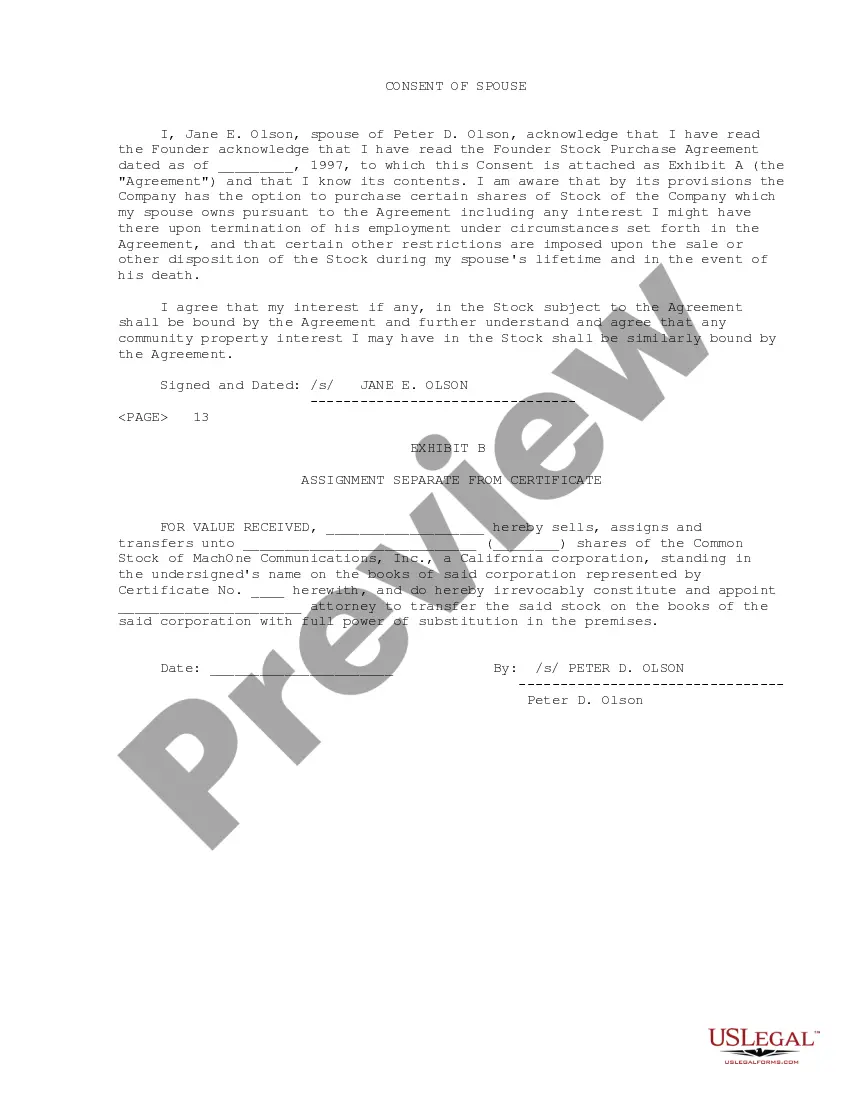

New York Sample Founder Stock Purchase Agreement between MachOne Communications, Inc. and Peter D. Olson

Description

How to fill out Sample Founder Stock Purchase Agreement Between MachOne Communications, Inc. And Peter D. Olson?

If you wish to complete, down load, or print authorized document layouts, use US Legal Forms, the most important selection of authorized varieties, that can be found on-line. Take advantage of the site`s basic and hassle-free lookup to find the papers you require. A variety of layouts for company and individual uses are categorized by types and says, or keywords and phrases. Use US Legal Forms to find the New York Sample Founder Stock Purchase Agreement between MachOne Communications, Inc. and Peter D. Olson in just a couple of clicks.

When you are already a US Legal Forms customer, log in for your profile and then click the Download switch to find the New York Sample Founder Stock Purchase Agreement between MachOne Communications, Inc. and Peter D. Olson. You may also accessibility varieties you formerly downloaded in the My Forms tab of your profile.

If you work with US Legal Forms for the first time, refer to the instructions under:

- Step 1. Ensure you have chosen the form for the right city/land.

- Step 2. Use the Preview option to check out the form`s content. Never overlook to learn the information.

- Step 3. When you are unhappy with the develop, take advantage of the Look for field at the top of the screen to get other variations of the authorized develop format.

- Step 4. Once you have identified the form you require, click the Acquire now switch. Select the costs program you like and put your references to sign up to have an profile.

- Step 5. Approach the purchase. You may use your charge card or PayPal profile to complete the purchase.

- Step 6. Choose the format of the authorized develop and down load it on the device.

- Step 7. Comprehensive, change and print or sign the New York Sample Founder Stock Purchase Agreement between MachOne Communications, Inc. and Peter D. Olson.

Each and every authorized document format you acquire is the one you have permanently. You may have acces to each and every develop you downloaded inside your acccount. Select the My Forms portion and decide on a develop to print or down load yet again.

Compete and down load, and print the New York Sample Founder Stock Purchase Agreement between MachOne Communications, Inc. and Peter D. Olson with US Legal Forms. There are thousands of expert and state-distinct varieties you may use for your company or individual requires.

Form popularity

FAQ

A stock purchase agreement typically includes the following information: Your business name. The name and mailing address of the entity buying shares in your company's stocks. The par value (essentially the sale price) of the stocks being sold. The number of stocks the buyer is purchasing.

This agreement allows the founders to document their initial ownership in the Company, including standard transfer restrictions and any vesting provisions with respect to their shares.

ASSET PURCHASE AND SALES AGREEMENT THIS AGREEMENT (the ?Agreement?) is made effective this [DATE] by and between [SELLER], (the ?Seller?) and [BUYER] (the ?Buyer?), referred to collectively as ?the Parties.? The Parties have reached an agreement regarding the Buyer's purchase of the [ASSET].

A stock purchase agreement is a contract signed by two parties when they buy or sell stock in a corporation in the US. Small firms that sell stock frequently use these agreements. Stock can be sold to buyers by either the corporation or its shareholders.

A share purchase agreement is a legal contract between two parties: a seller and a buyer. They may be referred to as the vendor and purchaser in the contract. The contract is proof that the sale and the terms of it were mutually agreed upon.

An RSPA will typically allow the Company to buyback shares from the founder through a repurchase option. The repurchase option can be triggered by a number of events, including the founder being fired or force to quit. Single / Double Trigger Acceleration.

A stock purchase agreement typically includes the following information: Your business name. The name and mailing address of the entity buying shares in your company's stocks. The par value (essentially the sale price) of the stocks being sold.

Stock purchase agreements (SPAs) are legally binding contracts between shareholders and companies. Also known as share purchase agreements, these contracts establish all of the terms and conditions related to the sale of a company's stocks.