This is a Promissory Note for use in any state. The promissory note is unsecured, with a fixed interest rate, and contains a provision for installment payments.

New York Unsecured Installment Payment Promissory Note for Fixed Rate

Description

How to fill out Unsecured Installment Payment Promissory Note For Fixed Rate?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a diverse selection of legal form templates that you can download or create.

By utilizing the website, you can discover thousands of forms for business and personal needs, organized by categories, states, or keywords. You can find the latest versions of documents like the New York Unsecured Installment Payment Promissory Note for Fixed Rate in just a few minutes.

If you already have a subscription, Log In and download the New York Unsecured Installment Payment Promissory Note for Fixed Rate from your US Legal Forms library. The Download button will appear on each form you view. You can access all previously downloaded forms in the My documents section of your account.

Select the format and download the form to your device.

Edit. Fill out, modify, print, and sign the downloaded New York Unsecured Installment Payment Promissory Note for Fixed Rate. Each document you add to your account does not expire and is yours forever. So, if you want to download or create another copy, just go to the My documents section and click on the form you need.

- If you want to use US Legal Forms for the first time, here are some simple steps to help you begin.

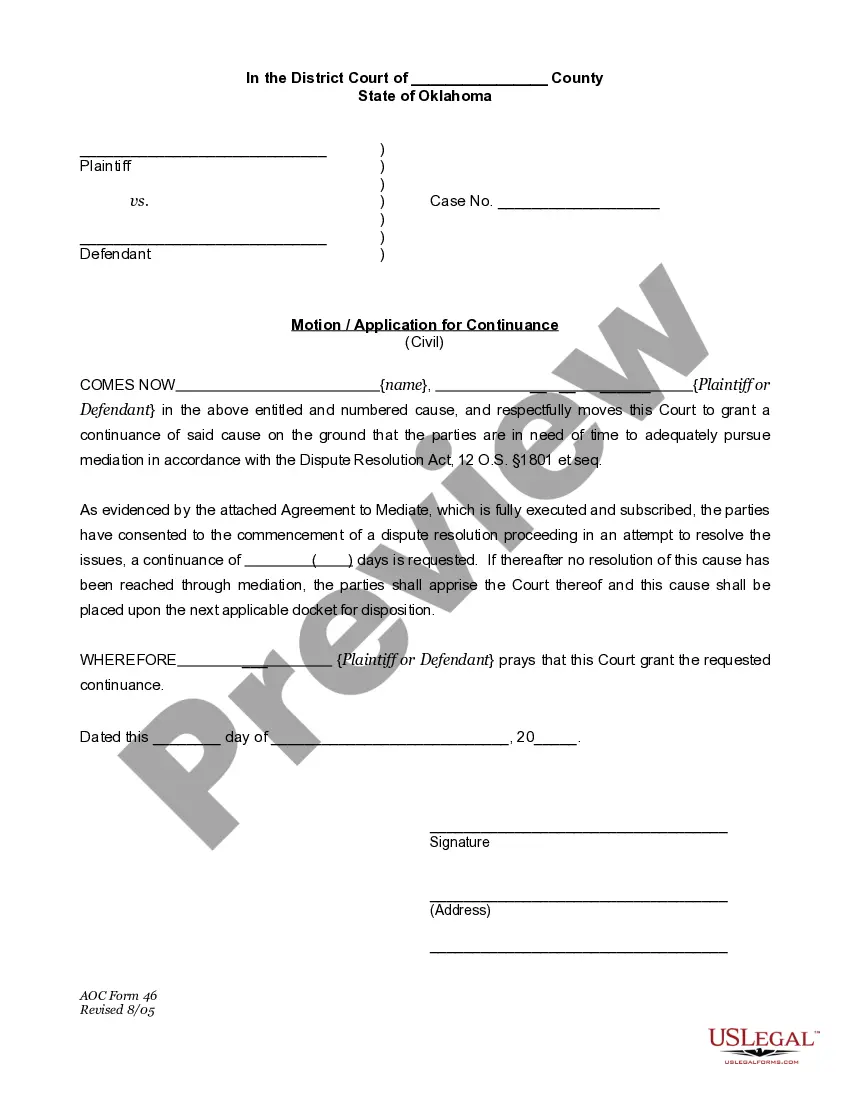

- Make sure you have selected the correct form for your city/state. Click the Preview button to review the form's content.

- Read the form details to confirm that you have selected the right document.

- If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

- If you are pleased with the form, confirm your selection by clicking the Buy now button. Then, choose the payment plan you prefer and provide your credentials to register for an account.

- Process the payment. Use your credit card or PayPal account to complete the transaction.

Form popularity

FAQ

As mentioned earlier, a promissory note does not need to be notarized in New York to be valid. Nonetheless, opting for notarization can strengthen your New York Unsecured Installment Payment Promissory Note for Fixed Rate by providing proof of identity and intent. This step can be beneficial if legal issues arise later. Consider using platforms like uslegalforms to access templates that guide you through the process smoothly.

In New York, a promissory note does not typically require notarization to be legally binding. However, having your New York Unsecured Installment Payment Promissory Note for Fixed Rate notarized can enhance its credibility and may help in case of disputes. Notarization serves as an additional layer of protection for both parties involved in the transaction. It's advisable to consult with a legal expert to ensure compliance with all requirements.

Promissory notes do not need to be secured; they can function effectively as unsecured notes. A New York Unsecured Installment Payment Promissory Note for Fixed Rate allows borrowers to obtain financing without the need for collateral. This flexibility can be attractive for individuals or businesses that prefer not to risk their assets. However, it's crucial to understand that unsecured notes may come with higher interest rates due to the increased risk for lenders.

Promissory notes can be classified as either secured or unsecured, depending on the presence of collateral. A New York Unsecured Installment Payment Promissory Note for Fixed Rate does not involve collateral, which means the borrower’s promise to repay serves as the primary assurance for the lender. This type of note can be beneficial for borrowers who may not have assets to pledge. However, lenders may consider the borrower's creditworthiness more seriously in unsecured notes.

Collecting on an unsecured promissory note involves several steps, including direct communication with the borrower to remind them of their repayment obligations. If informal methods fail, you may consider sending a formal demand letter or pursuing legal action. Using a well-structured New York Unsecured Installment Payment Promissory Note for Fixed Rate can streamline this process, as it clearly outlines the terms and conditions agreed upon.

An unsecured promissory note means that it is not backed by collateral. This type of note relies solely on the borrower's promise to repay, making it riskier for lenders. When dealing with a New York Unsecured Installment Payment Promissory Note for Fixed Rate, it is essential to assess the borrower's creditworthiness to mitigate risks associated with non-payment.

In New York, a promissory note does not legally require notarization to be valid. However, having a notary public witness your signature adds an extra layer of authenticity and can simplify the enforcement process. This is particularly beneficial when dealing with a New York Unsecured Installment Payment Promissory Note for Fixed Rate, as it can help clarify terms and protect both parties involved.

Generally, a promissory note does not need to be notarized to be considered legal. However, notarization can help provide an additional layer of authenticity and may be required in specific circumstances. For those using the New York Unsecured Installment Payment Promissory Note for Fixed Rate, it is advisable to check local regulations to ensure compliance.

Filling in a promissory note involves several key steps. Start by clearly stating the amount to be borrowed, the interest rate, and the repayment schedule. Then, include the names and addresses of both the borrower and the lender. For a comprehensive guide, consider using the New York Unsecured Installment Payment Promissory Note for Fixed Rate template available on US Legal Forms.