Oklahoma Revocable Trust for Grandchildren

Description

How to fill out Revocable Trust For Grandchildren?

Have you ever been in a location where you require documents for either business or personal purposes almost every day? There are numerous legal document templates accessible online, but finding reliable ones is not simple.

US Legal Forms provides a vast array of form templates, such as the Oklahoma Revocable Trust for Grandchildren, designed to comply with state and federal regulations.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. After that, you can download the Oklahoma Revocable Trust for Grandchildren template.

- Acquire the form you require and ensure it is for the correct state/region.

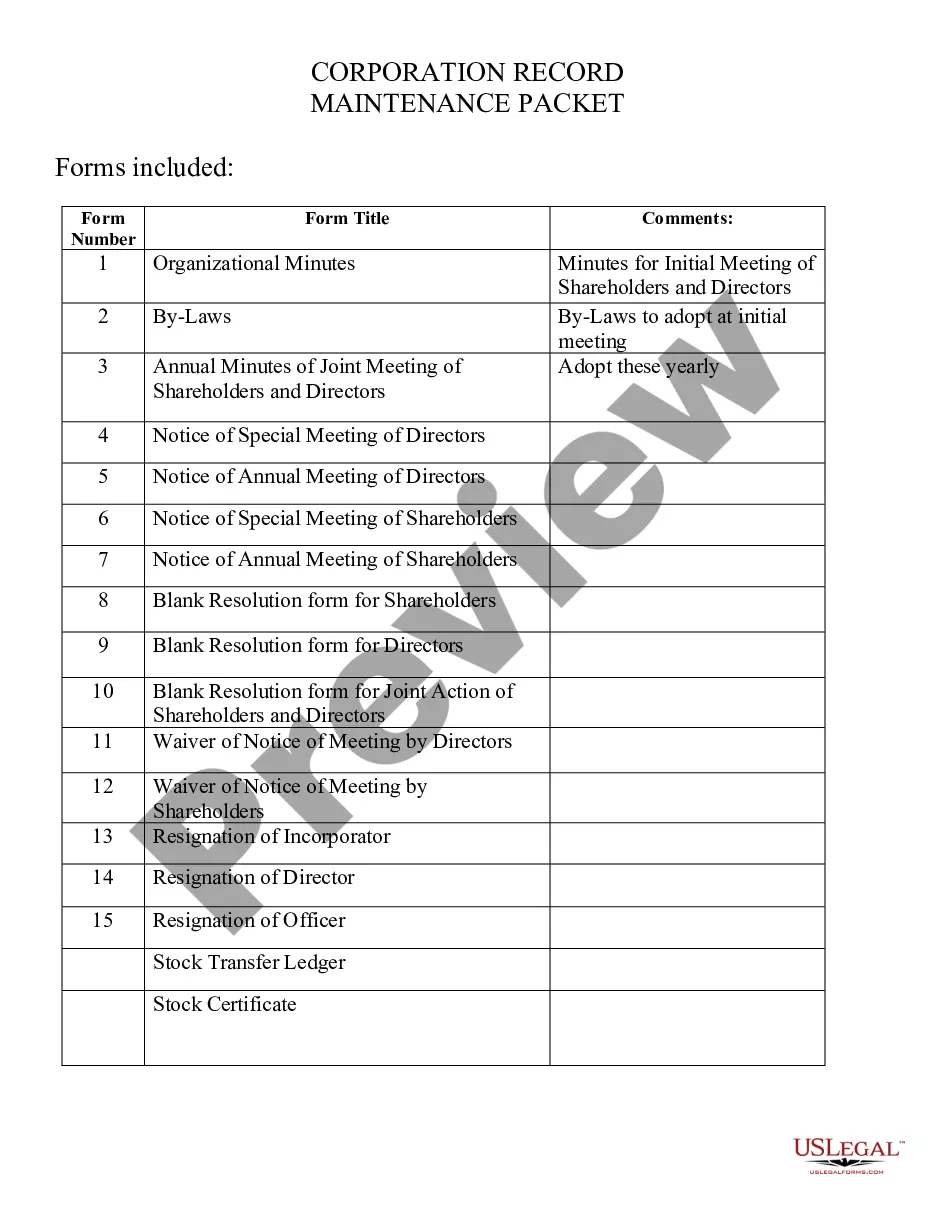

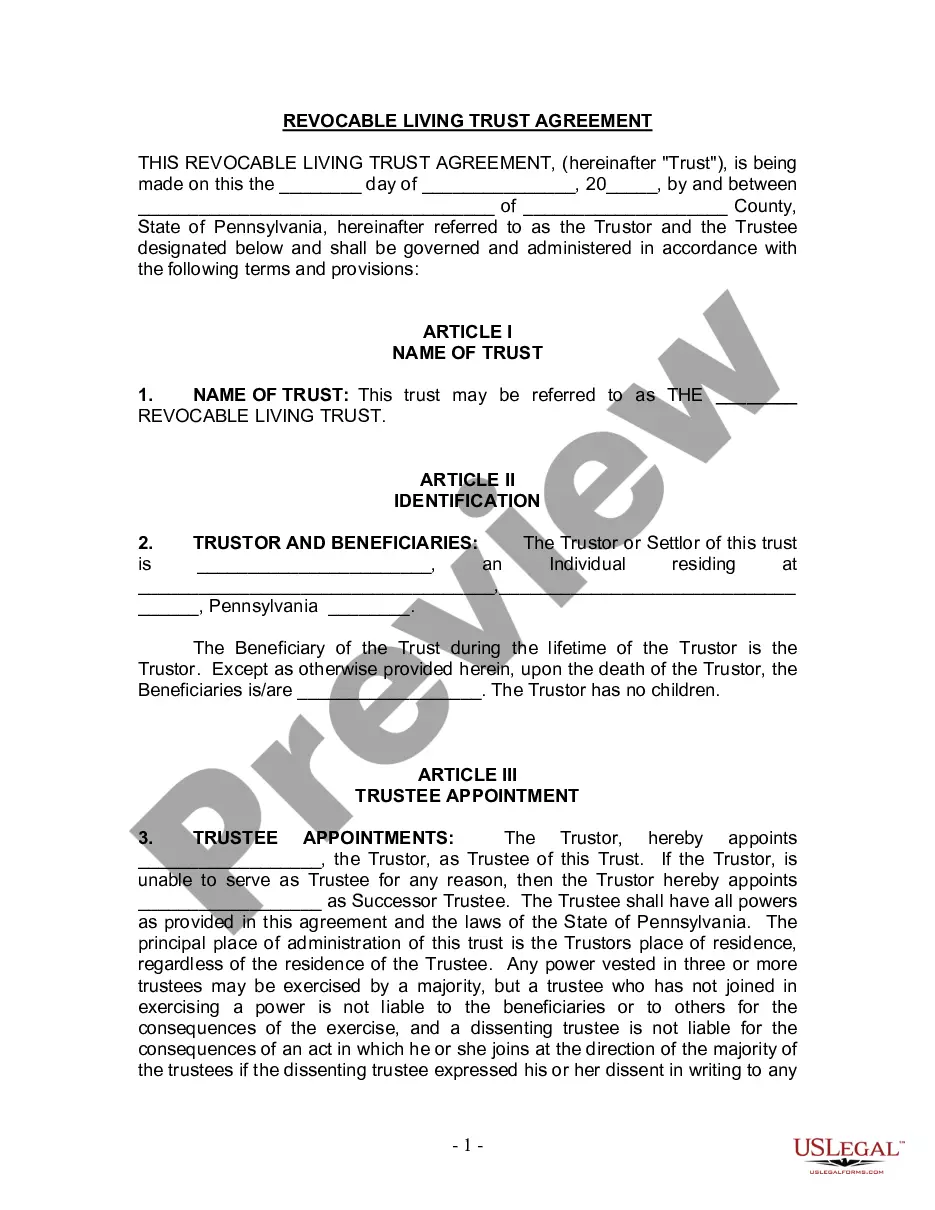

- Utilize the Preview feature to review the form.

