Oklahoma Receipt Template for Cash Payment

Description

How to fill out Receipt Template For Cash Payment?

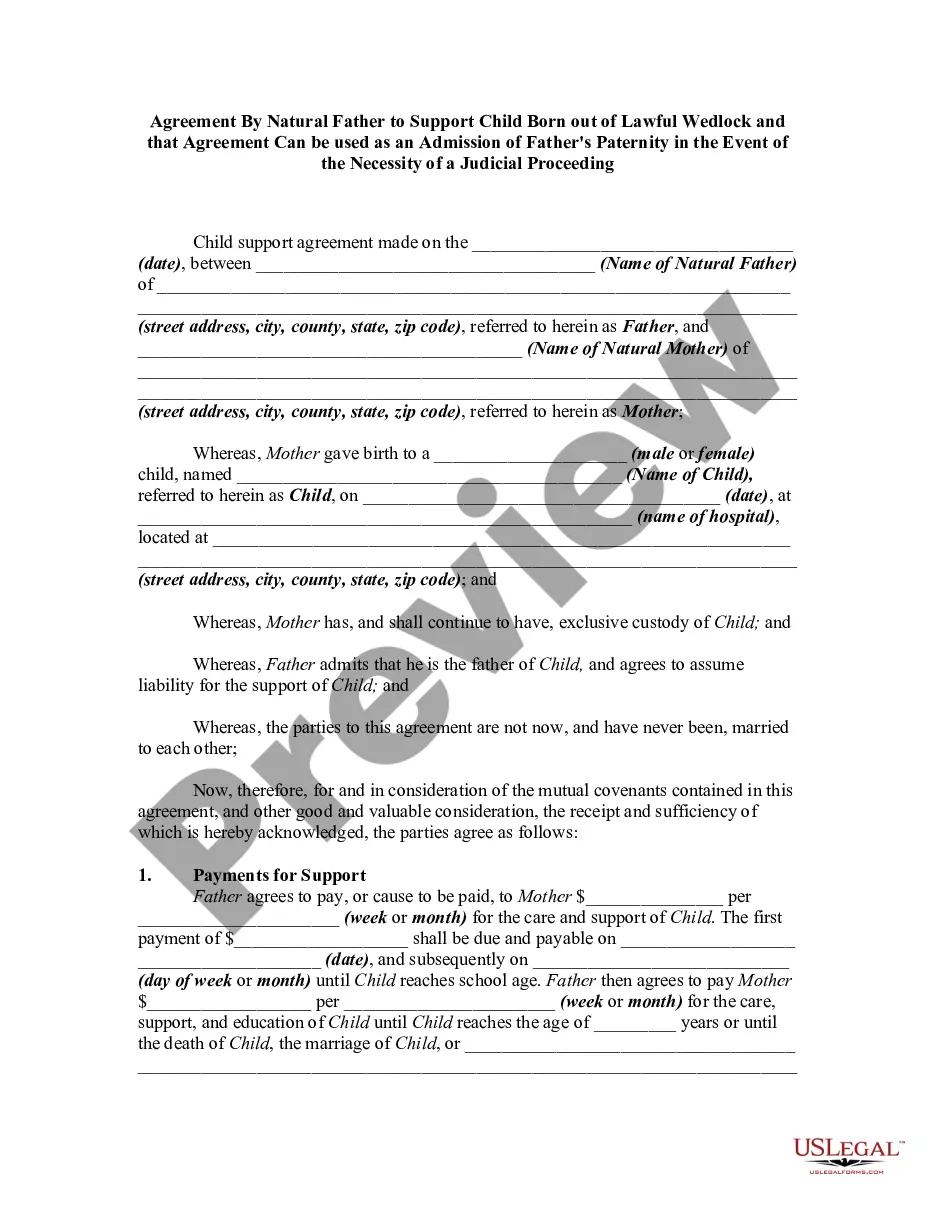

You might spend hours online searching for the legal document format that meets the state and federal requirements you need.

US Legal Forms provides thousands of legal documents that are reviewed by professionals.

You can effortlessly obtain or print the Oklahoma Receipt Template for Cash Payment from our platform.

If available, use the Preview button to view the format as well.

- If you have a US Legal Forms account, you can sign in and click the Download button.

- Then, you can complete, edit, print, or sign the Oklahoma Receipt Template for Cash Payment.

- Every legal document format you purchase is yours permanently.

