Ohio Personal Shopper Services Contract - Self-Employed Independent Contractor

Description

How to fill out Personal Shopper Services Contract - Self-Employed Independent Contractor?

If you want to complete, obtain, or create official document templates, utilize US Legal Forms, the largest repository of legal templates available online.

Take advantage of the site’s straightforward and user-friendly search feature to find the documents you require.

A wide range of templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Purchase now button. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.Step 6. Select the format of the legal form and download it to your device.Step 7. Complete, edit, and print or sign the Ohio Personal Shopper Services Contract - Self-Employed Independent Contractor. Every legal document template you acquire is yours indefinitely. You have access to every form you obtained in your account. Select the My documents section and choose a form to print or download again. Stay competitive and acquire, and print the Ohio Personal Shopper Services Contract - Self-Employed Independent Contractor with US Legal Forms. There are millions of professional and state-specific templates you can utilize for your business or personal requirements.

- Use US Legal Forms to acquire the Ohio Personal Shopper Services Contract - Self-Employed Independent Contractor with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to get the Ohio Personal Shopper Services Contract - Self-Employed Independent Contractor.

- You can also access forms you have previously obtained in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct area/region.

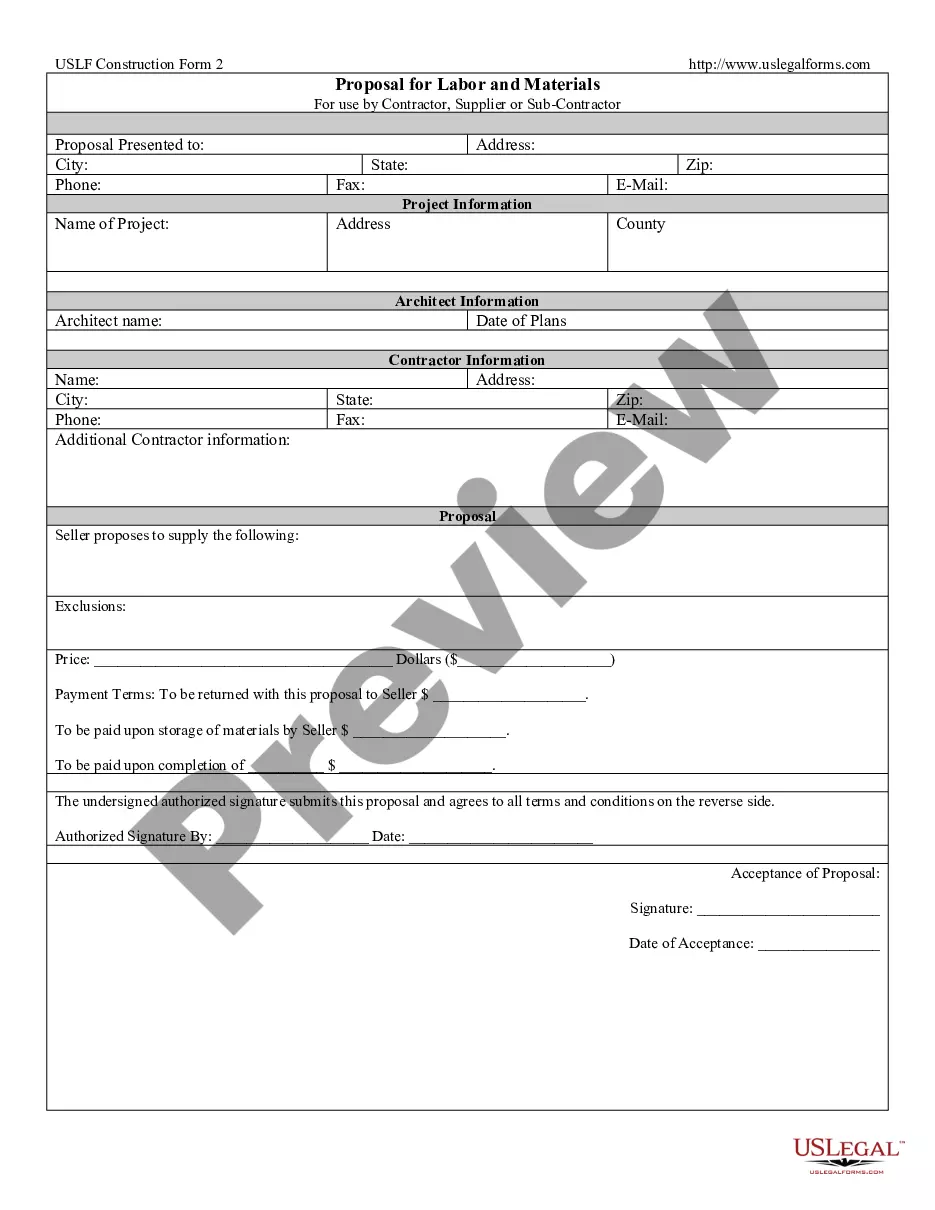

- Step 2. Use the Preview feature to review the form’s details. Don’t forget to read the information.

