Ohio Executive Officer One-Year Incentive Plan

Description

How to fill out Executive Officer One-Year Incentive Plan?

You can devote time on the web trying to find the legitimate file template that suits the federal and state specifications you want. US Legal Forms offers 1000s of legitimate forms that happen to be examined by specialists. It is simple to download or print out the Ohio Executive Officer One-Year Incentive Plan from my assistance.

If you currently have a US Legal Forms account, you can log in and click on the Down load button. Next, you can full, change, print out, or indicator the Ohio Executive Officer One-Year Incentive Plan. Each and every legitimate file template you buy is yours forever. To have an additional duplicate of the obtained form, proceed to the My Forms tab and click on the related button.

Should you use the US Legal Forms internet site the very first time, follow the easy instructions beneath:

- Very first, make sure that you have selected the right file template for the area/metropolis of your liking. Browse the form outline to ensure you have chosen the proper form. If readily available, use the Preview button to appear through the file template as well.

- If you want to find an additional model of your form, use the Look for discipline to discover the template that fits your needs and specifications.

- Once you have discovered the template you want, click Get now to continue.

- Pick the rates strategy you want, key in your qualifications, and sign up for an account on US Legal Forms.

- Complete the purchase. You should use your Visa or Mastercard or PayPal account to pay for the legitimate form.

- Pick the file format of your file and download it in your device.

- Make changes in your file if possible. You can full, change and indicator and print out Ohio Executive Officer One-Year Incentive Plan.

Down load and print out 1000s of file layouts using the US Legal Forms website, which provides the largest selection of legitimate forms. Use specialist and express-specific layouts to tackle your company or specific needs.

Form popularity

FAQ

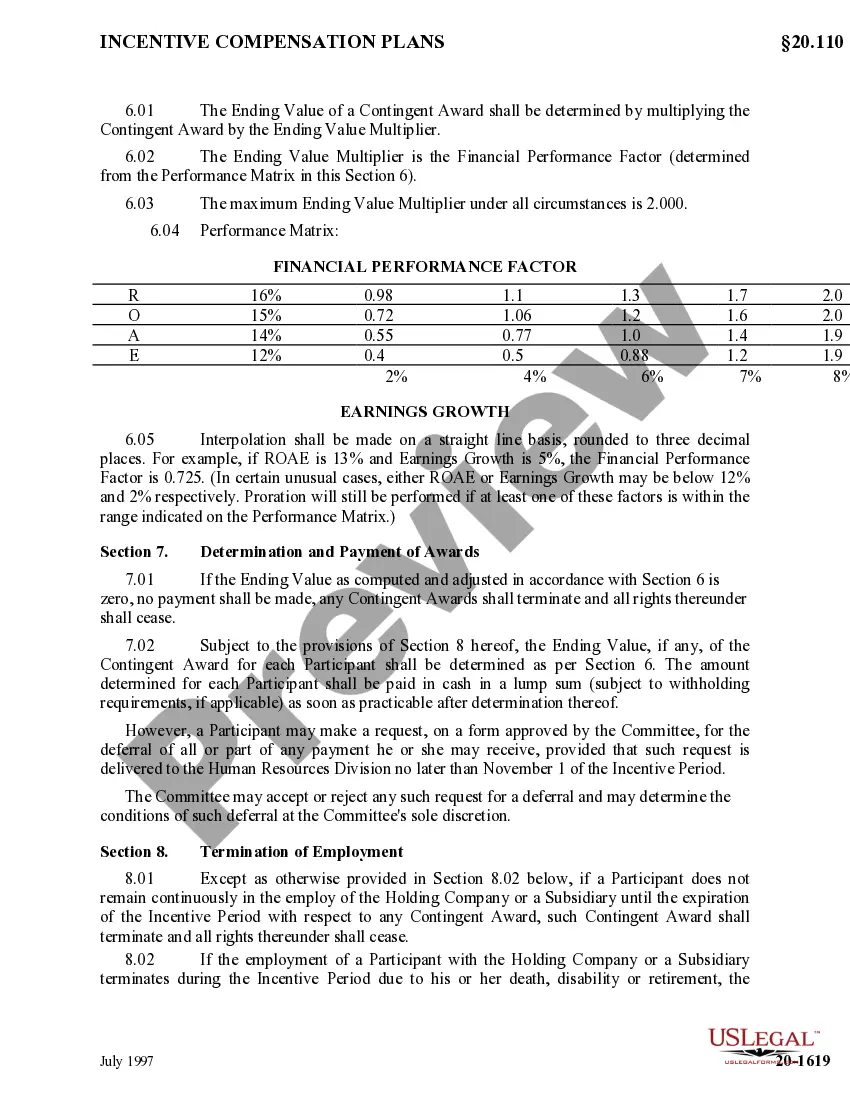

What Is an Annual Incentive Plan? An annual incentive plan is a plan for compensation that is earned and paid based upon the achievement of performance goals over a one-year period. These plans motivate performance and align executives' work with the company's short-term performance goals.

