Ohio Notice of Default under Security Agreement in Purchase of Mobile Home

Description

A secured transaction involves a sale on credit or lending money where a creditor is unwilling to accept the promise of a debtor to pay an obligation without some sort of collateral. The creditor (the secured party) requires the debtor to secure the obligation with collateral so that if the debtor does not pay as promised, the creditor can take the collateral, sell it, and apply the proceeds against the unpaid obligation of the debtor. A security interest is an interest in personal property or fixtures that secures payment or performance of an obligation. Personal property is basically anything that is not real property.

How to fill out Notice Of Default Under Security Agreement In Purchase Of Mobile Home?

You can invest several hours online searching for the legal document format that meets the state and federal requirements you have.

US Legal Forms offers a wide variety of legal templates that are reviewed by experts.

You can obtain or print the Ohio Notice of Default under Security Agreement in Purchase of Mobile Home with my help.

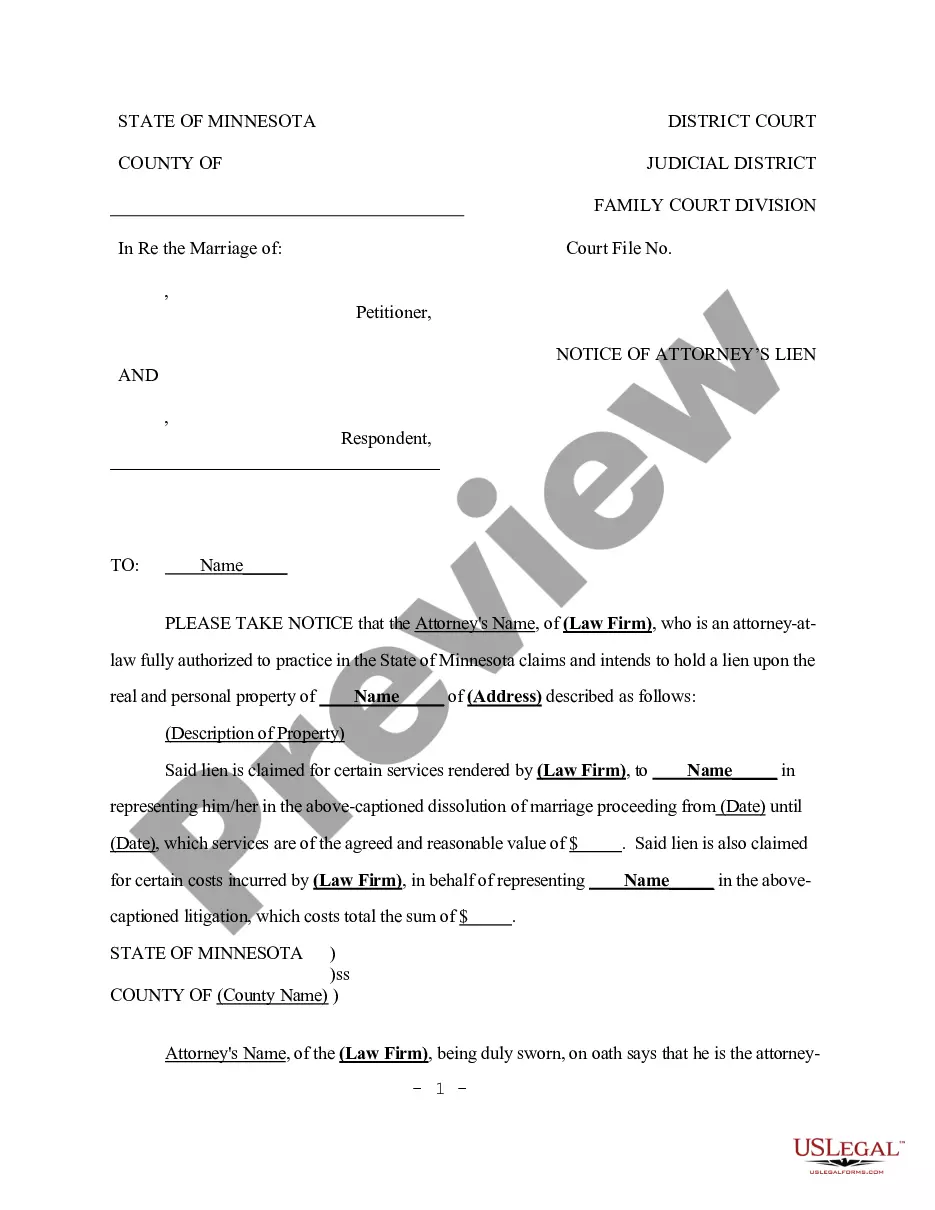

First, ensure that you have chosen the correct document format for the county/city of your preference. Review the document description to confirm you have selected the appropriate document. If available, utilize the Review option to examine the document format as well.

- If you already possess a US Legal Forms account, you may Log In and select the Acquire option.

- Following that, you can complete, alter, print, or sign the Ohio Notice of Default under Security Agreement in Purchase of Mobile Home.

- Every legal document format you acquire is yours indefinitely.

- To retrieve an additional copy of the purchased document, navigate to the My documents tab and select the relevant option.

- If you are accessing the US Legal Forms website for the first time, follow the simple instructions listed below.

Form popularity

FAQ

Debtor's rights in collateral. In such cases, the business will sign a conditional sales contract, which is also considered a security agreement, and which, under UCC sales rules, will give the business the necessary rights in the purchased items to use them as collateral.

To become a secured party, the creditor must obtain a security interest in the collateral of the debtor.

While the financing statement should include the names of the secured party and the debtor (along with some indication of the collateral), it need not be authenticated or signed. The financing statement lacks several of the requirements attached to a security agreement, so it cannot serve as a valid substitute.

A security agreement is a legal document that provides a lender a security interest in property or an asset that is promised as collateral. It gives the legal claim to the collateral to the creditor in case of a default by the borrower.

Often, secured parties use UCC-1 financing statement forms to achieve perfection of security interest outlined in a security agreement. Prepared and signed by both parties, this form includes the following information: The debtor's name (either the name of an organization or an individual taking on debt).

Secured Transaction Law: an overview A security interest arises when, in exchange for a loan, a borrower agrees in a security agreement that the lender (the secured party) may take specified collateral owned by the borrower if he or she should default on the loan.

A secured creditor is any creditor or lender associated with an issuance of a credit product that is backed by collateral. Secured credit products are backed by collateral. In the case of a secured loan, collateral refers to assets that are pledged as security for the repayment of that loan.

The term collateral refers to an asset that a lender accepts as security for a loan. Collateral may take the form of real estate or other kinds of assets, depending on the purpose of the loan. The collateral acts as a form of protection for the lender.

If two parties have a security interest in the same property, the party who filed first takes first. If the competing security interests are both unperfected, the party who was first to attach the property as collateral has priority. Other creditors of a debtor may have the first claim on secured property.

Security interest is an enforceable legal claim or lien on collateral that has been pledged, usually to obtain a loan. The borrower provides the lender with a security interest in certain assets, which gives the lender the right to repossess all or part of the property if the borrower stops making loan payments.