- To obtain another copy of any purchased form, visit the My documents section and click the appropriate button.

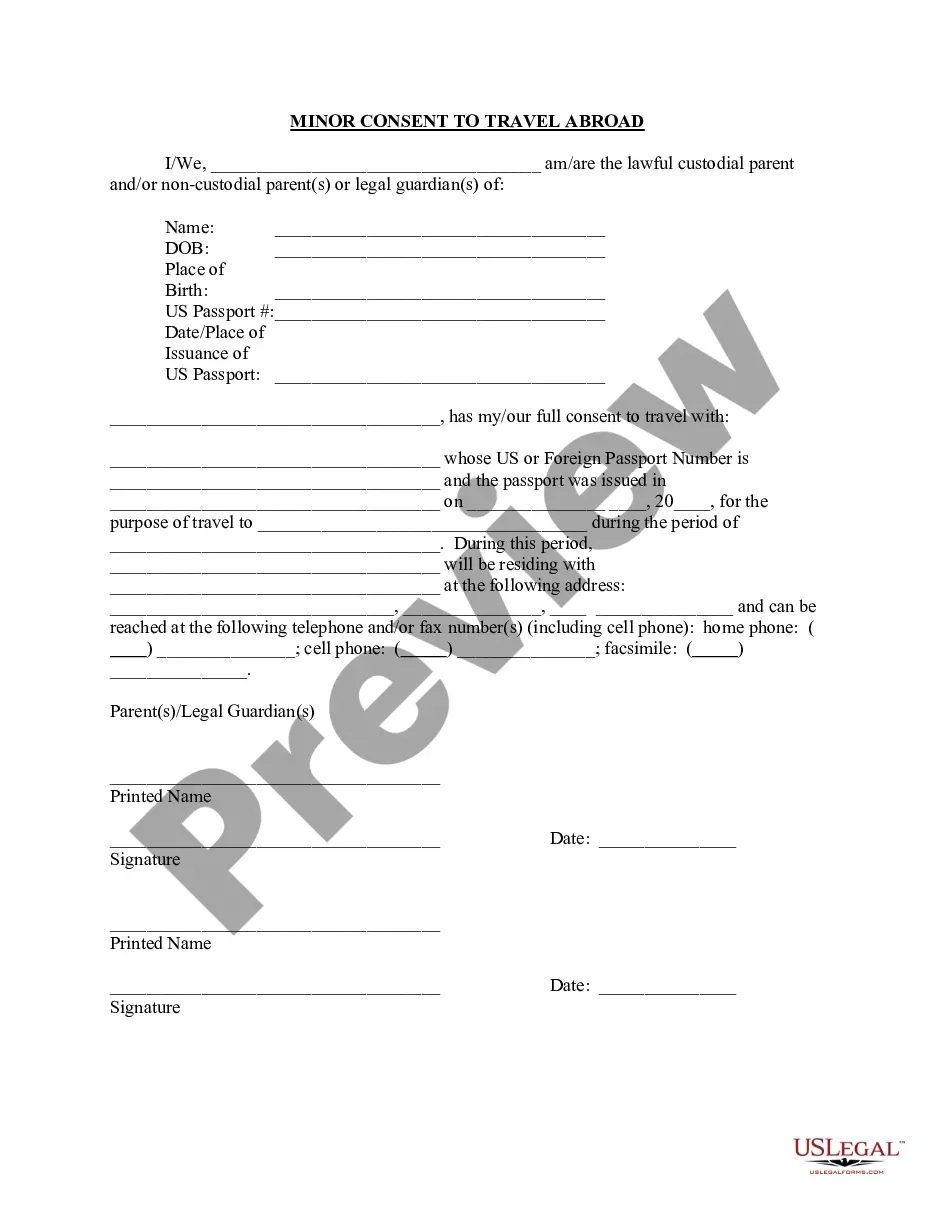

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct format for the county/city of your choice.

- Review the form description to confirm you have chosen the appropriate document.

