Ohio Employee Agreement - Vacation and Sick Pay

Description

How to fill out Employee Agreement - Vacation And Sick Pay?

Are you presently in a role that may require documentation for various organizational or specific purposes nearly every day of work.

There are many credible document templates accessible online, but finding ones you can trust is not straightforward.

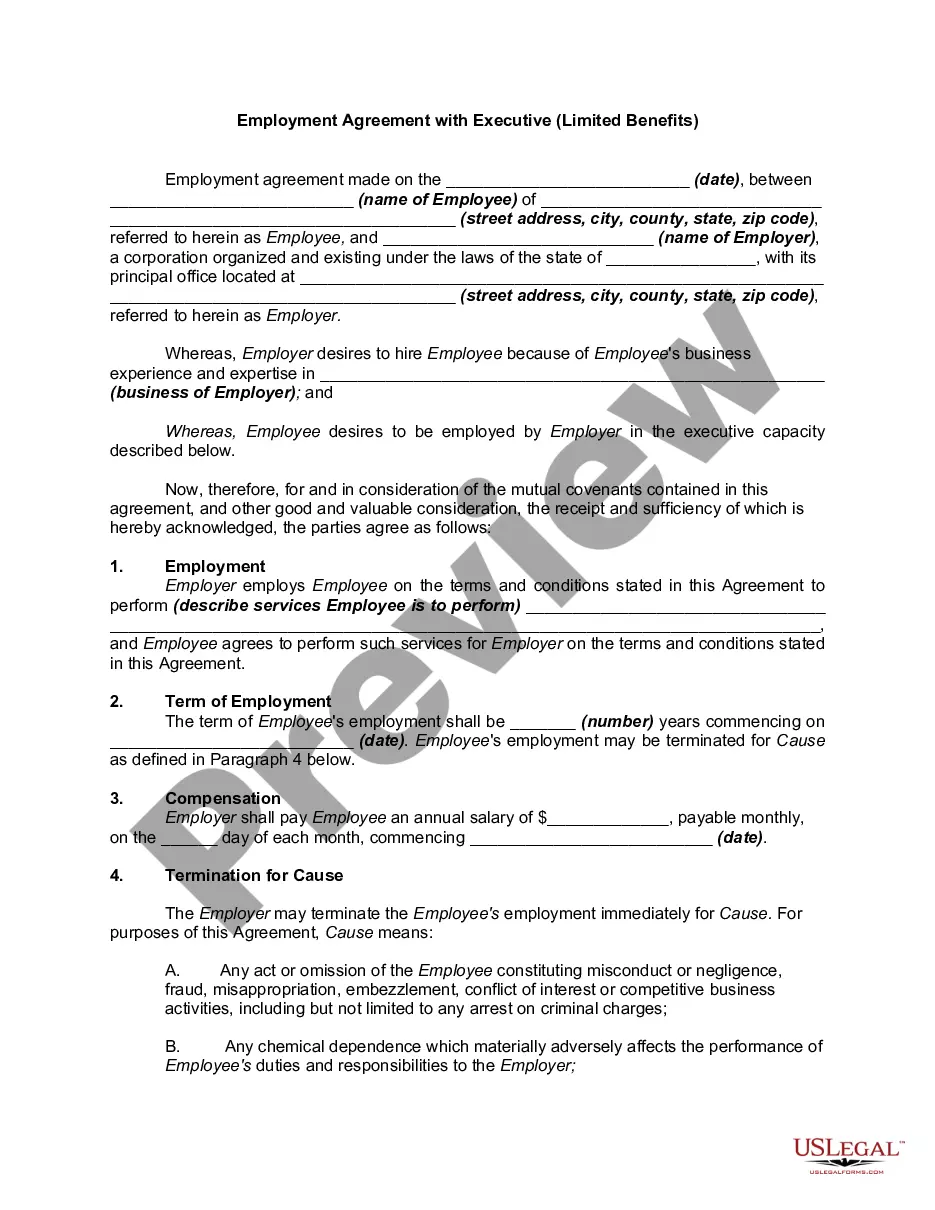

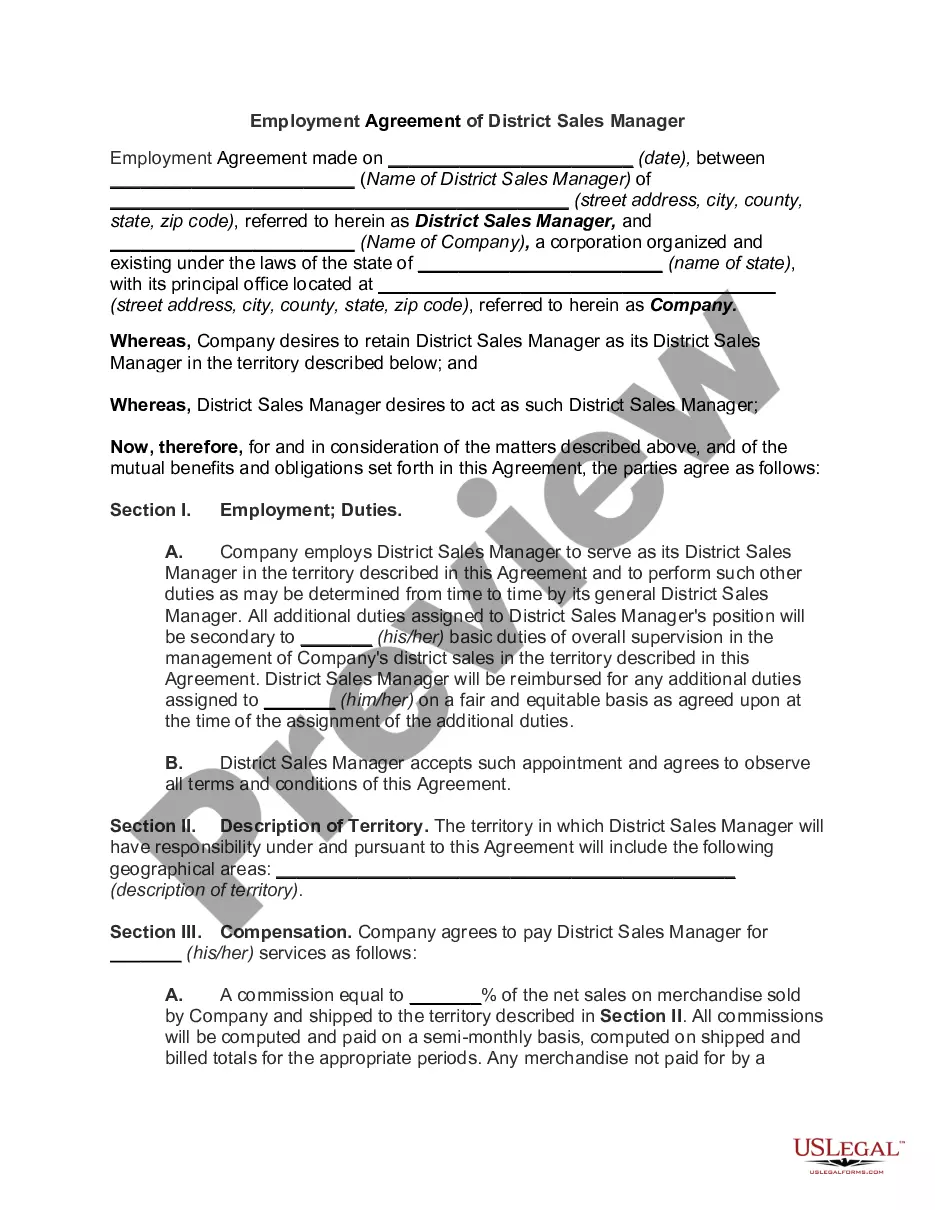

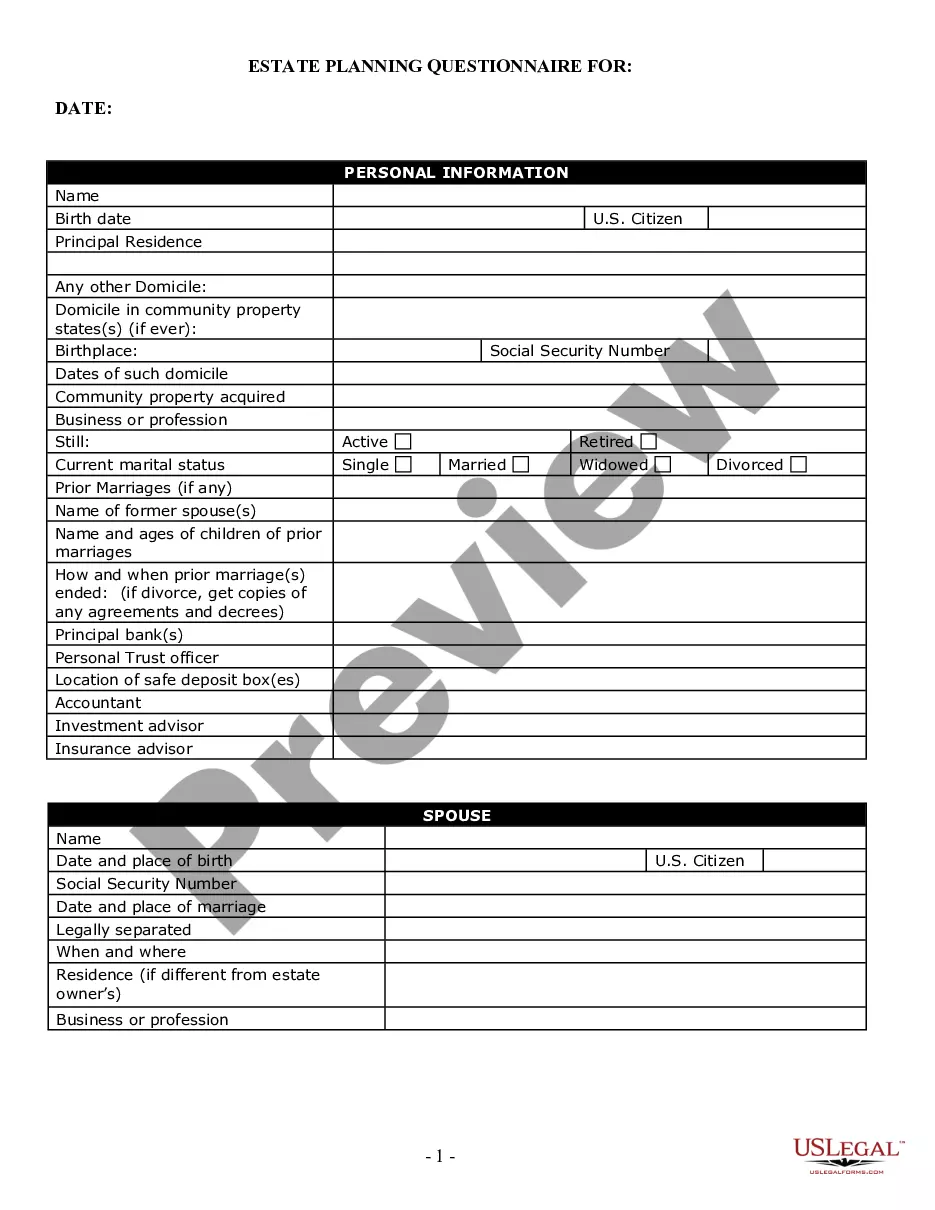

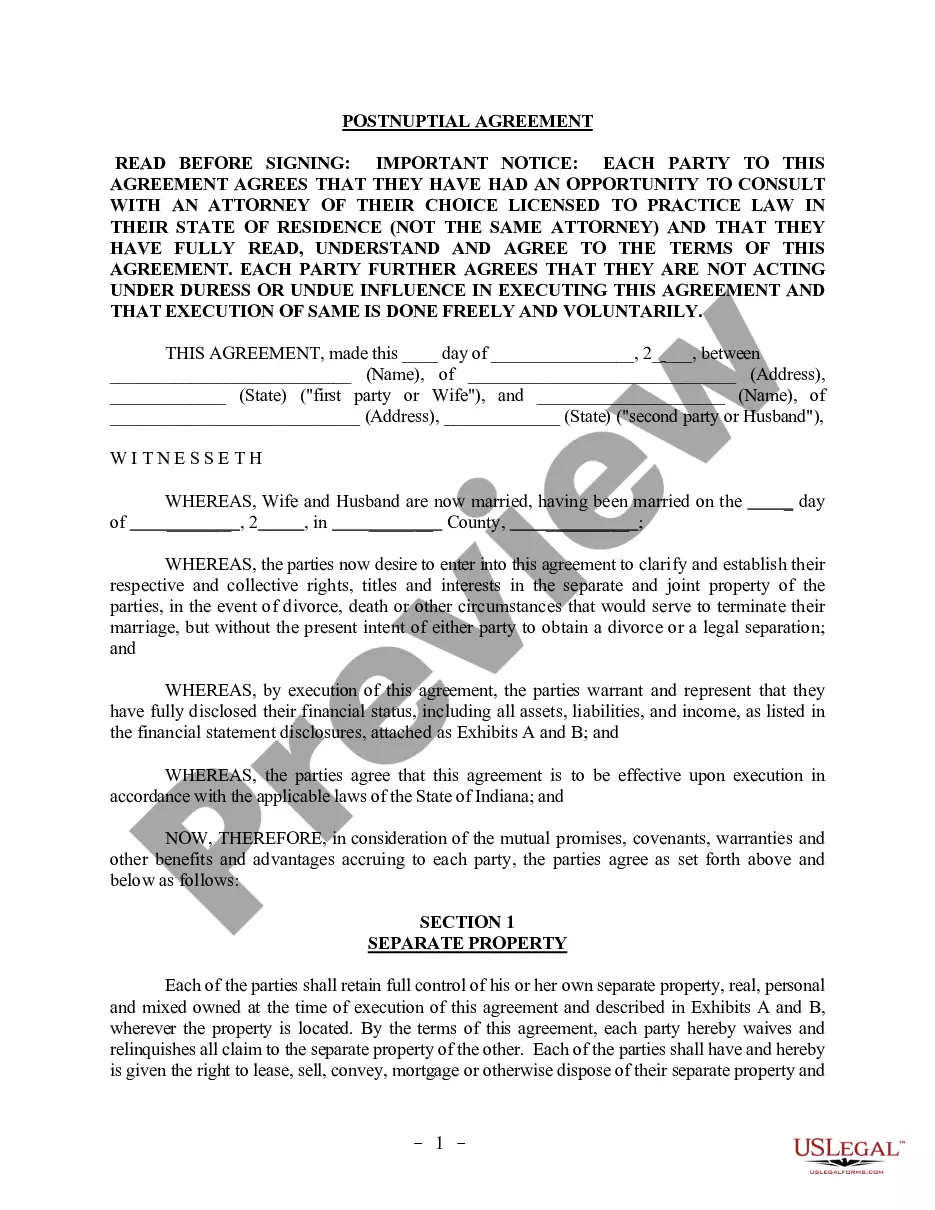

US Legal Forms offers thousands of form templates, including the Ohio Employee Agreement - Vacation and Sick Pay, which can be generated to comply with state and federal regulations.

Once you find the correct form, click Purchase now.

Select the pricing plan you prefer, provide the required details to set up your account, and complete your order using PayPal or a credit card.