Oklahoma Letter to Creditors notifying them of Identity Theft

Description

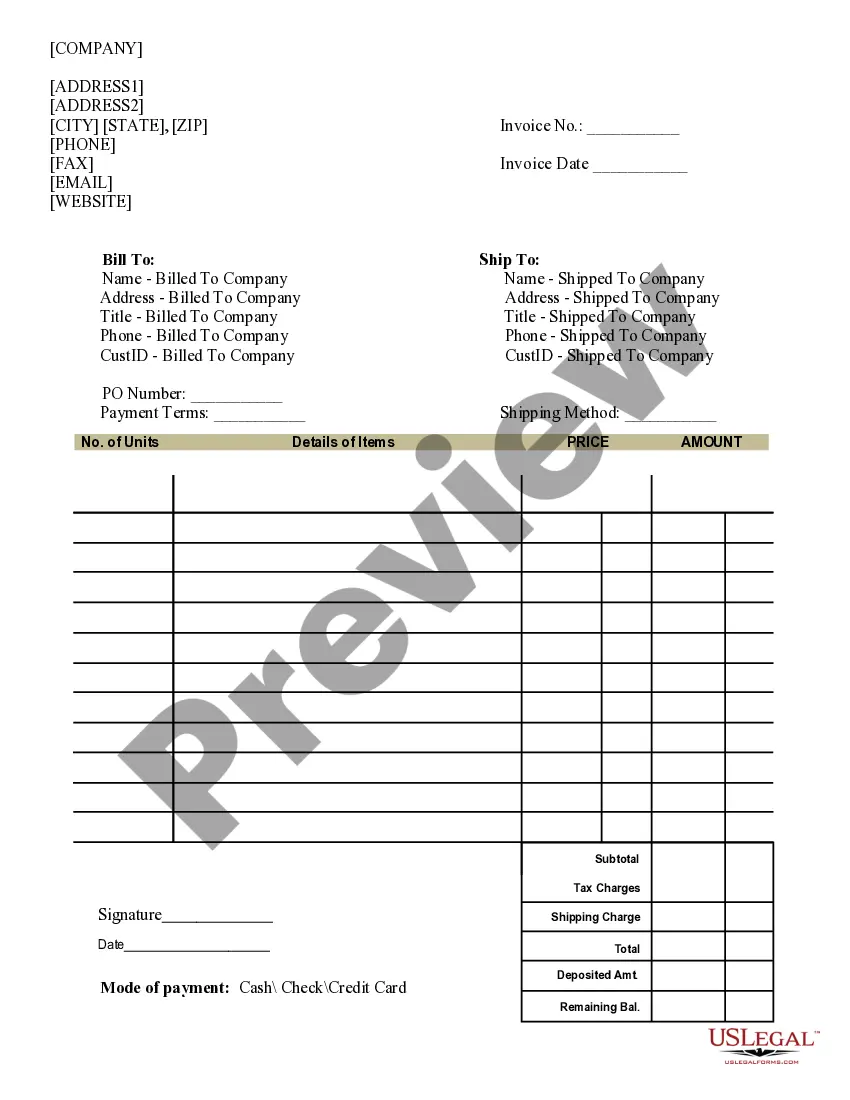

How to fill out Letter To Creditors Notifying Them Of Identity Theft?

US Legal Forms - one of the largest libraries of lawful types in America - provides an array of lawful file layouts you are able to acquire or printing. Making use of the site, you will get a large number of types for enterprise and specific reasons, categorized by classes, states, or keywords.You can find the most up-to-date variations of types such as the Oklahoma Letter to Creditors notifying them of Identity Theft within minutes.

If you already have a subscription, log in and acquire Oklahoma Letter to Creditors notifying them of Identity Theft from your US Legal Forms library. The Obtain option will show up on each form you see. You get access to all formerly saved types within the My Forms tab of your bank account.

In order to use US Legal Forms the very first time, listed here are simple directions to obtain started:

- Be sure to have picked out the right form for your personal area/state. Select the Preview option to review the form`s content material. Look at the form explanation to actually have selected the correct form.

- If the form does not match your needs, take advantage of the Research discipline towards the top of the screen to obtain the one who does.

- Should you be content with the shape, verify your option by visiting the Acquire now option. Then, select the costs strategy you prefer and give your credentials to sign up for an bank account.

- Procedure the transaction. Utilize your credit card or PayPal bank account to finish the transaction.

- Select the file format and acquire the shape in your product.

- Make modifications. Load, edit and printing and sign the saved Oklahoma Letter to Creditors notifying them of Identity Theft.

Every design you added to your account does not have an expiry day and is your own permanently. So, if you would like acquire or printing another version, just go to the My Forms area and click on the form you require.

Gain access to the Oklahoma Letter to Creditors notifying them of Identity Theft with US Legal Forms, probably the most substantial library of lawful file layouts. Use a large number of skilled and express-specific layouts that satisfy your company or specific requirements and needs.

