Ohio Unrestricted Charitable Contribution of Cash

Description

How to fill out Unrestricted Charitable Contribution Of Cash?

Locating the appropriate legitimate document template can be a challenge.

Certainly, there is an abundance of templates accessible online, but how can you find the authentic form you seek? Utilize the US Legal Forms website.

This service provides a multitude of templates, including the Ohio Unrestricted Charitable Contribution of Cash, which you can employ for both business and personal purposes. All the forms are verified by experts and adhere to state and federal regulations.

If the form does not align with your needs, use the Search field to find the appropriate document. Once you are convinced that the form is correct, click the Get now button to download it. Select the pricing plan you prefer and input the required information. Create your account and pay for the order using your PayPal account or credit card. Choose the document format and download the legitimate template to your device. Complete, modify, print, and sign the downloaded Ohio Unrestricted Charitable Contribution of Cash. US Legal Forms is the largest collection of legal documents where you can find various file templates. Leverage this service to obtain professionally drafted documents that comply with state regulations.

- If you are already a registered user, sign in to your account and click the Download button to obtain the Ohio Unrestricted Charitable Contribution of Cash.

- Use your account to browse through the legal documents you have previously purchased.

- Visit the My documents section of your account to acquire another copy of the document you need.

- For new users of US Legal Forms, here are straightforward instructions to follow.

- First, ensure you have chosen the correct form for your area/state.

