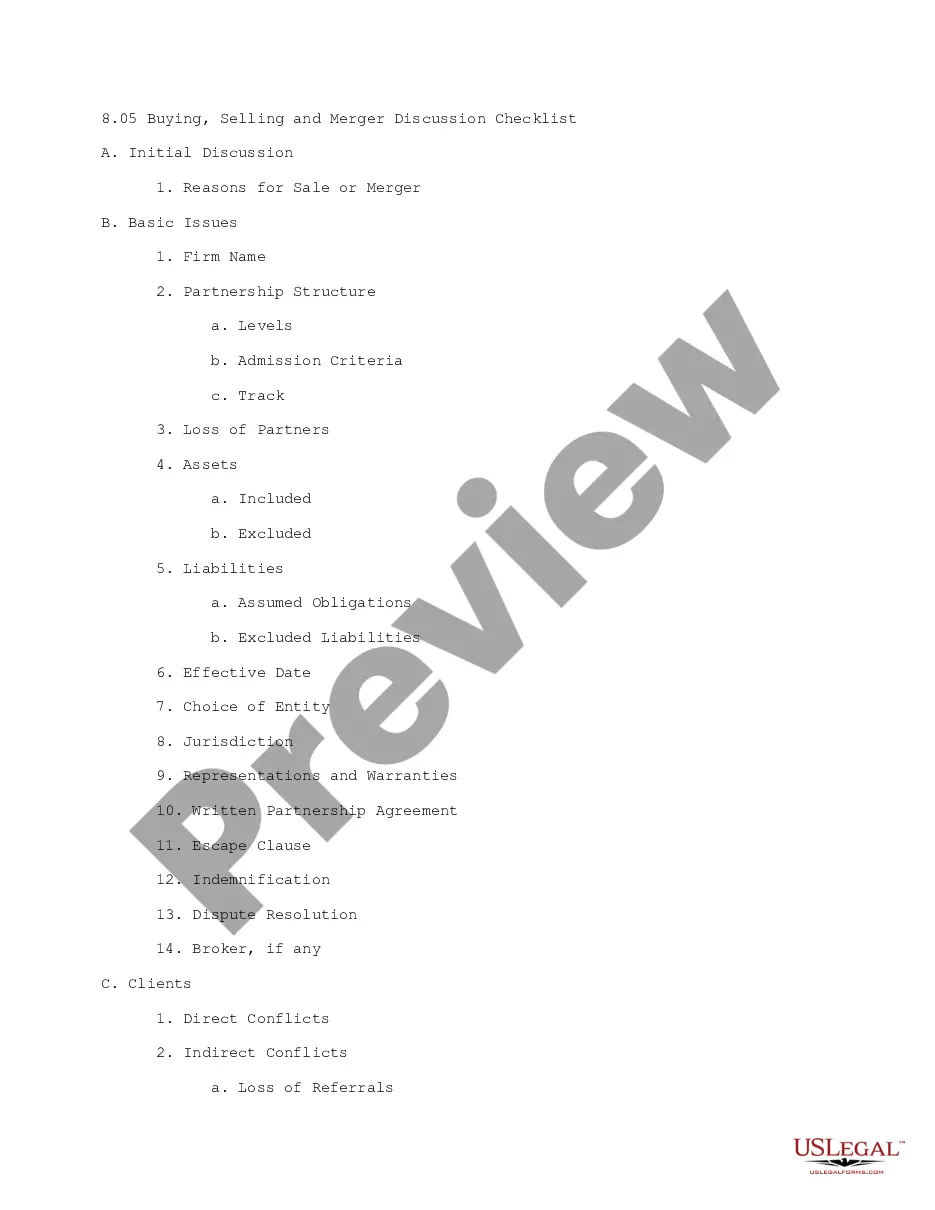

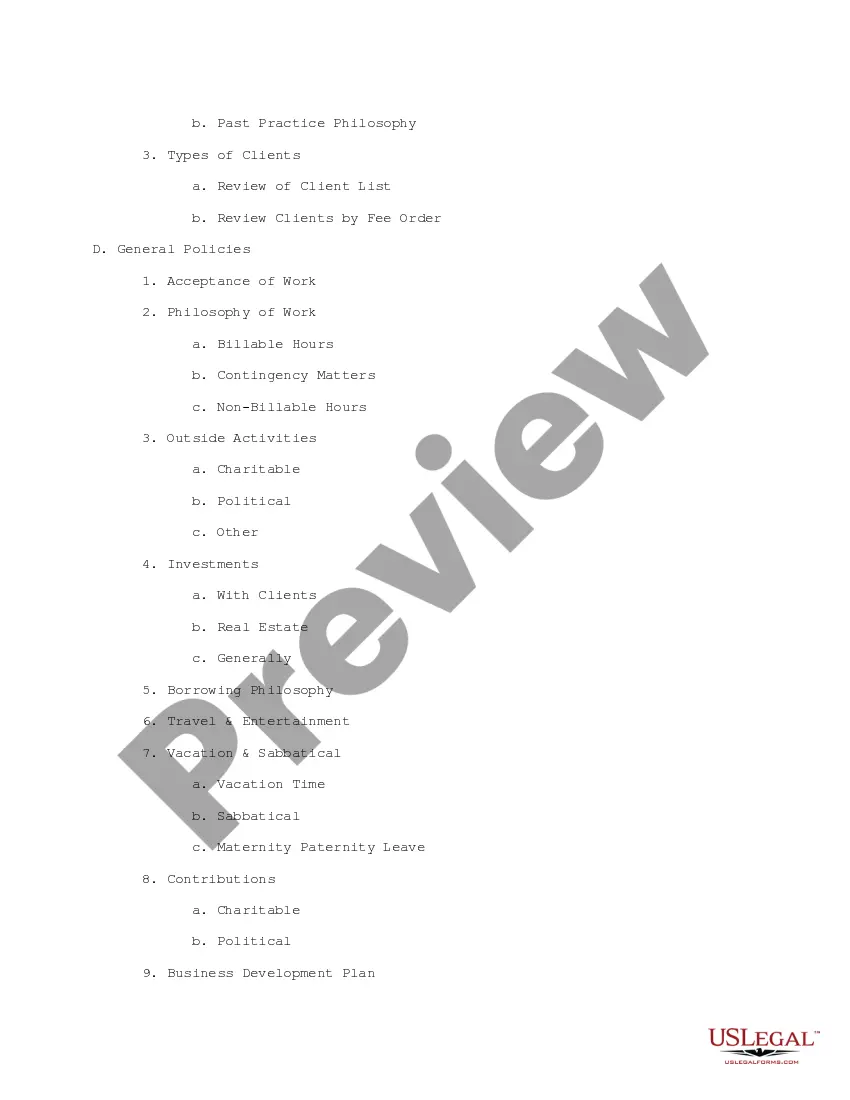

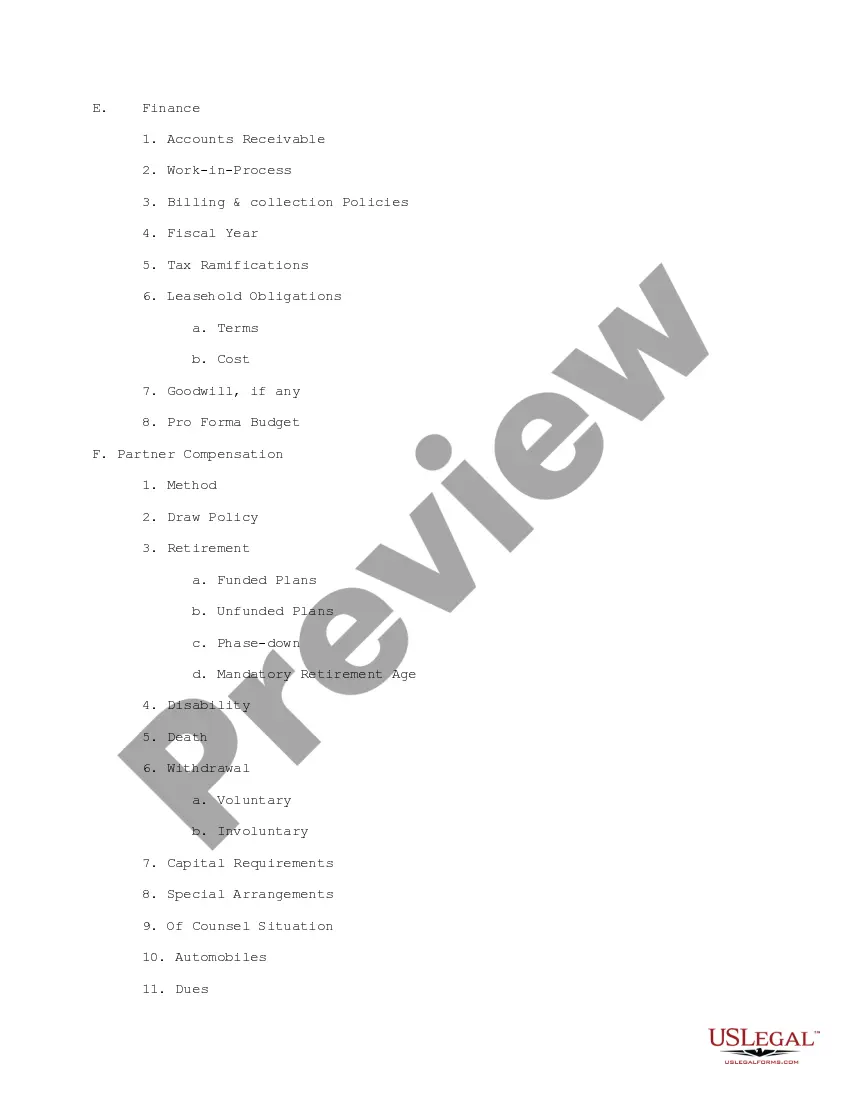

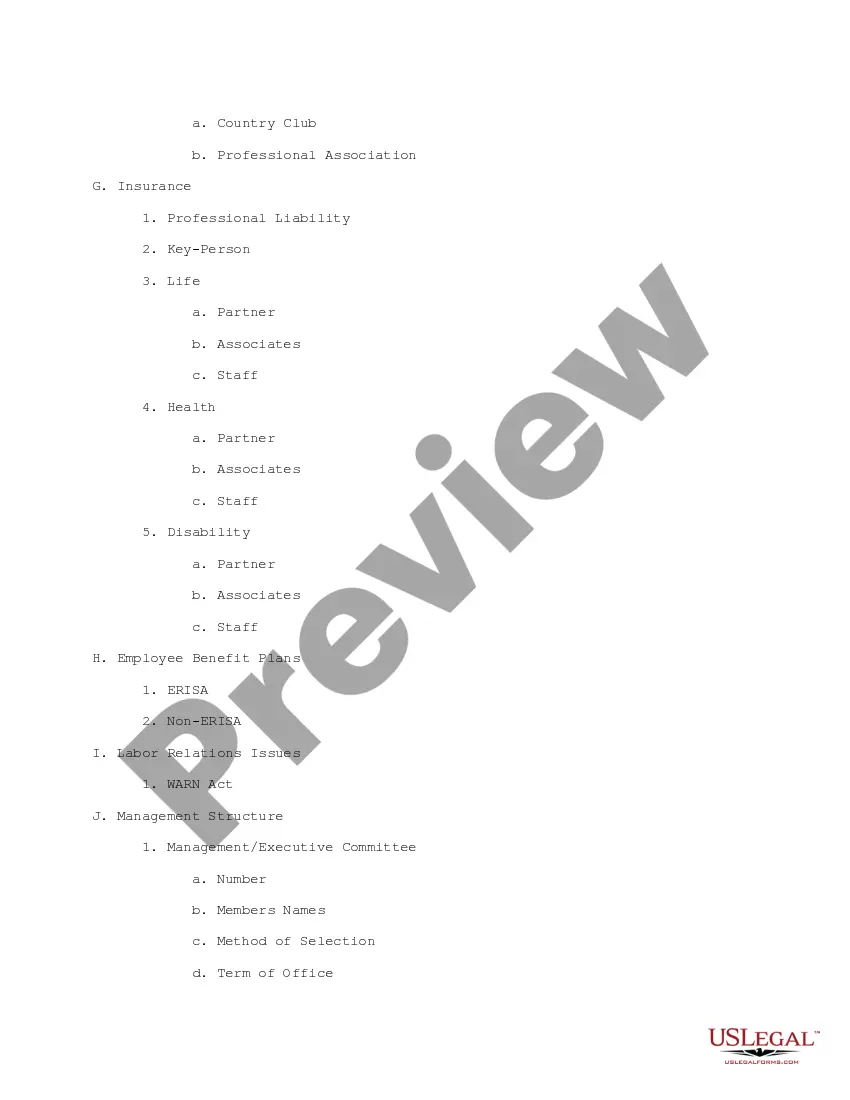

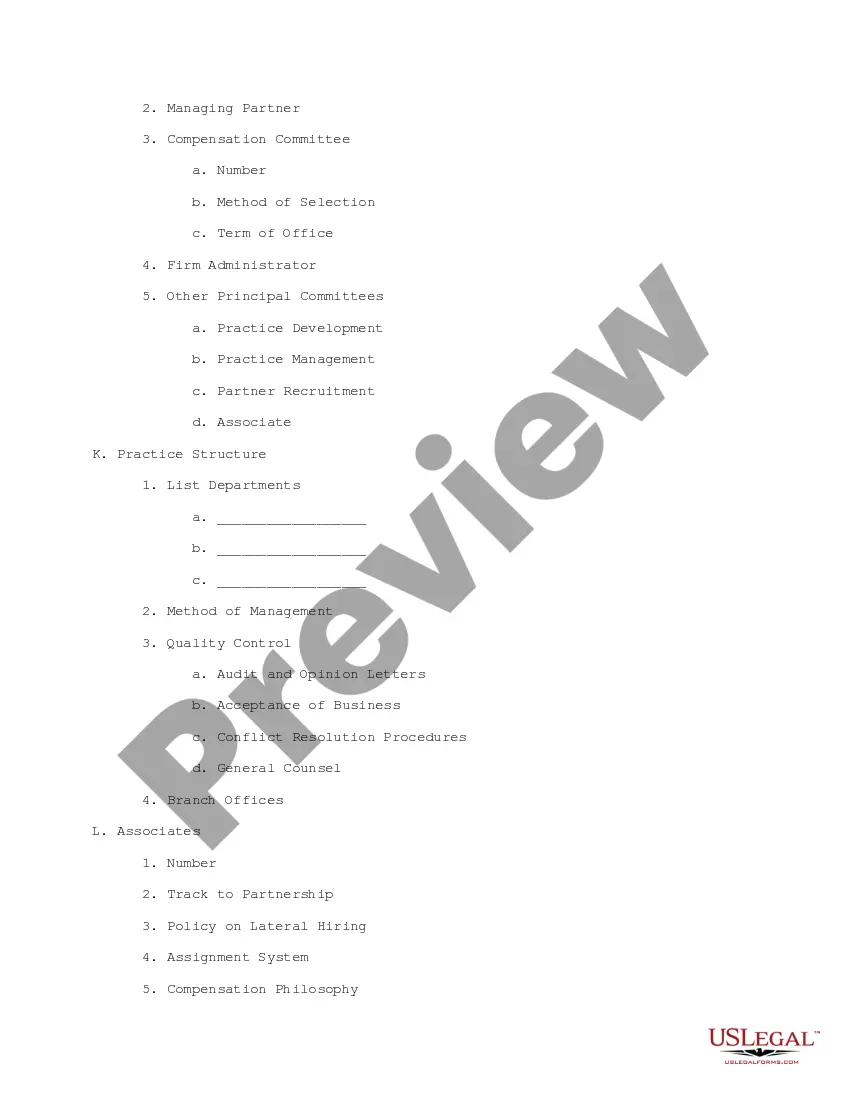

This is a checklist for the discussion of buying, selling, or merger of a law firm. Each category (clients, finance, partner compensation, etc.) is broken into sub-categories as a way of bringing to mind all issues to be discussed.

Ohio Buying, Selling and Merger Discussion Checklist

Description

How to fill out Buying, Selling And Merger Discussion Checklist?

You may spend time online attempting to find the lawful file template that fits the state and federal demands you require. US Legal Forms provides a huge number of lawful types which are examined by experts. You can easily download or print the Ohio Buying, Selling and Merger Discussion Checklist from my service.

If you already have a US Legal Forms profile, it is possible to log in and click the Acquire option. After that, it is possible to comprehensive, modify, print, or indication the Ohio Buying, Selling and Merger Discussion Checklist. Every lawful file template you purchase is your own property forever. To have another duplicate for any purchased kind, proceed to the My Forms tab and click the corresponding option.

Should you use the US Legal Forms internet site initially, adhere to the simple directions beneath:

- Initially, ensure that you have selected the proper file template for your county/town of your choosing. See the kind description to make sure you have selected the appropriate kind. If accessible, utilize the Review option to check throughout the file template too.

