Ohio Independent Contractor Services Agreement with Accountant

Description

How to fill out Independent Contractor Services Agreement With Accountant?

US Legal Forms - among the largest libraries of legal forms in the USA - provides a wide array of legal document layouts you can download or printing. Making use of the website, you will get thousands of forms for organization and personal purposes, sorted by categories, states, or key phrases.You will discover the latest models of forms like the Ohio Independent Contractor Services Agreement with Accountant in seconds.

If you already have a membership, log in and download Ohio Independent Contractor Services Agreement with Accountant in the US Legal Forms local library. The Obtain key can look on each kind you perspective. You gain access to all earlier saved forms within the My Forms tab of your own account.

In order to use US Legal Forms for the first time, here are easy guidelines to obtain began:

- Make sure you have selected the correct kind to your town/county. Select the Preview key to examine the form`s content material. See the kind description to ensure that you have chosen the appropriate kind.

- When the kind doesn`t satisfy your needs, take advantage of the Lookup field towards the top of the display to obtain the the one that does.

- If you are happy with the form, validate your option by clicking on the Get now key. Then, pick the prices prepare you prefer and give your accreditations to register for an account.

- Method the deal. Utilize your bank card or PayPal account to perform the deal.

- Select the format and download the form on the system.

- Make changes. Fill up, edit and printing and indicator the saved Ohio Independent Contractor Services Agreement with Accountant.

Every web template you included in your bank account lacks an expiry date which is your own permanently. So, if you want to download or printing yet another backup, just visit the My Forms area and click on in the kind you require.

Get access to the Ohio Independent Contractor Services Agreement with Accountant with US Legal Forms, one of the most comprehensive local library of legal document layouts. Use thousands of specialist and status-particular layouts that meet your business or personal requirements and needs.

Form popularity

FAQ

The accountant's not to-do list: 5 things to stop nowDo not waste time with bad clients.Do not check email regularly during your day.Do not say yes to everything.Do not give accounting advice for free.Do not keep knowledge to yourself.

Bookkeepers and accountants are independent contractors when they: Are hired (temporary or potentially for a long period of time) to accomplish a specific result and are not subject to direction or control over the methods or means to accomplish it.

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...

An accountant is a professional who handles the bookkeeping and prepares financial documents like profit-and-loss statements, balance sheets and more. They perform audits of your books, prepare reports for tax purposes, and handle all the financial information that's part of running your business.

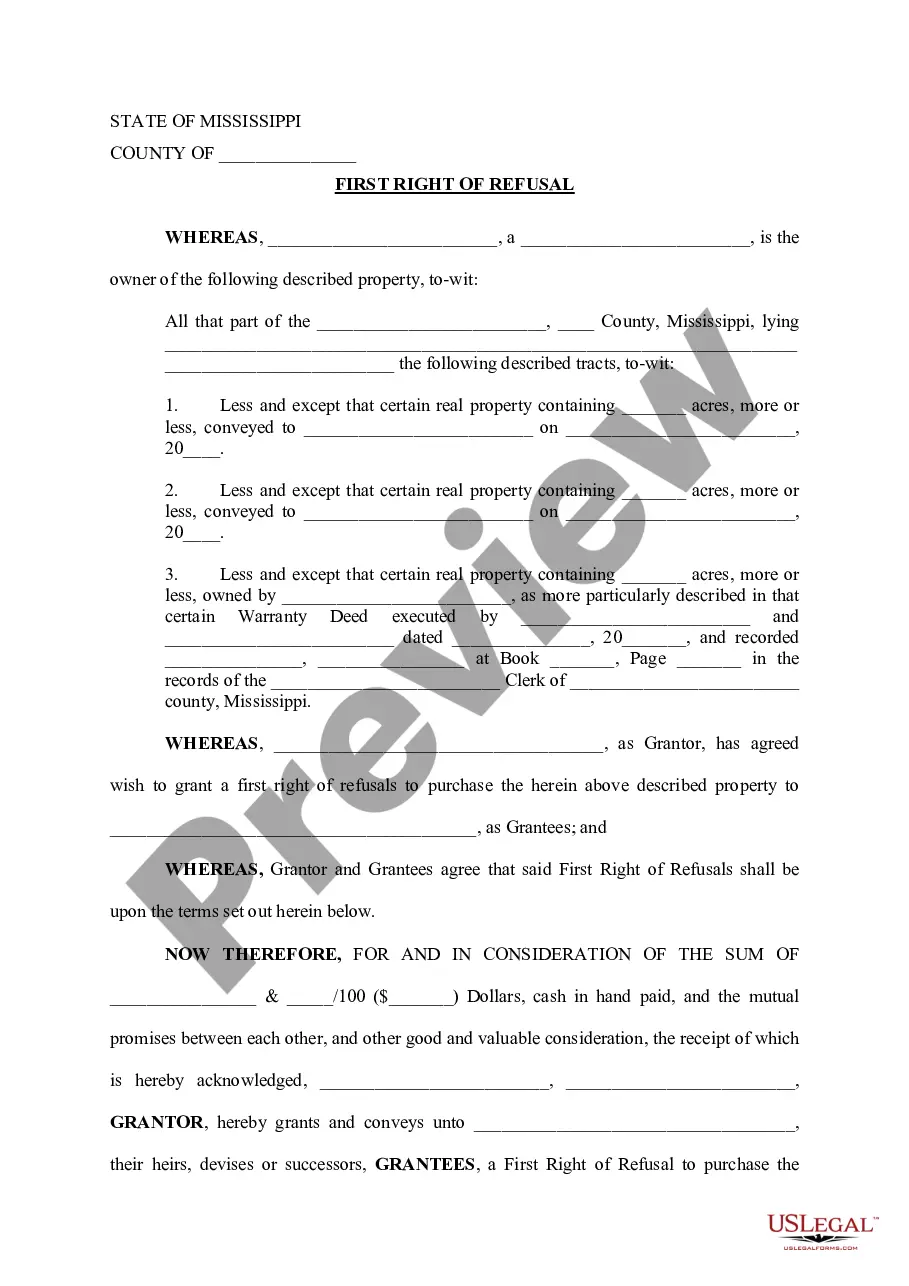

An Accounting Contract is a legal agreement between a client (individual or company) and an accountant, regarding the accounting needs of the client. Use this document to clarify your rights and responsibilities concerning the accounting services, define the scope of these services, and determine the deadlines.

Here are some steps you may use to guide you when you write an employment contract:Title the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.Employment.More items...?

According to the U.S. Bureau of Labor Statistics, jobs for accountants and auditors are projected to grow by 4% between 2019 and 2029, which is on par with the projected average for all occupations.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

People such as doctors, dentists, veterinarians, lawyers, accountants, contractors, subcontractors, public stenographers, or auctioneers who are in an independent trade, business, or profession in which they offer their services to the general public are generally independent contractors.

Accountants and their clients often use Accounting Contracts as a means of defining the scope and payment terms for work to be done. Signed by the client and the accountant, this essential document can help each party to set expectations and reduce the risk of disagreements.