Oklahoma Exchange Addendum to Contract - Tax Free Exchange Section 1031

Description

How to fill out Exchange Addendum To Contract - Tax Free Exchange Section 1031?

Have you ever been in a situation where you frequently need documents for potential business or personal purposes almost every workday.

There are numerous legal document templates accessible online, but finding ones you can trust is challenging.

US Legal Forms offers thousands of document templates, such as the Oklahoma Exchange Addendum to Contract - Tax Free Exchange Section 1031, which are designed to comply with state and federal regulations.

Select a convenient file format and download your copy.

Find all the document templates you have purchased in the My documents list. You can obtain an additional version of the Oklahoma Exchange Addendum to Contract - Tax Free Exchange Section 1031 at any time, if needed. Just select the required form to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Oklahoma Exchange Addendum to Contract - Tax Free Exchange Section 1031 template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Locate the document you require and confirm it is for your specific area/region.

- Use the Review feature to evaluate the form.

- Examine the information to ensure you have selected the correct document.

- If the document is not what you're looking for, utilize the Lookup field to find the form that meets your needs and requirements.

- Once you identify the correct document, click on Buy now.

- Choose the pricing plan you prefer, complete the necessary details to create your account, and pay for the transaction using your PayPal or Visa or Mastercard.

Form popularity

FAQ

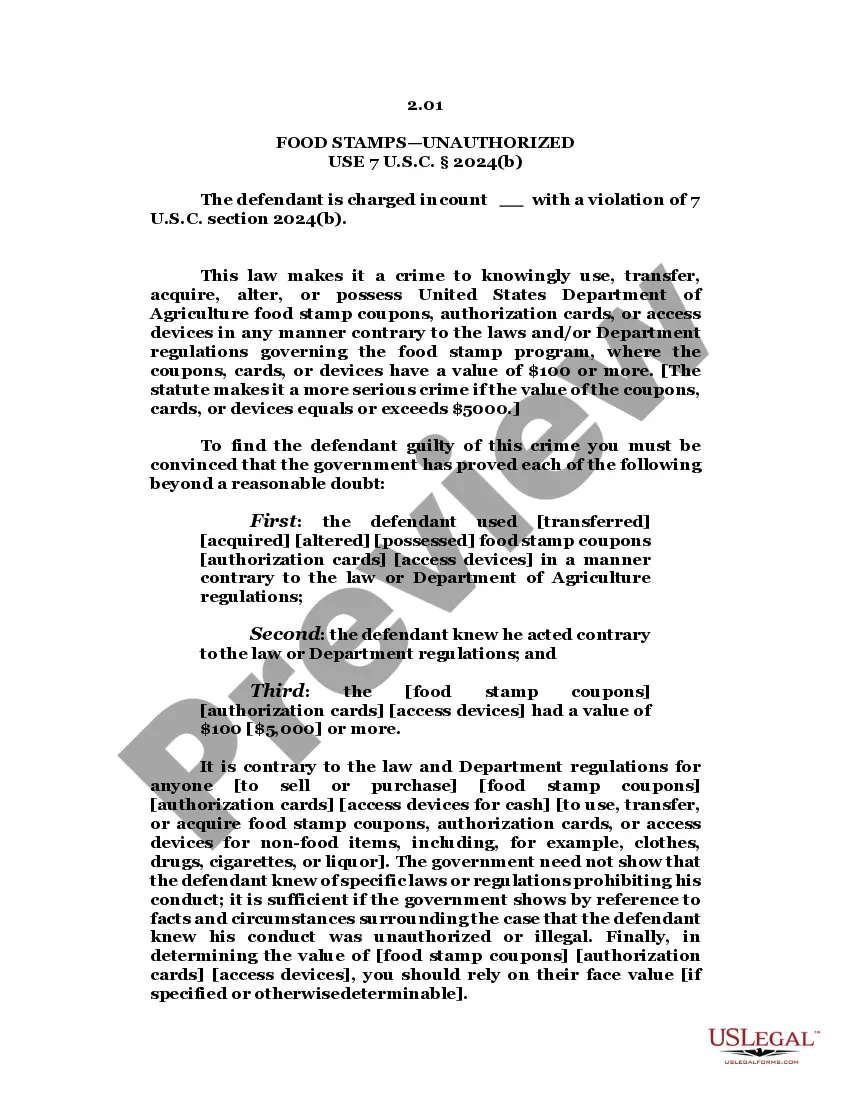

Another reason someone would not want to do a 1031 exchange is if they have a loss, since there will be no capital gains to pay taxes on. Or if someone is in the 10% or 12% ordinary income tax bracket, they would not need to do a 1031 exchange because, in that case, they will be taxed at 0% on capital gains.