Form popularity

FAQ

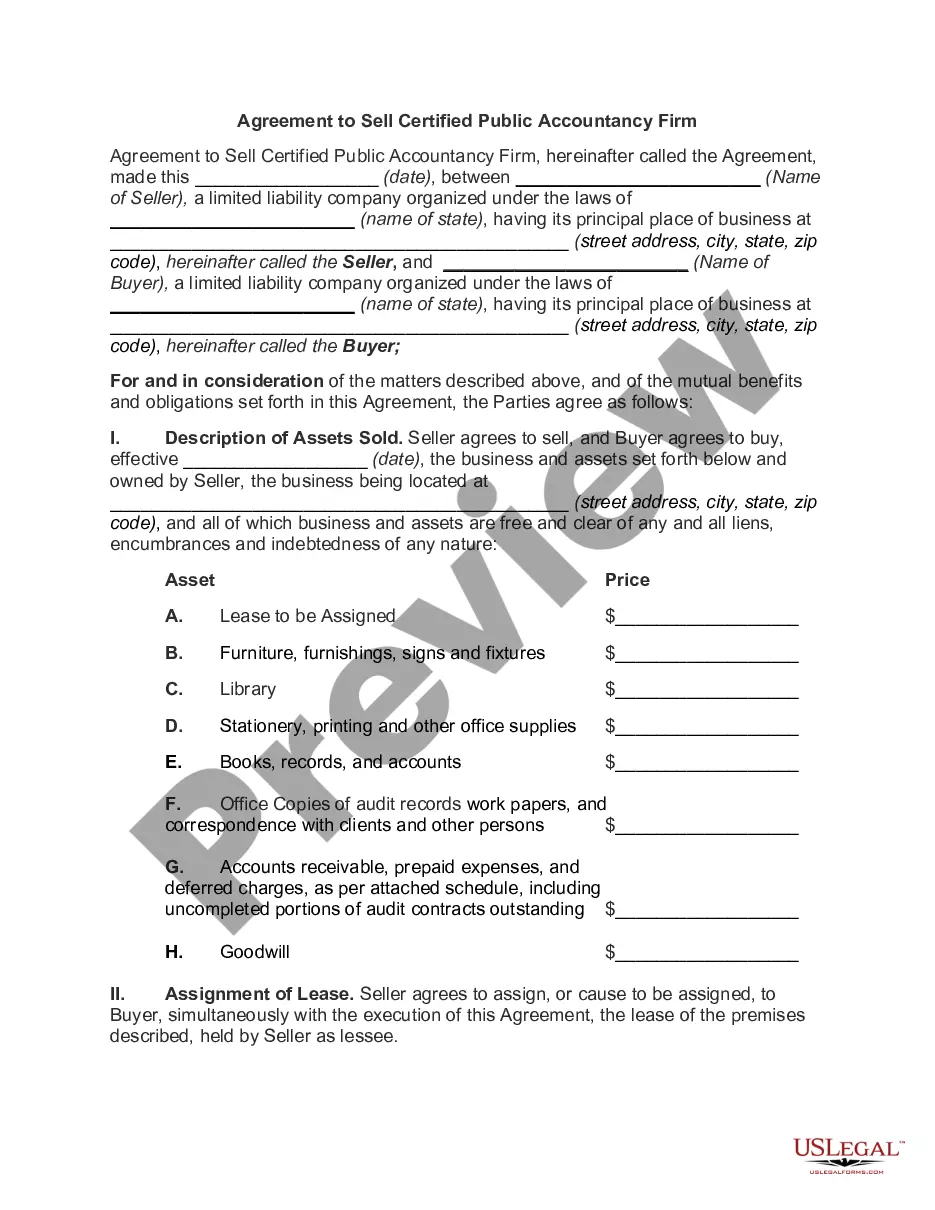

A cash receipt contains the following information:The date of the transaction.A unique number that identifies the document.The name of the payer.The amount of cash received.The payment method (such as by cash or check)The signature of the receiving person.09-Mar-2022

