Ohio Cash Disbursements and Receipts

Description

How to fill out Cash Disbursements And Receipts?

Selecting the appropriate legal document template can be challenging.

Indeed, there are numerous styles accessible online, but how can you obtain the legal document you desire.

Utilize the US Legal Forms website. The service provides an extensive array of templates, including the Ohio Cash Disbursements and Receipts, suitable for business and personal needs.

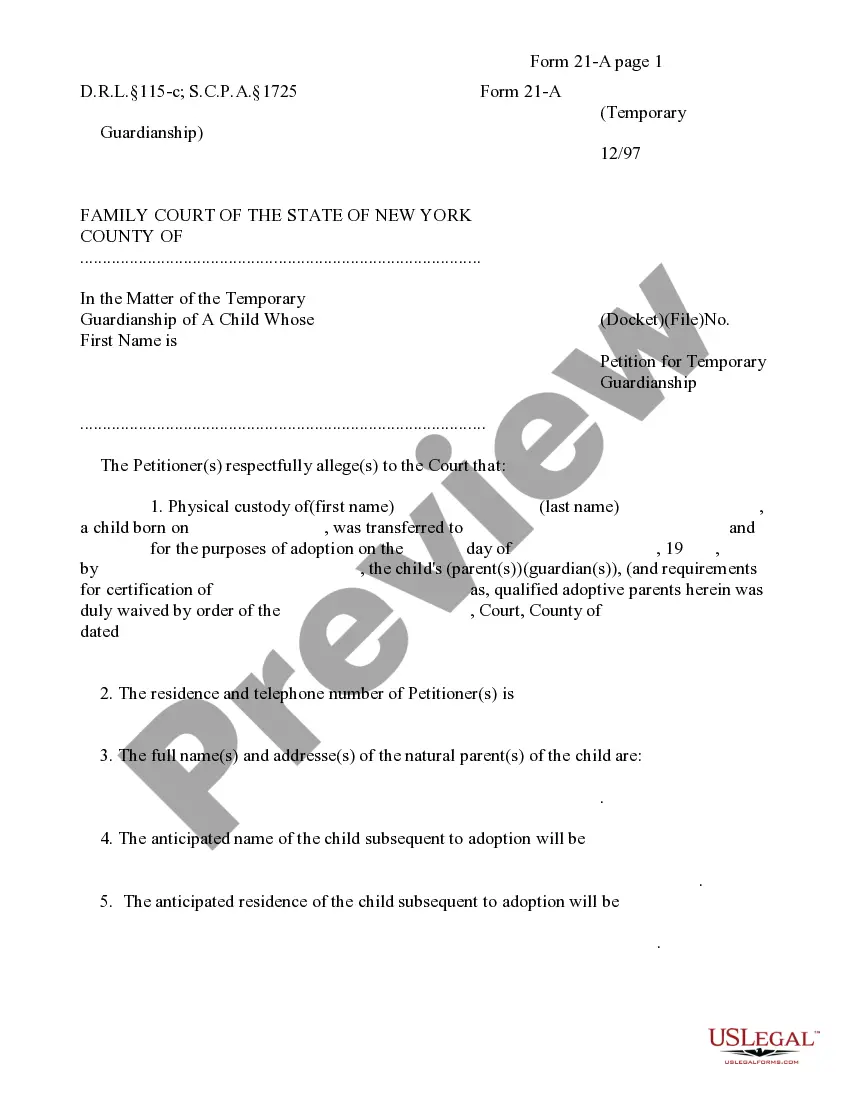

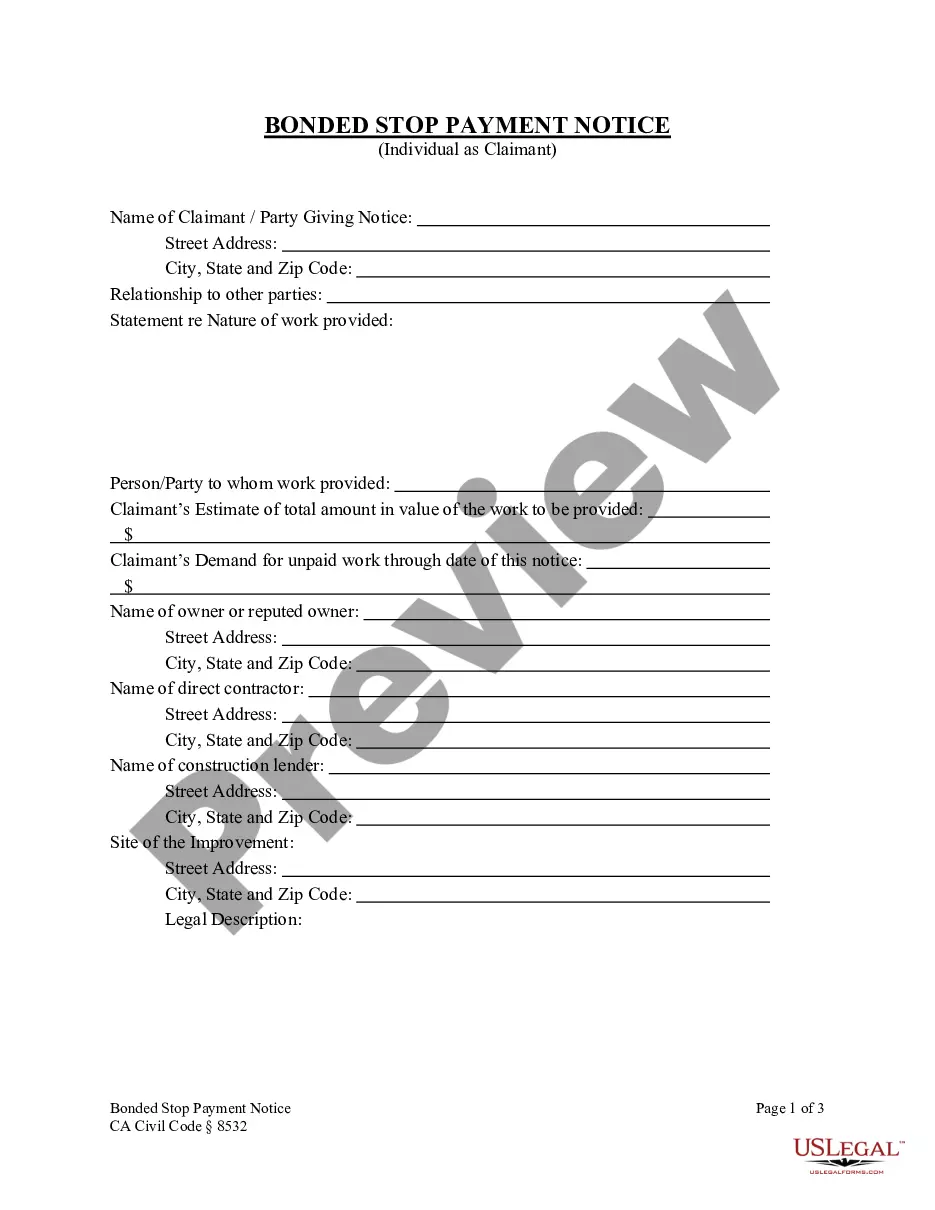

You can preview the document using the Preview option and read the document description to confirm it is suitable for your purposes.

- All templates are verified by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click on the Obtain button to download the Ohio Cash Disbursements and Receipts.

- Utilize your account to review the legal documents you have acquired previously.

- Navigate to the My documents tab in your account and download an additional copy of the documents you require.

- If you are a new user of US Legal Forms, here are straightforward instructions for you to follow.

- First, ensure you have selected the correct template for your city/state.

Form popularity

FAQ

In the context of Ohio Cash Disbursements and Receipts, CRJ stands for Cash Receipt Journal. You will record all cash inflows, including payments received from customers, sales, and any other cash transactions. Properly documenting these entries is crucial for maintaining accurate financial records. By organizing your CRJ effectively, you can easily track and manage your cash flow, which ultimately aids in better decision-making.

One frequent mistake is improperly reporting Ohio Cash Disbursements and Receipts, which can lead to discrepancies in your tax filings. Many individuals overlook necessary documentation, such as receipts or bank statements, which are essential for accurate reporting. Additionally, failing to track expenses throughout the year can complicate your filing process. To avoid these issues, consider using tools available on the USLegalForms platform to simplify your tax preparation and ensure you meet all requirements.

Cash disbursements encompass all expenditures made by a business, including payments for supplies, salaries, rent, and other operational costs. Essentially, any situation where cash leaves the business counts as a disbursement. In the context of Ohio Cash Disbursements and Receipts, tracking these outflows is crucial for maintaining accurate financial records and ensuring your business remains solvent.

