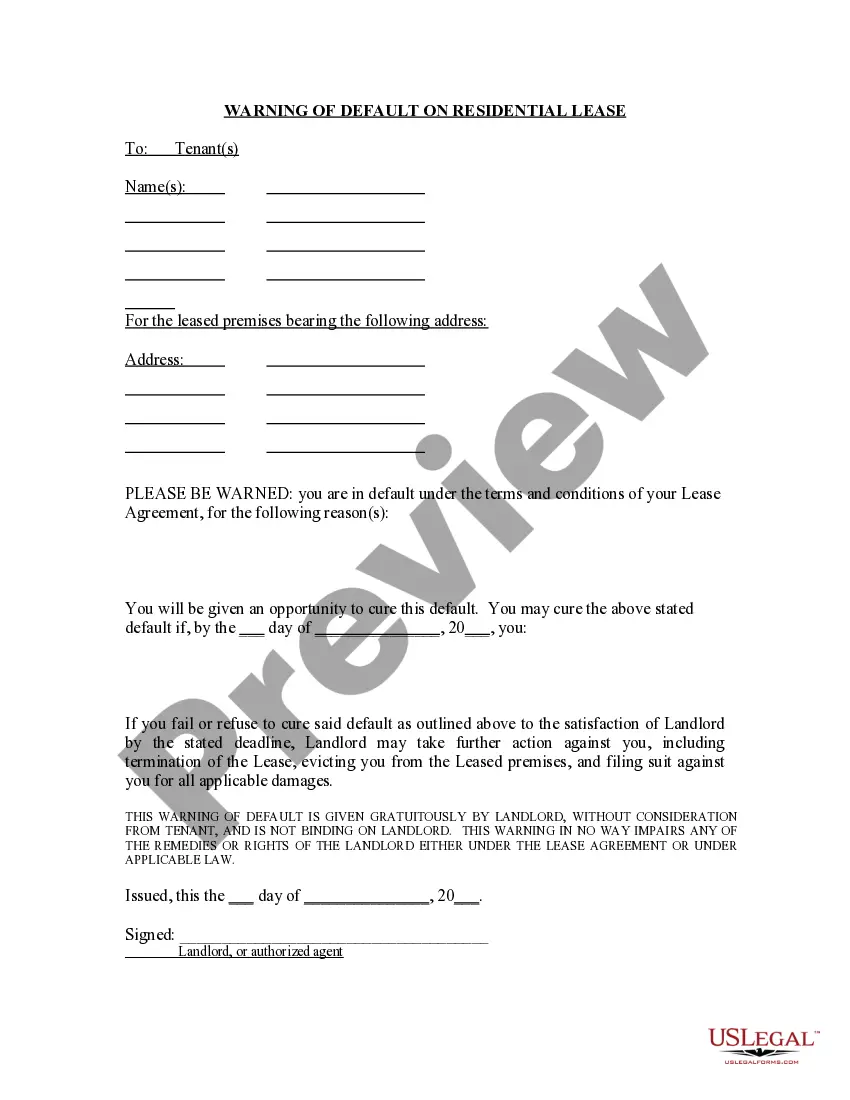

Letter from attorney to opposing counsel requesting documentation concerning homestead exemption for change of venue motion.

Oklahoma Sample Letter for Change of Venue and Request for Homestead Exemption

Description

How to fill out Sample Letter For Change Of Venue And Request For Homestead Exemption?

You are able to commit time on the Internet looking for the lawful record format that suits the federal and state specifications you need. US Legal Forms provides a huge number of lawful types which are examined by experts. It is possible to obtain or print the Oklahoma Sample Letter for Change of Venue and Request for Homestead Exemption from my assistance.

If you already have a US Legal Forms bank account, you may log in and click the Download button. Following that, you may comprehensive, edit, print, or indicator the Oklahoma Sample Letter for Change of Venue and Request for Homestead Exemption. Every single lawful record format you get is your own property eternally. To have one more version of any obtained form, check out the My Forms tab and click the corresponding button.

Should you use the US Legal Forms website for the first time, follow the simple instructions below:

- First, make sure that you have selected the correct record format to the region/metropolis of your liking. Browse the form description to make sure you have picked the correct form. If offered, make use of the Review button to appear throughout the record format at the same time.

- If you wish to discover one more edition from the form, make use of the Lookup area to discover the format that suits you and specifications.

- When you have located the format you want, click Acquire now to move forward.

- Select the costs program you want, key in your qualifications, and sign up for an account on US Legal Forms.

- Comprehensive the deal. You may use your Visa or Mastercard or PayPal bank account to cover the lawful form.

- Select the file format from the record and obtain it to your device.

- Make adjustments to your record if required. You are able to comprehensive, edit and indicator and print Oklahoma Sample Letter for Change of Venue and Request for Homestead Exemption.

Download and print a huge number of record web templates utilizing the US Legal Forms web site, which provides the biggest assortment of lawful types. Use professional and state-certain web templates to tackle your small business or person requirements.

Form popularity

FAQ

Any person who is the head of household with a Homestead Exemption may receive an additional $1,000 assessment exemption if the gross household income from all sources did not exceed $25,000 for the past calendar year.

An Additional Homestead Exemption is an exemption of an additional $1,000 off the assessed valuation of your primary residence.

Homestead can be applied to condominiums, mobile homes, and manufactured homes. However, you can have only one homestead residence. You cannot split it between two different pieces of real property, even if they are both here in Florida or even within the same county.

It's important to note that though a person may own multiple properties, Homestead Exemption can apply only to the one where you live.

Overview of Oklahoma Homestead Protection Law At least 75 percent of the total square footage claimed must be used as the homeowner's principle residence, and the homestead exemption may not exceed $5,000 if at least 25 percent is used for business purposes.

Senior Valuation Freeze Head-of-household (as defined below) must be age 65 or older prior to January 1, of current year. Head-of-household must be an owner of and occupy the Homestead property on January 1, of current year. Gross household income (as defined below) cannot exceed the current H.U.D.

If you are head of household and qualify for homestead exemption, you may also qualify for additional homestead. You may receive an additional $1,000 assessment exemption if the gross household income from all sources did not exceed $25,000 for the past calendar year.