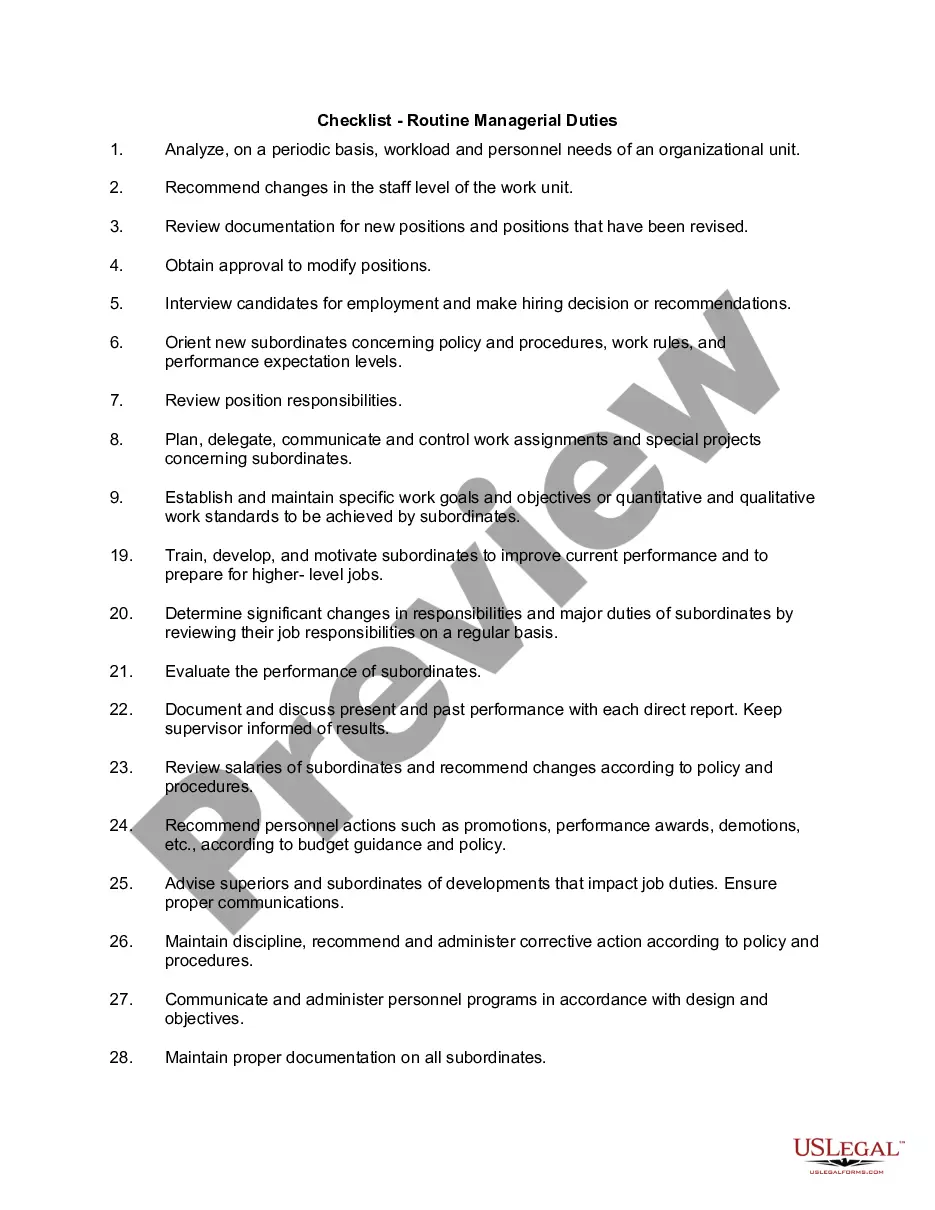

This Formula System for Distribution of Earnings to Partners provides a list of provisions to conside when making partner distribution recommendations. Some of the factors to consider are: Collections on each partner's matters, acquisition and development of new clients, profitablity of matters worked on, training of associates and paralegals, contributions to the firm's marketing practices, and others.

New York Formula System for Distribution of Earnings to Partners

Description

How to fill out Formula System For Distribution Of Earnings To Partners?

Discovering the right authorized document design could be a struggle. Obviously, there are plenty of web templates available online, but how will you discover the authorized type you want? Make use of the US Legal Forms web site. The service gives thousands of web templates, like the New York Formula System for Distribution of Earnings to Partners, which you can use for business and private needs. Each of the varieties are examined by professionals and meet up with federal and state demands.

Should you be already listed, log in for your bank account and click on the Acquire key to get the New York Formula System for Distribution of Earnings to Partners. Make use of your bank account to check with the authorized varieties you might have acquired in the past. Go to the My Forms tab of your bank account and have an additional version from the document you want.

Should you be a new user of US Legal Forms, listed below are straightforward guidelines so that you can adhere to:

- Initial, be sure you have chosen the right type for the area/county. You are able to examine the form using the Review key and read the form outline to guarantee it will be the best for you.

- If the type is not going to meet up with your preferences, use the Seach field to get the proper type.

- Once you are positive that the form is proper, select the Acquire now key to get the type.

- Opt for the rates strategy you would like and enter in the required information and facts. Design your bank account and buy an order using your PayPal bank account or credit card.

- Pick the document file format and obtain the authorized document design for your device.

- Full, revise and printing and indicator the acquired New York Formula System for Distribution of Earnings to Partners.

US Legal Forms will be the biggest library of authorized varieties for which you can find different document web templates. Make use of the company to obtain expertly-manufactured papers that adhere to condition demands.

Form popularity

FAQ

The easiest way in your case would be to allocate by percentage. Divide your NY earnings by the total earnings for this employer. Enter the percentage.

This means that the partnership itself is not subject to tax: any profits are instead taxable on the partners. Generally, for tax purposes each partner is treated as receiving their share of the income and expenses of the partnership as they arise.

Business income from a partnership is generally computed in the same manner as income for an individual. That is, taxable income is determined by subtracting allowable deductions from gross income. This net income is passed through as ordinary income to the partner on Schedule K-1.

Partnerships file an information return to report their income, gains, losses, deductions, credits, etc. A partnership does not pay tax on its income but "passes through" any profits or losses to its partners. Partners must include partnership items on their tax or information returns.

Each partner reports their share of the partnership's income or loss on their personal tax return. Partners are not employees and shouldn't be issued a Form W-2. The partnership must furnish copies of Schedule K-1 (Form 1065) to the partner.

If the partnership had income, debit the income section for its balance and credit each partner's capital account based on his or her share of the income. If the partnership realized a loss, credit the income section and debit each partner's capital account based on his or her share of the loss.

Partnerships are considered pass-through entities. That means that any income or losses are passed through the partnership to the individual owners, who are then responsible to account for that income or loss on their income tax returns.

Partnerships Investments by each partner are credited to the partners' capital accounts. Withdrawals from the partnership by a partner are debited to the respective drawing account. The net income for a partnership is divided between the partners as called for in the partnership agreement.