Ohio Plan of Reorganization

Description

How to fill out Plan Of Reorganization?

Have you been in the position in which you need papers for sometimes company or personal functions almost every working day? There are a lot of legal papers layouts available on the Internet, but getting kinds you can rely is not effortless. US Legal Forms offers a huge number of form layouts, just like the Ohio Plan of Reorganization, which can be written to fulfill federal and state specifications.

When you are already knowledgeable about US Legal Forms internet site and also have a merchant account, just log in. Next, you can down load the Ohio Plan of Reorganization web template.

Unless you have an profile and wish to begin using US Legal Forms, adopt these measures:

- Get the form you need and make sure it is for your appropriate metropolis/county.

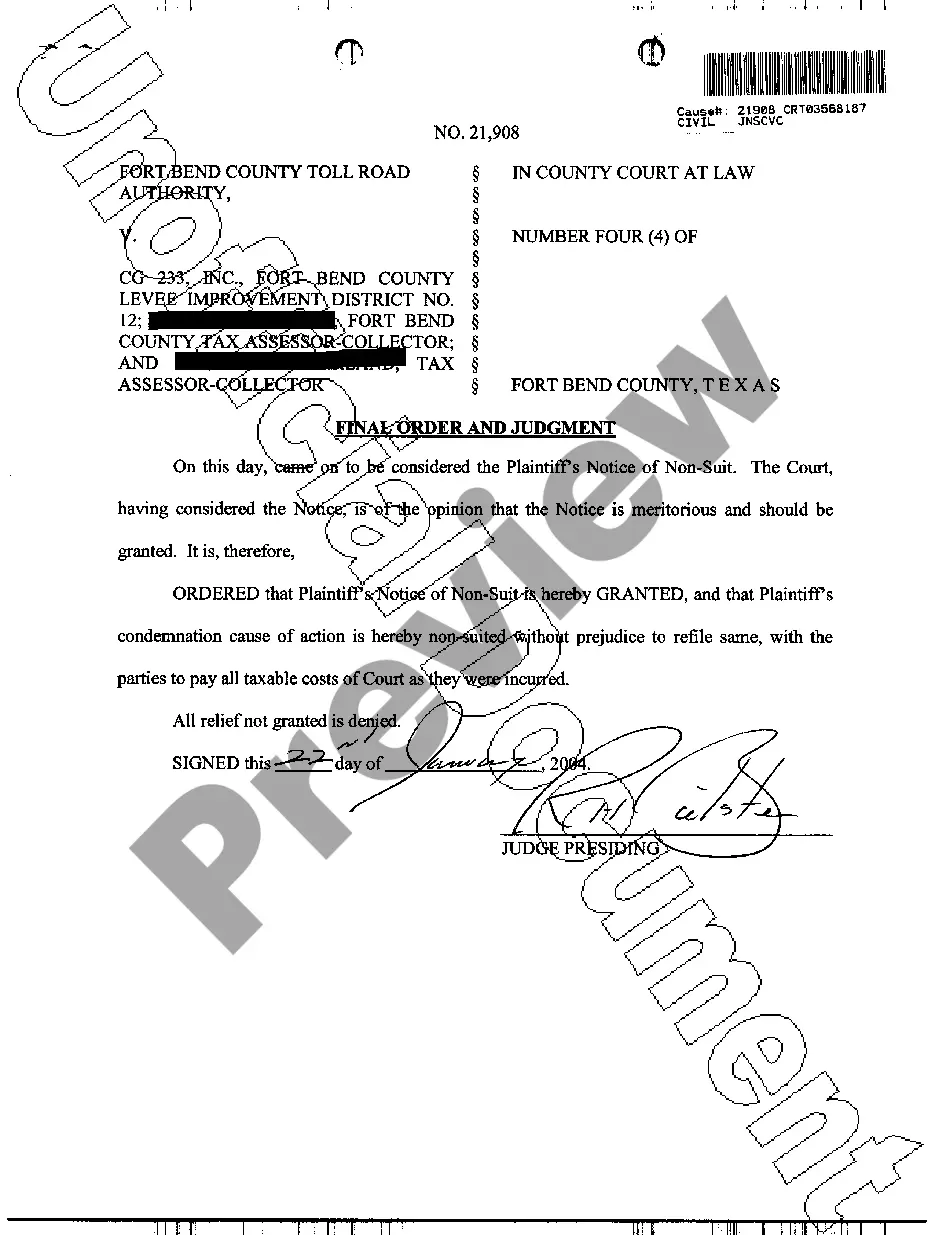

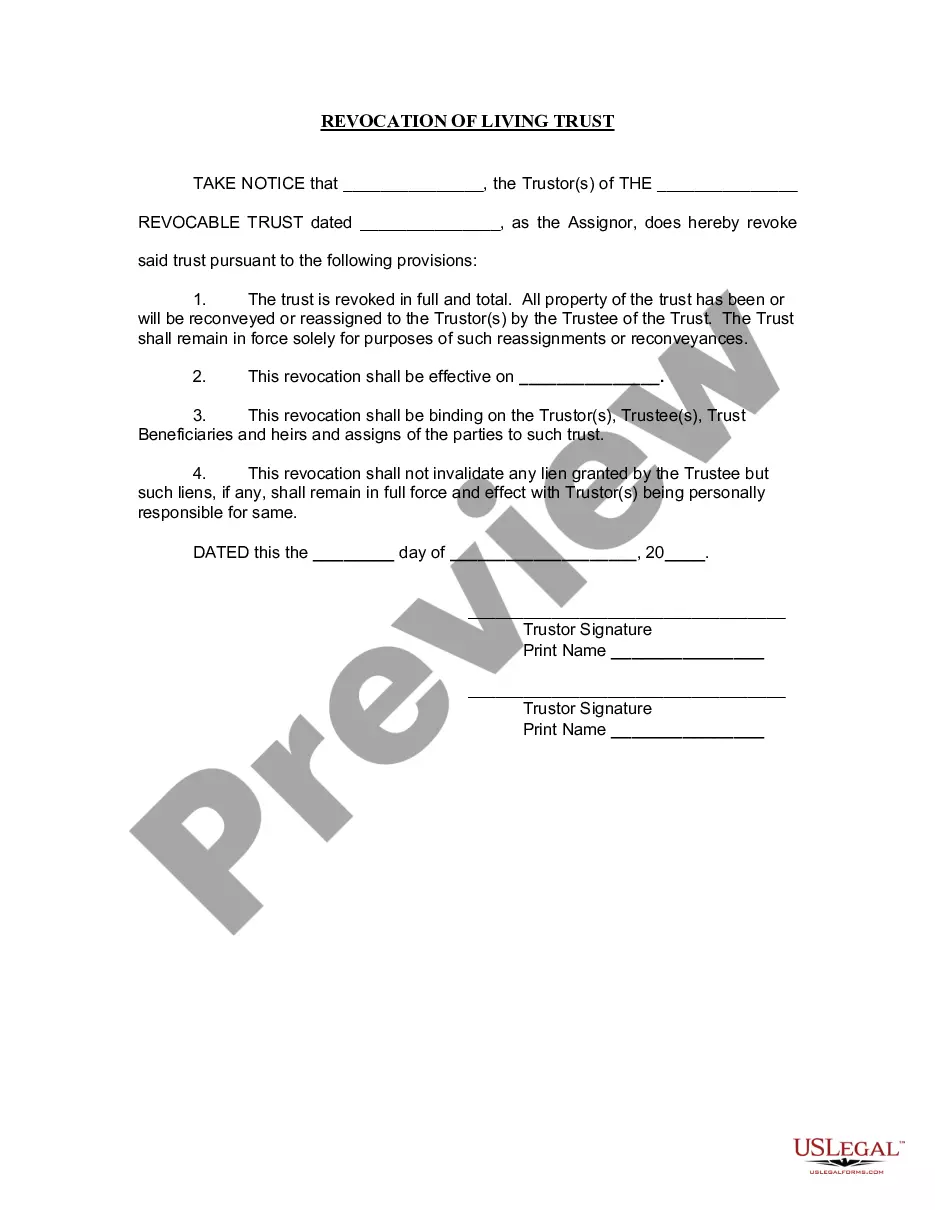

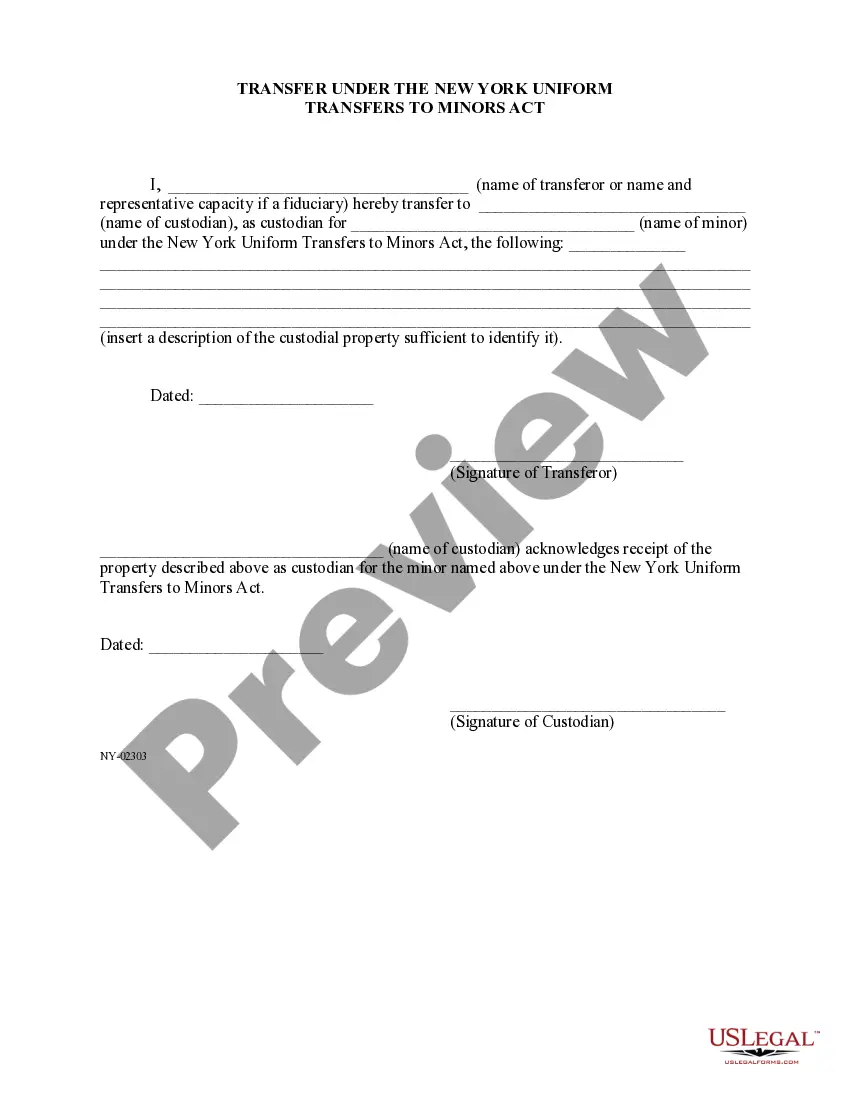

- Utilize the Review button to check the form.

- Read the information to ensure that you have chosen the right form.

