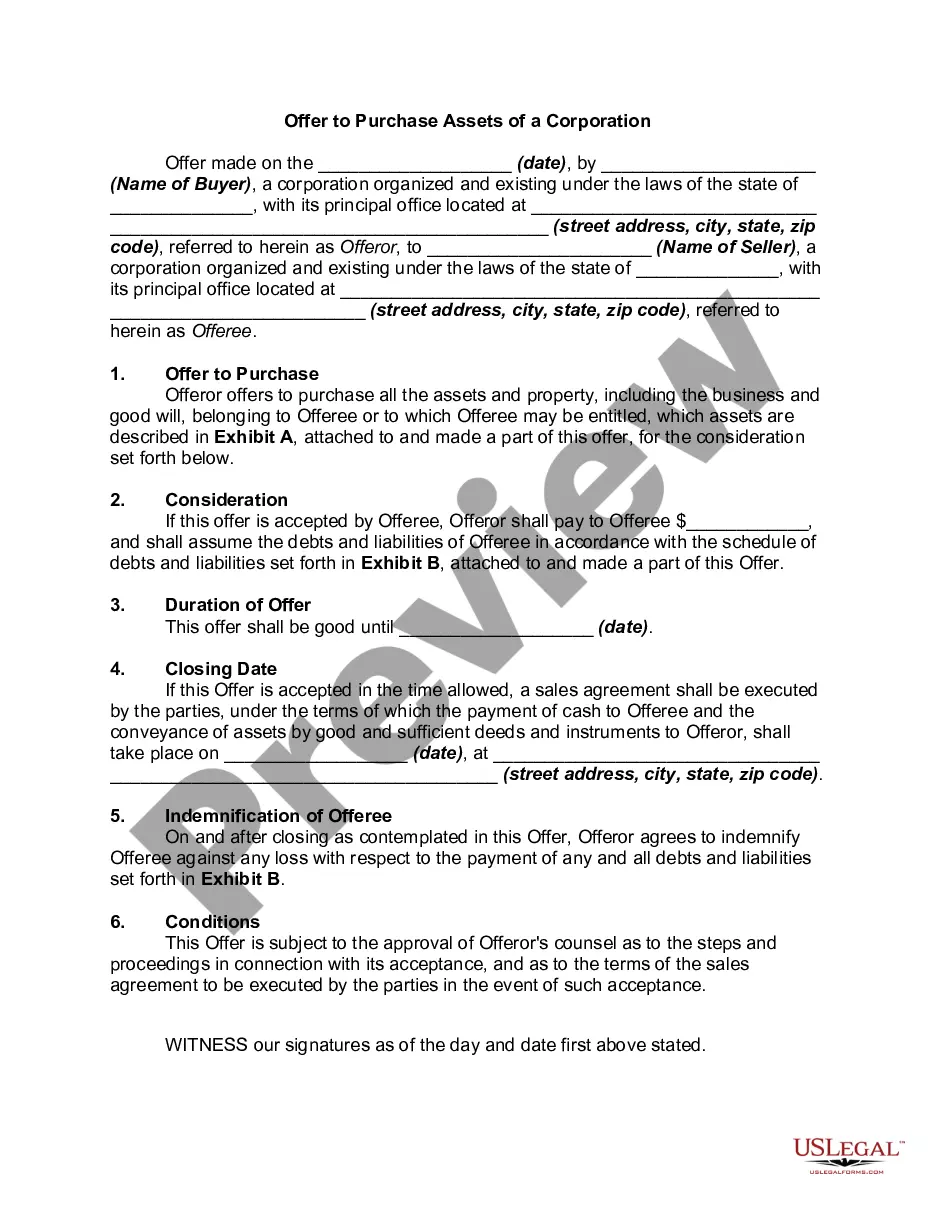

Ohio Offer to Purchase Assets of a Corporation

Description

Pursuant the Model Business Corporation Act, a sale of all of the assets of a corporation requires approval of the corporation's shareholders if the disposition would leave the corporation without a significant continuing business activity.

How to fill out Offer To Purchase Assets Of A Corporation?

If you wish to total, download, or produce authorized papers themes, use US Legal Forms, the greatest variety of authorized kinds, that can be found on the Internet. Take advantage of the site`s simple and handy lookup to get the files you will need. A variety of themes for business and specific reasons are categorized by types and suggests, or search phrases. Use US Legal Forms to get the Ohio Offer to Purchase Assets of a Corporation in a couple of click throughs.

When you are currently a US Legal Forms client, log in for your bank account and click on the Download key to find the Ohio Offer to Purchase Assets of a Corporation. You may also access kinds you in the past saved in the My Forms tab of your bank account.

If you work with US Legal Forms the very first time, follow the instructions beneath:

- Step 1. Be sure you have chosen the form to the right town/land.

- Step 2. Use the Preview method to check out the form`s content. Never overlook to read through the description.

- Step 3. When you are not happy using the form, use the Lookup area towards the top of the screen to get other versions of the authorized form design.

- Step 4. Once you have found the form you will need, go through the Get now key. Choose the pricing program you choose and add your credentials to sign up on an bank account.

- Step 5. Procedure the transaction. You can utilize your Мisa or Ьastercard or PayPal bank account to accomplish the transaction.

- Step 6. Find the file format of the authorized form and download it on the gadget.

- Step 7. Comprehensive, revise and produce or indicator the Ohio Offer to Purchase Assets of a Corporation.

Each authorized papers design you purchase is yours eternally. You might have acces to each form you saved inside your acccount. Click on the My Forms area and select a form to produce or download again.

Contend and download, and produce the Ohio Offer to Purchase Assets of a Corporation with US Legal Forms. There are thousands of professional and express-particular kinds you can use to your business or specific needs.

Form popularity

FAQ

Key Takeaways. In an asset sale, a firm sells some or all of its actual assets, either tangible or intangible. The seller retains legal ownership of the company that has sold the assets but has no further recourse to the sold assets. The buyer assumes no liabilities in an asset sale.

Generally speaking, an asset purchase is when an individual, either with an existing entity or by forming a new entity (LLC or Corporation), buys the assets of a business without buying the business itself. Asset Purchases entail buying everything that the business owns (the Assets).

To record the purchase of a fixed asset, debit the asset account for the purchase price, and credit the cash account for the same amount. For example, a temporary staffing agency purchased $3,000 worth of furniture.

An asset acquisition strategy is the purchase of another company through the process of buying its assets as opposed to buying its stock. Reasons for an asset acquisition strategy focus on promoting growth through external means as opposed to organic growth from within.

In an asset purchase, the buyer will only buy certain assets of the seller's company. The seller will continue to own the assets that were not included in the purchase agreement with the buyer. The transfer of ownership of certain assets may need to be confirmed with filings, such as titles to transfer real estate.

When you purchase the shares of a corporation you acquire both the assets and the liabilities of the corporation. Acquiring liabilities is generally a concern for a purchaser.

Purchasing Assets The buyer is taking ownership of the company when he or she buys up the shares, and all the company's assets and liabilities become the property of the shareholder who takes ownership. Only certain company assets can be purchased, not the liabilities as a way to reduce the potential risk.

There are two ways you can buy a business, you could buy its shares (and by extension all underlying assets, liabilities and obligations), or simply buy its underlying assets. Whilst an asset purchase sounds a great deal simpler, they can become complex affairs and have their own quirks.