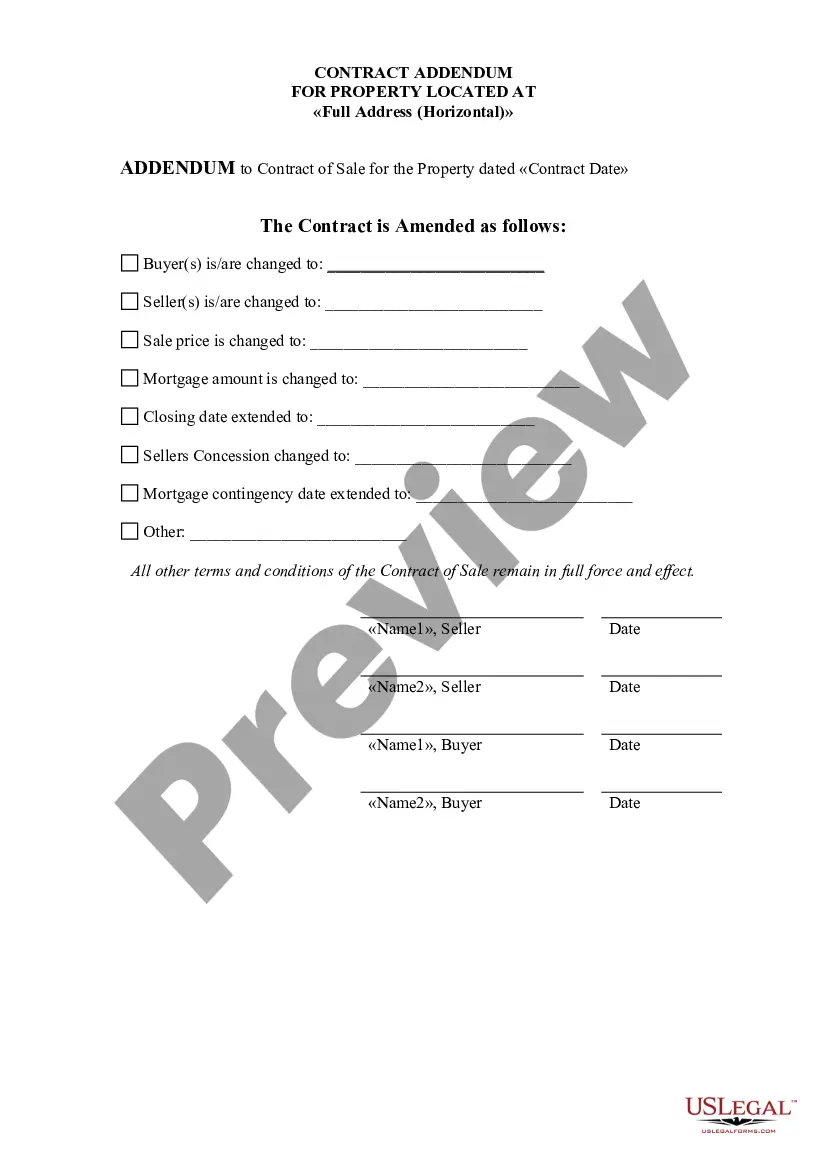

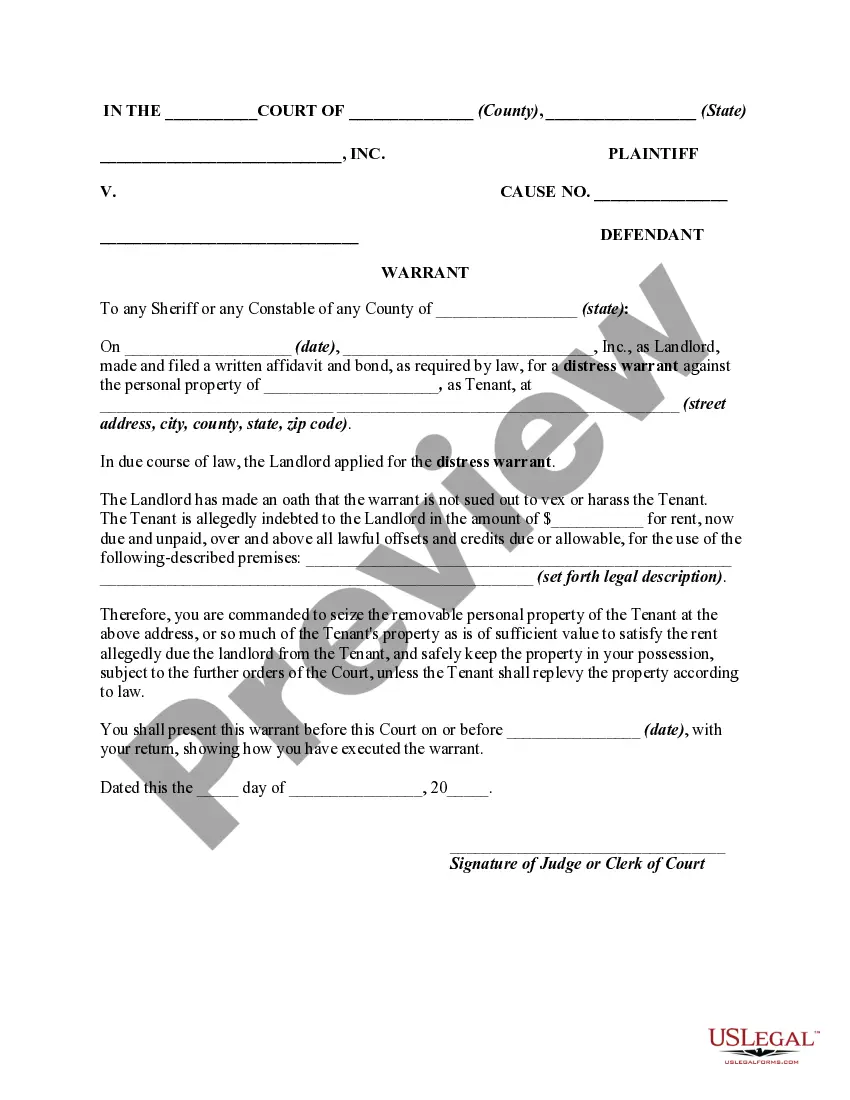

A 1031 addendum will normally clearly show intent to do a 1031 exchange, permit assignment, and advise the other party there will be no expense or liability as a result of the exchange. Sometimes there is cooperation language asserting that both parties to the contract will cooperate with a 1031 exchange.

Although many taxpayers include language in their purchase and sale agreements establishing their intent to perform an exchange, it is not required by the Internal Revenue Code in a Section 1031 exchange. It is important, however, that the purchase and sale agreements for both properties be assignable.

