If you wish to comprehensive, acquire, or print authorized file templates, use US Legal Forms, the biggest variety of authorized types, which can be found on-line. Take advantage of the site`s simple and hassle-free search to find the documents you need. Various templates for company and specific reasons are sorted by types and suggests, or keywords. Use US Legal Forms to find the Oklahoma Operating Agreement for States who have Adopted the Uniform Limited Liability Act and the Revised Uniform Limited Liability Act within a number of click throughs.

If you are already a US Legal Forms customer, log in in your account and click on the Down load button to find the Oklahoma Operating Agreement for States who have Adopted the Uniform Limited Liability Act and the Revised Uniform Limited Liability Act. You can even access types you previously delivered electronically within the My Forms tab of your own account.

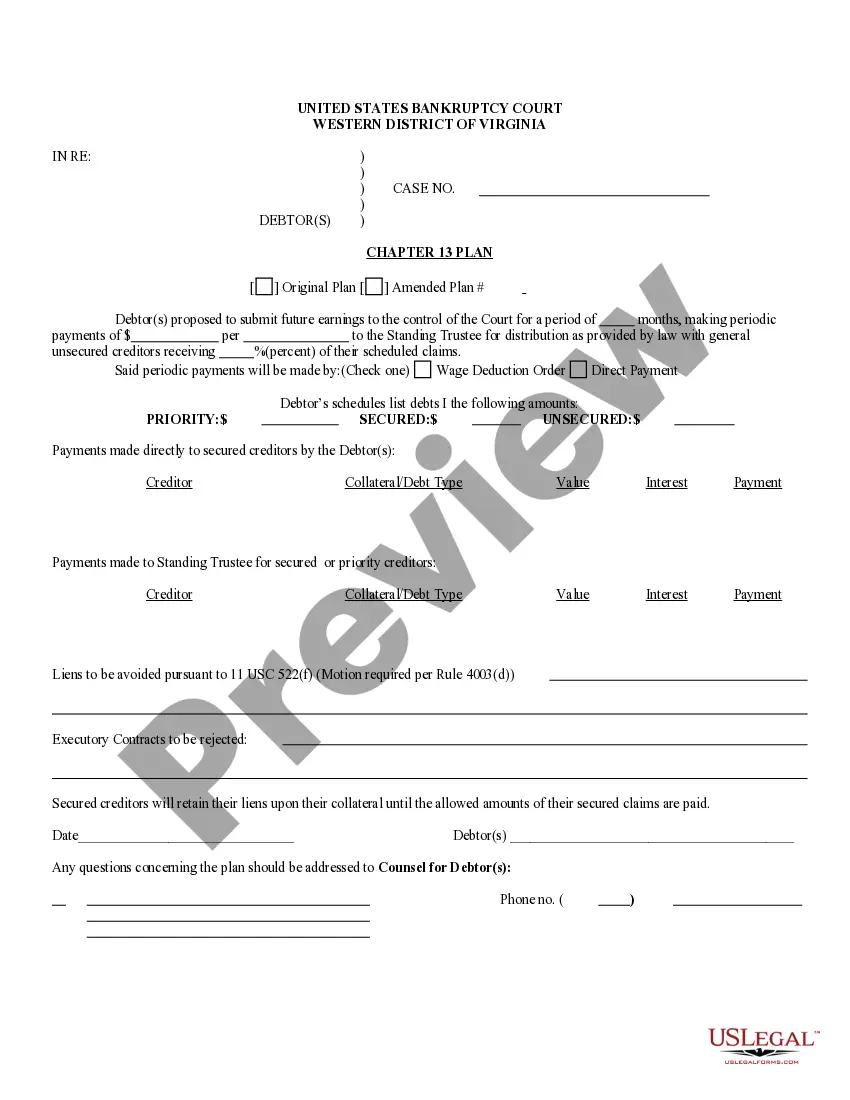

If you use US Legal Forms the first time, refer to the instructions listed below:

- Step 1. Make sure you have selected the shape for your correct area/land.

- Step 2. Take advantage of the Review choice to look over the form`s content material. Do not overlook to learn the information.

- Step 3. If you are not satisfied together with the form, take advantage of the Research discipline on top of the display screen to get other variations from the authorized form format.

- Step 4. After you have discovered the shape you need, go through the Buy now button. Choose the rates program you like and add your qualifications to sign up to have an account.

- Step 5. Method the transaction. You can use your bank card or PayPal account to perform the transaction.

- Step 6. Select the formatting from the authorized form and acquire it on the device.

- Step 7. Full, revise and print or indicator the Oklahoma Operating Agreement for States who have Adopted the Uniform Limited Liability Act and the Revised Uniform Limited Liability Act.

Every authorized file format you get is your own property forever. You might have acces to each and every form you delivered electronically in your acccount. Click the My Forms segment and pick a form to print or acquire again.

Be competitive and acquire, and print the Oklahoma Operating Agreement for States who have Adopted the Uniform Limited Liability Act and the Revised Uniform Limited Liability Act with US Legal Forms. There are millions of specialist and status-particular types you may use for the company or specific needs.