Ohio Guaranty of Payment of Open Account

Description

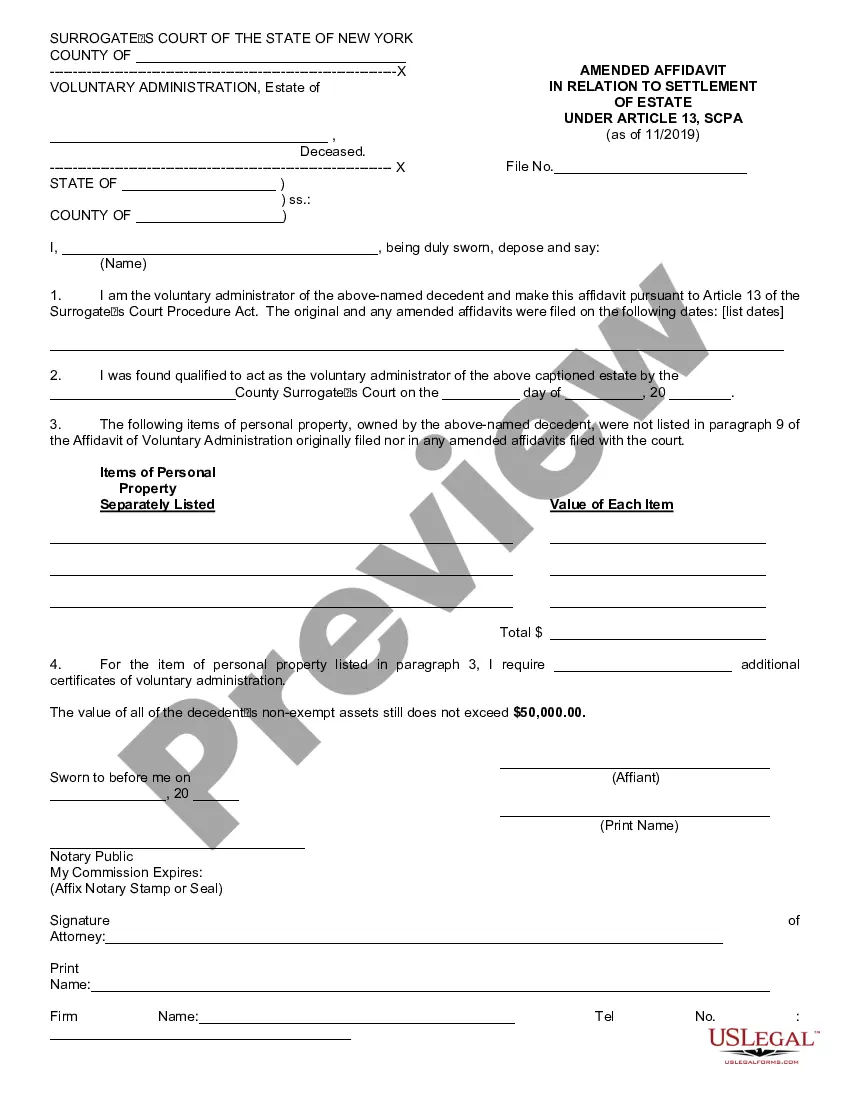

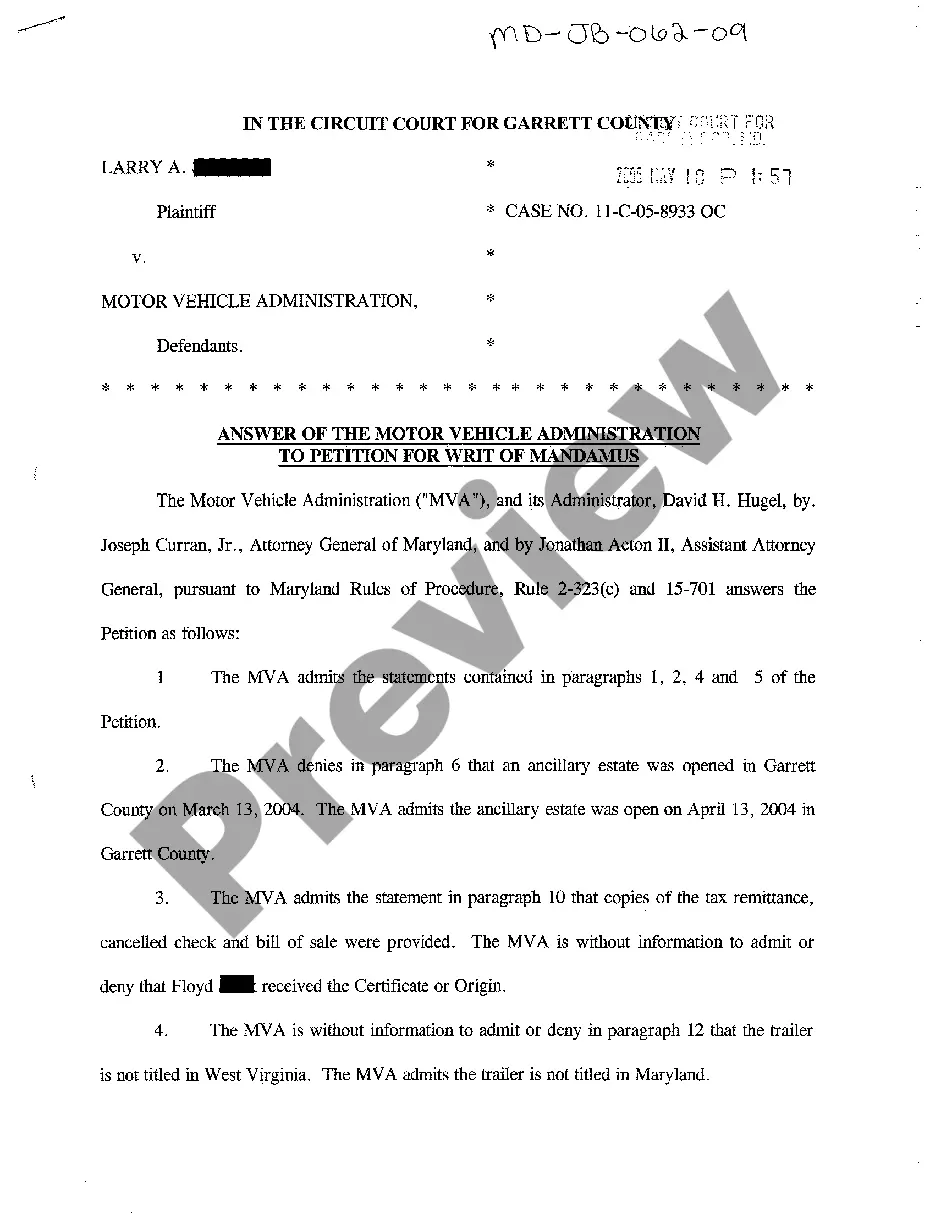

How to fill out Guaranty Of Payment Of Open Account?

If you desire to access extensive, obtain, or print sanctioned document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the site's straightforward and convenient search to find the documents you require.

Many templates for business and personal purposes are sorted by categories and states, or keywords.

Step 5. Process the transaction. You can use your Visa or MasterCard or PayPal account to complete the transaction.

Step 6. Choose the format of the legal document and download it onto your device. Step 7. Complete, edit, and print or sign the Ohio Guaranty of Payment of Open Account. Each legal document template you acquire is yours forever. You will have access to every form you downloaded in your account. Click the My documents section and select a form to print or download again. Compete and download, and print the Ohio Guaranty of Payment of Open Account with US Legal Forms. There are numerous professional and state-specific forms you can use for your business or personal needs.

- Take advantage of US Legal Forms to locate the Ohio Guaranty of Payment of Open Account in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Get button to obtain the Ohio Guaranty of Payment of Open Account.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have chosen the form for the correct region/state.

- Step 2. Utilize the Preview feature to review the form’s content. Don’t forget to read the details.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other forms in the legal document format.

- Step 4. After you have found the form you need, click the Buy now button. Select the pricing plan you prefer and enter your information to register for the account.

Form popularity

FAQ

To fill a guarantee form correctly, gather all required information, including the names of the parties, the amount guaranteed, and the payment terms. Ensure each section is completed thoroughly to avoid misunderstandings later. This meticulous approach supports the security of your Ohio Guaranty of Payment of Open Account. For added assistance, explore our user-friendly platform that simplifies the process.

