New York Grant Agreement from 501(c)(3) to 501(c)(4)

Description

How to fill out Grant Agreement From 501(c)(3) To 501(c)(4)?

If you have to complete, down load, or print legitimate document templates, use US Legal Forms, the most important collection of legitimate forms, that can be found on the Internet. Take advantage of the site`s simple and hassle-free look for to obtain the papers you want. Numerous templates for organization and person reasons are categorized by classes and claims, or key phrases. Use US Legal Forms to obtain the New York Grant Agreement from 501(c)(3) to 501(c)(4) in just a couple of mouse clicks.

If you are already a US Legal Forms consumer, log in in your profile and click on the Acquire key to get the New York Grant Agreement from 501(c)(3) to 501(c)(4). You may also entry forms you previously downloaded in the My Forms tab of your respective profile.

If you work with US Legal Forms the very first time, refer to the instructions beneath:

- Step 1. Ensure you have chosen the form to the proper city/nation.

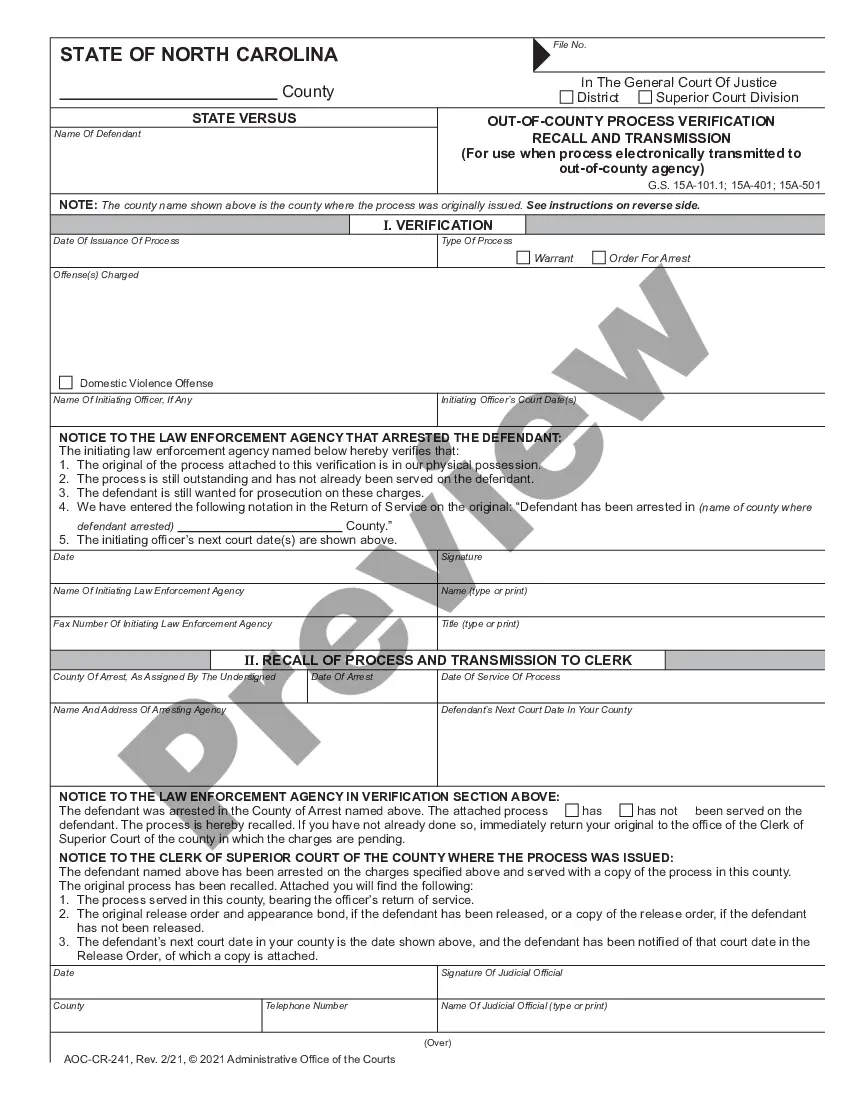

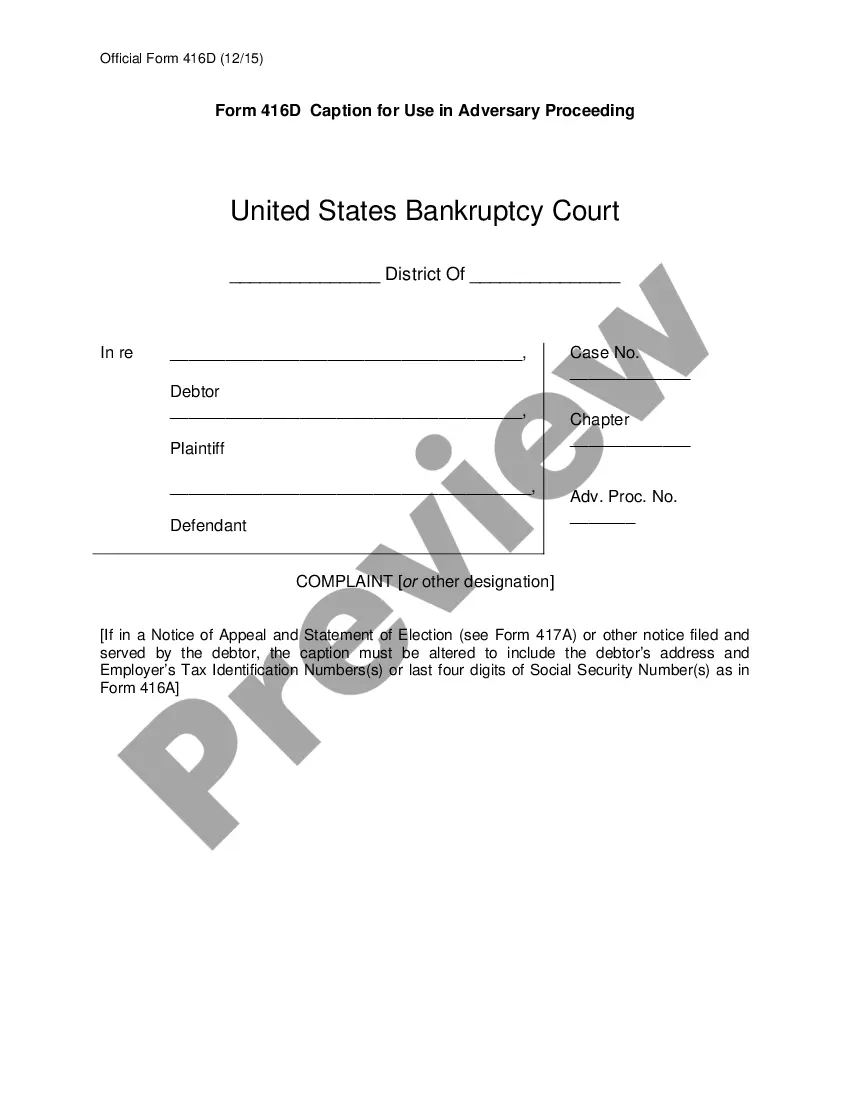

- Step 2. Utilize the Preview method to examine the form`s information. Do not forget to read through the outline.

- Step 3. If you are not satisfied with all the develop, make use of the Look for area near the top of the display to get other types of your legitimate develop template.

- Step 4. After you have discovered the form you want, select the Get now key. Choose the costs program you choose and put your references to register for the profile.

- Step 5. Procedure the purchase. You can use your charge card or PayPal profile to accomplish the purchase.

- Step 6. Choose the file format of your legitimate develop and down load it on your gadget.

- Step 7. Complete, change and print or signal the New York Grant Agreement from 501(c)(3) to 501(c)(4).

Every legitimate document template you acquire is yours for a long time. You may have acces to every single develop you downloaded with your acccount. Go through the My Forms segment and choose a develop to print or down load once more.

