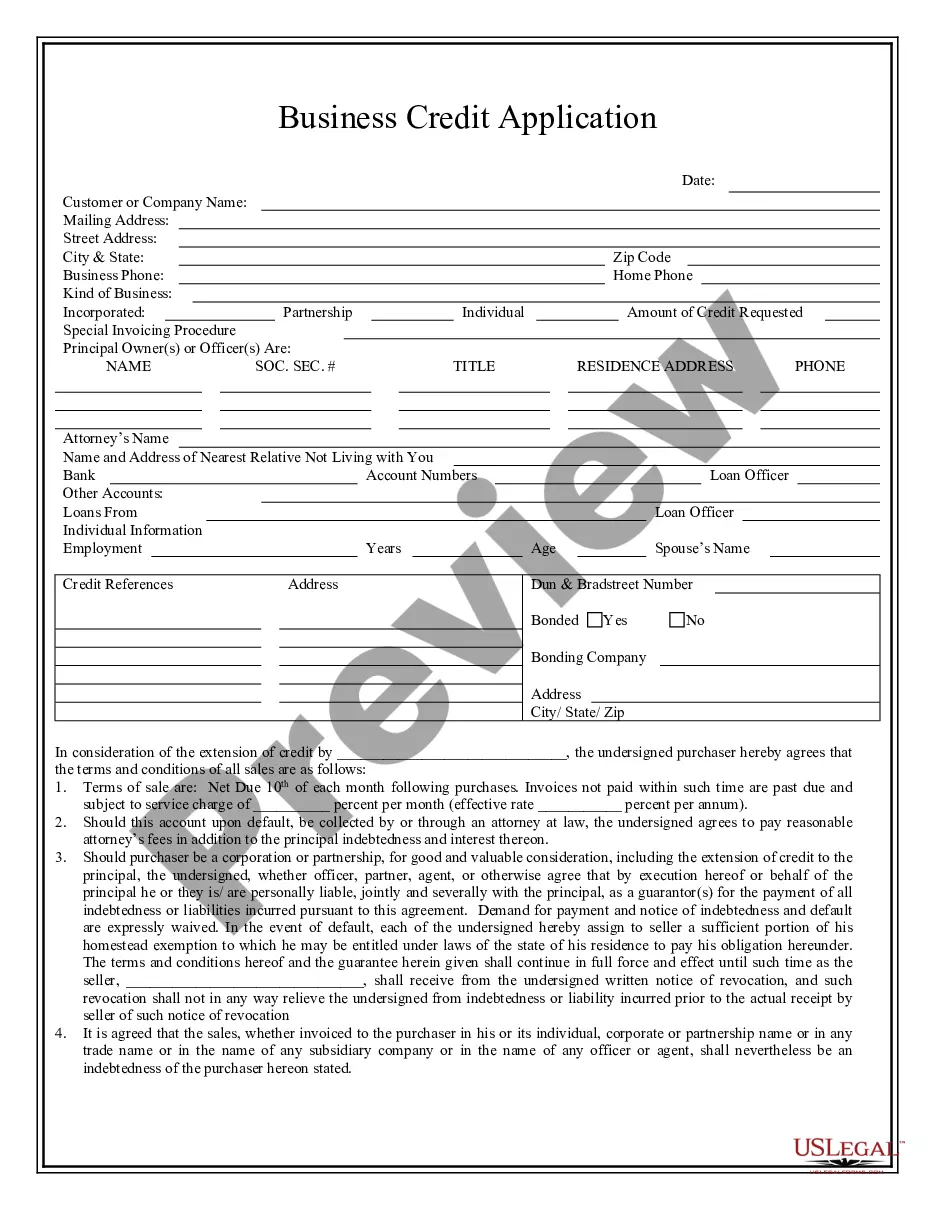

This is an official form from the Oklahoma Secretary of State, which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by Oklahoma statutes and law.

Oklahoma Restated Certificate of Incorporation - Not for Profit

Description

How to fill out Oklahoma Restated Certificate Of Incorporation - Not For Profit?

When it comes to submitting Oklahoma Restated Certificate of Incorporation - Not for Profit, you probably think about a long process that requires choosing a appropriate sample among countless similar ones after which being forced to pay out an attorney to fill it out for you. On the whole, that’s a slow and expensive option. Use US Legal Forms and choose the state-specific form in a matter of clicks.

For those who have a subscription, just log in and then click Download to have the Oklahoma Restated Certificate of Incorporation - Not for Profit form.

