Ohio Authorization to Release Credit Information

Description

How to fill out Authorization To Release Credit Information?

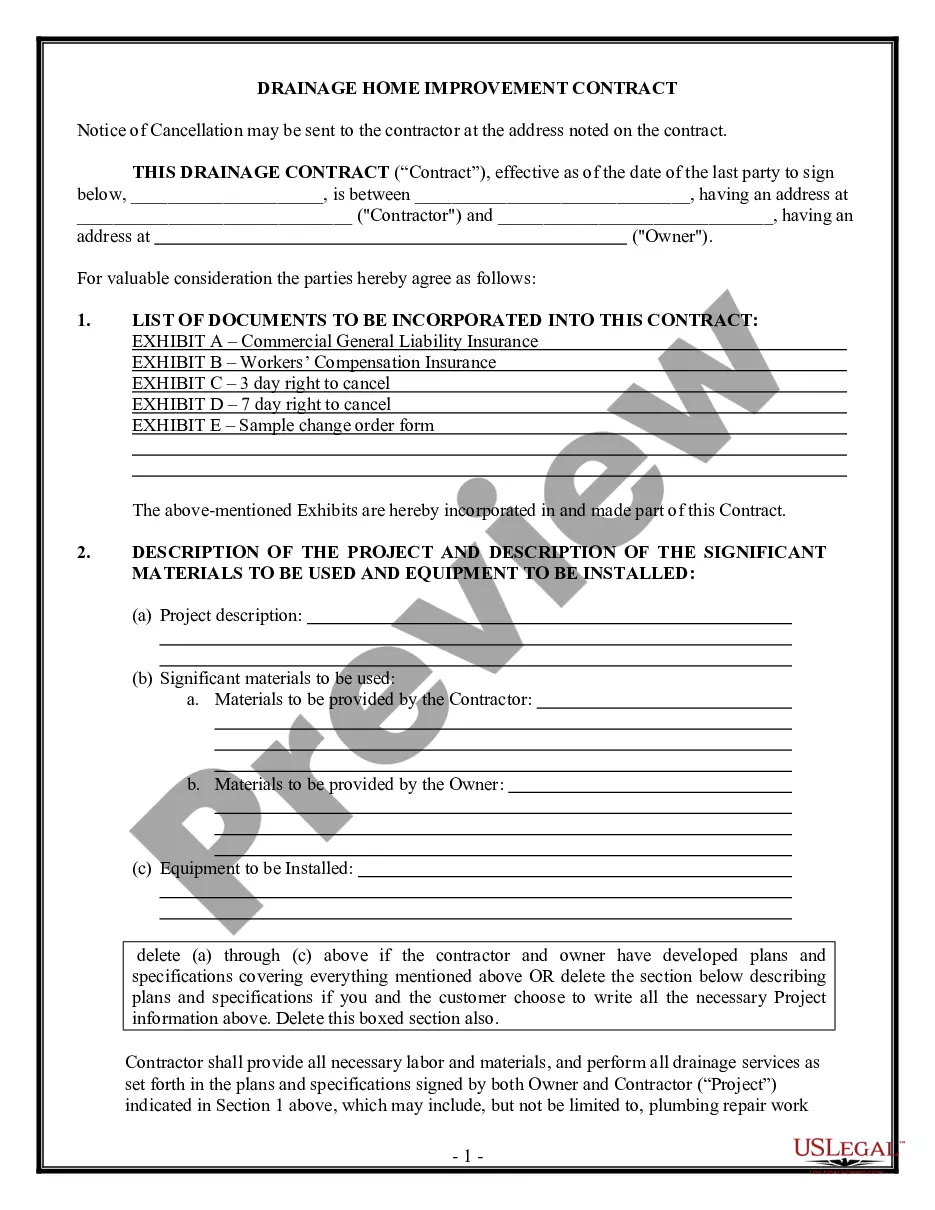

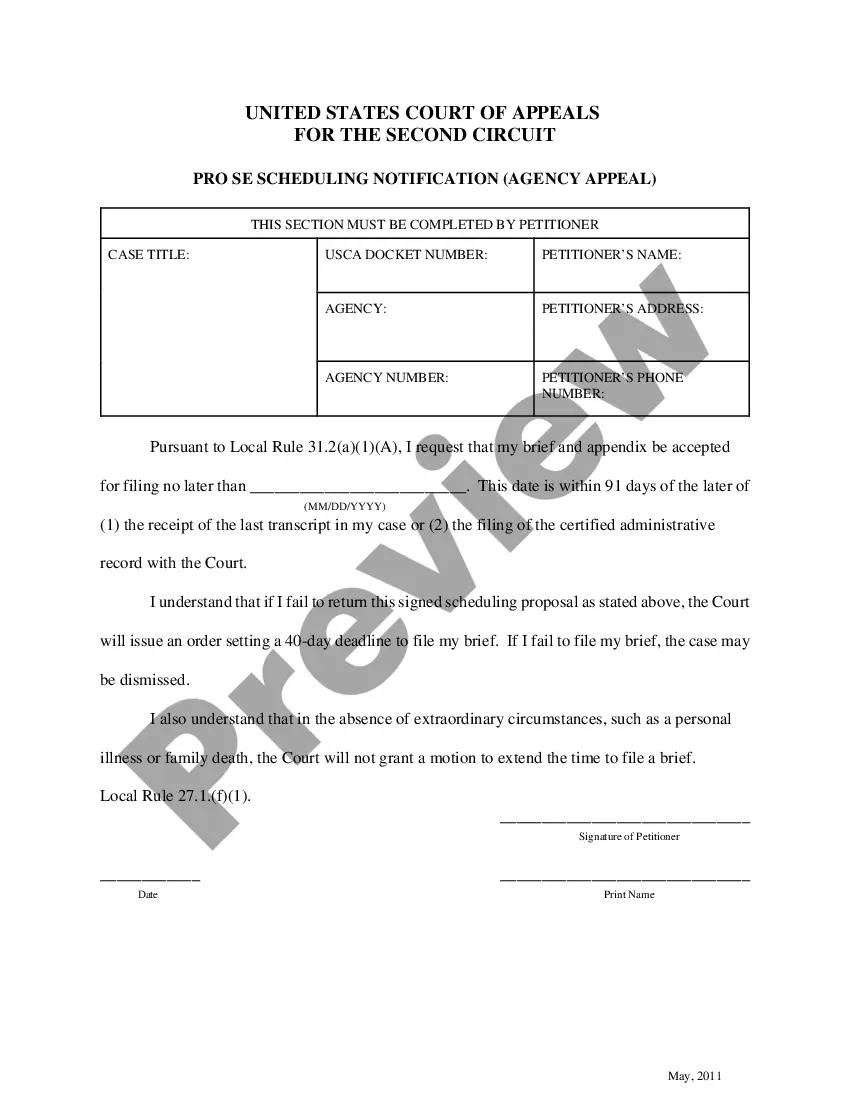

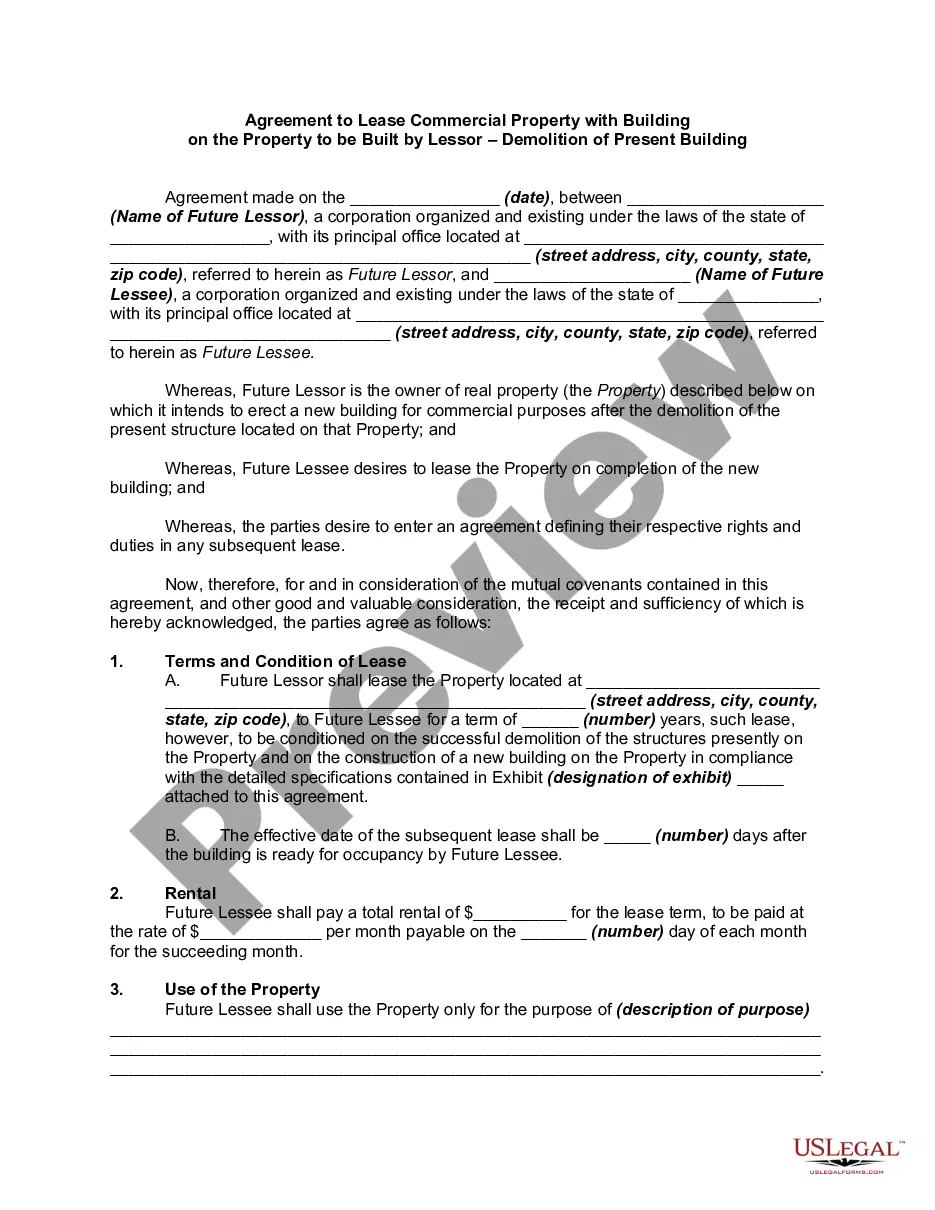

Choosing the best legitimate papers template might be a struggle. Obviously, there are a variety of themes available online, but how do you find the legitimate develop you want? Use the US Legal Forms internet site. The service delivers thousands of themes, like the Ohio Authorization to Release Credit Information, that you can use for enterprise and private requirements. All of the forms are inspected by specialists and meet up with federal and state demands.

When you are already listed, log in for your bank account and click the Down load switch to find the Ohio Authorization to Release Credit Information. Make use of your bank account to look with the legitimate forms you possess ordered earlier. Go to the My Forms tab of your bank account and acquire yet another version of your papers you want.

