New York Declaration of Election by Lessor to Convert Royalty Interest to Working Interest

Description

How to fill out Declaration Of Election By Lessor To Convert Royalty Interest To Working Interest?

Discovering the right legitimate papers template can be a have a problem. Needless to say, there are plenty of themes available on the net, but how will you obtain the legitimate form you require? Utilize the US Legal Forms internet site. The services provides a large number of themes, like the New York Declaration of Election by Lessor to Convert Royalty Interest to Working Interest, which you can use for enterprise and private needs. All the varieties are checked by pros and meet up with state and federal specifications.

In case you are already listed, log in in your bank account and then click the Obtain key to find the New York Declaration of Election by Lessor to Convert Royalty Interest to Working Interest. Utilize your bank account to look through the legitimate varieties you might have purchased in the past. Go to the My Forms tab of your bank account and acquire another version in the papers you require.

In case you are a new customer of US Legal Forms, here are basic recommendations that you can follow:

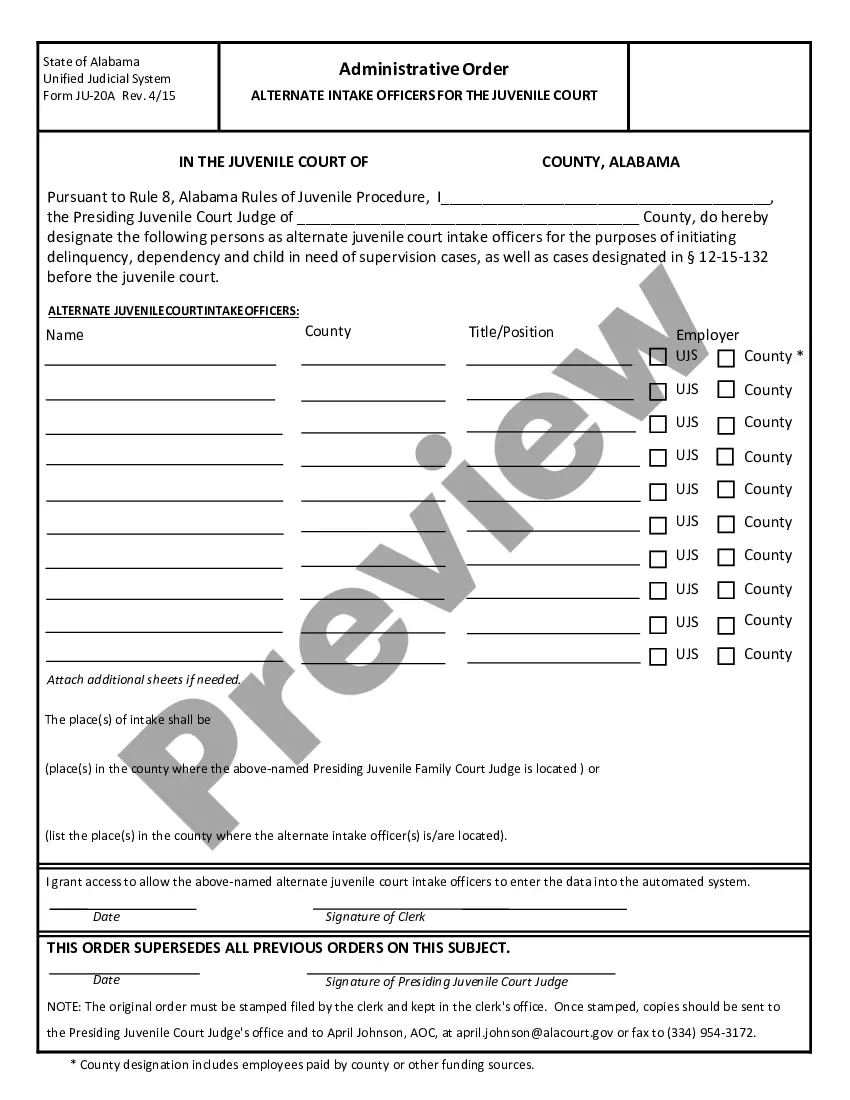

- Initial, ensure you have chosen the right form for the area/state. You are able to check out the shape making use of the Review key and look at the shape explanation to make sure this is the right one for you.

- If the form does not meet up with your expectations, use the Seach area to discover the proper form.

- When you are certain that the shape is proper, go through the Get now key to find the form.

- Choose the costs program you would like and enter the necessary information. Build your bank account and buy the transaction using your PayPal bank account or credit card.

- Opt for the file structure and download the legitimate papers template in your product.

- Total, change and print and indication the acquired New York Declaration of Election by Lessor to Convert Royalty Interest to Working Interest.

US Legal Forms is the most significant local library of legitimate varieties that you can see a variety of papers themes. Utilize the service to download appropriately-created paperwork that follow express specifications.

Form popularity

FAQ

To calculate the number of net royalty acres I'm selling, I use this formula: [acres in tract] X [% of minerals owned] X 8 X [royalty interest reserved in lease] X [fraction of royalty interest being sold]. 640 acres X 25% X 8 X 1/4 X 1/2 = 160 net royalty acres. Net Royalty Acres Defined - Oil and Gas Lawyer Blog oilandgaslawyerblog.com ? net-royalty-acre... oilandgaslawyerblog.com ? net-royalty-acre...

Overriding Royalty Interests To calculate the ORRI, multiply the gross production revenue by the ORRI interest percentage, and the figure gotten is what the ORRI owner is entitled to. How to Calculate Oil and Gas Royalty Payments? - Pheasant Energy pheasantenergy.com ? how-to-calculate-oil-... pheasantenergy.com ? how-to-calculate-oil-...

Overriding Royalty Interest: A given interest severed out of the record title interest or lessee's share of the oil, and not charged with any of the cost or expense of developing or operation. The interest provides no control over the operations of the lease, only revenue from lease production.

How to calculate the overriding royalty interest? ORRI = NRI * 5 percent. $750,000 * 0.005 = $3,750.

If at any time Assignee desires to transfer or dispose of all or any portion of the Overriding Royalty Interest, Assignee must first give to Assignor written notice thereof stating: (a) the amount of the Overriding Royalty Interest offered by Assignee; (b) the form of consideration (which shall be either cash or a ...

ORRIs are created out of the working interest in a property and do not affect mineral owners. An overriding royalty interest (ORRI) is often kept or assigned to a geologist, landman, brokerage, or any entity that was able to reserve an interest in the properties. Non-Participating Royalty Interest (NPRI) Endeavor Energy Resources, LP ? 2019/07 Endeavor Energy Resources, LP ? 2019/07 PDF

In contrast to a royalty interest, a working interest refers to an investment in an oil and gas operation where the investor does bear some costs for exploration, drilling and production. An investor holding a royalty interest bears only the cost of the initial investment and isn't liable for ongoing operating costs.