Compete and down load, and print the New York Grant Agreement from 501(c)(3) to 501(c)(4) with US Legal Forms. There are thousands of expert and express-particular forms you may use for your organization or person requirements.

Form popularity

FAQ

Nonprofit corporations in New Jersey are eligible for state income tax exemption, sales and use tax exemption, and a petroleum products gross receipt tax exemption. Obtaining these exemptions, however, may first require being determined federally tax exempt by the IRS.

The biggest difference between 501(c)(3) and 501(c)(4) fundraising is that 501(c)(3) organizations generally raise the majority of their funds from foundations while 501(c)(4) organizations rely on support from individuals, in the form of large and small contributions.

To make tax exempt purchases: Complete Form ST-119.1 (This form is mailed with your exemption certificate, and is not available on our Web site. To get additional copies of this form, contact our sales tax information center.) Present the completed form to the store at the time of purchase.

A 501(c)(4) needs to ensure it is primarily engaged in social welfare activities. At least 51% of its activities must be aimed at ensuring the public is informed and participating in the public policy process. 501(c)(4)s can support the election or defeat of a candidate for public office as a secondary activity.

A 501c3 organization can spend funds only related to its tax-exempt philanthropic purposes. As we discussed above, if the nonprofit falls under one of these categories- charitable, educational, religious, scientific, literary, or other specified purposes, then it is only under this category that they can make spends.

How many board members does a charitable corporation have to have? A corporation formed in New York must have at least three board members.

NEW YORK CITY TAX EXEMPTION All 501c3 organization that would like to be exempt from New York State sales tax must submit Form ST-119.2, Application for Exempt Organization Certificate.

The Tax Law exempts purchases for resale; most sales to or by the federal and New York State governments, charitable organizations, and certain other exempt organizations; sales of most food for home consumption; and sales of prescription and nonprescription medicines. Sales tax also does not apply to most services.