When you are a fresh customer of US Legal Forms, listed here are straightforward recommendations so that you can stick to:

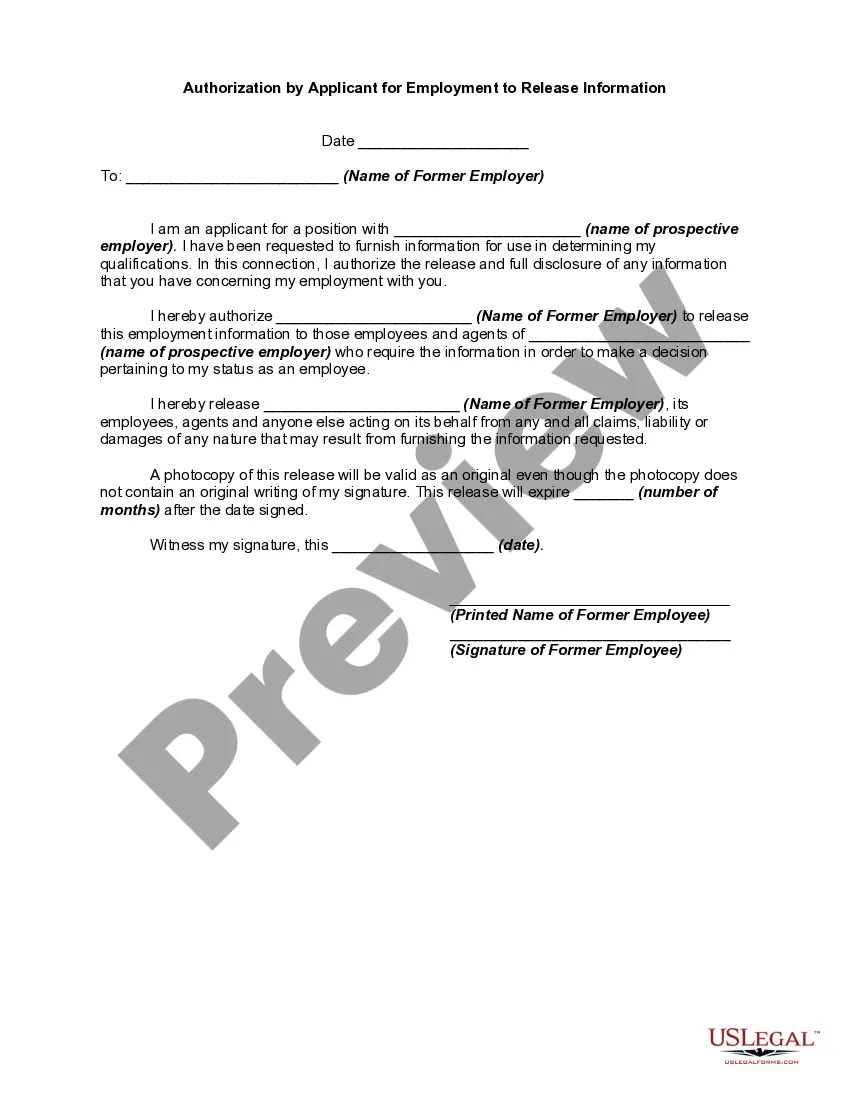

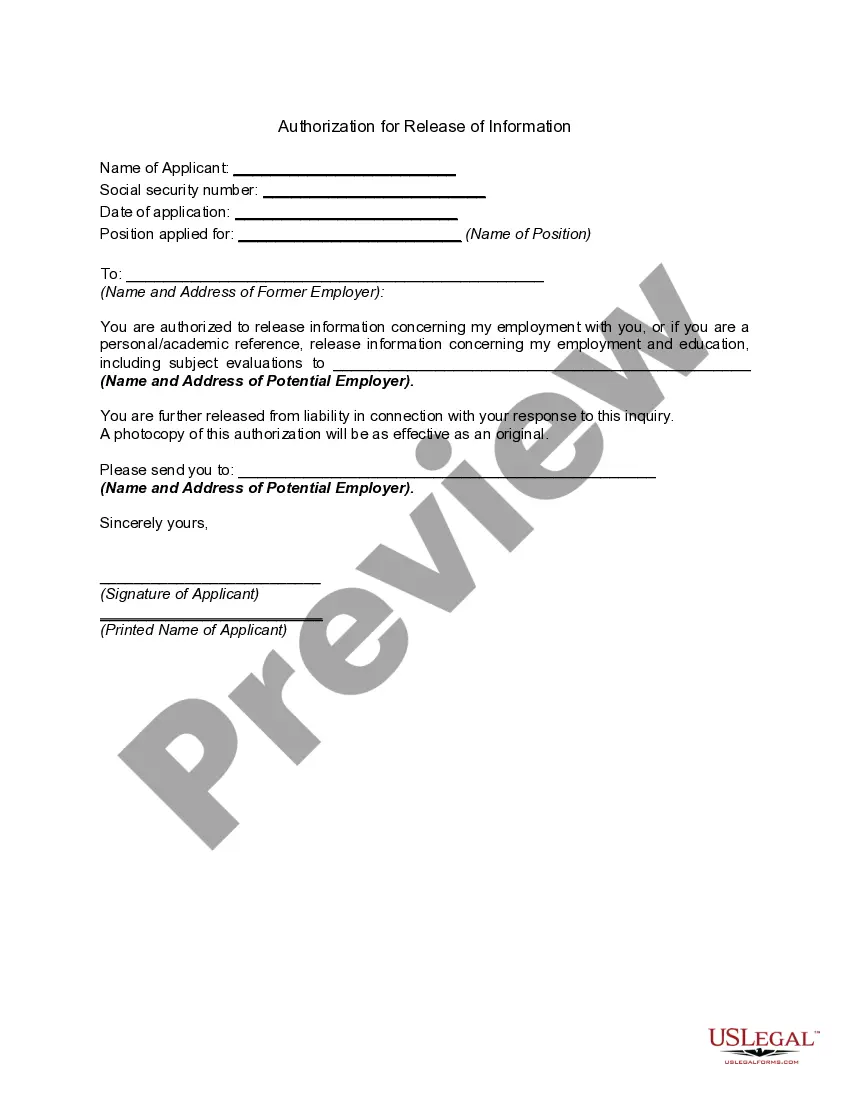

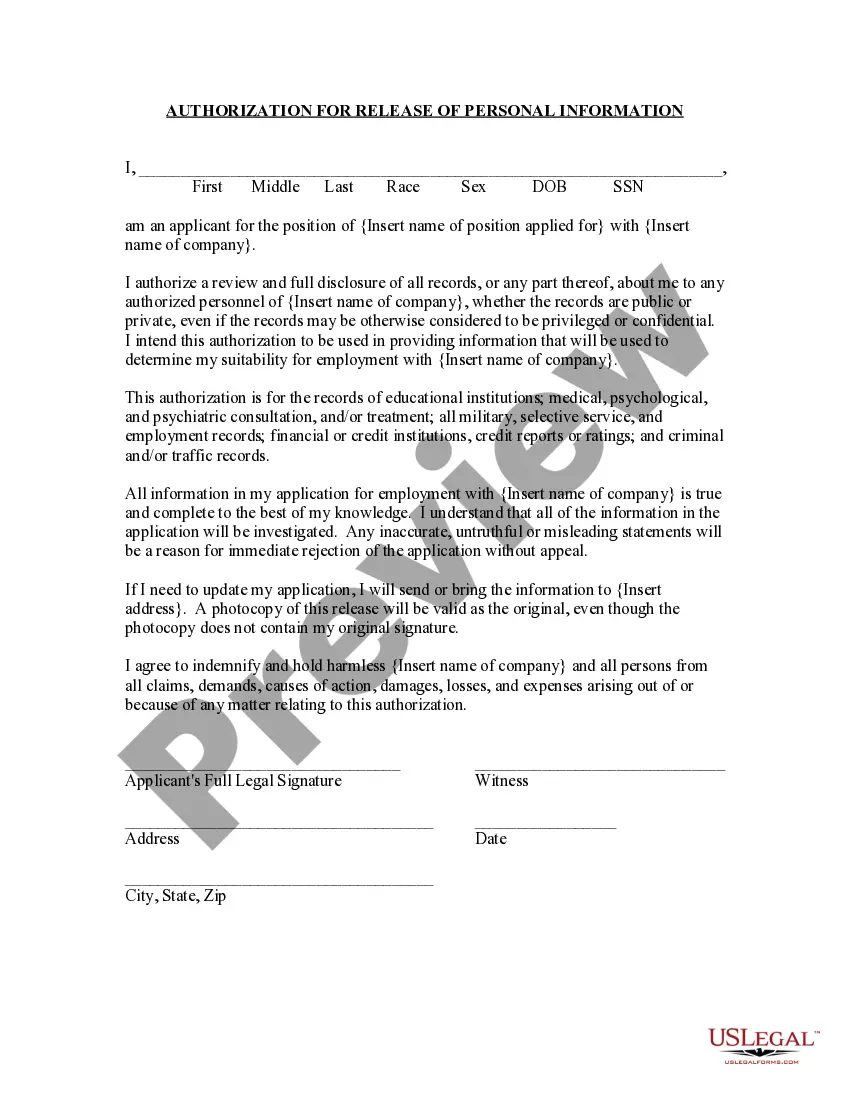

- Very first, make certain you have chosen the appropriate develop to your area/state. You may examine the shape utilizing the Review switch and look at the shape information to guarantee it will be the right one for you.

- In case the develop will not meet up with your requirements, use the Seach field to discover the correct develop.

- Once you are positive that the shape is acceptable, go through the Purchase now switch to find the develop.

- Opt for the pricing plan you would like and enter the required details. Build your bank account and pay for the order using your PayPal bank account or credit card.

- Opt for the document format and download the legitimate papers template for your gadget.

- Comprehensive, edit and produce and indicator the attained Ohio Authorization to Release Credit Information.