- In order to discover another version of the kind, utilize the Lookup discipline to get the template that meets your needs and demands.

- Upon having located the template you want, click Purchase now to continue.

- Pick the pricing program you want, enter your credentials, and sign up for an account on US Legal Forms.

- Comprehensive the transaction. You can utilize your bank card or PayPal profile to purchase the lawful kind.

- Pick the structure of the file and download it in your product.

- Make changes in your file if needed. You may comprehensive, modify and indication and print Ohio Buying, Selling and Merger Discussion Checklist.

Acquire and print a huge number of file themes using the US Legal Forms Internet site, which provides the largest collection of lawful types. Use expert and state-particular themes to tackle your company or person requirements.

Form popularity

FAQ

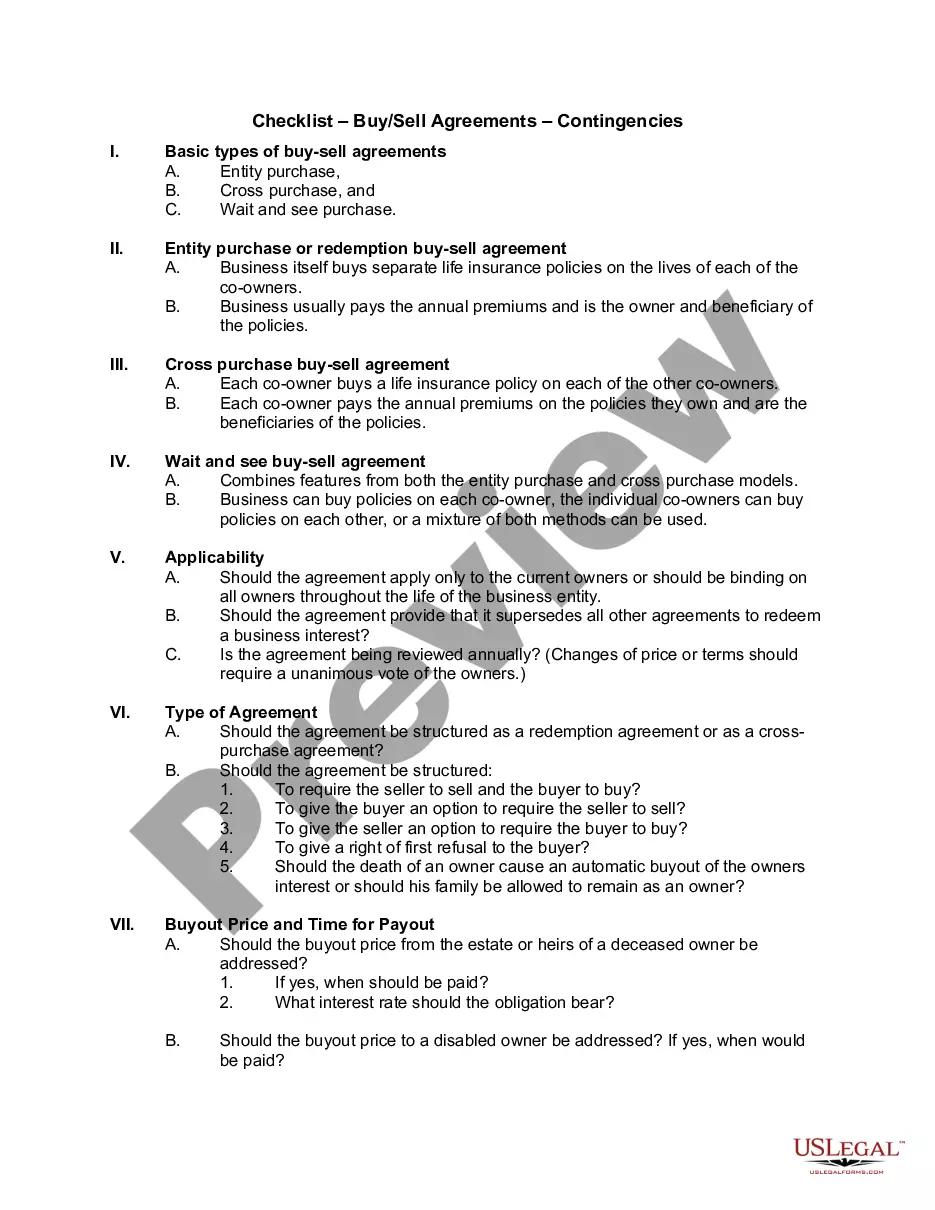

Due diligence falls into three main categories: legal due diligence. financial due diligence. commercial due diligence.

