Ohio LLC Operating Agreement for Real Estate

Description

How to fill out LLC Operating Agreement For Real Estate?

If you need to total, procure, or print official document templates, utilize US Legal Forms, the largest assortment of legal forms, available online.

Leverage the site’s straightforward and user-friendly search to locate the documents you require. Various templates for businesses and personal purposes are organized by categories and states, or keywords.

Use US Legal Forms to find the Ohio LLC Operating Agreement for Real Estate with just a few clicks.

Each legal document template you acquire belongs to you permanently. You will have access to every form you saved in your account. Click on the My documents section and select a form to print or download again.

Act promptly to acquire and print the Ohio LLC Operating Agreement for Real Estate with US Legal Forms. There are numerous professional and state-specific forms you can utilize for your business or personal needs.

- If you are currently a US Legal Forms customer, Log In to your account and click on the Download button to acquire the Ohio LLC Operating Agreement for Real Estate.

- You can also access forms you have previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Review option to examine the form’s content. Don’t forget to read the summary.

- Step 3. If you are unsatisfied with the form, use the Search field at the top of the screen to find other templates within the legal document category.

- Step 4. Once you have located the form you need, select the Get Now button. Choose the pricing plan you prefer and provide your details to register for an account.

- Step 5. Complete the payment. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Choose the format of the legal document and download it to your device.

- Step 7. Complete, edit and print or sign the Ohio LLC Operating Agreement for Real Estate.

Form popularity

FAQ

Do you have to pay for an LLC every year? Ohio LLCs with gross receipts over $150,000 must pay a commercial activity tax, but LLCs with receipts less than that amount do not have to pay every year.

An operating agreement is ONLY required in the five (5) States of California, Delaware, Maine, Missouri, and New York. In all other States, an operating agreement is not required but is recommended to be written and signed by all members of the LLC.

How to File (4 Steps)Step 1 Select a Business Name.Step 2 Appoint a Statutory Agent.Step 3 File Documents with Secretary of State.Step 4 Execute an Operating Agreement.Step 5 Register Company for Taxation.

