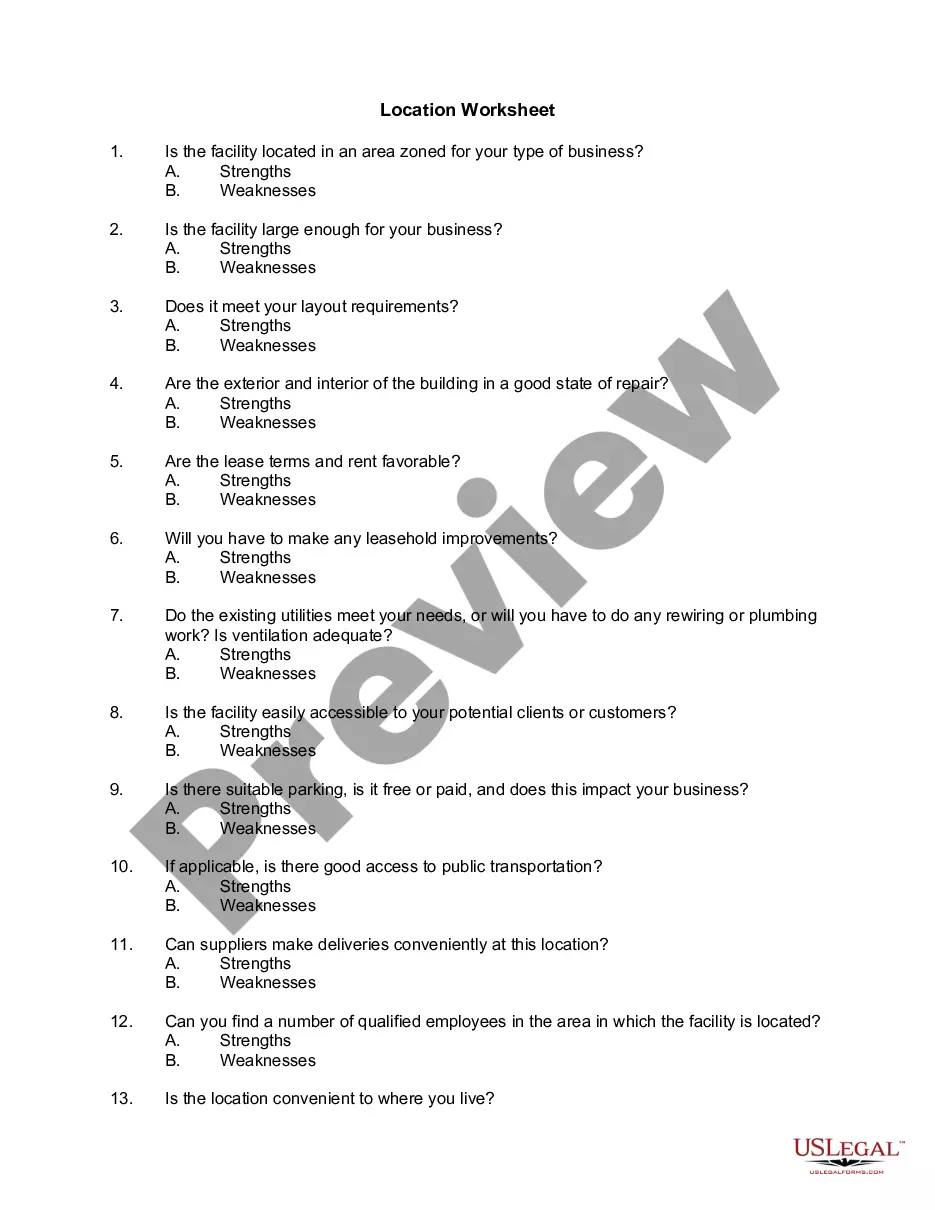

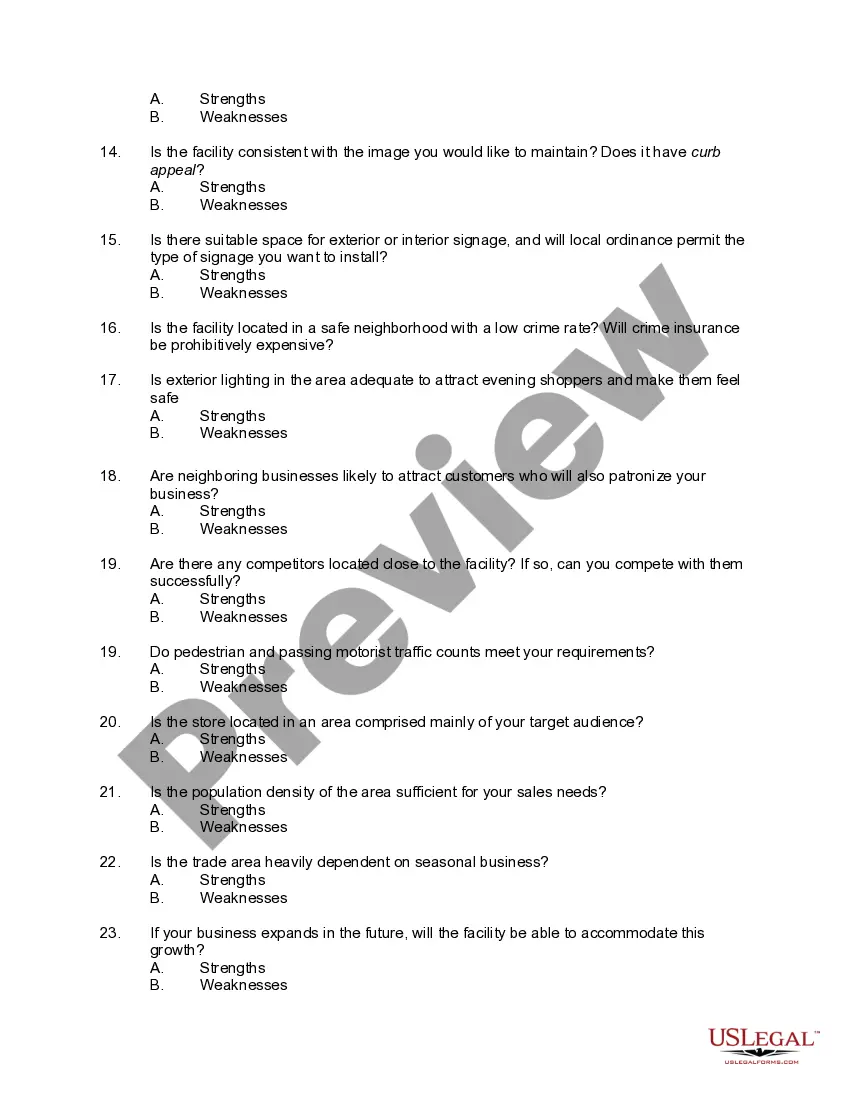

Ohio Location Worksheet

Description

How to fill out Location Worksheet?

Selecting the finest permitted document template can be quite challenging. Naturally, there are numerous templates available on the internet, but how can you locate the authorized form you need.

Utilize the US Legal Forms website. The service provides thousands of templates, including the Ohio Location Worksheet, that you can employ for business and personal purposes. All forms are vetted by professionals and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Download button to obtain the Ohio Location Worksheet. Use your account to review the legal forms you have previously ordered. Visit the My documents section of your account to retrieve another copy of the documents you require.

Fill out, modify, print, and sign the acquired Ohio Location Worksheet. US Legal Forms is the largest collection of legal forms where you can find a variety of document templates. Utilize the service to obtain professionally crafted documents that meet state requirements.

- If you are a new user of US Legal Forms, here are simple steps you should follow.

- First, ensure you have selected the appropriate form for your city/county. You can preview the document using the Review button and read the document details to confirm it is suitable for you.

- If the form does not suit your needs, utilize the Search field to find the correct form.

- Once you are certain the document is right, click the Acquire now button to obtain the form.

- Choose the payment plan you desire and input the necessary information. Create your account and pay for the transaction using your PayPal account or credit card.

- Select the file format and download the authorized document template to your device.

Form popularity

FAQ

In Ohio, you typically file city taxes in the municipality where you work if you reside outside that area. However, if you live within a municipality with its own tax requirements, you may need to file in both locations. The Ohio Location Worksheet helps clarify your obligations according to your living and working arrangements.

Ohio form IT NRS must be filed by non-residents or part-year residents who have earned income from Ohio sources. If you live outside of Ohio but work within its borders, this filing requirement applies to you. The Ohio Location Worksheet can simplify this process by outlining your specific filing needs.