If you don’t have an account yet but want one, stick to the step-by-step guideline listed below:

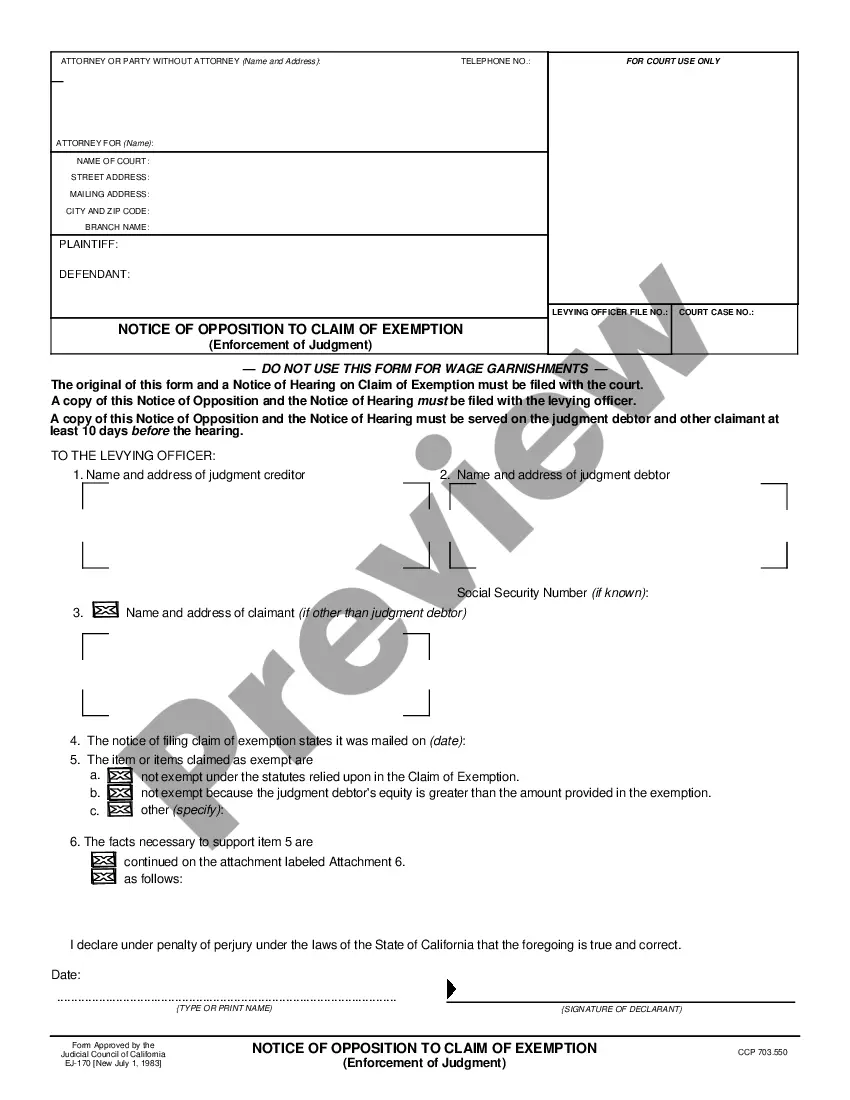

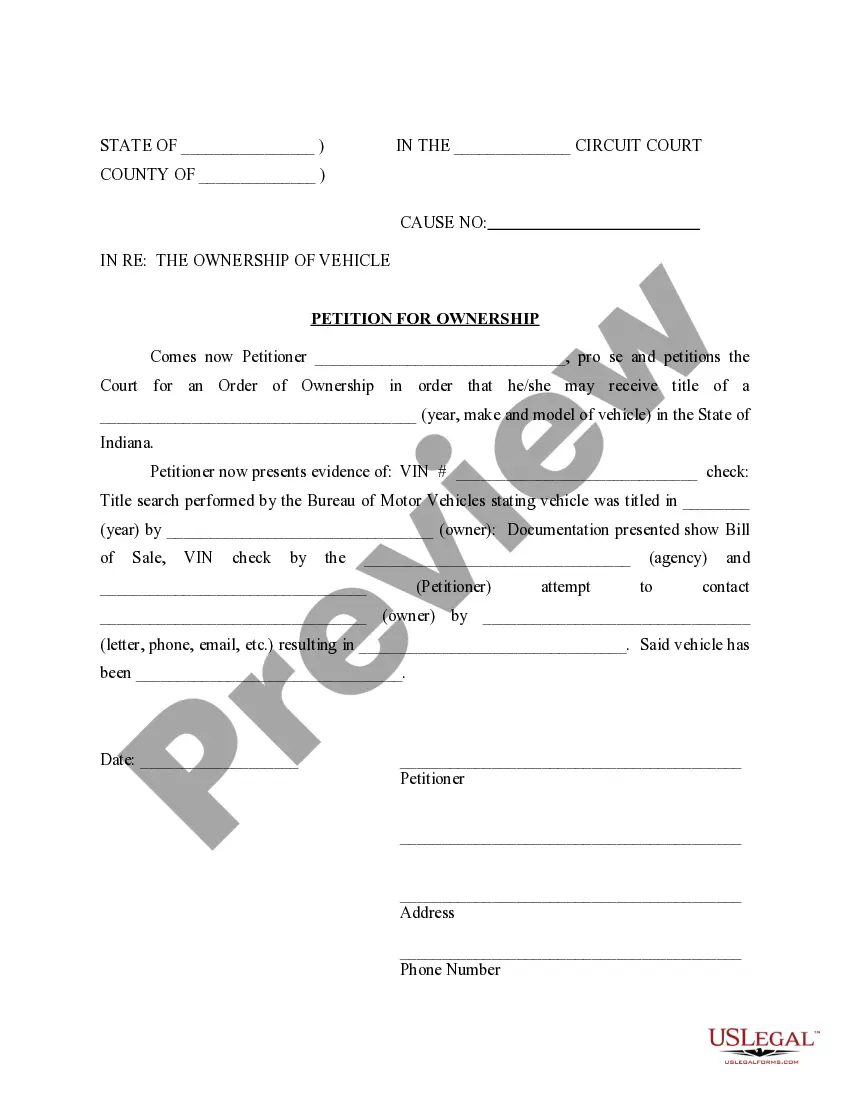

- Make sure the document you’re downloading applies in your state (or the state it’s required in).

- Do so by looking at the form’s description and through clicking on the Preview option (if readily available) to find out the form’s content.

- Click on Buy Now button.

- Select the proper plan for your budget.

- Join an account and select how you would like to pay: by PayPal or by card.

- Download the document in .pdf or .docx format.

- Find the record on your device or in your My Forms folder.

Professional lawyers work on drawing up our templates so that after saving, you don't have to worry about editing content outside of your personal info or your business’s details. Join US Legal Forms and receive your Oklahoma Restated Certificate of Incorporation - Not for Profit example now.

Form popularity

FAQ

You can just file an amendment to change the name of your Oklahoma LLC. Doing this will inform the Secretary of State about your plan. Additionally, your LLC also needs to change its name on the records with the state and government.

Hold a board of directors meeting and formally move to dissolve your corporation. Fill out and file the Certificate of Dissolution with the Oklahoma Secretary of State. Fulfill all tax obligations with the state of Oklahoma, as well as with the IRS.