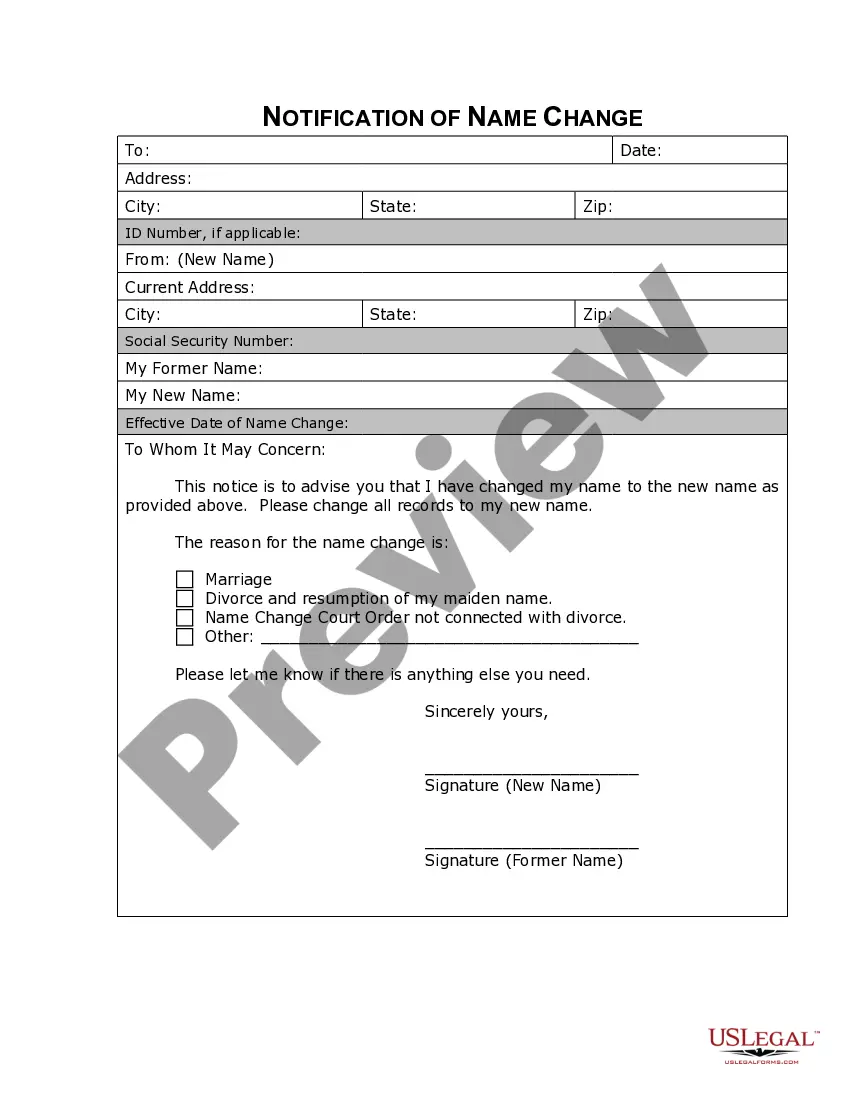

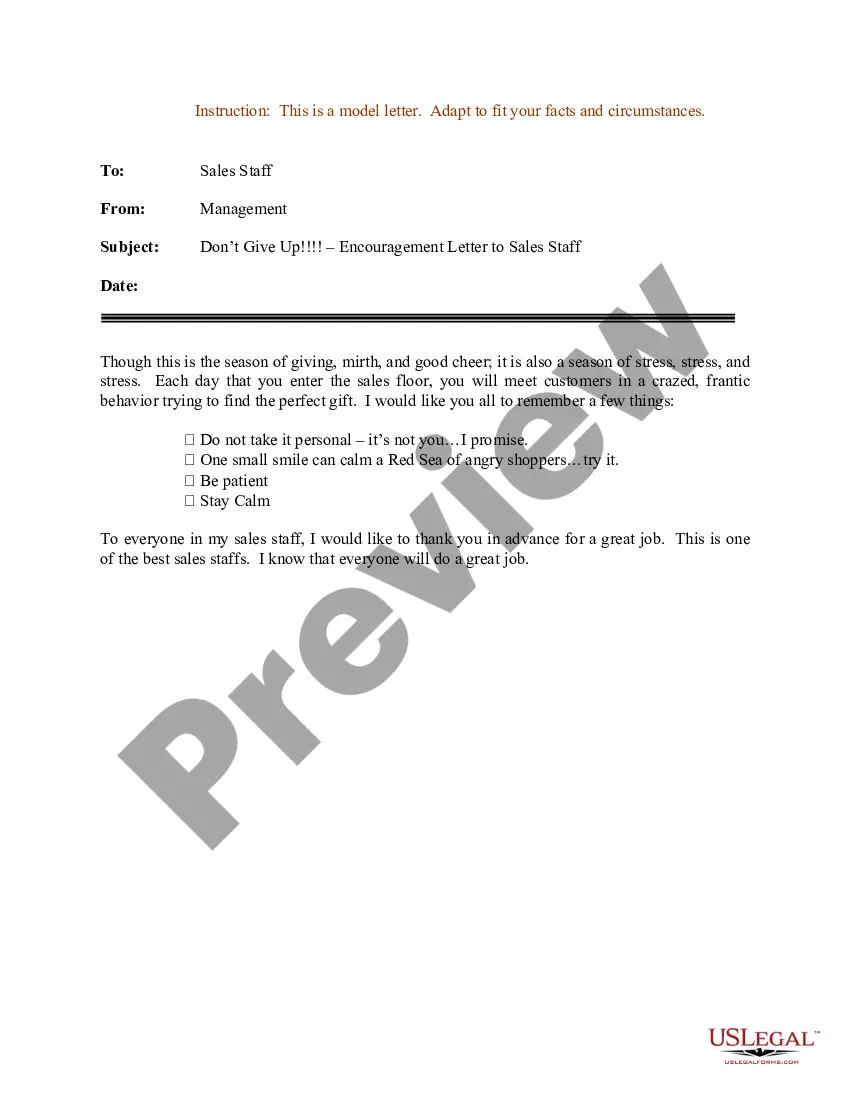

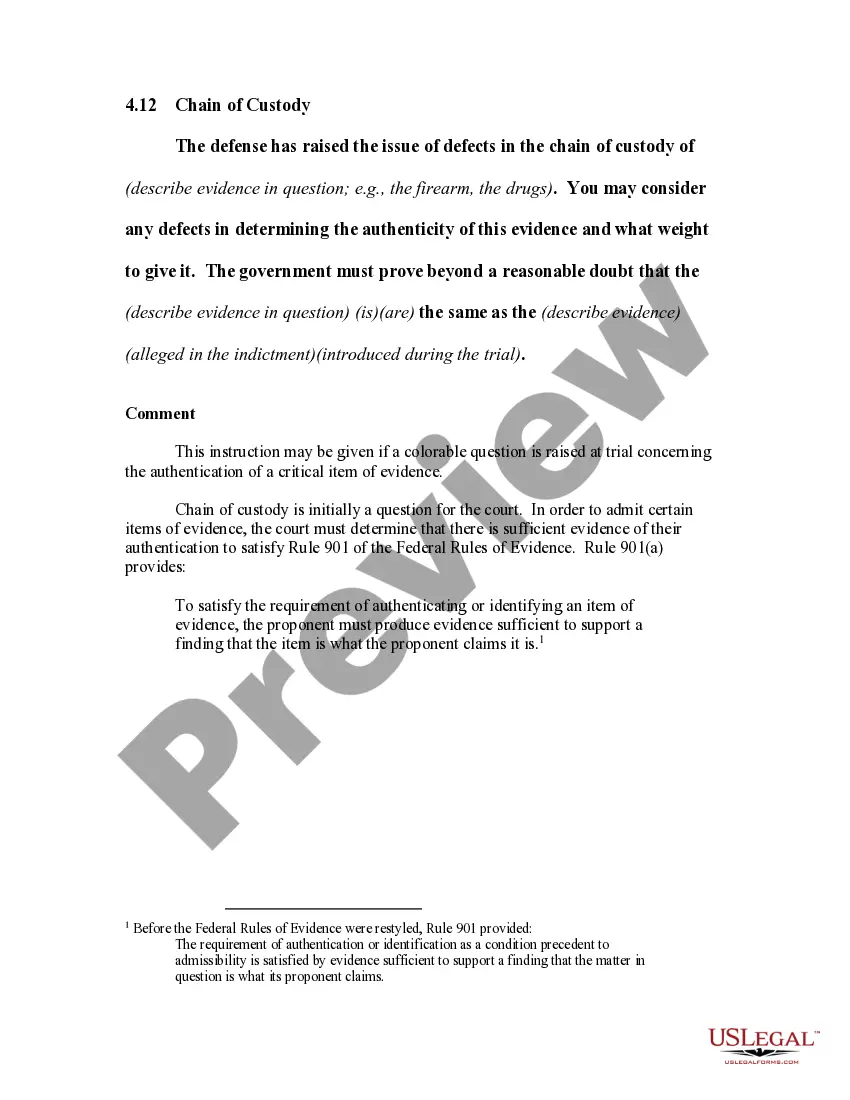

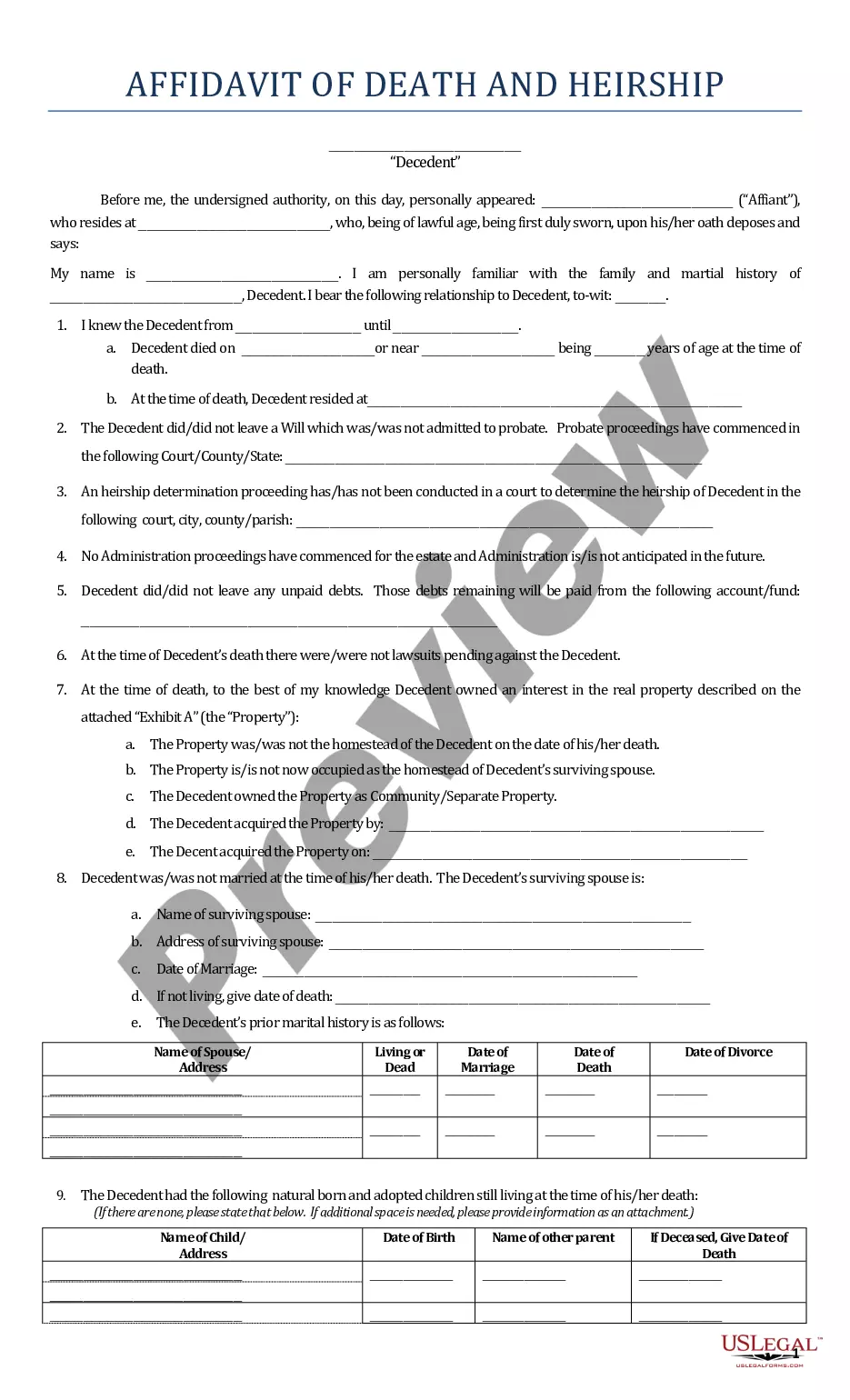

- You can preview the form using the Preview button and review the form details to confirm it meets your requirements.

Form popularity

FAQ

To classify charitable contributions, start by determining if the organization is qualified as a 501(c)(3) charity. The Ohio Unrestricted Charitable Contribution of Cash allows for flexible giving, but it’s crucial to categorize your donations accurately for tax purposes. Contributions can be classified as cash, property, or services, each with specific rules and limitations. Utilizing templates and forms from US Legal Forms can simplify this process and ensure your contributions are categorized correctly.

When it comes to the Ohio Unrestricted Charitable Contribution of Cash, the maximum amount you can deduct depends on your adjusted gross income. Typically, you can deduct cash contributions to qualified charitable organizations up to 60% of your adjusted gross income. It's important to keep accurate records of your donations to maximize your tax benefits. For specific situations or further guidance, consulting a tax professional or using resources from the US Legal Forms platform can provide valuable assistance.