- Step 3. If you are not satisfied with the form, utilize the Search area at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

Independent contractors generally need to fill out a few essential forms, such as the independent contractor agreement and a W-9 form for tax purposes. If you are operating under the Ohio Personal Shopper Services Contract - Self-Employed Independent Contractor, ensure that you have all required documentation in place. Depending on your location and services, you might also need to complete local business registration forms. Consult with a legal professional for tailored guidance.

To fill out an independent contractor form, gather necessary details such as your personal information, project description, and payment arrangement. Clearly articulate your role as defined in the Ohio Personal Shopper Services Contract - Self-Employed Independent Contractor. Ensure that you complete all sections accurately and provide any additional documentation required, like tax forms. This thoroughness minimizes misunderstandings down the road.

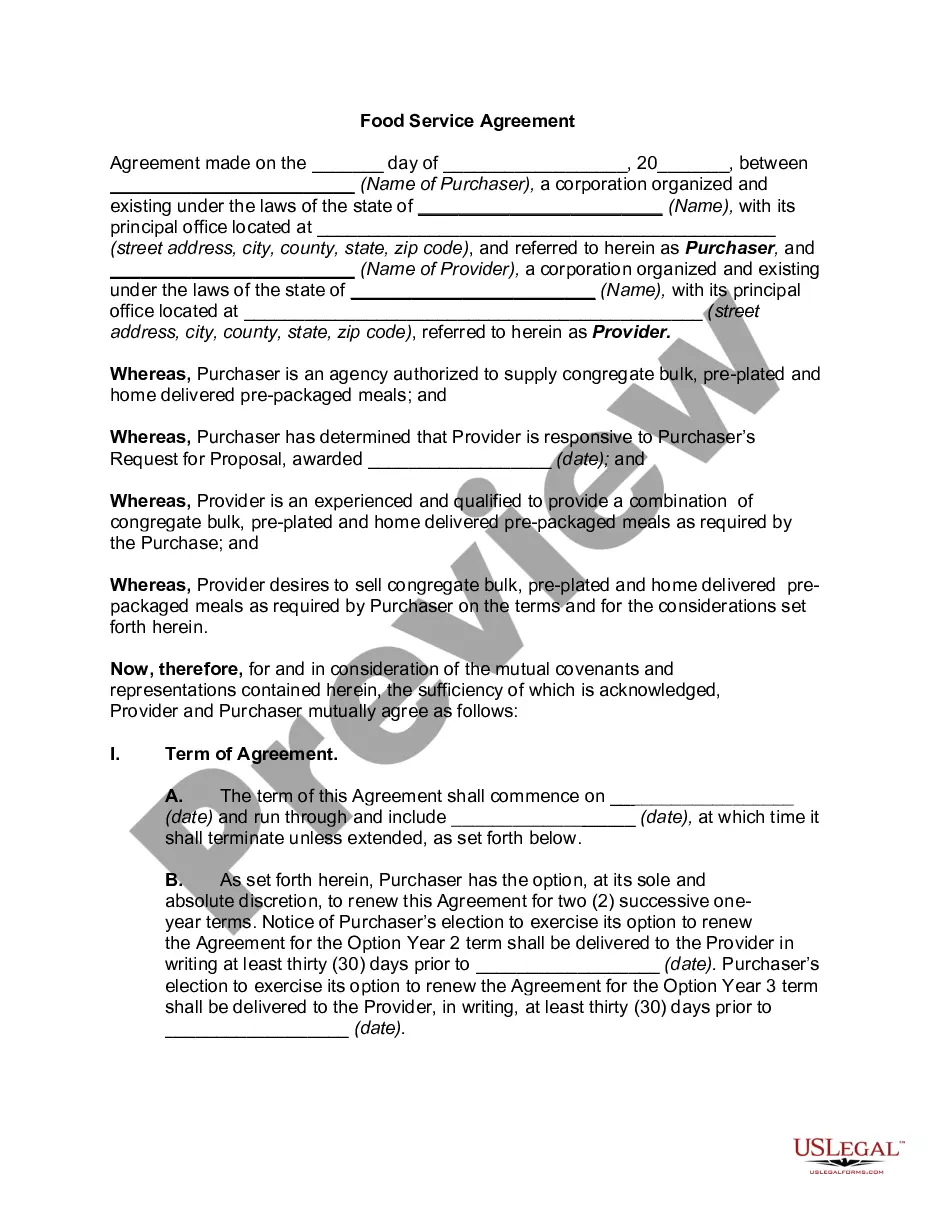

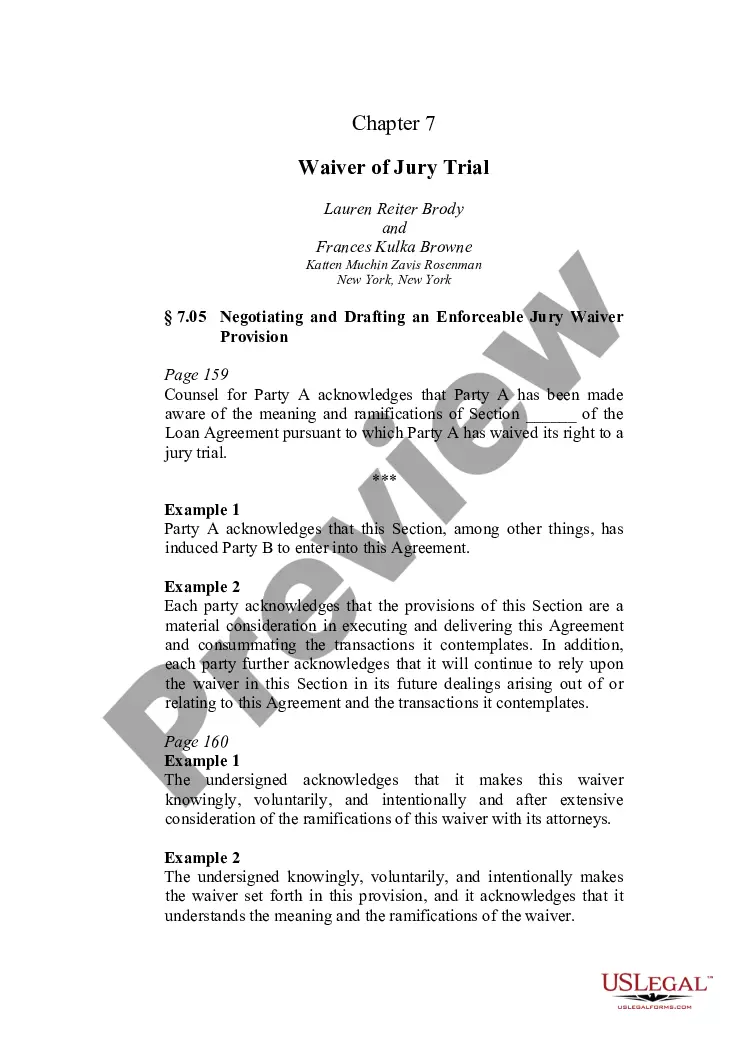

Filling out an independent contractor agreement requires attention to detail. Start by entering the correct names and contact information of both parties involved. Then, provide specifics about the project under the Ohio Personal Shopper Services Contract - Self-Employed Independent Contractor, including the services rendered, payment schedule, and duration of the agreement. Finally, both parties should sign the document to make it legally binding.

To write an independent contractor agreement, begin by clearly defining the scope of work. Specify the services you will provide under the Ohio Personal Shopper Services Contract - Self-Employed Independent Contractor. Include details like payment terms, deadlines, and any confidentiality requirements. After outlining these key points, both parties should review and sign the document to ensure mutual understanding.