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- After logging in, you can download the Ohio Employee Agreement - Vacation and Sick Pay template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and verify that it is for the right city/region.

- Utilize the Review button to examine the form.

- Read the description to confirm that you have selected the correct form.

- If the form is not what you are looking for, use the Search field to find the form that meets your requirements.

Form popularity

FAQ

Because Ohio law considers vacation pay a deferred payment of an earned benefit, an employer generally cannot withhold accrued vacation pay at the end of employment (just like it cannot withhold wages from a final paycheck).

Tennessee law does not require employers to provide vacation, sick leave, or paid time off. However, employers who do provide vacation or PTO must include any accrued but unused paid time off in an employee's final wages paid out on termination if required to do so by company policy or a labor agreement.

Ohio: While use-it-or-lose-it policies are allowed, accrued vacation time must be paid out at the end of employment if a vacation policy is silent on the matter. Oregon: Use-it-or-lose-it policies are allowed, but employers must pay out accrued vacation time if a vacation policy is silent on the issue.

Ohio: While use-it-or-lose-it policies are allowed, accrued vacation time must be paid out at the end of employment if a vacation policy is silent on the matter. Oregon: Use-it-or-lose-it policies are allowed, but employers must pay out accrued vacation time if a vacation policy is silent on the issue.

Sick or carer's leave is generally not paid out when employment ends, unless an award, contract or registered agreement says otherwise.

There is no federal or state law in Florida requiring private employers to pay out an employee's accrued vacation or other paid time off (PTO) at the time of termination.

What About Vacation or Sick Pay? Oklahoma does not have a law that requires employers to pay employees for any unused vacation time or other benefits in the final paycheck. However, Oklahoma courts will enforce any established policy or employment contract that specifies this payout is due with the final paycheck.

Oklahoma does not have a law that requires employers to pay employees for any unused vacation time or other benefits in the final paycheck. However, Oklahoma courts will enforce any established policy or employment contract that specifies this payout is due with the final paycheck.

Because Ohio law considers vacation pay a deferred payment of an earned benefit, an employer generally cannot withhold accrued vacation pay at the end of employment (just like it cannot withhold wages from a final paycheck).

Is my employer required to pay me for holidays? No, the State of Ohio has no requirements for the payment of holiday, vacation, or sick time.