The maximum you can write off for charitable donations, including the Ohio Unrestricted Charitable Contribution of Cash, depends on your adjusted gross income and the type of charity. Generally, you can deduct up to 60% of your adjusted gross income for cash donations to qualifying organizations. Be aware that limitations may apply based on your specific situation and type of donation. For tailored help and resources in determining your maximum deductions, uslegalforms offers convenient solutions.

To deduct charitable contributions such as the Ohio Unrestricted Charitable Contribution of Cash, you must itemize your deductions on Schedule A of your federal tax return. Gather all receipts and documentation that show the amount you donated and to whom you made the contributions. It's important to ensure that your donations are made to qualified organizations, as this impacts your eligibility for deductions. Using a platform like uslegalforms can guide you through the necessary documentation to optimize your tax savings.

Noncash charitable contributions refer to donations made in forms other than cash, such as clothing, vehicles, or stocks. These contributions can also provide potential tax benefits similar to your Ohio Unrestricted Charitable Contribution of Cash. It is crucial to assess the fair market value of noncash items when you claim them on your taxes.

In many cases, you cannot deduct charitable contributions without itemizing your deductions on your tax return. However, the COVID-19 relief measures introduced some temporary changes that allowed for certain deductions even if you took the standard deduction. If you have questions about your options regarding the Ohio Unrestricted Charitable Contribution of Cash, consider seeking guidance from uslegalforms.

Yes, charitable contributions are generally tax deductible in Ohio, as long as they meet certain criteria set by the IRS. Donations made to qualified organizations can be included as part of your Ohio Unrestricted Charitable Contribution of Cash. Remember to confirm that the charity is recognized as a 501(c)(3) to qualify for the deduction.

To claim charitable contributions in Ohio, gather the necessary documentation proving your donations, such as receipts or acknowledgment letters from charities. When filing your taxes, you will need to report your Ohio Unrestricted Charitable Contribution of Cash on your return. Using platforms like uslegalforms can streamline the process and ensure you have all the required forms.

In Ohio, you may write off various expenses, including state and local taxes, mortgage interest, and charitable contributions, among others. Specifically, you can include your Ohio Unrestricted Charitable Contribution of Cash when preparing your taxes. It is essential to keep proper documentation of your contributions to ensure you maximize your deductions.

The Ohio charitable tax credit offers a way for taxpayers to receive a credit for donations made to qualified charities. This credit allows you to deduct a percentage of your Ohio Unrestricted Charitable Contribution of Cash from your tax bill, thus reducing what you owe. Engaging in charitable giving not only benefits others but also provides tax advantages, making it a worthwhile consideration.