The cash receipts and disbursements method tracks the inflow and outflow of cash within a specific period. This method records transactions only when cash actually changes hands. For Ohio Cash Disbursements and Receipts, this method helps businesses monitor cash flow in real time, ensuring they can make informed financial decisions based on actual cash availability.

An example of a disbursement is making a payment to contractors for services rendered. Disbursements can encompass a wide range of financial transactions, including rent, utilities, and payroll. Understanding these transactions is integral to managing Ohio Cash Disbursements and Receipts effectively.

To fill out a cash receipt, start by entering the date of the transaction and the amount received. Next, include the name of the payer and describe the purpose of the payment. This process ensures that your documentation around Ohio Cash Disbursements and Receipts is clear and organized, which can be easily managed using platforms like uslegalforms.

Examples of receipts include sales invoices, bank deposit slips, and payment confirmations. Each of these documents serves as proof of transactions involving Ohio Cash Disbursements and Receipts. Receipts are crucial for financial tracking and ensuring accountability in your transactions.

Not all states impose a Business and Occupation (B&O) tax; it is specific to certain states like Washington. Ohio does not have a traditional B&O tax, but understanding different state tax obligations is essential for business owners. Keeping track of Ohio Cash Disbursements and Receipts can simplify your understanding of applicable state taxes.

Ohio sales tax includes charges for tangible personal property and certain services provided in the state. This tax applies to most retail sales and is a vital aspect of collecting revenues. Accurate tracking of Ohio Cash Disbursements and Receipts will help ensure compliance with sales tax regulations.

The gross receipts tax in Ohio is levied on businesses based on their total revenue. The rates and requirements vary by business type and are essential for a clear financial overview. Effectively managing this tax will help ensure your Ohio Cash Disbursements and Receipts align with state regulations.