A discretionary trust is a trust where the beneficiaries and/or their entitlements to the trust fund are not fixed, but are determined by the criteria set out in the trust instrument by trustor. Discretionary trusts can be discretionary in two respects. First, the trustees usually have the power to determine which beneficiaries (from within the class) will receive payments from the trust. Second, trustees can select the amount of trust property that the beneficiary receives. Although most discretionary trusts allow both types of discretion, either can be allowed on its own. It is permissible in most legal systems for a trust to have a fixed number of beneficiaries and for the trustees to have discretion as to how much each beneficiary receives.

Ohio Discretionary Distribution Trust for the Benefit of Trustor's Children with Discretionary Powers over Accumulation and Distribution of Principal and Income Separate Trust for each Beneficiary

Description

How to fill out Discretionary Distribution Trust For The Benefit Of Trustor's Children With Discretionary Powers Over Accumulation And Distribution Of Principal And Income Separate Trust For Each Beneficiary?

If you need to finalize, acquire, or print valid document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Make use of the website's user-friendly and convenient search to locate the documents you require.

A variety of templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you’ve found the form you need, click the Buy now button. Choose your preferred payment plan and provide your details to register for an account.

Step 5. Process the transaction. You can complete the purchase using your credit card or PayPal account. Step 6. Select the format of your legal form and download it to your device. Step 7. Complete, customize, and print or sign the Ohio Discretionary Distribution Trust for the Benefit of Trustor's Children with Discretionary Powers over Accumulation and Distribution of Principal and Income Separate Trust for each Beneficiary.

- Utilize US Legal Forms to locate the Ohio Discretionary Distribution Trust for the Benefit of Trustor's Children with Discretionary Powers over Accumulation and Distribution of Principal and Income Separate Trust for each Beneficiary in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Acquire button to obtain the Ohio Discretionary Distribution Trust for the Benefit of Trustor's Children with Discretionary Powers over Accumulation and Distribution of Principal and Income Separate Trust for each Beneficiary.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you're using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure that you have selected the form for your specific region/state.