US Legal Forms is the greatest library of legitimate forms for which you can find a variety of papers themes. Use the company to download professionally-produced documents that stick to state demands.

Form popularity

FAQ

Hard inquiries typically require your written permission. These occur when you're applying for a credit card or personal loan, trying to rent an apartment and other situations where a business is attempting to assess your financial health for a specific purpose.

In some, but not all, instances, consumers must have initiated a transaction or agreed in writing before the credit bureau can release their report. For example, employers can request a job applicant's credit report, but only with the applicant's permission.

I authorize the person whom this application is delivered, to obtain my credit report from any credit-reporting agency and to contact my current or previous landlord and/or employer(s), to establish or verify my financial standing.

By signing this form, you are giving consent to have your consumer/credit reports furnished by consumer reporting agencies as part of an investigation to determine your suitability or fitness for federal employment or fitness to perform work under a contract.

Getting Consent to Run a Credit Report Step 1 ? Explain the Purpose to the Individual. ... Step 2 ? Completing the Form. ... Step 3 ? Obtaining a Real Signature. ... Step 4 ? Run the Credit Report. ... Step 5 ? Review and Give a Copy to the Consenter (if asked)

The Fair Credit Reporting Act (FCRA) has a strict limit on who can check your credit and under what circumstance. The law regulates credit reporting and ensures that only business entities with a specific, legitimate purpose, and not members of the general public, can check your credit without written permission.

Now, the good news is that lenders can't just access your credit report without your consent. The Fair Credit Reporting Act states that only businesses with a legitimate reason to check your credit report can do so, and generally, you have to consent in writing to having your credit report pulled.

The Fair Credit Reporting Act (FCRA) has a strict limit on who can check your credit and under what circumstance. The law regulates credit reporting and ensures that only business entities with a specific, legitimate purpose, and not members of the general public, can check your credit without written permission.