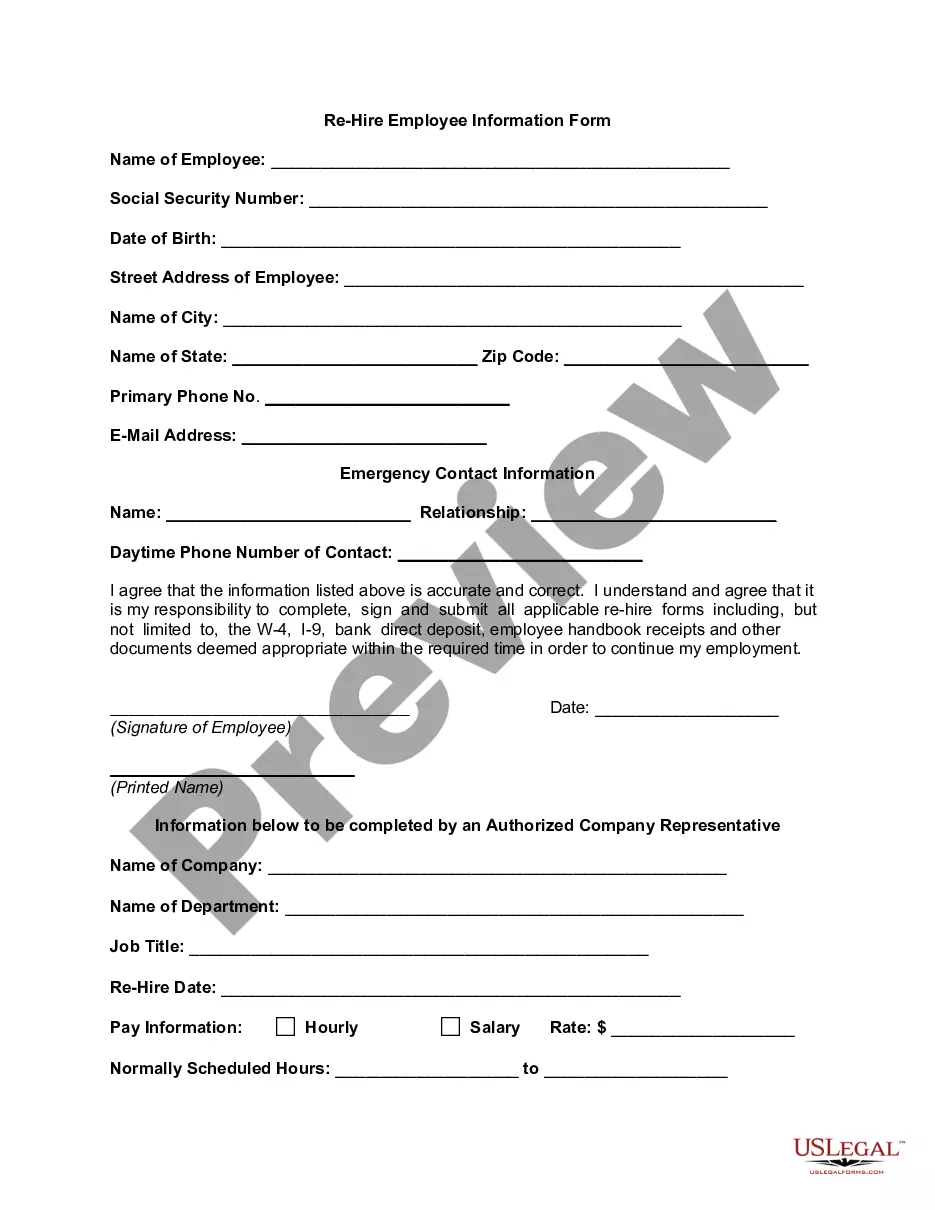

Ohio Re-Hire Employee Information Form

Description

How to fill out Re-Hire Employee Information Form?

Choosing the right lawful papers template could be a have difficulties. Obviously, there are a lot of web templates available online, but how do you get the lawful develop you want? Use the US Legal Forms site. The service provides a huge number of web templates, like the Ohio Re-Hire Employee Information Form, that you can use for company and personal requirements. Every one of the varieties are checked out by specialists and meet federal and state demands.

In case you are already authorized, log in to your account and then click the Acquire key to obtain the Ohio Re-Hire Employee Information Form. Make use of your account to look with the lawful varieties you might have ordered formerly. Check out the My Forms tab of the account and acquire an additional duplicate of your papers you want.