Individuals residing in certain Ohio school districts may be subject to school district taxes based on their income. This tax helps fund local educational services and programs. Check your residency against the districts listed in the Ohio Location Worksheet to confirm if this tax applies to you.

To file the Ohio IT-3, you must complete the form with details about your income and tax withholdings. Ensure you gather all necessary documents before starting the process. By consulting the Ohio Location Worksheet, you can clarify the filing requirements for your specific situation and avoid mistakes.

Ohio form IT NRS is necessary for non-residents or part-year residents who owe tax on income sourced from Ohio. If you earned income in Ohio but reside elsewhere, you must file this form. Using the Ohio Location Worksheet will aid in tracking your income sources and fulfilling your tax obligations accurately.

Anyone earning income while living or working in Ohio must file state income taxes. This includes residents and non-residents who generate income from Ohio sources. The Ohio Location Worksheet can serve as a helpful guide to understand your tax responsibilities based on your location.

Businesses with profits generated within Ohio municipalities are required to file the Ohio municipal net profit tax. This tax applies to any entity or individual conducting business activities in these jurisdictions. To simplify compliance, utilize tools like the Ohio Location Worksheet to identify your obligations.

Yes, filing an Ohio school district tax return is necessary for individuals residing in specific districts. If you make income that exceeds a certain threshold, you must complete this requirement. The Ohio Location Worksheet can help you determine your filing status and which taxes apply.

In Ohio, not everyone is required to file city taxes; it depends on your city's tax regulations and your income level. Generally, individuals who earn income in a city that imposes a municipal income tax must file, regardless of residency. However, using the Ohio Location Worksheet can help you determine your filing obligations based on your income and location, ensuring you remain compliant with local tax laws.

To fill out a tax exemption form in Ohio, you need to provide your identification details, including your name, address, and the specific exemption type you are applying for. Make sure to include any relevant documents that support your exemption claim. The Ohio Location Worksheet can simplify this process by guiding you through the required steps and documentation needed to achieve your tax exemption.