New York Partial Release of Liens for Notes and Security Agreements

Description

How to fill out Partial Release Of Liens For Notes And Security Agreements?

If you have to full, acquire, or printing legitimate file templates, use US Legal Forms, the biggest collection of legitimate types, that can be found on the web. Take advantage of the site`s simple and easy convenient look for to discover the paperwork you will need. Various templates for enterprise and individual functions are categorized by classes and says, or keywords and phrases. Use US Legal Forms to discover the New York Partial Release of Liens for Notes and Security Agreements in just a couple of click throughs.

When you are currently a US Legal Forms consumer, log in in your profile and click on the Obtain option to obtain the New York Partial Release of Liens for Notes and Security Agreements. Also you can entry types you earlier saved in the My Forms tab of your profile.

If you use US Legal Forms the first time, refer to the instructions below:

- Step 1. Be sure you have selected the shape for your correct area/region.

- Step 2. Utilize the Review solution to check out the form`s content. Do not neglect to learn the outline.

- Step 3. When you are not satisfied with the form, utilize the Lookup industry at the top of the display to find other versions of the legitimate form template.

- Step 4. When you have located the shape you will need, go through the Buy now option. Pick the pricing program you favor and include your accreditations to sign up for an profile.

- Step 5. Method the transaction. You may use your bank card or PayPal profile to finish the transaction.

- Step 6. Pick the structure of the legitimate form and acquire it on your gadget.

- Step 7. Complete, revise and printing or signal the New York Partial Release of Liens for Notes and Security Agreements.

Each legitimate file template you get is the one you have permanently. You have acces to each and every form you saved inside your acccount. Select the My Forms segment and decide on a form to printing or acquire again.

Remain competitive and acquire, and printing the New York Partial Release of Liens for Notes and Security Agreements with US Legal Forms. There are thousands of professional and express-certain types you can utilize for the enterprise or individual requires.

Form popularity

FAQ

A partial discharge is when you have more than one property secured by the same home loan, and you want to release one of those properties as security without repaying the entire loan amount. These may take longer than traditional discharges because your Lender may need a valuation done on the remaining properties.

Each Obligor must (at its own cost) take any action and enter into and deliver any document which is required by the Security Trustee so that a Security Document provides for effective and perfected security in favour of any successor Security Trustee.

Lenders require proof of payment, a survey map, appraisal, and a letter outlining the reason for the partial release. Borrowers may need to pay fees to the lender and to the county recorder's office. A mortgagor may request a partial release when they wish to sell a portion of the land on their property.

What Is a Release Clause? A release clause is a term that refers to a provision within a mortgage contract. The release clause allows for the freeing of all or part of a property from a claim by the creditor after a proportional amount of the mortgage has been paid.

Partial Release Clause is a provision under which the mortgagee agrees to release certain parcels from the lien of the blanket mortgage upon payment of a certain sum of money by the mortgagor. It's frequently found in tract development construction loans.

Most blanket mortgages come with a release clause. This clause frees up the borrower from the portion of the loan that's already been paid for. So when the borrower sells a piece of property covered under the loan, they can use these funds to purchase another property.

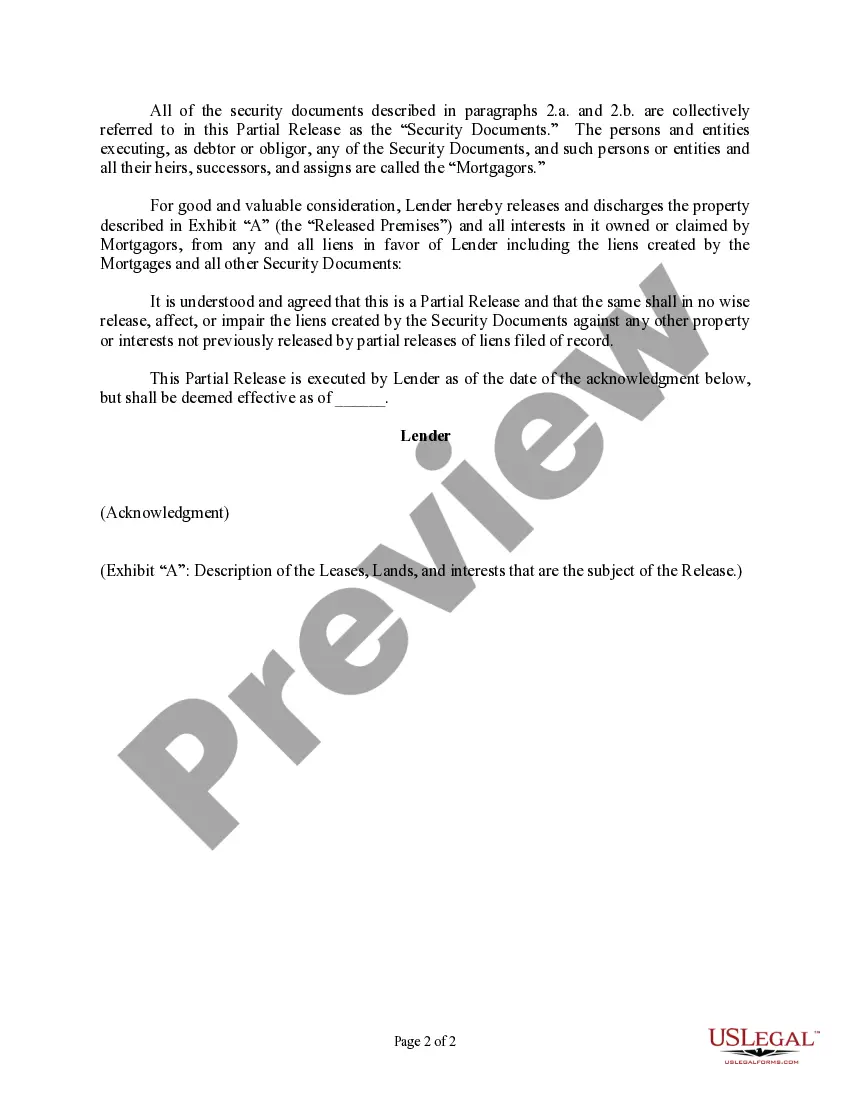

A release of a portion of commercial real property from the lien of a mortgage in New York. Lenders in New York customarily use a partial release of mortgage to discharge a mortgage lien against some, but not all, of the borrower's commercial real property.

A partial release is a mortgage provision that allows some of the collateral to be released from a mortgage after the borrower pays a certain amount of the loan. Lenders require proof of payment, a survey map, appraisal, and a letter outlining the reason for the partial release.