To accept payments as an independent contractor, set up a reliable system that suits your business model. Options include invoicing clients directly, using payment platforms, or accepting checks. Always detail your payment preferences in the Ohio Personal Shopper Services Contract - Self-Employed Independent Contractor to ensure clarity and proper documentation.

Contractors accept payments through various methods, including checks, electronic transfers, and payment apps. It’s vital to communicate your preferred payment methods upfront in the Ohio Personal Shopper Services Contract - Self-Employed Independent Contractor. This approach minimizes disputes and fosters trust between you and your clients.

Yes, a salesperson can indeed operate as an independent contractor. This arrangement lets them maintain flexibility while working with various clients. When using the Ohio Personal Shopper Services Contract - Self-Employed Independent Contractor, salespeople can define their terms and conditions clearly, making it beneficial for both parties involved.

Receiving payments as an independent contractor involves setting up a reliable payment method. You can use platforms like PayPal, direct bank transfers, or services specifically designed for contractors. It's essential to include your payment terms in the Ohio Personal Shopper Services Contract - Self-Employed Independent Contractor to avoid confusion and ensure timely payments.

To determine if you are an independent contractor, consider your working relationship with clients. If you manage your own business tasks, including client interactions and service delivery, you likely fall under this classification. Utilizing an Ohio Personal Shopper Services Contract - Self-Employed Independent Contractor can help solidify your status and protect your interests.

A shopper typically provides personalized shopping services to clients. This role can vary from grocery shopping to gift purchasing, tailored to client preferences. As an independent contractor under an Ohio Personal Shopper Services Contract, you can define your services and attract clients seeking these specialized offerings.