.

If you work with US Legal Forms the very first time, refer to the instructions below:

- Step 1. Be sure you have selected the shape for that appropriate metropolis/country.

- Step 2. Use the Preview method to check out the form`s content material. Never neglect to learn the information.

- Step 3. When you are not happy with all the develop, take advantage of the Lookup industry at the top of the monitor to find other versions from the lawful develop web template.

- Step 4. Upon having located the shape you require, click the Purchase now button. Select the pricing strategy you like and include your accreditations to sign up for the profile.

- Step 5. Process the financial transaction. You should use your charge card or PayPal profile to complete the financial transaction.

- Step 6. Select the formatting from the lawful develop and download it on your gadget.

- Step 7. Complete, edit and printing or indicator the Oklahoma Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust.

Each lawful file web template you buy is yours permanently. You possess acces to every develop you delivered electronically in your acccount. Select the My Forms area and decide on a develop to printing or download once more.

Compete and download, and printing the Oklahoma Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust with US Legal Forms. There are millions of expert and status-distinct kinds you may use for your personal organization or person needs.

Form popularity

FAQ

In the world of estates and trusts, a disclaimer is a refusal to accept a gift or a bequest. It may sound strange to refuse a gift but a disclaimer is a useful tool for tax, asset protection and estate planning.

The full probate procedure in Oklahoma is used if an estate is worth over $200,000. The simplified probate procedure may be available for estates worth less than $200,000.

File the disclaimer within nine months of the transfer (e.g., the death of the creator of the interest) with the district court having jurisdiction over the estate and deliver a copy of it to the representative, trustee, or other person holding legal title of the property.

Who Gets What in Oklahoma? If you die with:here's what happens:children but no spousechildren inherit everythingspouse but no descendants, parents, or siblingsspouse inherits everythingspouse and descendants from you and that spousespouse inherits 1/2 of your intestate property your descendants inherit everything else5 more rows

Your rights as the beneficiary of an estate plan in Oklahoma As a beneficiary in Oklahoma, you have several rights. At the most basic level, you are entitled to receive information about the estate and its administration. You also have a right to an accounting of the estate's assets, debts, and distributions.

The disclaimer must be in writing: A signed letter by the person doing the disclaiming, identifying the decedent, describing the asset to be disclaimed, and the extent and amount, percentage or dollar amount, to be disclaimed, must be delivered to the person in control of the estate or asset, such as an executor, ...

If you have no will, the laws of intestate succession apply. ing to the laws of intestate succession in Oklahoma, one half of all property goes to the spouse and the other half goes to your children.

If all inheritors do not agree then the property cannot be sold. Chill! If majority of the inheritors are willing to sell the property they need to go through a probate court. The inheritors can file a 'partition action' lawsuit in the probate court.