Ohio Department Time Report for Payroll

Description

How to fill out Department Time Report For Payroll?

Selecting the appropriate legal document design can be challenging. Clearly, there are numerous templates accessible online, but how will you access the legal form you require? Utilize the US Legal Forms website. This service provides thousands of templates, including the Ohio Department Time Report for Payroll, which you can use for both business and personal purposes.

All of the forms are reviewed by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Download button to obtain the Ohio Department Time Report for Payroll. Use your account to browse the legal forms you have previously purchased. Navigate to the My documents section of your account and obtain another copy of the documents you need.

Choose the file format and download the legal document design to your device. Complete, modify, print, and sign the acquired Ohio Department Time Report for Payroll. US Legal Forms is the largest repository of legal documents where you can find numerous document templates. Use this service to acquire professionally crafted documents that adhere to state requirements.

- If you are a new user of US Legal Forms, here are simple instructions to follow.

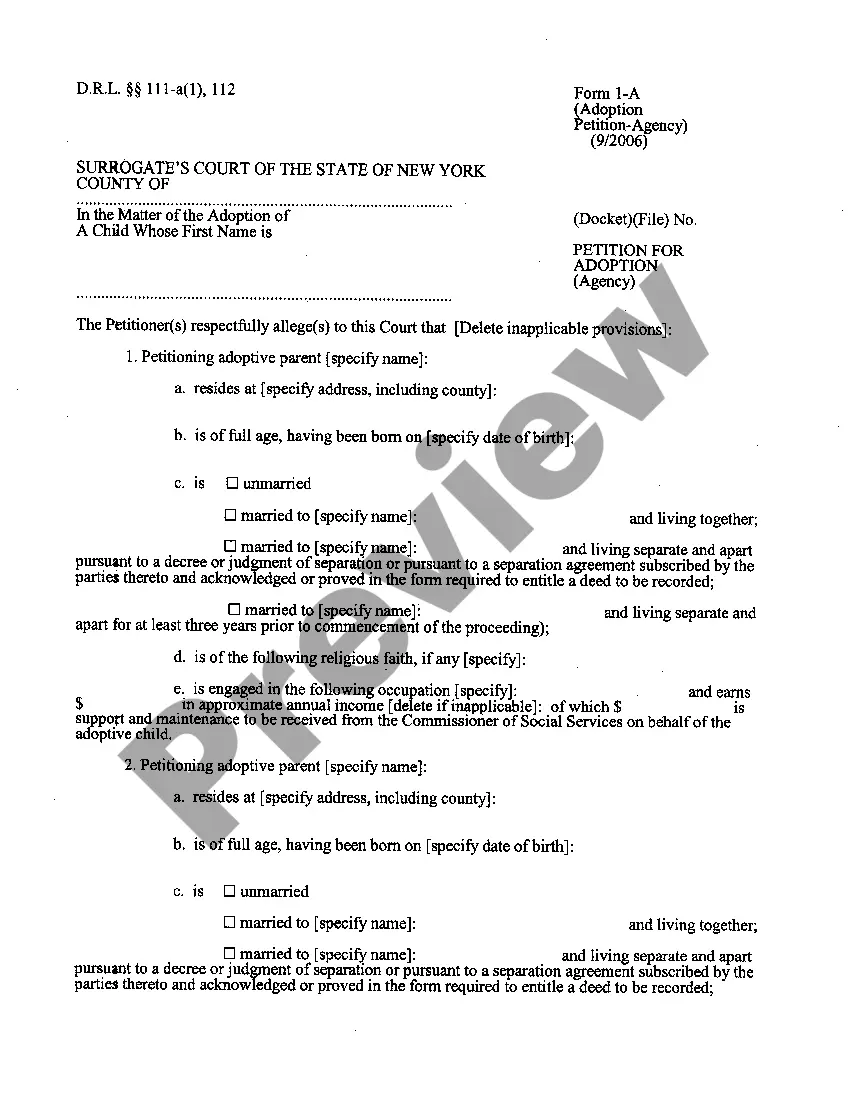

- First, ensure you have selected the correct form for your specific area/region. You can preview the form using the Preview button and review the form details to confirm it is suitable for you.

- If the form does not meet your needs, use the Search field to find the appropriate form.

- Once you are confident that the form is correct, click on the Purchase now button to acquire the form.

- Select the pricing option you want and enter the required information.

- Create your account and complete the transaction using your PayPal account or credit card.

Form popularity

FAQ

True-up is when the employer reports the actual payroll for the policy year. If there's a difference in the employer's actual payroll and what was used to calculate their estimated annual premium or EAP. If the employer was overcharged, they will receive a refund.

What payroll reports do employers need to file?Wages paid to employees.Federal income tax withheld from employee wages.Medicare and Social Security taxes deducted from employee wages.Employer contributions to Medicare and Social Security taxes.

Ohio Required Workday Break & Meal Periods 2022 While many states have labor regulations specifying the timing and duration of meal breaks that must be provided to employees, the Ohio government has no such laws.

The state will pay 72% of your AWW (derived from your last six weeks of wages) for the first 12 weeks and two-thirds of your AWW after that. Remember, state law caps those benefits at $950 a week for 2019 injuries. That amount could be lower if you receive social security retirement benefits.

No, the State of Ohio has no requirements for the payment of holiday, vacation, or sick time.

How much does workers' compensation insurance cost in Ohio? Estimated employer rates for workers' compensation in Ohio are $0.74 per $100 in covered payroll.

If an employee works 8 or more consecutive hours, the employer must provide a 30-minute break and an additional 15 minute break for every additional 4 consecutive hours worked.

Meal Breaks in Ohio In the Buckeye state, until employees reach the age of 18, minor employees must be given at least a 30-minute uninterrupted break for every 5 hours of continuous work. Adult employees are not entitled to any breaks under federal or state law.

The payroll true-up report is the process that requires employers to report their actual payroll for the prior policy year and reconcile any over- or underpayments in premiums paid. Payroll true-up reporting is critical to allowing the BWC to more accurately calculate the premiums of company's year after year.

Ohio Required Workday Break & Meal Periods 2022 While many states have labor regulations specifying the timing and duration of meal breaks that must be provided to employees, the Ohio government has no such laws.