Ohio Assignment of Bank Account

Description

How to fill out Assignment Of Bank Account?

If you need to full, acquire, or print authorized document web templates, use US Legal Forms, the greatest selection of authorized forms, which can be found on-line. Utilize the site`s simple and easy convenient lookup to find the files you want. Various web templates for business and specific purposes are sorted by categories and claims, or key phrases. Use US Legal Forms to find the Ohio Assignment of Bank Account in a number of click throughs.

Should you be already a US Legal Forms customer, log in in your profile and then click the Acquire option to obtain the Ohio Assignment of Bank Account. You can even access forms you formerly downloaded inside the My Forms tab of your own profile.

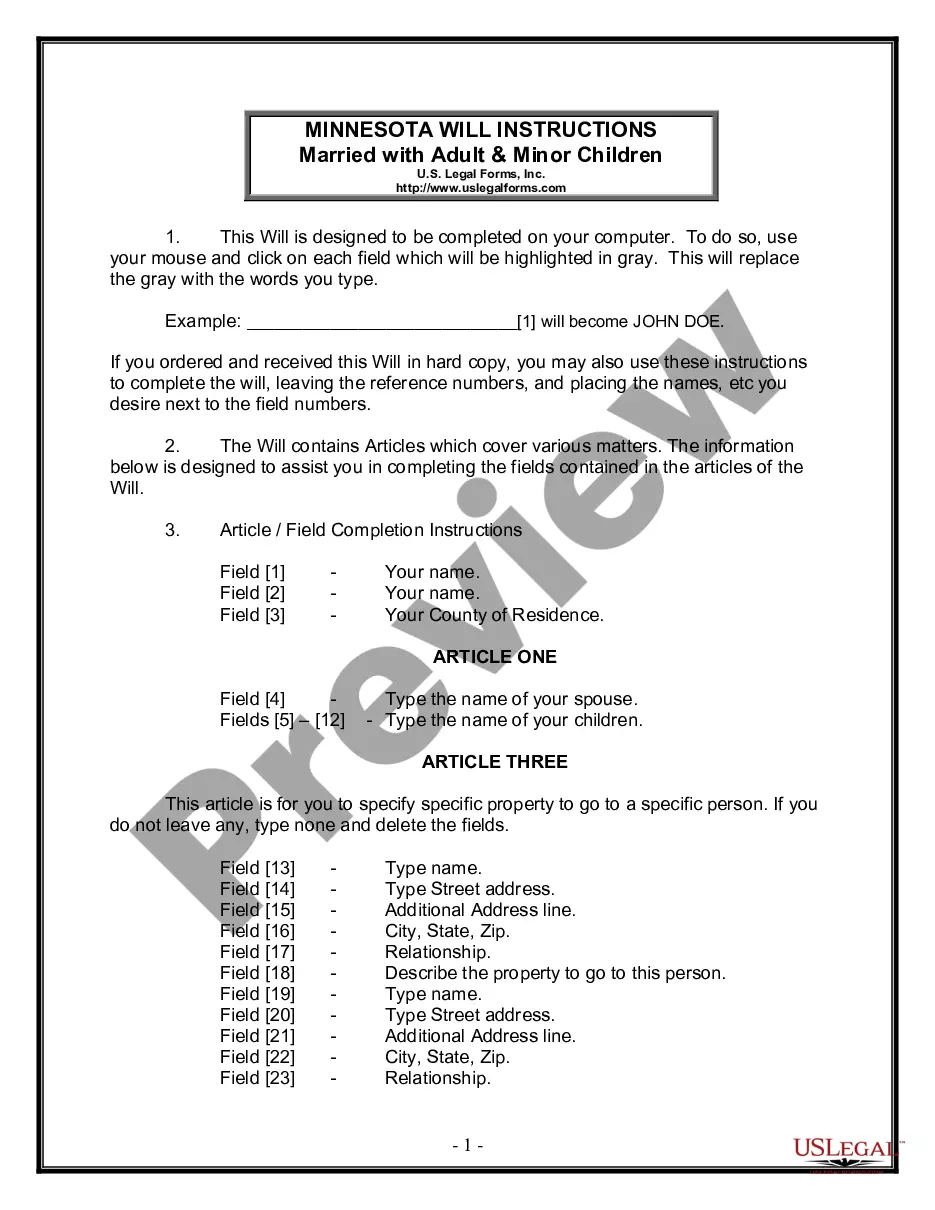

If you are using US Legal Forms initially, follow the instructions listed below:

- Step 1. Be sure you have selected the form for the right city/nation.

- Step 2. Take advantage of the Review choice to look through the form`s articles. Never forget about to see the explanation.

- Step 3. Should you be unsatisfied together with the kind, take advantage of the Look for field near the top of the display screen to find other versions of the authorized kind format.

- Step 4. Once you have discovered the form you want, select the Purchase now option. Choose the costs program you favor and include your references to register on an profile.

- Step 5. Procedure the purchase. You can use your Мisa or Ьastercard or PayPal profile to perform the purchase.

- Step 6. Pick the file format of the authorized kind and acquire it on the gadget.

- Step 7. Full, change and print or indicator the Ohio Assignment of Bank Account.

Every single authorized document format you buy is your own property eternally. You may have acces to every single kind you downloaded with your acccount. Select the My Forms segment and decide on a kind to print or acquire again.

Compete and acquire, and print the Ohio Assignment of Bank Account with US Legal Forms. There are thousands of specialist and state-particular forms you can utilize for your personal business or specific requirements.

Form popularity

FAQ

Ohio law authorizes individuals to enter into contracts with banks and other financial institutions to make the contents of a financial account payable to a designated beneficiary on the owner's death. These are called ?payable on death? or ?POD? accounts if the funds are in a bank account.

(1) An interest of a deceased owner shall be transferred to the transfer on death beneficiaries who are identified in the affidavit by name and who survive the deceased owner or that are in existence on the date of the deceased owner's death.

With the form filed, the bank has a legal document clearly stating who you named as beneficiary (who should inherit the money in your account). P.O.D.s typically override a Will or any other financial Estate Planning document (such as a Trust).

Because a POD account is revocable, the owner can close the account, withdraw all of the money in it or change the beneficiary at any time. If the account is jointly owned, the beneficiary cannot access the assets in the account until both owners have died.

(B)(1) Every administrator and executor, within six months after appointment, shall render a final and distributive account of the administrator's or executor's administration of the estate unless one or more of the following circumstances apply: (a) An Ohio estate tax return must be filed for the estate.

The Benefits of Establishing a California POD Account The account owner is entitled to the full use and access of the account funds while they are still alive. The beneficiaries can receive the proceeds without any need for probate.

Ohio Revised Code § 1109.07 explains that money deposited into a joint account can be paid out to either named account owners. So if you have an account owned with a spouse or an adult child, the co-owner will continue to have access to bank funds when you die.

Typically, TOD designations are used for stocks, bonds, mutual funds and other brokerage accounts, while POD designations are used for bank accounts.