In case you are a fresh end user of US Legal Forms, listed here are simple directions that you can comply with:

- Initially, ensure you have selected the proper develop to your town/county. You can look over the form making use of the Review key and study the form outline to guarantee this is basically the right one for you.

- In the event the develop fails to meet your needs, take advantage of the Seach discipline to get the right develop.

- When you are certain the form is proper, select the Get now key to obtain the develop.

- Opt for the pricing strategy you want and enter in the essential details. Make your account and pay money for your order utilizing your PayPal account or Visa or Mastercard.

- Pick the document file format and down load the lawful papers template to your product.

- Full, change and printing and sign the attained Ohio Re-Hire Employee Information Form.

US Legal Forms may be the biggest collection of lawful varieties that you can discover various papers web templates. Use the service to down load appropriately-created files that comply with condition demands.

Form popularity

FAQ

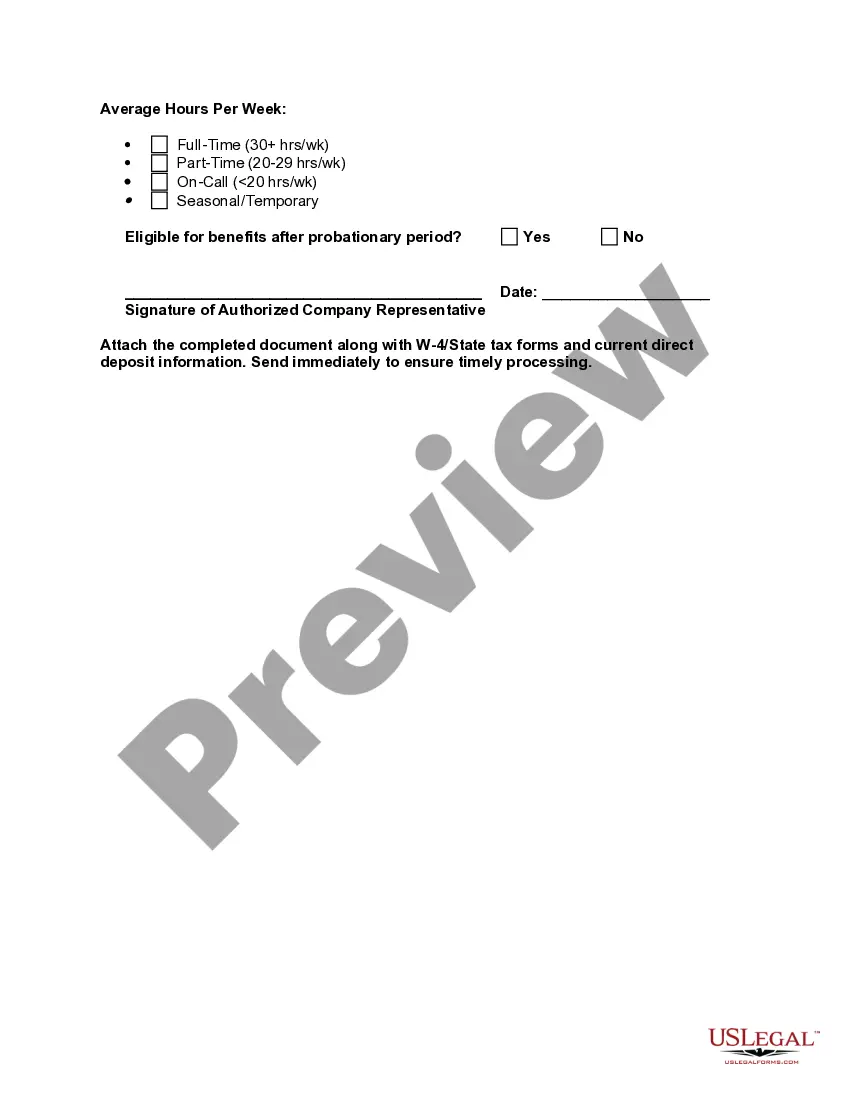

Make sure you and new hires complete employment forms required by law.W-4 form (or W-9 for contractors)I-9 Employment Eligibility Verification form.State Tax Withholding form.Direct Deposit form.E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.

4 form (or 9 for contractors) I9 Employment Eligibility Verification form. State Tax ithholding form. Direct Deposit form....An employment contract should include:Job information (job title, department)ork schedule.Length of employment.Compensation and benefits.Employee responsibilities.Termination conditions.

