Ohio Receipt and Withdrawal from Partnership

Description

How to fill out Receipt And Withdrawal From Partnership?

Are you currently in a situation where you require documents for either business or personal purposes almost all the time.

There are numerous legal document templates accessible online, but finding forms you can trust is not straightforward.

US Legal Forms offers a wide selection of form templates, such as the Ohio Receipt and Withdrawal from Partnership, designed to comply with federal and state regulations.

Once you find the correct form, click Buy now.

Choose the payment plan you want, fill in the necessary information to complete your transaction, and finalize your purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Ohio Receipt and Withdrawal from Partnership template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and confirm it is for your specific city/state.

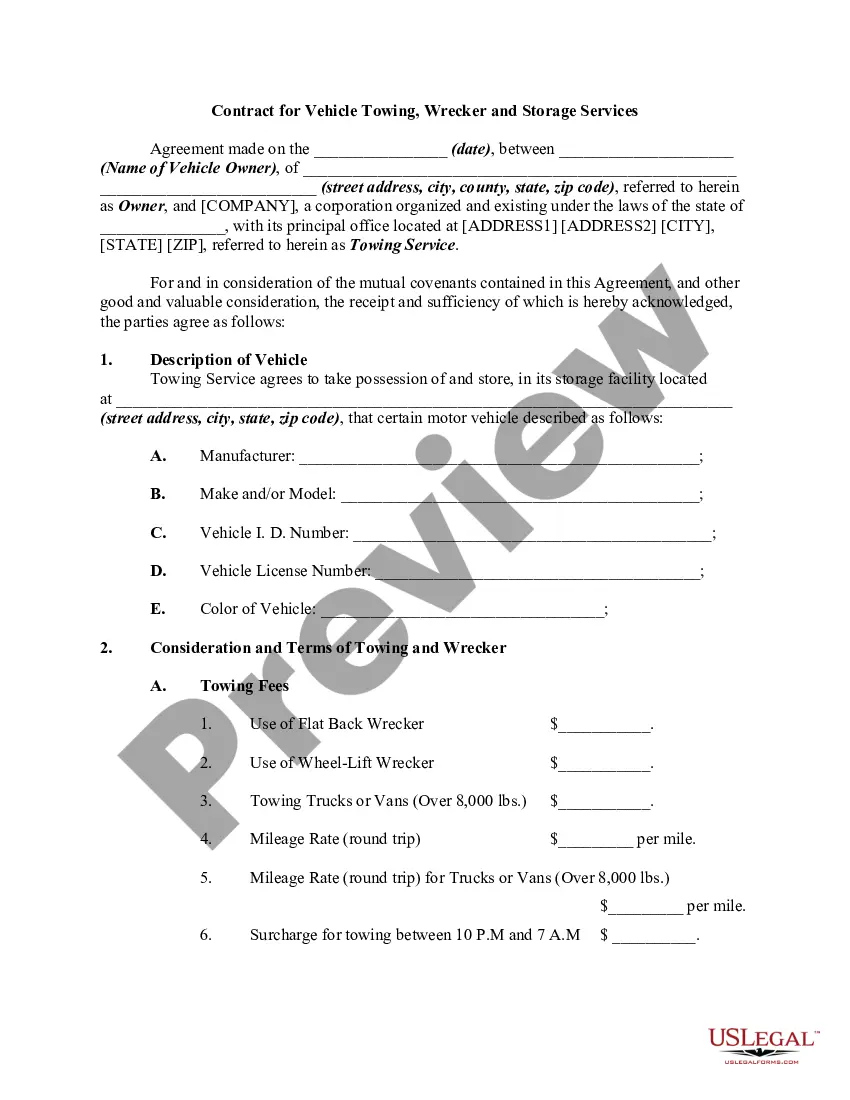

- Use the Preview button to review the form.

- Check the details to make sure you have selected the correct form.

- If the form is not what you are looking for, utilize the Search field to find the form that meets your needs.

Form popularity

FAQ

Form IT 1140 is an Ohio Corporate Income Tax form. Like the Federal Form 1040, states each provide a core tax return form on which most high-level income and tax calculations are performed.

Individuals claiming to be irrebuttably presumed to be full-year nonresidents for Ohio income tax purposes must file this form no later than the 15th day of the 10th month following the close of their tax year. For most taxpayers, the due date will be October 15th.

Any entity that (i) is treated as a partnership or an S corporation for federal income tax purposes, (ii) is electing to file a single (com- posite) annual income tax return on behalf of one, some or all of its noncorporate investors and (iii) is required to make estimated payments (may use coupon Ohio form IT 4708ES).

Form IT 1140 is an Ohio Corporate Income Tax form. Like the Federal Form 1040, states each provide a core tax return form on which most high-level income and tax calculations are performed.

All qualifying pass-through entities and qualifying trusts must attach to form IT-1140 the K-1 Information (dis- cussed below). qualifying investor or qualifying beneficiary (see Tax Credits Available to Certain Investors and Ben- eficiaries, on this page).

As provided in Ohio Revised Code Section 1776.65, a partner may file a Statement of Dissolution (Form 567), which signals the end of the partnership. Dissolution means the partnership will no longer be conducting new business, but concluding all existing business and ending the partnership's existence.

Qualifying pass-through entities whose equity investors are limited to nonresident individuals, nonresident estates and nonresident trusts can file either Ohio form IT 1140 or IT 4708. All other qualifying pass-through entities must file Ohio form IT 1140 and may also choose to file Ohio form IT 4708.

Form IT-4708 is the composite return that can be added in File > Client Properties. The composite return can be filed for all partner types except C-corporations.

If the qualifying pass-through entity or quali- fying trust has secured from the IRS an extension of time to file, use Ohio form IT-1140ES (for taxable years beginning in 2000) to remit any 5% withholding tax and/ or 8.5% entity tax due but not paid as of the unextended due date.

Form IT-4708 is the composite return that can be added in File > Client Properties. The composite return can be filed for all partner types except C-corporations.