US Legal Forms - among the most significant libraries of lawful varieties in the States - provides an array of lawful file templates you may acquire or print. Making use of the site, you may get 1000s of varieties for company and personal uses, categorized by types, states, or key phrases.You will find the newest variations of varieties such as the Ohio Letter Informing Debt Collector of Unfair Practices in Collection Activities - Communicating with a Consumer Regarding a Debt by Post Card in seconds.

If you currently have a registration, log in and acquire Ohio Letter Informing Debt Collector of Unfair Practices in Collection Activities - Communicating with a Consumer Regarding a Debt by Post Card from the US Legal Forms catalogue. The Down load button will show up on every type you view. You have access to all formerly downloaded varieties within the My Forms tab of your own bank account.

In order to use US Legal Forms the very first time, allow me to share easy guidelines to help you get started:

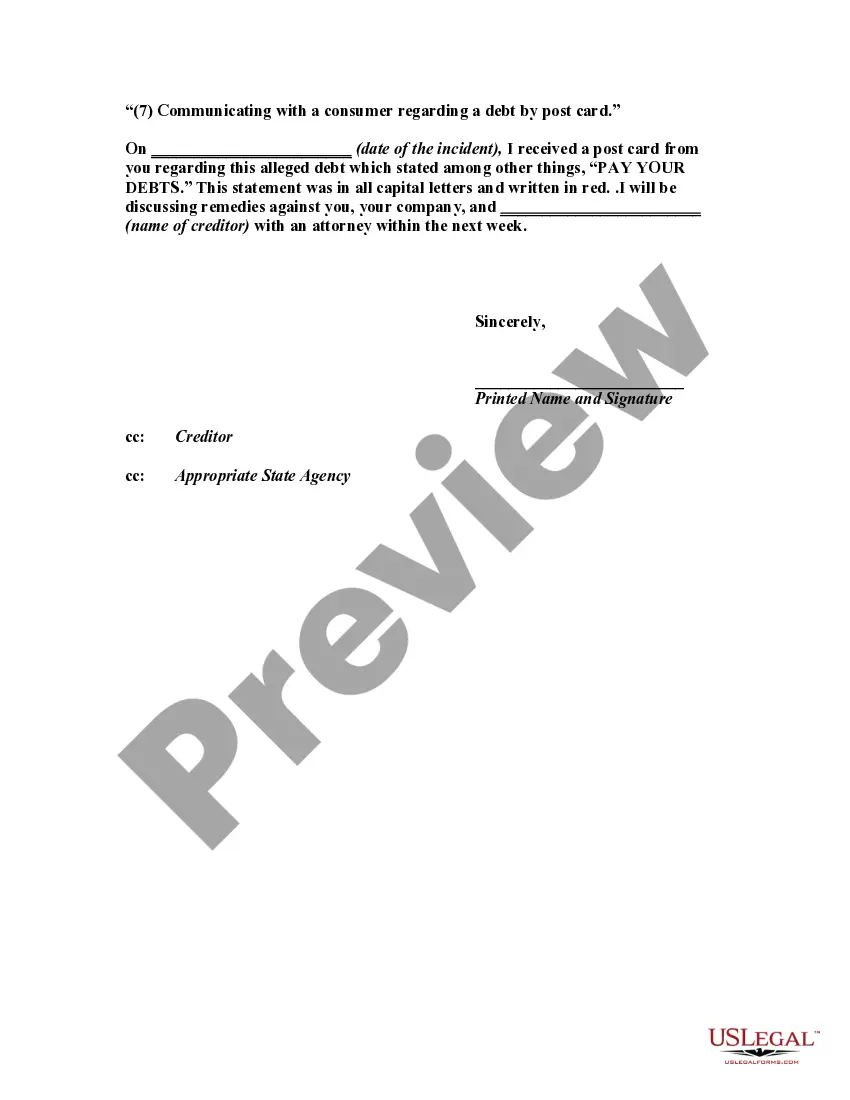

- Be sure to have picked out the best type to your city/area. Click the Preview button to check the form`s content. Browse the type outline to ensure that you have chosen the right type.

- In the event the type does not satisfy your requirements, take advantage of the Research area towards the top of the display screen to find the one which does.

- If you are happy with the shape, validate your option by clicking on the Buy now button. Then, choose the rates strategy you favor and supply your qualifications to register for the bank account.

- Process the purchase. Use your charge card or PayPal bank account to accomplish the purchase.

- Select the file format and acquire the shape on the system.

- Make alterations. Load, modify and print and indicator the downloaded Ohio Letter Informing Debt Collector of Unfair Practices in Collection Activities - Communicating with a Consumer Regarding a Debt by Post Card.

Each web template you put into your bank account lacks an expiry time and it is the one you have forever. So, if you would like acquire or print one more version, just visit the My Forms area and click around the type you will need.

Gain access to the Ohio Letter Informing Debt Collector of Unfair Practices in Collection Activities - Communicating with a Consumer Regarding a Debt by Post Card with US Legal Forms, by far the most substantial catalogue of lawful file templates. Use 1000s of expert and express-distinct templates that satisfy your small business or personal needs and requirements.