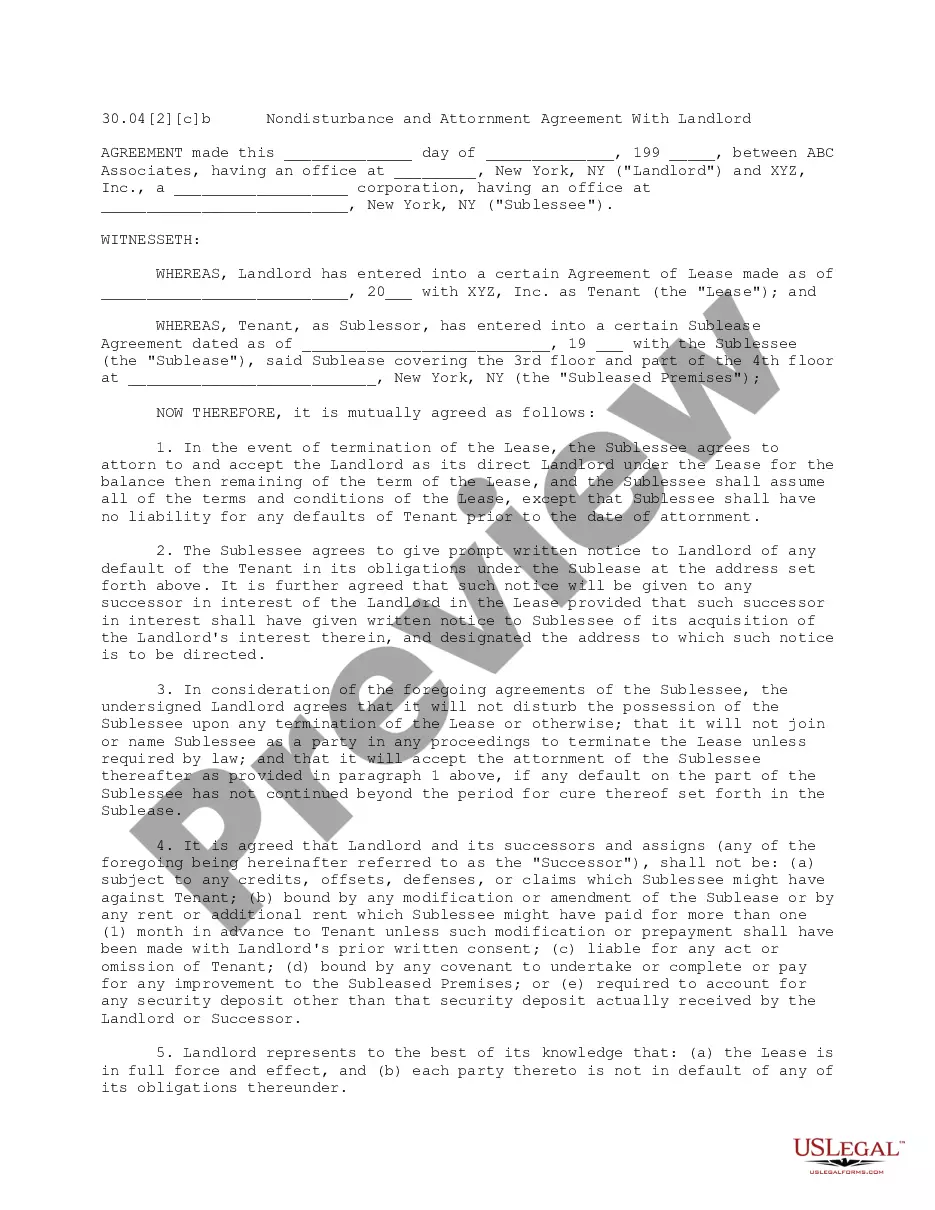

People report the payment by filing Form 8300, Report of Cash Payments Over $10,000 Received in a Trade or BusinessPDF. A person can file Form 8300 electronically using the Financial Crimes Enforcement Network's BSA E-Filing System. E-filing is free, quick and secure.

What information must I put on a receipt?your company's details including name, address, phone number and/or email address.the date of transaction showing date, month and year.a list of products or services showing a brief description of the product and quantity sold.More items...

The basic components of a receipt include:The name and address of the business or individual receiving the payment.The name and address of the person making the payment.The date the payment was made.A receipt number.The amount paid.The reason for the payment.How the payment was made (credit card, cash, etc)More items...

How do you write a receipt for a cash payment? If you are writing out a receipt for a cash payment, include the date, items purchased, quantity of each item, price of each item, total price, type of payment and payment amount, and your business name and contact information.

The basic components of a receipt include:The name and address of the business or individual receiving the payment.The name and address of the person making the payment.The date the payment was made.A receipt number.The amount paid.The reason for the payment.How the payment was made (credit card, cash, etc)More items...

Just make sure they include:The date of payment,A description of the services or goods purchased,The amount paid in cash, and.The name of the company or person paid.

To prove that cash is income, use:Invoices.Tax statements.Letters from those who pay you, or from agencies that contract you out or contract your services.Duplicate receipt ledger (give one copy to every customer and keep one for your records)