An annual incentive plan outlines compensation to be paid to employees when they achieve certain performance-related goals over 12 months. This compensation is in addition to their regular salary ? it may be an employee gift, cash incentive, or another type of bonus or reward.

term incentive plan (LTIP) incentivizes employees to take actions that will maximize shareholder value and promote longterm growth for the organization. In a standard LTIP, the employee, who is normally a senior executive, is required to meet a number of criteria to receive the incentive.

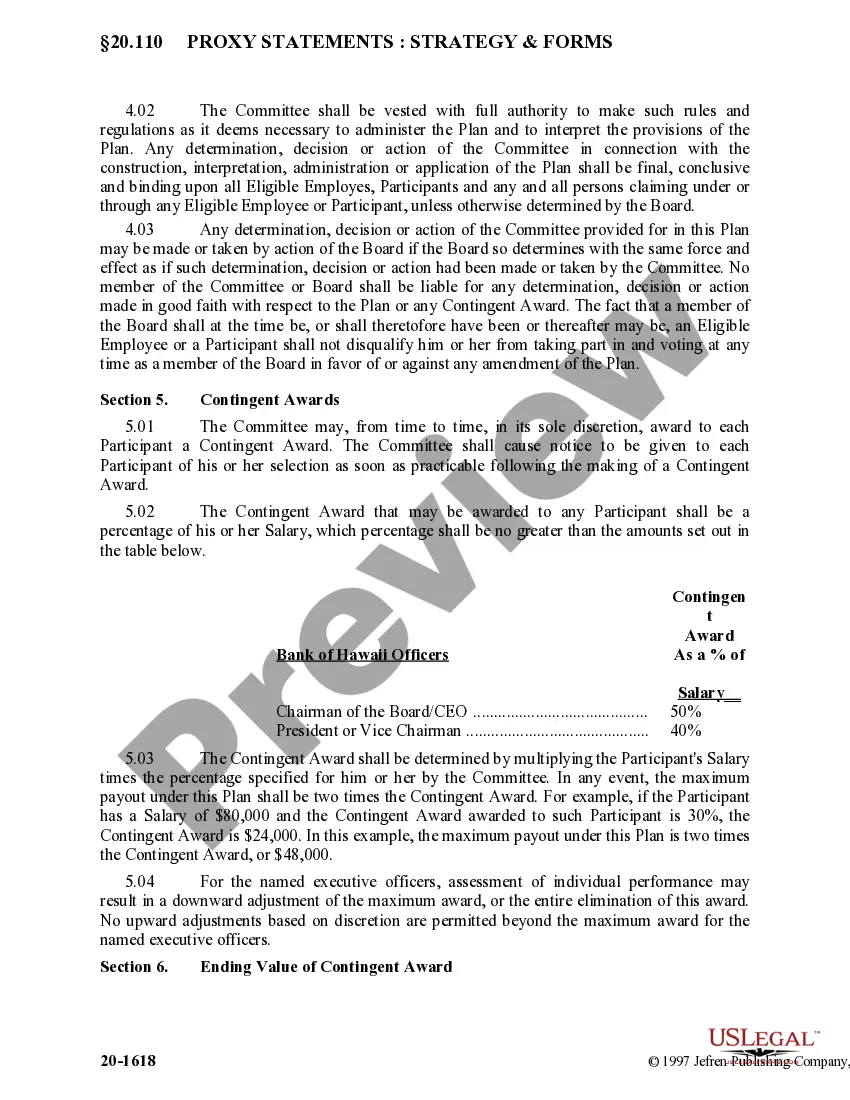

Payout Opportunity A Participant's payout target amount under the Plan is determined by pay grade as follows: The range of incentive opportunity for a Plan Participant is 0% to 200% of the Participant's total value target. This means the maximum payout that a Participant can receive from this Plan is 200%.

Incentive compensation is simply additional money, or rewards of value (i.e. stock), paid to employees based on their performance, and on top of their base salary. The performance measures companies use to structure these comp plans can vary widely.