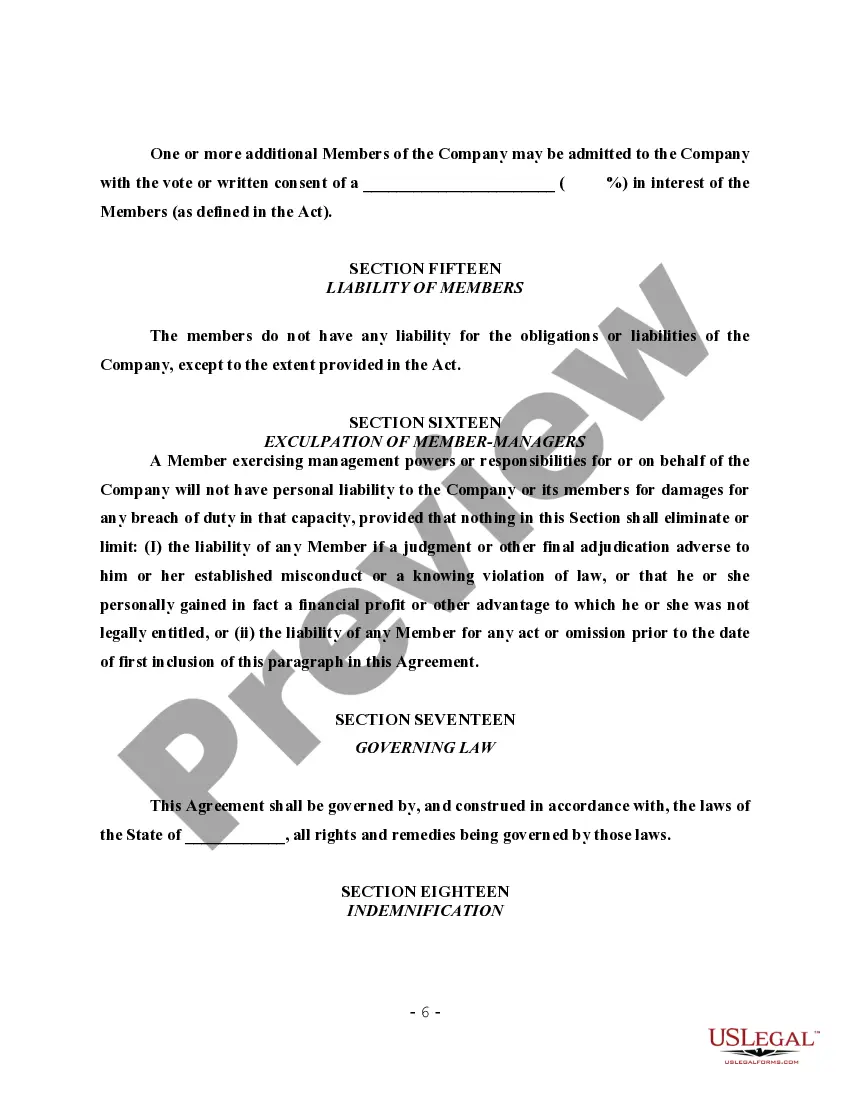

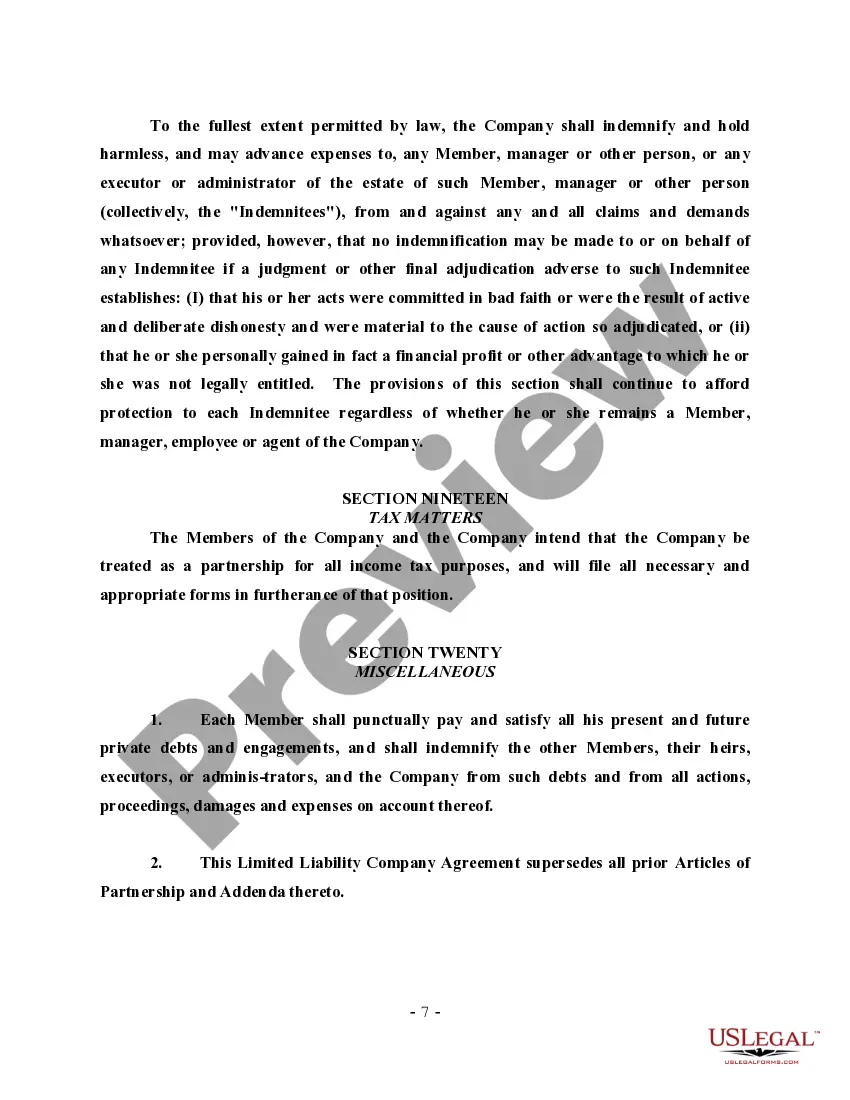

An Ohio LLC operating agreement is a legal document that would be used by any sized business that would like to establish the policies, standard operating procedures, member relations, and more, pertaining to their business.

You're now authorized to do business in Ohio as an LLC. But there are still a few more steps you need to follow to ensure that your LLC remains in good standing with the state.

This agreement can be implied, written, or oral. If you're formingor have formedan LLC in California, New York, Missouri, Maine, or Delaware, state laws require you to create an LLC Operating Agreement. But no matter what state you're in, it's always a good idea to create a formal agreement between LLC members.

Every Ohio LLC owner should have an operating agreement in place to protect the operations of their business. While not legally required by the state, having an operating agreement will set clear rules and expectations for your LLC while establishing your credibility as a legal entity.

An operating agreement is a key business document that shows your business operates like a legit company. Without the operating agreement, your state might not acknowledge you as an LLC, and which means someone could sue to go after you without there being any shield to protect your personal assets.

Negotiate and execute an operating agreement.Ohio does not require an operating agreement in order to form an LLC, but executing one is highly advisable.