New York Contract Administrator Agreement - Self-Employed Independent Contractor

Description

How to fill out Contract Administrator Agreement - Self-Employed Independent Contractor?

US Legal Forms - one of the most crucial collections of legal documents in the United States - provides a variety of legal form templates that you can download or print. By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the most recent editions of forms such as the New York Contract Administrator Agreement - Self-Employed Independent Contractor in just a few moments.

If you have a subscription, Log In and obtain the New York Contract Administrator Agreement - Self-Employed Independent Contractor from the US Legal Forms library. The Download button will be visible on each form you view. You can access all previously downloaded forms from the My documents section of your account.

To use US Legal Forms for the first time, here are simple guidelines to get you started: Make sure you have selected the correct form for your city/county. Click on the Review button to examine the form's content. Check the form summary to ensure you have chosen the correct form. If the form does not meet your needs, utilize the Search box at the top of the screen to find one that does. Once you are satisfied with the form, confirm your selection by clicking the Order now button. Then, choose the pricing plan you prefer and provide your information to create an account. Complete the transaction. Use your credit card or PayPal account to finalize the transaction. Select the format and download the form to your device. Make edits. Fill out, modify, print, and sign the obtained New York Contract Administrator Agreement - Self-Employed Independent Contractor. Every template you added to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need.

- Access the New York Contract Administrator Agreement - Self-Employed Independent Contractor with US Legal Forms, the most comprehensive collection of legal document templates.

- Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- Explore a vast library of legal resources.

- Download forms easily and conveniently.

- Ensure compliance with local laws.

- Modify documents to suit your particular situation.

