Ohio Net Lease of Equipment (personal Propety Net Lease) with no Warranties by Lessor and Option to Purchase

Description

How to fill out Net Lease Of Equipment (personal Propety Net Lease) With No Warranties By Lessor And Option To Purchase?

Have you found yourself in a scenario where you require documents for various business or personal purposes virtually every day.

There are numerous legal document templates accessible online, but locating ones you can rely on can be challenging.

US Legal Forms offers thousands of form templates, such as the Ohio Net Lease of Equipment (Personal Property Net Lease) without Warranties by Lessor and Option to Purchase, which are designed to meet state and federal requirements.

Once you find the appropriate form, click Buy now.

Select the pricing plan you prefer, fill in the required information to create your account, and complete the purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Ohio Net Lease of Equipment (Personal Property Net Lease) without Warranties by Lessor and Option to Purchase template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/region.

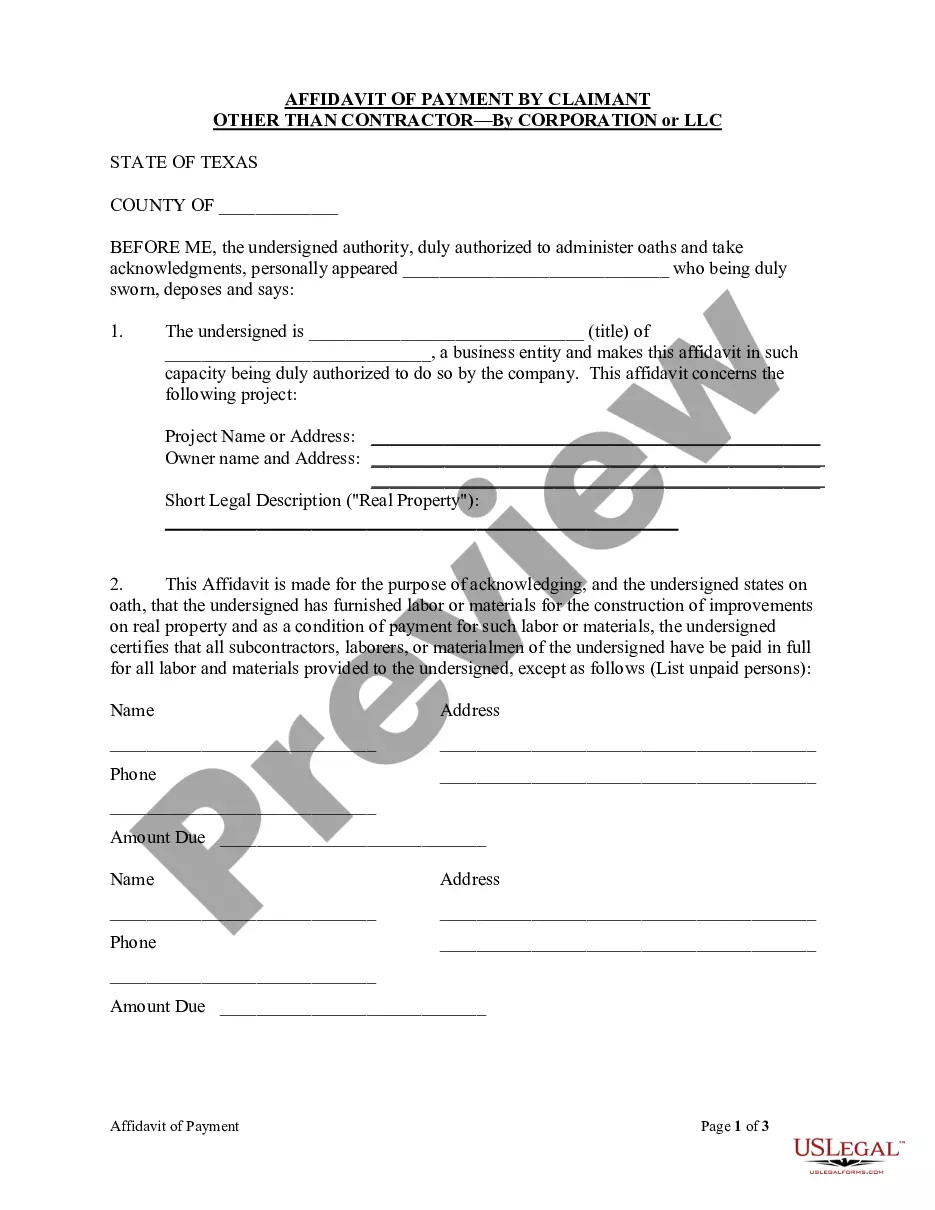

- Utilize the Review button to inspect the document.

- Check the description to confirm that you have selected the right form.

- If the form is not what you’re looking for, use the Search field to find the form that meets your requirements.

Form popularity

FAQ

Yes, in Ohio, the lease of equipment is generally subject to sales tax. However, the specifics can vary based on the type of equipment and its intended use. If you are considering an Ohio Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase, it's essential to consult tax regulations to understand potential tax implications for your lease agreement.

In Ohio, certain items are exempt from sales tax, including food for human consumption, prescription drugs, and some agricultural supplies. Understanding these exemptions can benefit businesses and individuals alike, especially when utilizing an Ohio Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase. This lease option can help manage costs effectively while ensuring compliance with tax regulations.

Yes, rent-to-own agreements are legal in Ohio. They allow tenants to rent equipment or property with the option to purchase later, offering a flexible financial arrangement. Engaging in an Ohio Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase is a common example of a rent-to-own situation that is both viable and regulated.

Leases do not need to be recorded in Ohio, but recording them can serve as an excellent safeguard. A recorded lease provides a clear public declaration of the agreement, which can be helpful if disputes arise later. This is particularly relevant for an Ohio Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase.

In Ohio, recording a lease is not required, but doing so can help clarify the terms and protect the interests of both parties. Recording a lease especially beneficial for long-term agreements such as an Ohio Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase, as it confirms the arrangements in a public record.

Recording a lease is not mandatory in Ohio, but it is advisable for significant agreements. This can provide legal protection and clarity for both lessor and lessee. For an Ohio Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase, recording offers security against potential claims by third parties.

Leases do not generally need to be filed in Ohio; recording is optional. However, filing can be advantageous, especially if disputes arise regarding the lease terms. For thoroughness, consider using an Ohio Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase, and consult legal resources if you're unsure.

Filling out an Ohio residential lease agreement requires attention to detail. Start by including the names of the parties involved, terms of the lease, and payment information. Using resources like USLegalForms can simplify this process, especially when addressing terms related to the Ohio Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase.

In Ohio, lease agreements do not have to be notarized to be valid. However, notarization can add a layer of authenticity and help in legal proceedings. When dealing with an Ohio Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase, notarization can enhance trust between parties.

In Ohio, recording an assignment of lease is not legally required; however, it is recommended for protection. By documenting the assignment with proper recording, you can establish a clear, public record. This can prevent potential disputes involving the Ohio Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase, ensuring your rights are secure.