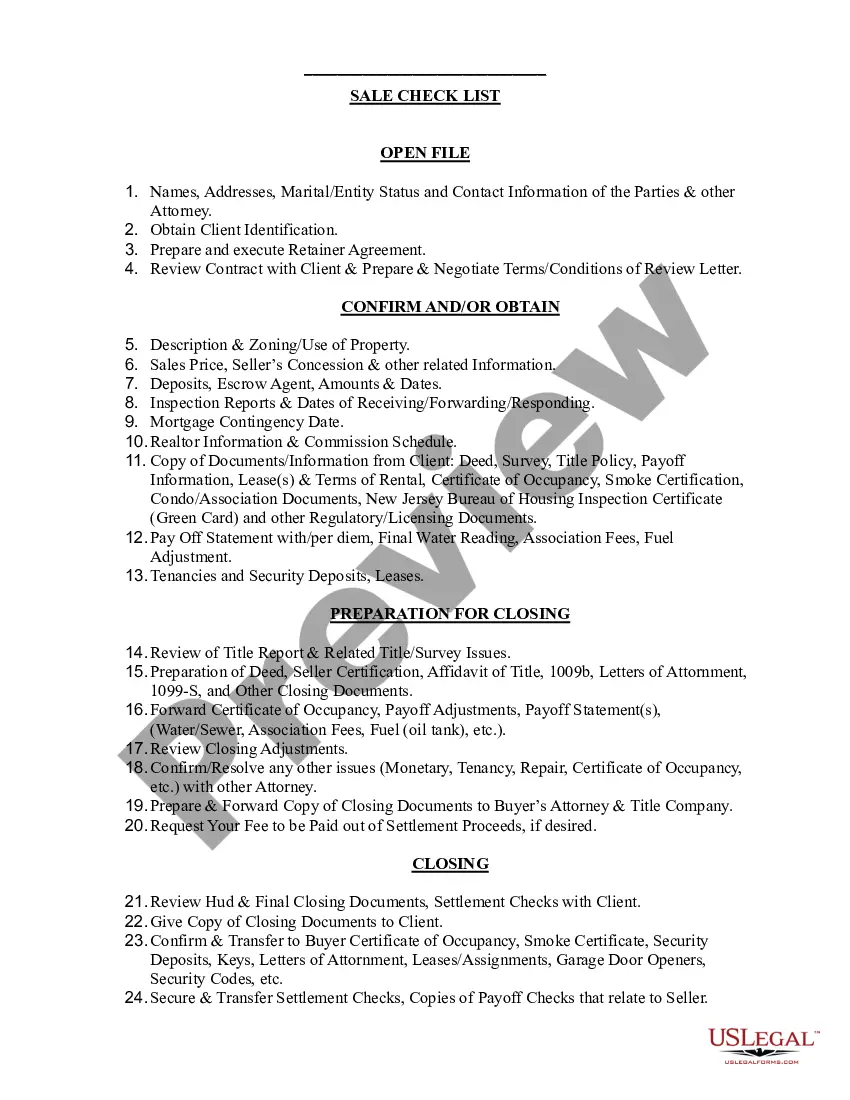

Comprehensive M&A due diligence checklist steps Handle preliminary matters. Assemble the due diligence team. Submit the due diligence request. Distribute and organize materials. Communicate and report due diligence findings. Review key sources of information. Determine whether specialist review is necessary.