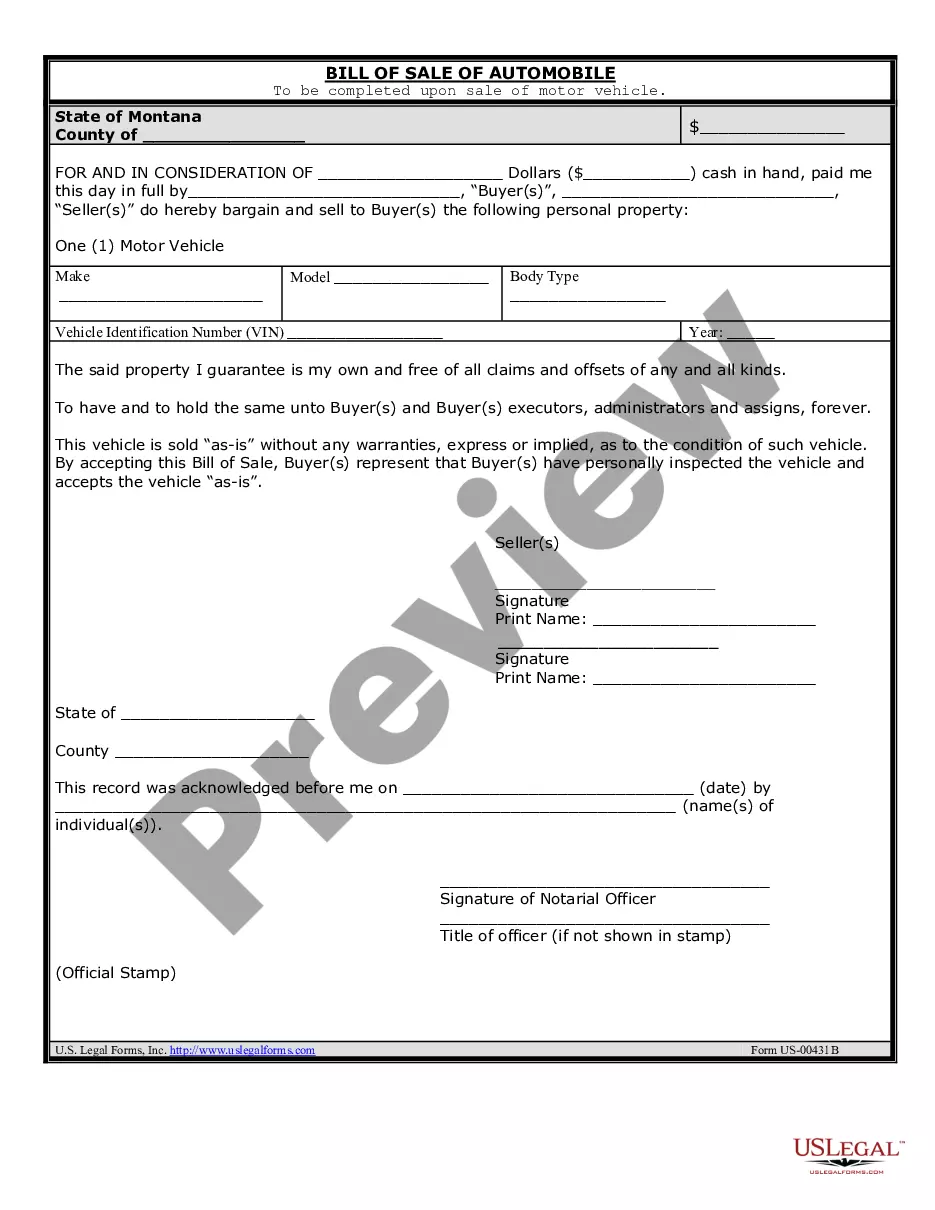

What is a 1031 Exchange? The sale of a business or investment asset can create a large tax liability. A properly structured tax deferred exchange under Internal Revenue Code §1031 allows businesses and individuals to defer the recognition of capital gains and other taxes associated with the sale.