Form popularity

FAQ

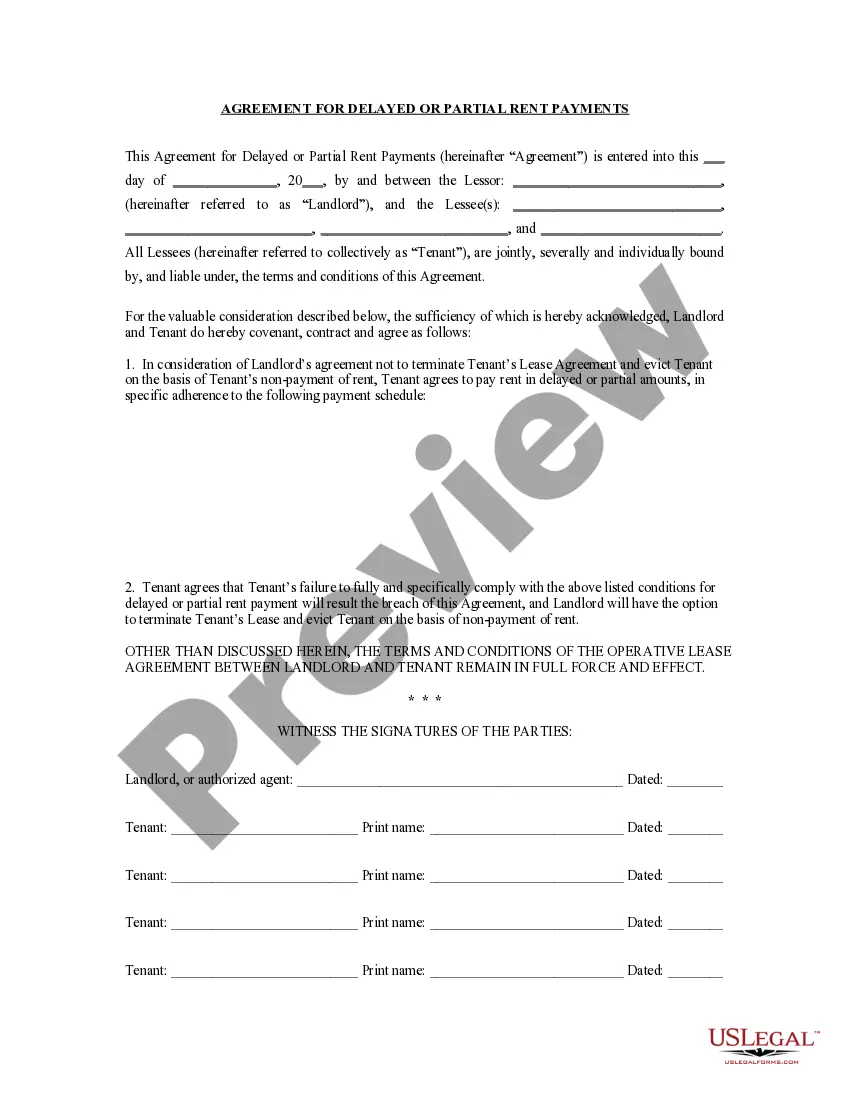

Writing an independent contractor agreement involves a few key steps. Start with a title that reflects the purpose of the document, such as New York Contract Administrator Agreement - Self-Employed Independent Contractor. Clearly outline the work to be performed, payment structure, and responsibilities of both parties. To ensure legal compliance and clarity, consider using uslegalforms, which offers easy-to-follow templates that meet New York state regulations.

When filling out an independent contractor agreement, begin by identifying all parties involved, including their names and contact information. Then, define the scope of work, including deliverables and deadlines, to avoid confusion later. For a New York Contract Administrator Agreement - Self-Employed Independent Contractor, it’s essential to outline payment terms and specify any relevant legal obligations. Utilizing uslegalforms can streamline this process and provide you with proven templates.

To fill out an independent contractor form, start by gathering your personal details, such as your legal name and contact information. Next, include your business details if applicable, along with the type of services you provide. When working with a New York Contract Administrator Agreement - Self-Employed Independent Contractor, ensure that you clearly state the terms of your work and compensation. You can simplify this process using uslegalforms to access templates and guidance tailored for your needs.

Independent contractors should complete a variety of forms to ensure compliance and proper tax reporting. Essential forms include the W-9 for tax purposes, the 1099-MISC to report income, and the declaration of independent contractor status. Using a reliable platform like US Legal Forms can simplify this process by providing templates specifically designed for the New York Contract Administrator Agreement - Self-Employed Independent Contractor. This resource can help ensure you have all necessary documentation ready.

To fill out a declaration of independent contractor status form, start by entering your personal information. You need to provide accurate details about your business, including its name and address. Clearly outline the nature of your work and the agreements in place under the New York Contract Administrator Agreement - Self-Employed Independent Contractor. Finally, review all entries for accuracy and completeness before submitting the form to avoid any issues.

Yes, a 1099 employee can have a contract outlining the details of their work relationship. In fact, many independent contractors prefer having a formal agreement to clarify terms, expectations, and payment structures. When you’re engaged in a New York Contract Administrator Agreement - Self-Employed Independent Contractor, a written contract helps protect your interests.

Yes, an independent contractor is generally considered self-employed. When working under a New York Contract Administrator Agreement - Self-Employed Independent Contractor, you operate as your own boss and manage your business obligations. This status allows for flexibility but also comes with responsibilities such as paying your own taxes.

Whether independent contractors need workers' compensation in New York can depend on specific circumstances. While it is not always mandatory for self-employed individuals, if you are a New York Contract Administrator Agreement - Self-Employed Independent Contractor, obtaining workers' comp might be wise for your protection and peace of mind. Always check for recent state regulations that may apply.

Independent contractors often need various types of insurance, including general liability and professional liability insurance. For those working under a New York Contract Administrator Agreement - Self-Employed Independent Contractor, ensuring that you have adequate protection is crucial. This helps safeguard against risks and unexpected issues that can arise in the business landscape.

Independent contractors can qualify for workers' compensation but it depends on the nature of their work and their specific contracts. If an independent contractor works under a New York Contract Administrator Agreement - Self-Employed Independent Contractor, they may need to secure their own coverage. This differs from traditional employees, who are generally covered automatically.