Oklahoma Lease Form for Car

Description

How to fill out Lease Form For Car?

It is feasible to dedicate time online looking for the valid document template that meets the state and federal criteria you require.

US Legal Forms offers a vast selection of valid forms that have been reviewed by experts.

You can download or print the Oklahoma Lease Form for Car from this service.

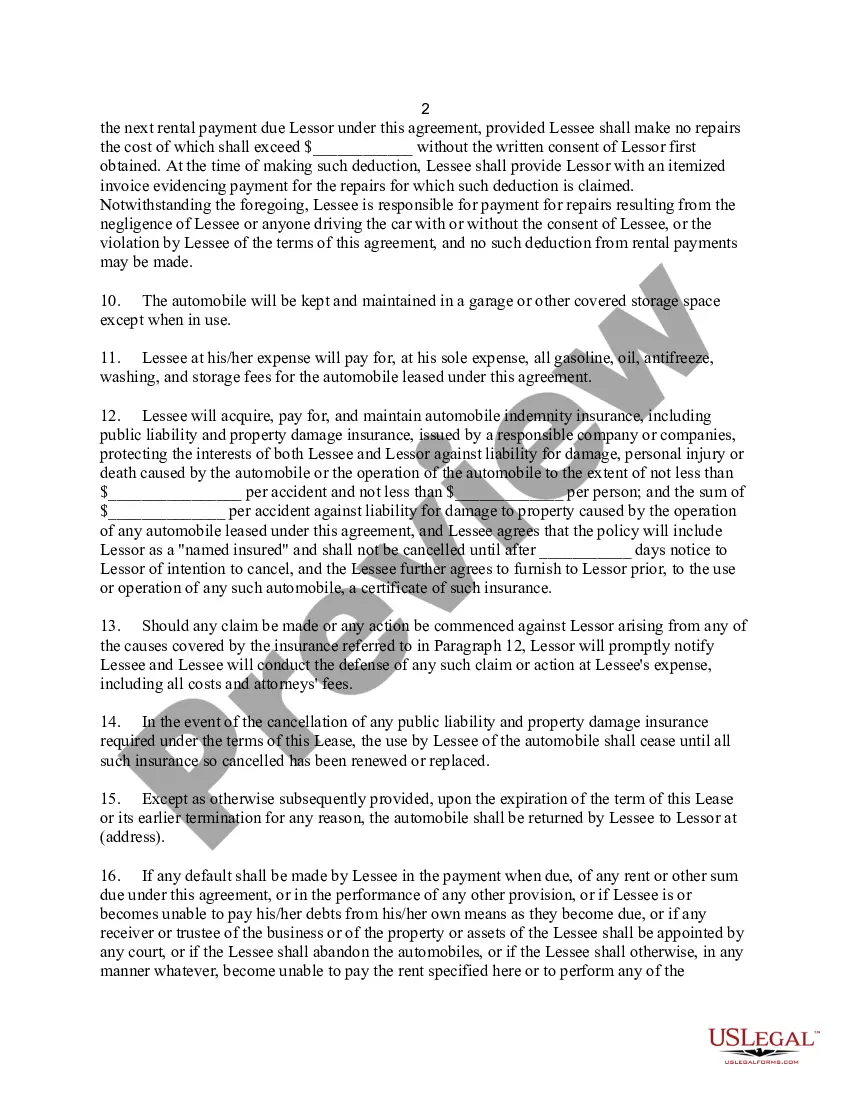

If available, use the Preview option to review the document template as well.

- If you have a US Legal Forms account, you may Log In and click the Obtain button.

- After that, you can complete, modify, print, or sign the Oklahoma Lease Form for Car.

- Every valid document template you acquire is yours indefinitely.

- To obtain an additional copy of the purchased form, go to the My documents section and select the relevant option.

- If you are using the US Legal Forms website for the first time, follow the simple guidelines below.

- Firstly, ensure that you have selected the correct document template for the county/city of your choice.

- Check the form description to confirm that you have selected the appropriate form.

Form popularity

FAQ

Monthly lease payments on a car are determined by its expected depreciation and your interest rate. To calculate depreciation (also known as amortization), lenders subtract the vehicle's predicted residual value from its purchase price.

What information is necessary to include in a Vehicle Lease Agreement template?A description of the vehicle.The vehicle manufacturer's suggested retail price.The residual value of the car (the anticipated price of the car at the end of the lease term)The lessee's contact information.More items...?

This is most typically a valid driving licence or an up-to-date passport, so that we can be assured we're leasing to the right person. You'll also need to provide proof of your home address- this can be in the form of a bank statement, utility bill, or credit card bill.

Most leases have 24, 36, 48 and 60 month terms. the longer your term, the lower your monthly payments, however, you'll end up paying more in interest.

A car lease lets you drive a new vehicle without paying a large sum of cash or taking out a loan. To lease a car, you simply make a small down payment -- less than the typical 20% of a car's value you'd pay to buy-- followed by monthly payments for the term of the lease. When the term expires, you return the car.

Oklahoma law does not provide for a cooling off or cancellation period for a motor vehicle sale. This means that once you sign a contract at the dealership, it is a valid contract and can only be cancelled if the dealer agrees. You cannot cancel simply because you change your mind.

Requirements for Leasing a CarGood to excellent credit. Not only should your credit history be excellent, but all of your existing loans, revolving lines of credit and credit card accounts should be current.Current ability to pay.Co-signor.Driver's License.Insurance.

7 Steps to Getting a Great Auto Lease DealChoose cars that hold their value. When you lease a vehicle you are paying for its depreciation, plus interest, tax and some fees.Check leasing specials.Price the car.Get quotes from dealers.Spot your best deal.Ask for lease payments.Close the deal.

Under California law, a lease does have to be in writing to be enforceable, but only when the lease is for a period of more than a year.

8 Biggest Disadvantages to Leasing a CarExpensive in the Long Run.Limited Mileage.High Insurance Cost.Confusing.Hard to Cancel.Requires Good Credit.Lots of Fees.No Customizations.More items...