In real estate, a 1031 exchange is a swap of one investment property for another that allows capital gains taxes to be deferred.

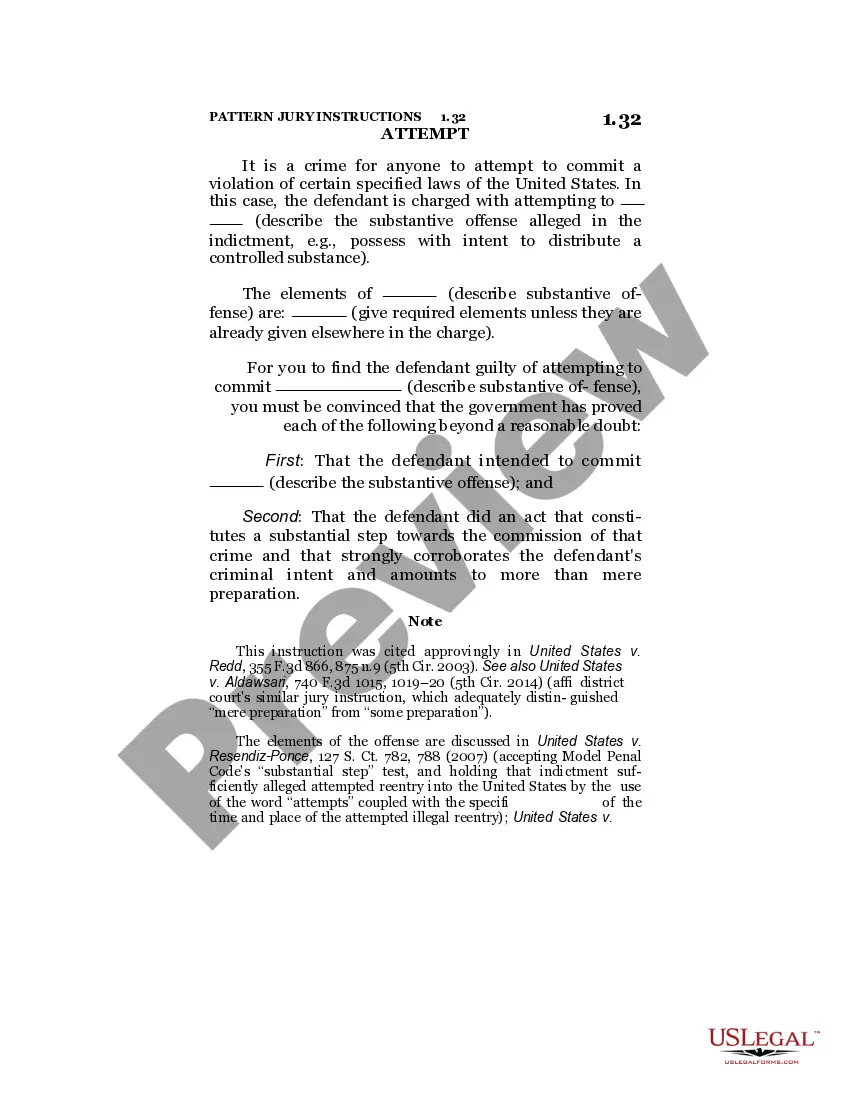

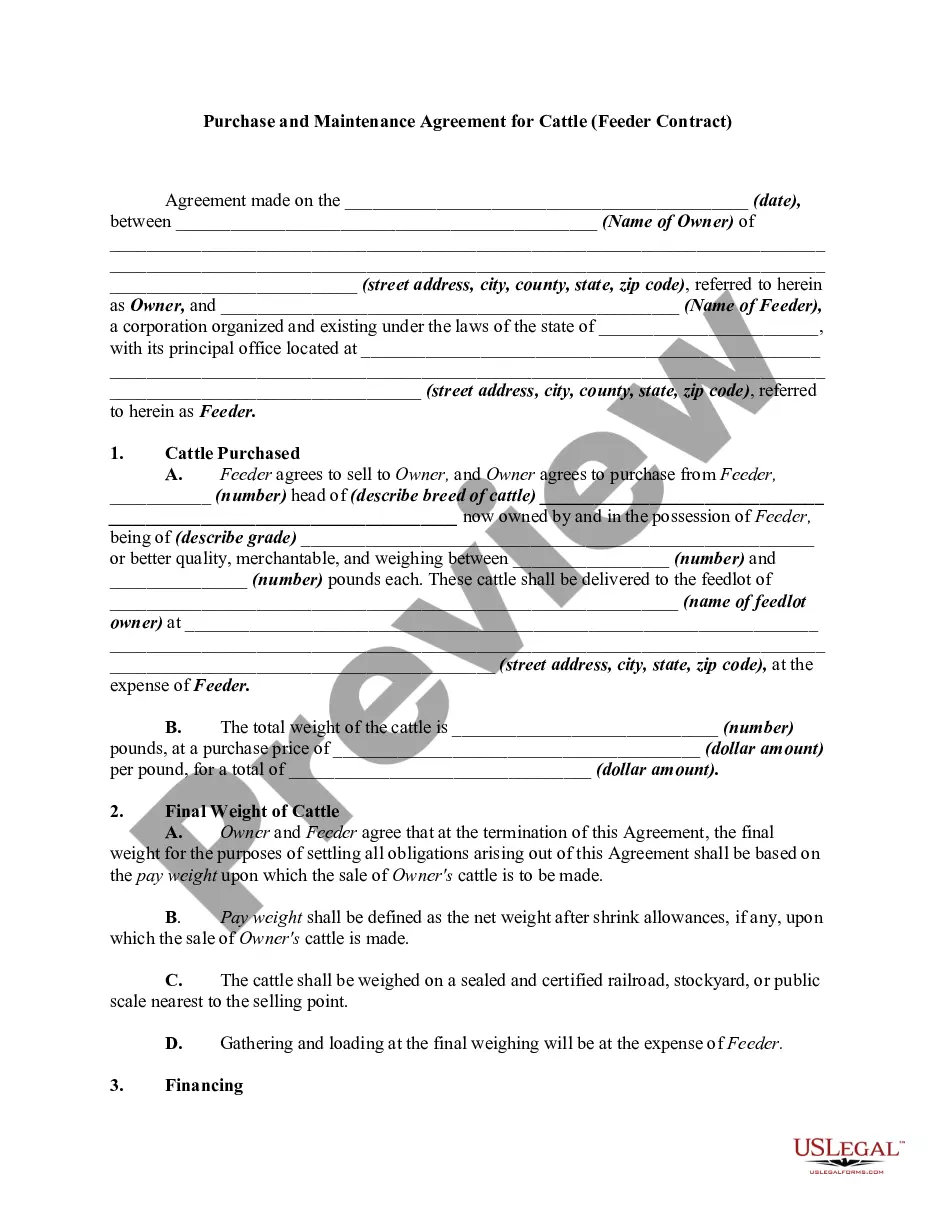

Notes and the 1031 ExchangeThough a contract sale can be incorporated in an exchange, it may not be possible to accomplish this goal all the time. In order for a note to be used in an exchange, you, the Exchangor, must not have actual or constructive receipt of the note.

A 1031 exchange is a real estate investing tool that allows investors to swap out an investment property for another and defer capital gains or losses or capital gains tax that you otherwise would have to pay at the time of sale.

If you own investment property and are thinking about selling it and buying another property, you should know about the 1031 tax-deferred exchange. This is a procedure that allows the owner of investment property to sell it and buy like-kind property while deferring capital gains tax.

A 1031 exchange allows you to sell one investment or business property and buy another without incurring capital gains taxes as long as the exchange is completed according to IRS rules and the new property is of the same nature or character (like kind).