To fill out a guarantee form, start by entering the names of all involved parties and their respective addresses. Clearly state the amount you are guaranteeing, along with any relevant conditions. It’s crucial to be precise, as this ensures a valid commitment under your Ohio Guaranty of Payment of Open Account. If you encounter challenges, consider using our platform for guidance.

Filling out a guaranty form requires clear information about the parties involved. Begin by providing the full names and addresses of both the guarantor and the borrower. Next, include the specific amount being guaranteed, ensuring that you understand the income and payment terms. Completing this process accurately reinforces your Ohio Guaranty of Payment of Open Account.

Yes, you can set up a payment plan for Ohio state taxes. The Ohio Department of Taxation offers various payment options, allowing you to manage your tax obligations more effectively. This service can help you maintain compliance and ease financial pressure. By setting up a plan, you support your commitment to fulfilling your Ohio Guaranty of Payment of Open Account.

A guaranty of payment is an independent agreement by a person or an entity to pay the loan when it goes into default. Even if the borrower is unable or unwilling to pay back the loan, the Bank can require the guarantor to pay it back.

A guarantee is a secondary obligation guaranteeing the obligations of another party (usually a borrower) and depends on that other having defaulted. An indemnity on the other hand is a free standing obligation not dependent on the borrower's default but enforceable in its own right.

For the guarantee to be enforceable it must prove that a debt is owed and provide sufficient proof of a valid obligation and enforceable debt. The creditor must prove you intended to be responsible for the debt you are being pursued for.

A guarantee must be in writing (or evidenced in writing) and signed by the guarantor or a person authorised by the guarantor (section 4, Statute of Frauds 1677). Guarantees and indemnities are often executed as deeds to overcome any argument about whether good consideration has been given.

A personal guarantee can be enforced the same way as any debt. If the business owner does not pay, the creditor can bring a lawsuit to receive a judgment and levy the owner's personal assets to cover the debt. The exact terms of a personal guarantee specify a creditor's options under the guarantee.

An offer to guarantee must be accepted, either by express or implied acceptance. If a surety's assent to a guarantee has been procured by fraud by the person to whom it is given, there is no binding contract.