Ohio Letter to Creditors Notifying Them of Identity Theft of Minor for New Accounts

Description

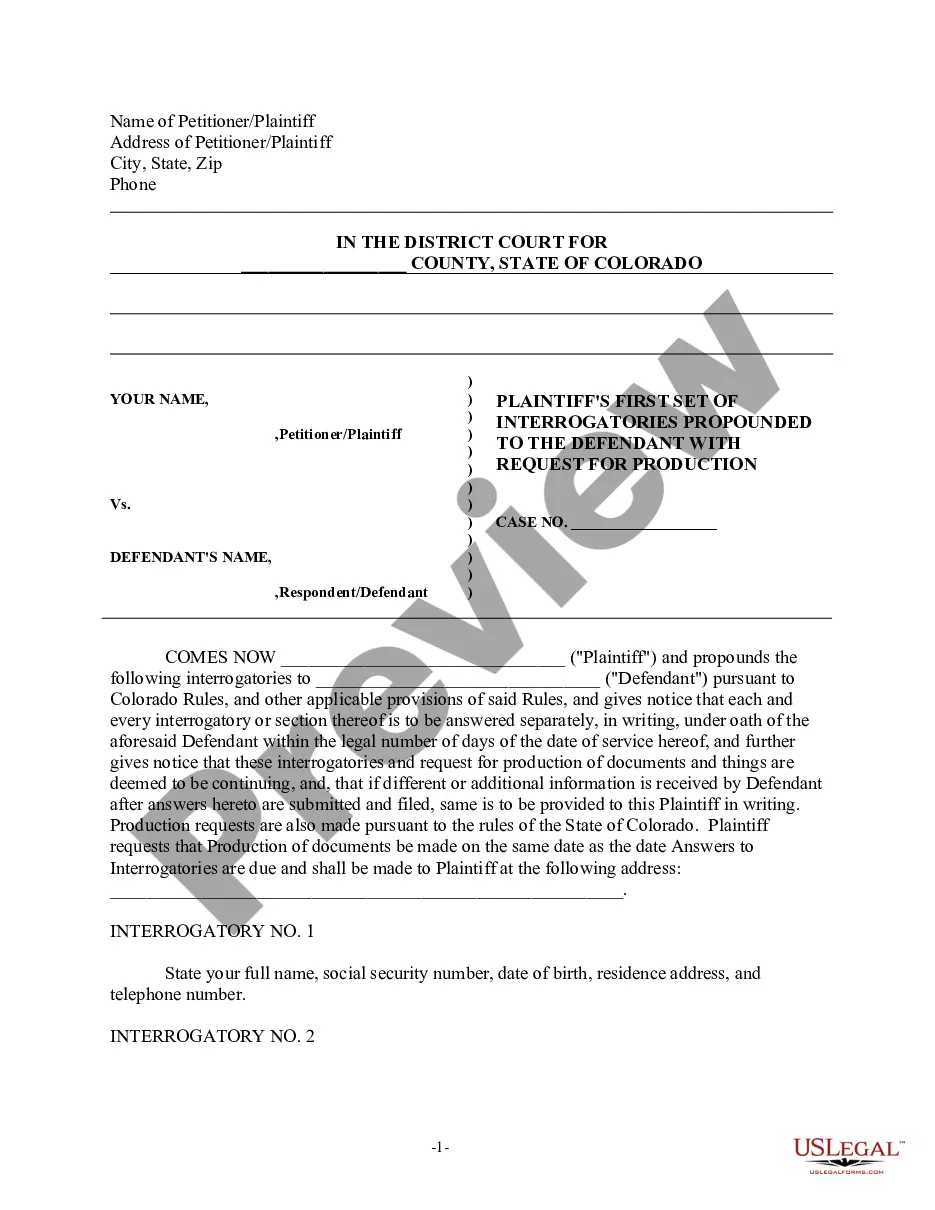

How to fill out Letter To Creditors Notifying Them Of Identity Theft Of Minor For New Accounts?

US Legal Forms - one of many most significant libraries of authorized kinds in the USA - provides a wide range of authorized papers themes you can down load or produce. Making use of the site, you will get 1000s of kinds for enterprise and individual functions, sorted by categories, states, or keywords and phrases.You will find the most recent variations of kinds such as the Ohio Letter to Creditors Notifying Them of Identity Theft of Minor for New Accounts in seconds.

If you have a monthly subscription, log in and down load Ohio Letter to Creditors Notifying Them of Identity Theft of Minor for New Accounts in the US Legal Forms library. The Download switch will appear on each develop you see. You gain access to all previously acquired kinds in the My Forms tab of your account.

If you want to use US Legal Forms for the first time, allow me to share straightforward guidelines to get you began:

- Be sure you have picked the best develop for the area/area. Select the Review switch to examine the form`s content material. Look at the develop outline to ensure that you have selected the appropriate develop.

- When the develop does not match your needs, use the Search field on top of the display screen to obtain the one which does.

- If you are content with the form, validate your option by visiting the Purchase now switch. Then, select the pricing plan you want and offer your qualifications to sign up for the account.

- Process the purchase. Utilize your Visa or Mastercard or PayPal account to complete the purchase.

- Pick the structure and down load the form in your device.

- Make adjustments. Fill out, modify and produce and indication the acquired Ohio Letter to Creditors Notifying Them of Identity Theft of Minor for New Accounts.

Each and every web template you added to your account does not have an expiry particular date and is your own forever. So, if you wish to down load or produce one more copy, just go to the My Forms segment and then click on the develop you need.

Get access to the Ohio Letter to Creditors Notifying Them of Identity Theft of Minor for New Accounts with US Legal Forms, probably the most comprehensive library of authorized papers themes. Use 1000s of professional and status-particular themes that meet up with your small business or individual requirements and needs.

Form popularity

FAQ

Identity theft occurs when someone obtains and uses your personal information without your permission to commit a fraud. Common types of identity theft include: Financial identity theft: Someone opens an account or takes out a loan in your name.

The first step of identity theft is when thieves steal your personal data. This can happen through a variety of means, including hacking, fraud and trickery, phishing scams, mail theft, and data breaches. Data breaches are among the most common ways identity thieves collect personal data.

Go to IdentityTheft.gov or call 1-877-438-4338. Based on information your enter, IdentityTheft.gov will create your Identity Theft Report and recovery plan. If your personal information was stolen, you might want to file an identity theft report with the police. Also, creditors might ask you to file a police report.

File a report with your local police department. Place a fraud alert on your credit report. ... Consumer Reporting Agencies (CRA's) Close the accounts that you know or believe have been tampered with or opened fraudulently. ... Report the theft to the Federal Trade Commission. ... File a police report.

The penalties for violating federal identity theft laws can include up to 15 years in jail, with the possibility of heavy fines. If a victim of identity theft suffered some financial loss, the courts may require a defendant to pay the costs of restitution to the victim.

Police reports play an important role when identity theft occurs. They can play a crucial role in disputing incorrect information your credit report, or in filing a complaint with a regulatory agency (like the Consumer Protection Financial Bureau or the Federal Trade Commission), or completing a fraud affidavit.