Ohio Agreement to Assign Lease to Incorporators Forming Corporation

Description

How to fill out Agreement To Assign Lease To Incorporators Forming Corporation?

Are you currently in a scenario where you frequently require documents for business or personal reasons.

There are numerous legal document templates accessible online, but finding reliable forms is not straightforward.

US Legal Forms provides a vast array of document templates, such as the Ohio Agreement to Assign Lease to Incorporators Forming Corporation, which can be customized to comply with state and federal regulations.

Choose the pricing plan you prefer, enter the required information to create your account, and complete the payment using your PayPal or credit card.

Select a convenient document format and download your copy. You can access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Ohio Agreement to Assign Lease to Incorporators Forming Corporation at any time if needed. Simply click on the desired form to download or print the document template.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- Once logged in, you can download the Ohio Agreement to Assign Lease to Incorporators Forming Corporation template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the document you need and ensure it is for the correct city/state.

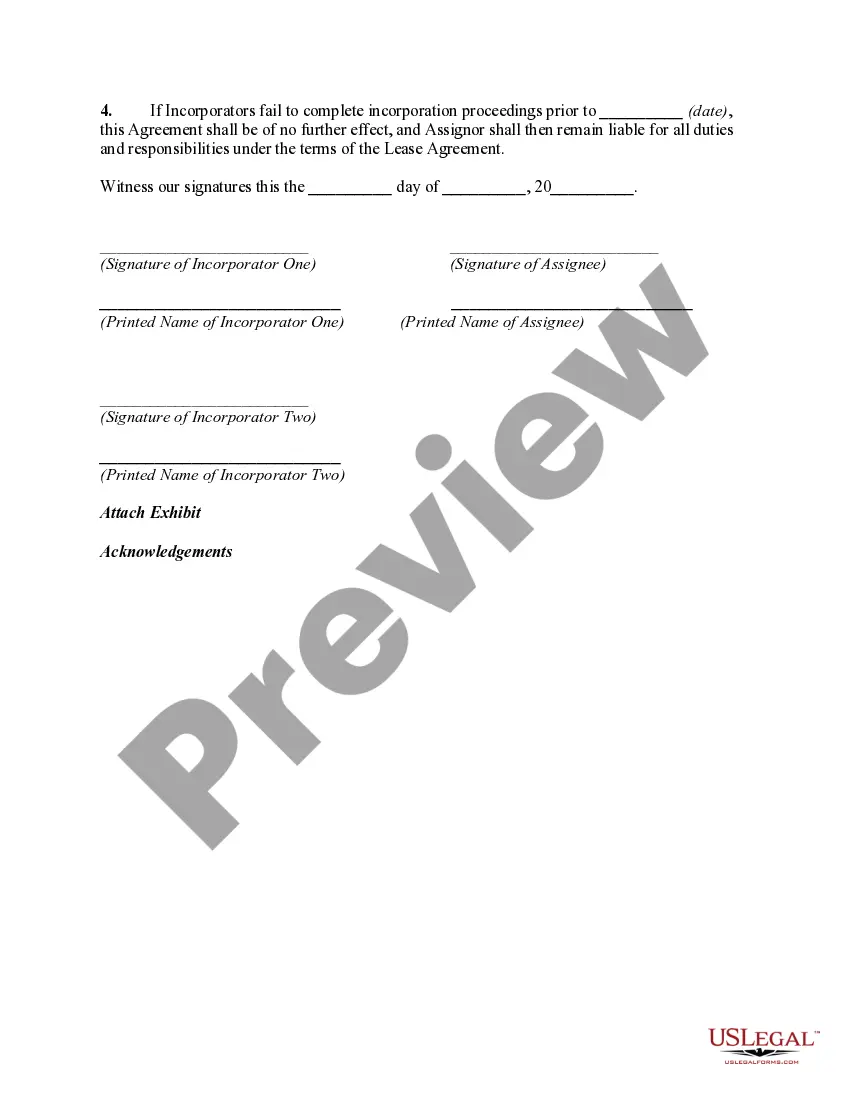

- Utilize the Review option to examine the document.

- Check the description to confirm that you have selected the appropriate form.

- If the form does not meet your criteria, use the Search feature to locate the document that satisfies your needs.

- When you find the correct form, click Get now.

Form popularity

FAQ

Yes, Ohio requires nonprofits to create and maintain bylaws that govern their operations. Bylaws outline the structure and rules by which the nonprofit will operate, including the duties of directors and officers. It's crucial to understand and establish these guidelines early on, especially when forming a corporation. For related documentation, the Ohio Agreement to Assign Lease to Incorporators Forming Corporation can be a beneficial resource.

In Ohio, leases do not typically require notarization unless specified in the lease agreement itself. However, having your lease notarized can provide an extra layer of security and help avoid disputes. If you are a corporation, using the Ohio Agreement to Assign Lease to Incorporators Forming Corporation ensures a proper transition of leases, providing clarity in your agreements.

To dissolve a 501c3 in Ohio, you must first ensure that your organization has settled all debts and obligations. Then, you need to file a dissolution application with the Ohio Secretary of State. It's essential to document this process correctly, especially if you have leases tied to your nonprofit activities. Consider using the Ohio Agreement to Assign Lease to Incorporators Forming Corporation to streamline any related lease transfers.

Backing out of a lease after signing in Ohio is generally difficult unless there is a legal reason, such as non-disclosure of significant issues or mutual agreement to terminate. Utilizing the Ohio Agreement to Assign Lease to Incorporators Forming Corporation can facilitate discussions around lease assignments to allow smoother transitions. Always seek advice to understand your rights and obligations before proceeding.

In Ohio, a lease becomes legally binding when both parties agree to the terms, sign the document, and exchange consideration, such as rent. Key elements often include the parties' identification, property description, lease duration, and payment terms. When forming a corporation, using the Ohio Agreement to Assign Lease to Incorporators Forming Corporation helps ensure adherence to legal requirements in the lease process.

In Ohio, a verbal lease agreement can be legally binding, but it often poses challenges in enforcement. For clarity and security, many opt for written agreements, such as the Ohio Agreement to Assign Lease to Incorporators Forming Corporation. Always keep records of all communications and agreements to better protect your interests.

The best excuse for breaking a lease typically relates to significant issues such as medical emergencies, job relocations, or unsafe living conditions. Utilizing the Ohio Agreement to Assign Lease to Incorporators Forming Corporation can provide a strategic way to manage lease obligations during such transitions. It is advisable to communicate openly with your landlord to discuss your options.

In Ohio, a tenant may break a lease for several legal reasons, such as uninhabitable conditions, the tenant being a victim of domestic violence, or if the lease contains a clause allowing early termination. Those using the Ohio Agreement to Assign Lease to Incorporators Forming Corporation must consider how these reasons may affect lease assignments. Always consult relevant legal guidance to understand your specific situation.

Section 1702.47 in the Ohio Revised Code pertains to the formation and organization of corporations in Ohio. This section outlines the requirements for the Ohio Agreement to Assign Lease to Incorporators Forming Corporation. Essentially, it details how incorporators can assume lease obligations during the formation of a corporation, ensuring legal clarity and compliance.

Section 1701.87 focuses on the distribution of dividends and other financial distributions within Ohio corporations. This section outlines compliance measures to ensure that financial benefits are shared fairly among shareholders. When executing an Ohio Agreement to Assign Lease to Incorporators Forming Corporation, awareness of Section 1701.87 can aid in making sound financial decisions for the corporation.