Employee's Withholding Ask all new employees to give you a signed Form W-4 when they start work. Make the form effective with the first wage payment. If employees claim exemption from income tax withholding, then they must indicate this on their W-4.

New employees first paid wages during 2020 must use the new redesigned Form W-4. In addition, employees who worked for an employer before 2020 but are rehired during 2020 also must use the redesigned 2020 Form W-4. Continuing employees who provided a Form W-4 before 2020 do not have to furnish the new Form W-4.

Every employee must provide an employer with a signed withholding exemption certificate (Form W-4) on or before the date of employment. Every quarter, employers must file Form 941-Employer's Quarterly Federal Tax Return.

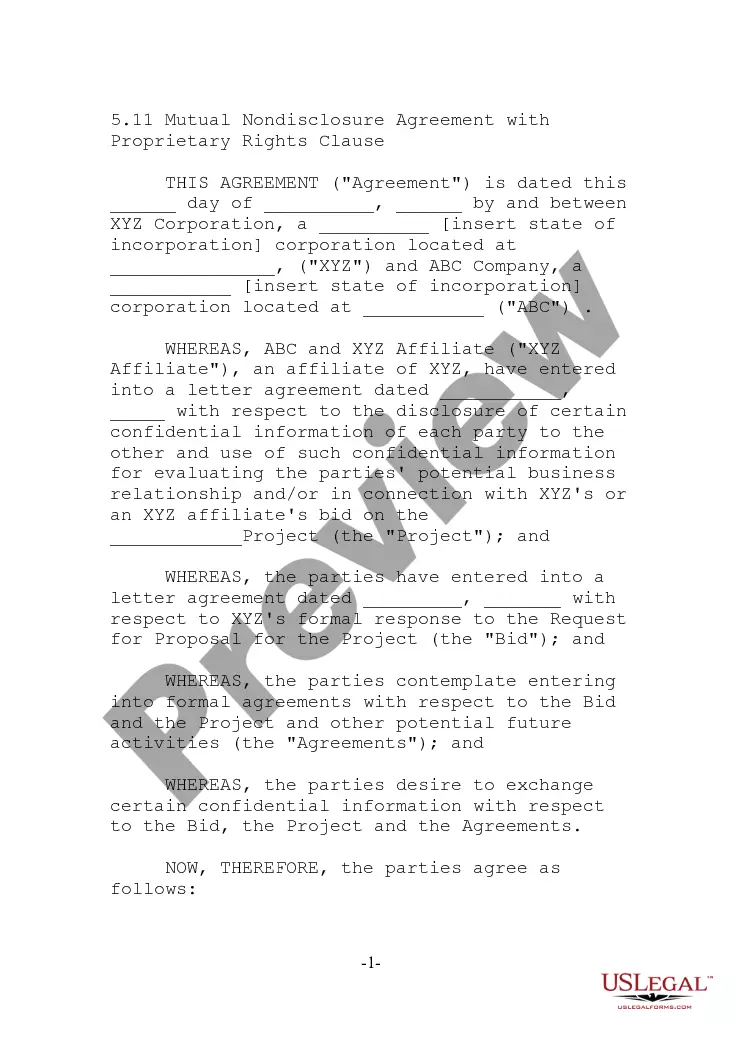

9 Employment Eligibility Verification completed. W4 federal and state tax withholding forms completed....5. Complete any other employerspecific requirements or documents:Arbitration agreement.Orientation/training documents.Confidentiality/nondisclosure agreement.Direct deposit form.Any other company specific forms.

Here are some forms you can expect to fill out when you begin a new job:Job-specific forms. Employers usually create forms unique to specific positions in a company.Employee information.CRA and tax forms.Compensation forms.Benefits forms.Company policy forms.Job application form.Signed offer letter.More items...?

Initial hiring documentsJob application form.Offer letter and/or employment contract.Drug testing records.Direct deposit form.Benefits forms.Mission statement and strategic plan.Employee handbook.Job description and performance plan.More items...?

California employers must provide the following documents for example: I-9 Employment Eligibility Verification completed. W-4 federal and state tax withholding forms completed. Workers' Compensation Time of Hire Pamphlet: Personal Chiropractor or Acupuncturist Designation Form and Personal Physician Designation Form.

Each new employee will need to fill out the I-9 Employment Eligibility Verification Form from U.S. Citizenship and Immigration Services. The I-9 Form is used to confirm citizenship and eligibility to work in the U.S.