Form popularity

FAQ

To report identity theft, contact: The Federal Trade Commission (FTC) online at IdentityTheft.gov or call 1-877-438-4338. The three major credit reporting agencies. Ask them to place fraud alerts and a credit freeze on your accounts.

If you report your identity theft to the FTC within two business days of discovering it, you will only be liable to pay $50 of any unauthorized use of your bank and credit accounts (under federal law). The longer you leave it, the more that financial liability falls on your shoulders.

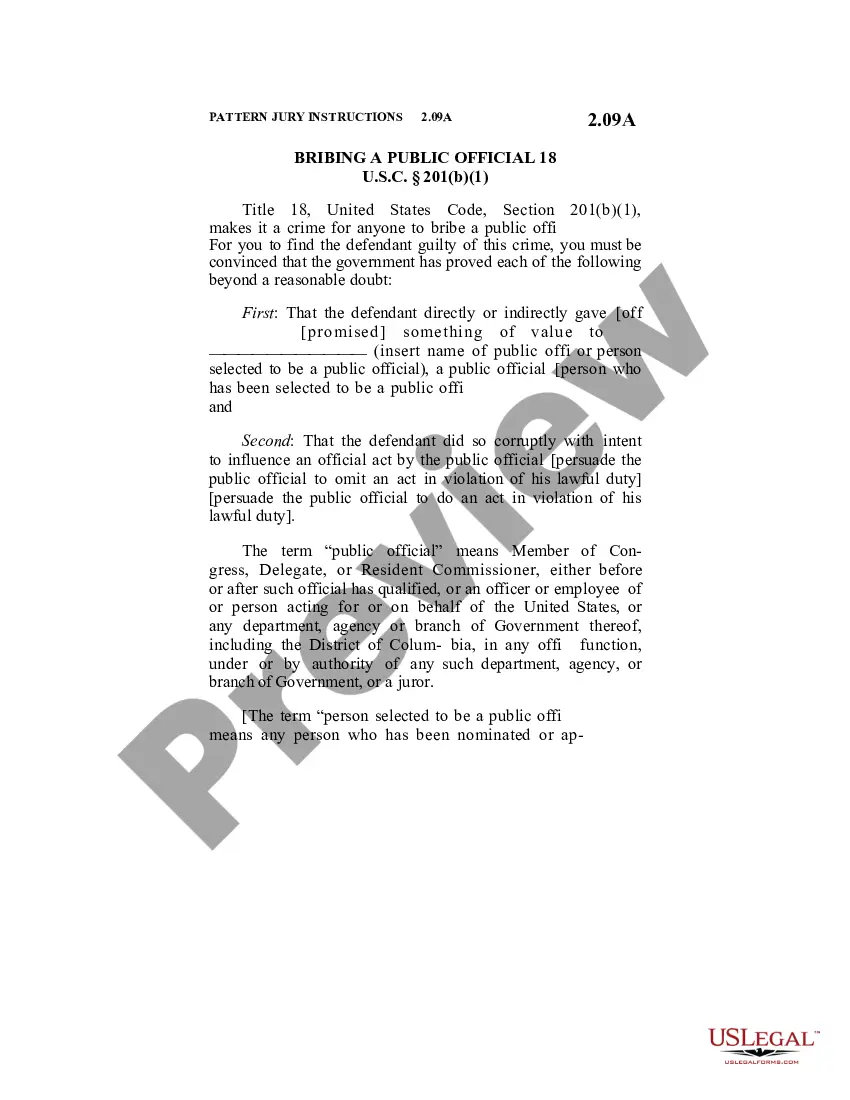

It is unlawful for any person to use with fraudulent intent the personal identity of another person, living or dead, or any information relating to the personal identity of another person, living or dead, to obtain or attempt to obtain credit or anything of value.

Could it hurt my credit scores? Unfortunately, being a victim of identity theft means your credit scores may be negatively impacted. Thieves could open new lines of credit or credit cards in your name -- and fail to pay the bills.

To make certain that you do not become responsible for any debts incurred in your name by an identity thief, you must prove that you didn't create the debt. Taking action quickly is important, so don't delay. Create a personalized recovery plan at IdentityTheft.gov that walks you through each step of the process.

You may receive a debt collection letter, to which you can respond by notifying the debt collector of the identity theft and providing it with proof of the theft, such as your Identity Theft Report. You should also contact the business that reported the debt to the collection agency and tell it to stop.

I am a victim of identity theft, and did not make the charge(s). I am requesting that the item(s) be blocked to correct my credit report. Enclosed are copies of (describe any enclosed documents) supporting my position. Please investigate this (these) matter(s) and block the disputed item(s) as soon as possible.

Identity theft has profound consequences for its victims. They can have their bank accounts wiped out, credit histories ruined, and jobs and valuable possessions taken away.