Written Resolution. Pay creditors. Distribute to Members. Complete Articles of Dissolution. File with Secretary of State. File with Oklahoma Tax Commission. File with IRS. Unemployment Authority.

Think of this as the Birth Certificate of your corporation. It is also sometimes referred to as the Articles of Incorporation.There are a number of documents for which a Certified Copy is available, including a Certificate of Formation/Incorporation, an Annual Report, a Stock Amendment and others.

To reinstate your Oklahoma entity you need to file Certificate of Renewal, Revival, Extension and Restoration (for corporations) or Application for Reinstatement (for LLCs) with Oklahoma Secretary of State and pay any fees, missing annual reports and penalties.

In California you can reinstate your company any time after suspension or forfeiture. Dissolved California entities cannot be reinstated, so in case like that you would need to file as a new entity.

Under Domestic Organizations, select Domestic Profit Corporation. Enter your name and email address. Complete the Oklahoma Certificate of Incorporation. Submit and pay the filing fee.

How do you change your registered agent in Oklahoma? File the Notice of Change of Registered Office/ Registered Agent form with the Oklahoma Secretary of State by mail, in person or online. The filing fee is $35 for all LLCs and domestic corporations. Pay $50 to change the agent of a foreign corporation.

In Oklahoma, to search for a business entity (Corporation, LLC, Limited Partnership) go to the Secretary of State's Website where you may lookup by Name, Filing Number, Officer, or Registered Agent for free.