Ohio Performance Bond

Description

How to fill out Performance Bond?

Finding the right legal document format might be a have difficulties. Needless to say, there are plenty of web templates available on the Internet, but how will you obtain the legal form you require? Take advantage of the US Legal Forms internet site. The support offers a large number of web templates, for example the Ohio Performance Bond, that can be used for business and private requirements. Every one of the kinds are checked by experts and meet federal and state requirements.

Should you be currently signed up, log in to your profile and then click the Down load option to have the Ohio Performance Bond. Make use of your profile to check through the legal kinds you might have ordered in the past. Proceed to the My Forms tab of the profile and acquire an additional version of your document you require.

Should you be a brand new consumer of US Legal Forms, allow me to share straightforward recommendations that you can stick to:

- Initial, make certain you have selected the correct form for your city/region. You are able to look over the shape using the Preview option and browse the shape outline to guarantee this is the right one for you.

- In case the form fails to meet your expectations, utilize the Seach industry to discover the right form.

- When you are certain that the shape is acceptable, go through the Buy now option to have the form.

- Choose the prices program you desire and type in the essential details. Create your profile and buy your order utilizing your PayPal profile or credit card.

- Select the data file formatting and download the legal document format to your product.

- Full, edit and print out and sign the acquired Ohio Performance Bond.

US Legal Forms is the largest collection of legal kinds that you will find various document web templates. Take advantage of the company to download professionally-created documents that stick to state requirements.

Form popularity

FAQ

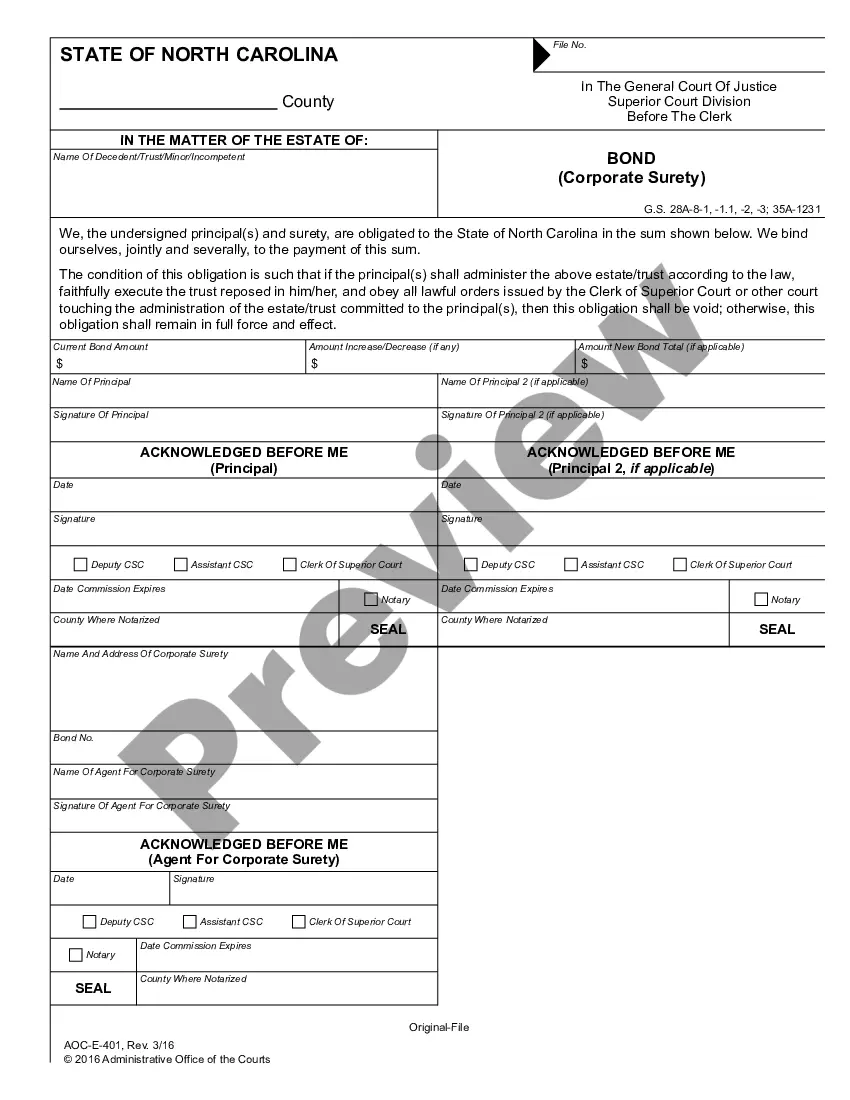

A performance bond is a type of contract construction bond that guarantees a contractor will complete a project ing to the terms outlined in a contract by the project owner, also called the obligee. The obligee can be a city, state, or local government, as well as the federal government or a private developer.

Performance bonds are considered as a three-party agreement between a surety company, the obliged and the principal. The principal is the employer or company which will offer the services and the obliged is the project owner.

The cost of a performance surety bond can vary by the type of bond and the client, but a good rule of thumb is that it costs one to three percent (1-3%) of the contractual amount. The cost of a performance bond may go up by 1.5% to 2% on riskier contracts, or down even lower if your financial rating is stellar.

One key difference between performance bonds and surety bonds is the scope of their coverage. Performance bonds only cover a specific project, while surety bonds can cover multiple projects or ongoing business activities.

The contractor will engage with a bond provider, or surety, to provide a performance bond for that project. In order to get a performance bond, the contractor agrees to pay the surety a small percentage of the total bond amount, usually between 1% and 4%.

Performance bonds are a subset of contract bonds and guarantee that a contractor will fulfill the terms of the contract. If they fail to do so, the Surety company is responsible for completing the contract obligations, either by securing a new contractor to complete the job or by financial compensation.

A payment bond and a performance bond work hand in hand. A payment bond guarantees a party pays all entities, such as subcontractors, suppliers, and laborers, involved in a particular project when the project is completed. A performance bond ensures the completion of a project.