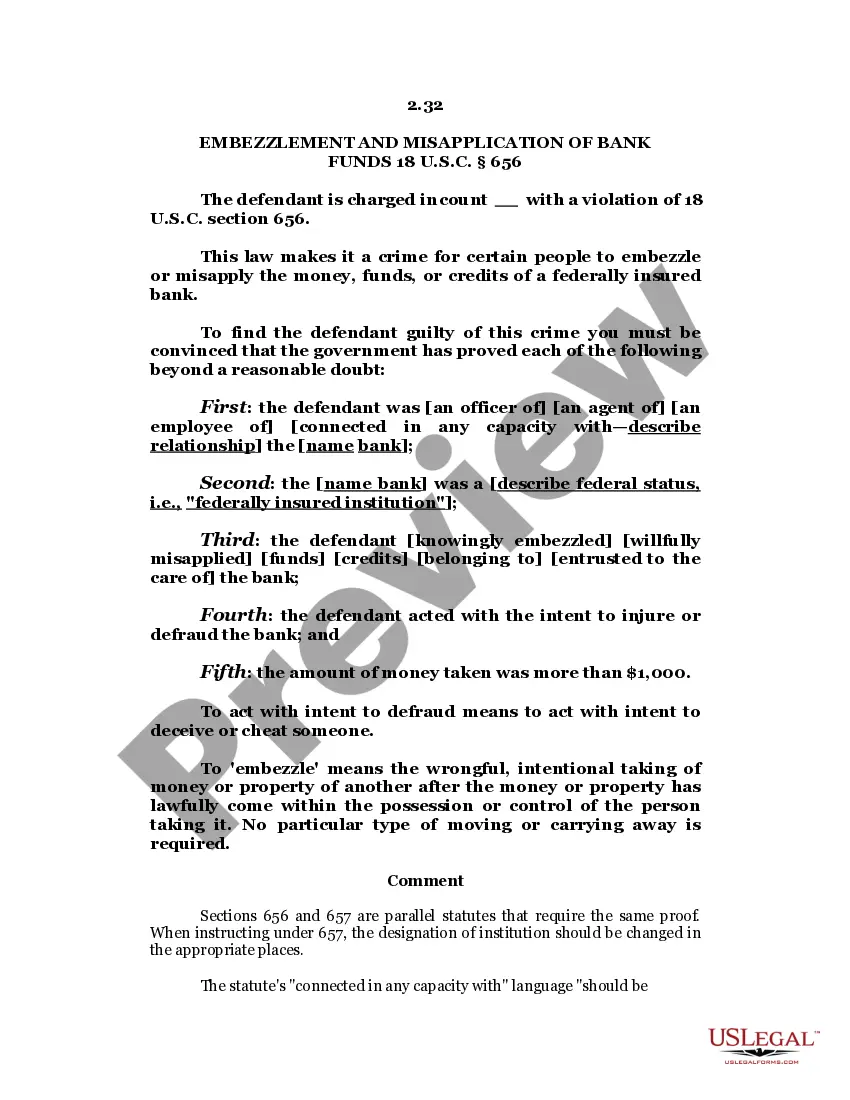

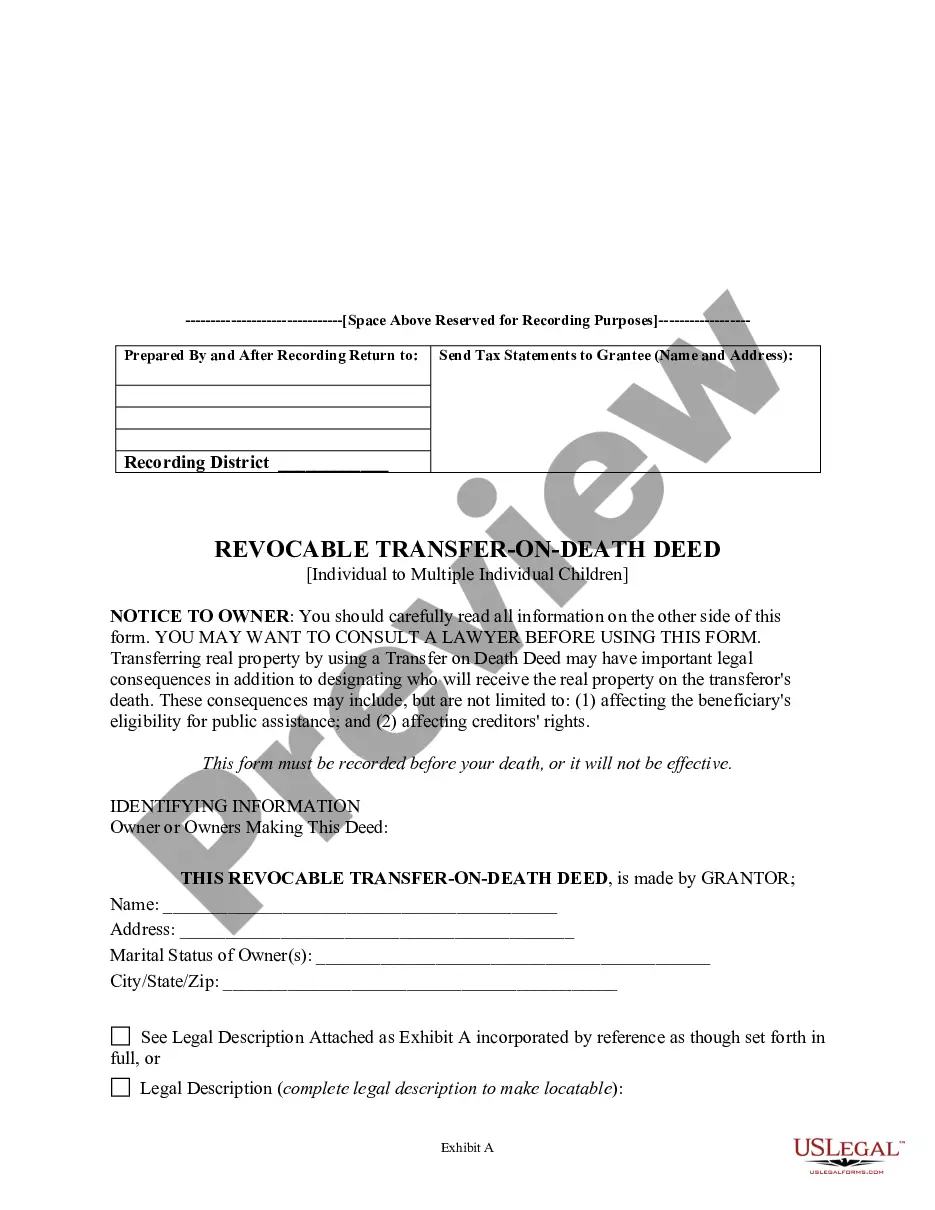

- Step 2. Use the Preview feature to review the content of the form. Don't forget to check the summary.

- Step 3. If you're not satisfied with the template, utilize the Search box at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

Primary tabs. A discretionary trust is a trust that contains a provision giving the trustee discretion to pay to the beneficiary only so much of the income and principal of the trust property as the trustee sees fit.

A trust distribution is a payment or other distribution of trust assets made by a trustee to one or more trust beneficiary.

Beneficiaries are entitled to see legal advice provided it is paid for by the trust fund. beneficiaries may not see legal advice relating to trustees' disputes with beneficiaries; and. if trustees have a controlling shareholding in a company then company documents may be subject to disclosure.

The trustee has an absolute discretion as to how income and capital of the trust is distributed on a year to year basis. Therefore, the trustee can distribute the whole or part of the income for a year and capital to any one of the primary, secondary or tertiary beneficiaries.

Generally, when you inherit money it is tax-free to you as a beneficiary. This is because any income received by a deceased person prior to their death is taxed on their own final individual return, so it is not taxed again when it is passed on to you.

Key TakeawaysTrust beneficiaries must pay taxes on income and other distributions that they receive from the trust. Trust beneficiaries don't have to pay taxes on returned principal from the trust's assets. IRS forms K-1 and 1041 are required for filing tax returns that receive trust disbursements.

The grantor can set up the trust, so the money distributes directly to the beneficiaries free and clear of limitations. The trustee can transfer real estate to the beneficiary by having a new deed written up or selling the property and giving them the money, writing them a check or giving them cash.

Beneficiaries of a trust typically pay taxes on the distributions they receive from the trust's income, rather than the trust itself paying the tax. However, such beneficiaries are not subject to taxes on distributions from the trust's principal.

Discretionary distribution means a distribution which the trustee is not directed to make, but is permitted to make in the trustee's discretion. For example, the language in a trust instrument providing for a discretionary distribution may contain the words "may" or "in the trustee's discretion".

If you inherit from a simple trust, you must report and pay taxes on the money. By definition, anything you receive from a simple trust is income earned by it during that tax year. The trustee must issue you a Schedule K-1 for the income distributed to you, which you must submit with your tax return.