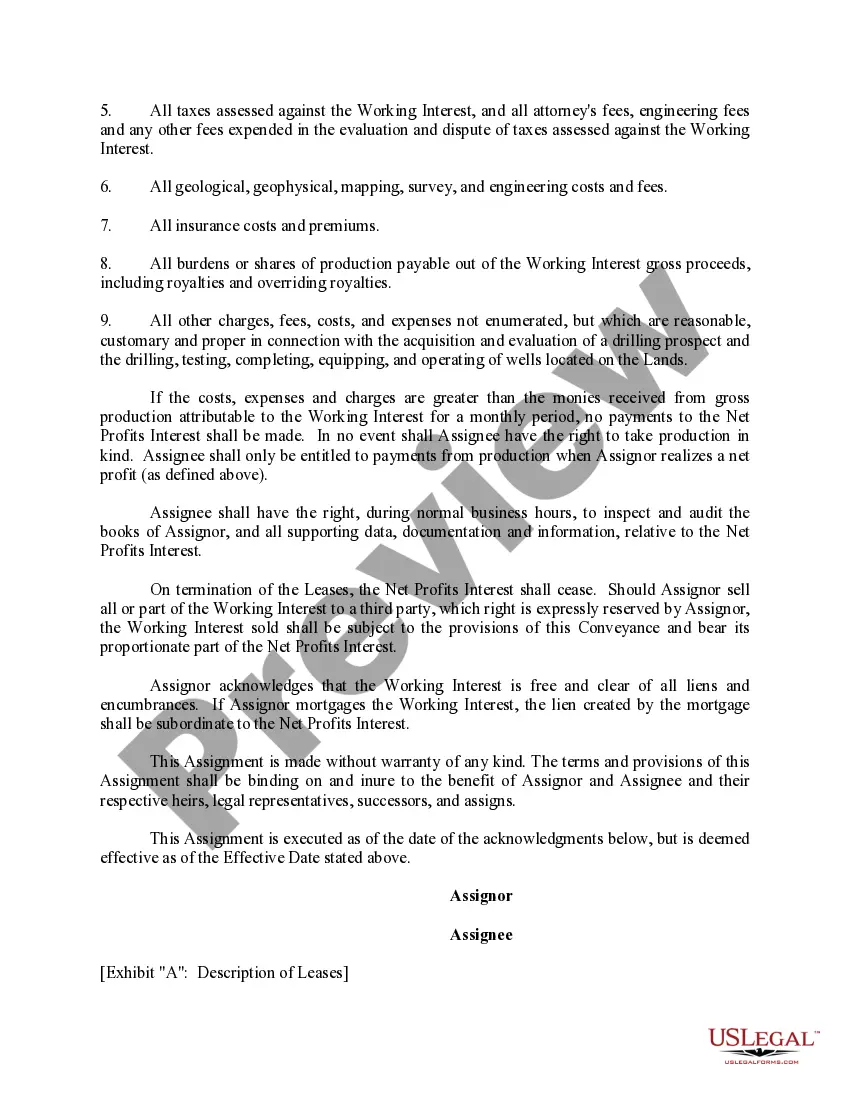

This form is used when Assignor grants, assigns, and conveys to Assignee a percentage of the net profit interest in the Working Interest. The Net Profits Interest is the stated percentage interest in the share of monies payable for gross production attributable to the Working Interest less the costs and expenses attributable to the Working Interest.

Ohio Assignment of Net Profits Interest

Description

How to fill out Assignment Of Net Profits Interest?

Are you presently inside a place where you need to have documents for sometimes company or individual purposes just about every working day? There are plenty of legal file layouts available on the Internet, but discovering versions you can depend on is not straightforward. US Legal Forms provides a huge number of develop layouts, just like the Ohio Assignment of Net Profits Interest, that happen to be created to satisfy state and federal needs.

If you are presently knowledgeable about US Legal Forms internet site and have your account, simply log in. Next, you can obtain the Ohio Assignment of Net Profits Interest template.

If you do not offer an account and want to start using US Legal Forms, follow these steps:

- Discover the develop you require and ensure it is for the appropriate city/state.

- Make use of the Review switch to examine the form.

- Read the information to ensure that you have chosen the appropriate develop.

- When the develop is not what you are trying to find, utilize the Look for industry to find the develop that meets your requirements and needs.

- Once you discover the appropriate develop, simply click Acquire now.

- Select the pricing plan you would like, fill in the desired information and facts to generate your account, and purchase the transaction utilizing your PayPal or bank card.

- Choose a practical document structure and obtain your copy.

Find all the file layouts you have bought in the My Forms food list. You can aquire a further copy of Ohio Assignment of Net Profits Interest any time, if necessary. Just go through the needed develop to obtain or print out the file template.

Use US Legal Forms, one of the most comprehensive selection of legal types, in order to save some time and stay away from blunders. The services provides professionally manufactured legal file layouts that you can use for a selection of purposes. Create your account on US Legal Forms and start making your life a little easier.

Form popularity

FAQ

A profits interest is an equity-like form of compensation that limited liability companies (LLCs) can offer to employees and other service providers. The value of a profits interest is based on the growing value of the LLC, which allows employees (or ?partners?) to benefit from the LLC's appreciation in value.

Example 1: Profits interest ? Let's say that the company is worth $1,000,000 and has $50,000 in annual profits. A worker with a 10% interest grant doesn't have any interest in the company's current market value, but they do have a 10% interest in annual profits, which equates to $5,000.

This means that if the company goes out of business or is sold immediately after the grant is issued, the future profits interest-holder has no right to receive any share of the company's assets. Example: A company is worth $1,000,000 and is later sold for $2,000,000.

A capital interest is a type of equity commonly issued by LLCs, under which the member of the LLC contributes capital to the LLC and has an ownership interest. Unlike a capital interest, profits interests do not represent ownership in the LLC.

Profits interests are taxed as capital gains When designed and directed properly, the recipient pays no tax at grant (as long as granted at or above the threshold value), no tax at vesting, and no ordinary income taxation upon the liquidation event.

Vested profits interests could lose their tax treatment over capital interests in four situations: If the profits interest is related to a predictable source of income. This includes revenue from high-quality debt securities and net leases. If the grant holder disposes of the profit interests within two years of ...

Revenue Procedure 93-27 provides, subject to certain exceptions, a ?safe harbor? indicating that the receipt of a ?profits interest? in exchange for the provision of services to or for the benefit of a partnership in a partner capacity (or in anticipation of being a partner), is not a taxable event.

A net profits interest is an agreement that provides a payout of an operation's net profits to the parties of the agreement. It is a non-operating interest that may be created when the owner of a property, typically an oil and gas property, leases it out to another party for development and production.