- Examine the description to confirm that you have chosen the right form.

- If the form does not meet your needs, use the Search field to find the form that suits your requirements and specifications.

- Once you find the appropriate form, click on Get now.

- Select the pricing plan you prefer, complete the necessary information for payment, and finalize your order using PayPal or a credit card.

- Choose a convenient file format and download your copy.

Form popularity

FAQ

To minimize the impact of inheritance tax, an Oklahoma Revocable Trust for Grandchildren is an excellent option. This trust allows you to transfer assets outside of probate, potentially reducing tax liabilities for your heirs. By planning ahead and leveraging the features of this trust, you can help your grandchildren inherit more of your estate while maintaining compliance with state laws.

An Oklahoma Revocable Trust for Grandchildren is highly beneficial for securing your grandchildren's financial future. This trust allows you to manage and oversee the distribution of funds, ensuring they are used for educational, health, or other essential needs. Additionally, it offers the flexibility to be amended as circumstances change, providing peace of mind that your legacy supports your grandchildren effectively.

The ideal trust for leaving assets to your children often depends on your goals and family dynamics. An Oklahoma Revocable Trust for Grandchildren typically allows for flexibility and control, enabling you to adjust the terms as life changes. Additionally, this type of trust can protect your assets and ensure they are distributed according to your wishes, providing a secure financial future for your children.

In Oklahoma, creating a trust requires adherence to specific state laws, including proper documentation and clear intentions. You must define the trust's purpose, designate beneficiaries, and appoint a trustee to manage the assets. For those interested in an Oklahoma Revocable Trust for Grandchildren, understanding these rules can help ensure your wishes are honored and assets are managed effectively.

In Oklahoma, a revocable trust allows you to change or dissolve the trust at any time during your lifetime, providing flexibility in managing your assets. On the other hand, an irrevocable trust cannot be altered once established, which may protect your assets from taxes or creditors. If you are considering an Oklahoma Revocable Trust for Grandchildren, it offers a way to maintain control while planning for their future. Understanding these differences is crucial to making the right choice for your estate planning needs.

To list a trust as a beneficiary, you should first ensure the trust is properly established, such as creating an Oklahoma Revocable Trust for Grandchildren. Next, when filling out beneficiary forms, clearly state the name of the trust and include the date it was created. It is vital to specify the trustee's name, as this person will manage the trust for the beneficiaries. Consider consulting with legal professionals to ensure accurate completion and to maximize the benefits of your trust.

One disadvantage of a family trust, like an Oklahoma Revocable Trust for Grandchildren, is the potential for higher upfront costs and ongoing maintenance fees. Establishing and managing a trust requires legal guidance and administrative effort, which can be burdensome for some families. Additionally, a family trust can complicate the estate distribution process if not managed well, leading to possible conflicts among beneficiaries.

While trusts offer many benefits, a potential downside is the ongoing management and administrative responsibilities they require. Some individuals may find these responsibilities burdensome or complex, particularly if they are unaware of the requirements. However, using an Oklahoma Revocable Trust for Grandchildren can streamline this process when you leverage platforms like UsLegalForms for guidance.

To create a valid trust in Oklahoma, you must have a clear intent to establish a trust, designated beneficiaries, and identifiable trust assets. Additionally, the trust document must comply with state laws. Setting up an Oklahoma Revocable Trust for Grandchildren meets these requirements while providing flexibility and ease of management.

The best account to start for a grandchild generally depends on your goals, but a custodial account or 529 college savings plan are popular choices. These accounts provide tax advantages and help ensure that funds are used for education or other essential needs. Complementing these accounts with an Oklahoma Revocable Trust for Grandchildren can enhance financial security.