- If the form is not what you`re looking for, make use of the Search industry to find the form that suits you and specifications.

- If you find the appropriate form, simply click Buy now.

- Pick the rates program you need, submit the specified info to make your bank account, and purchase an order utilizing your PayPal or Visa or Mastercard.

- Decide on a convenient file formatting and down load your backup.

Get all the papers layouts you have bought in the My Forms food list. You can obtain a more backup of Ohio Plan of Reorganization any time, if required. Just click the essential form to down load or produce the papers web template.

Use US Legal Forms, probably the most considerable selection of legal varieties, in order to save efforts and steer clear of blunders. The service offers professionally manufactured legal papers layouts that can be used for a range of functions. Produce a merchant account on US Legal Forms and initiate generating your way of life a little easier.

Form popularity

FAQ

The Legislative Service Commission staff updates the Revised Code on an ongoing basis, as it completes its act review of enacted legislation.

Officially titled "An Ordinance for the Government of the Territory of the United States North-West of the River Ohio," the Northwest Ordinance was adopted on July 13, 1787, by the Confederation Congress, the one-house legislature operating under the Articles of Confederation.

The Ohio Revised Code contains all current statutes of the Ohio General Assembly of a permanent and general nature, consolidated into provisions, titles, chapters and sections.

Ohio law designates the Director of the Legislative Service Commission as the codifier of the state's laws and administrative rules (R.C. 103.05 and 103.131).

The Revised Code is organized into 31 general titles broken into chapters dealing with individual topics of law. The chapters are divided into sections which contain the text of individual statutes. The laws are collected and published in the Ohio Revised Code.

Ohio law consists of the Ohio Constitution, the Ohio Revised Code and the Ohio Administrative Code. The Constitution is the state's highest law superseding all others. The Revised Code is the codified law of the state while the Administrative Code is a compilation of administrative rules adopted by state agencies.