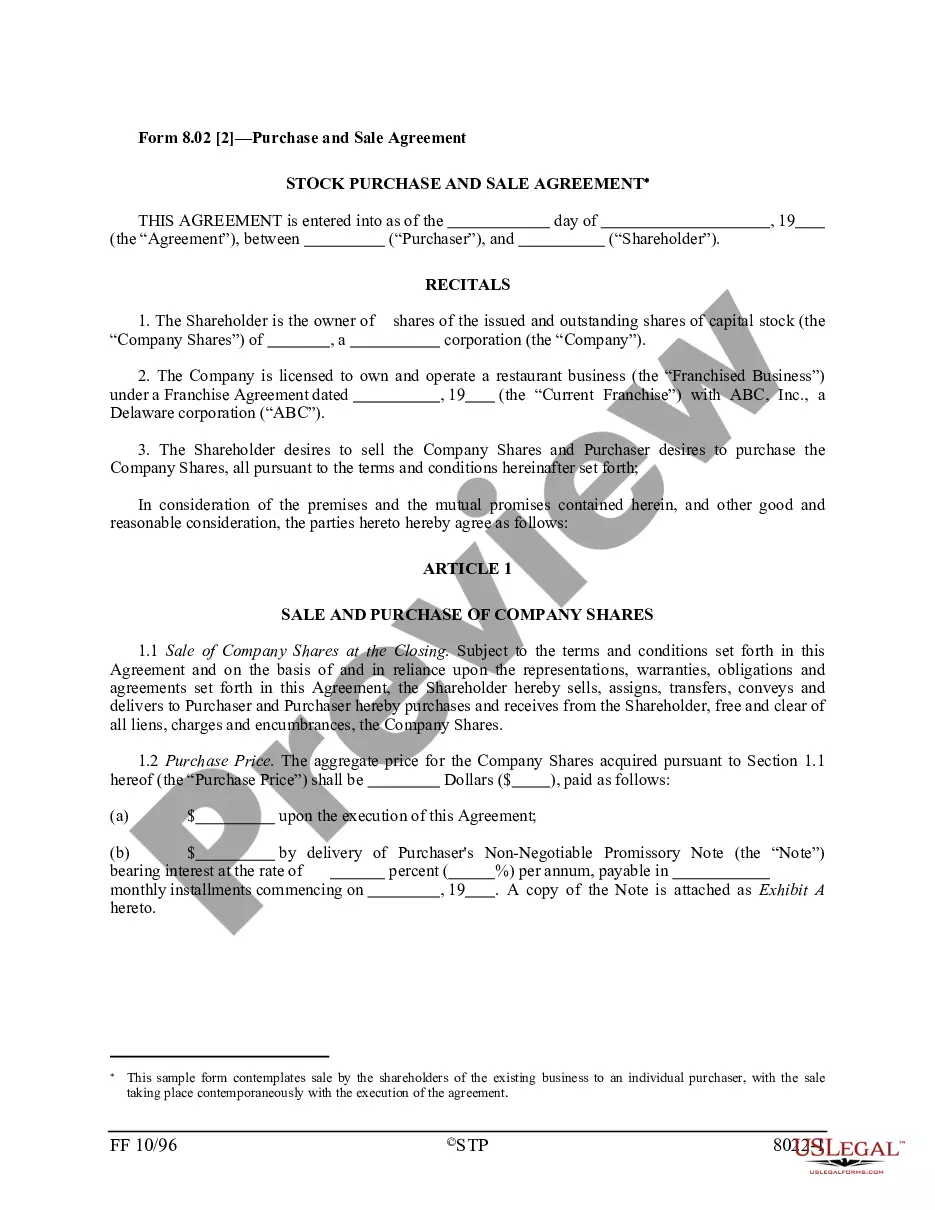

Hear this out loud PauseLegal due diligence is the process of collecting and assessing all of the legal documents and information relating to the target company. It gives both the buyer and seller the chance to scrutinize any legal risks, such as lawsuits or intellectual property details, before closing the deal.

Hear this out loud PauseWhat is HR due diligence? HR due diligence is where the target company's HR processes and human capital are put under the microscope. The culture of the company, as well as the roles, capabilities and attitudes of its people are investigated.

Approval of Shareholders: Before a merger or acquisition can take place, the proposal must be approved by the shareholders of each company involved. The Companies Act requires that at least 75% of the shareholders present and voting must approve the proposal.

The process of due diligence ensures that potential acquirers gain an accurate and complete understanding of a company. It helps evaluate a company's strengths, weaknesses, risks, and opportunities. The creation of a due diligence checklist provides the detailed roadmap required to guide such an extensive analysis.

The due diligence process helps stakeholders understand the synergies and potential scalability of the businesses after the merger/acquisition. During the process, all internal and external factors that create risk in the acquisition are identified and focus is driven towards key factors that drive profitability.

Hear this out loud PauseA due diligence checklist is an organized way to analyze a company. The checklist will include all the areas to be analyzed, such as ownership and organization, assets and operations, the financial ratios, shareholder value, processes and policies, future growth potential, management, and human resources.