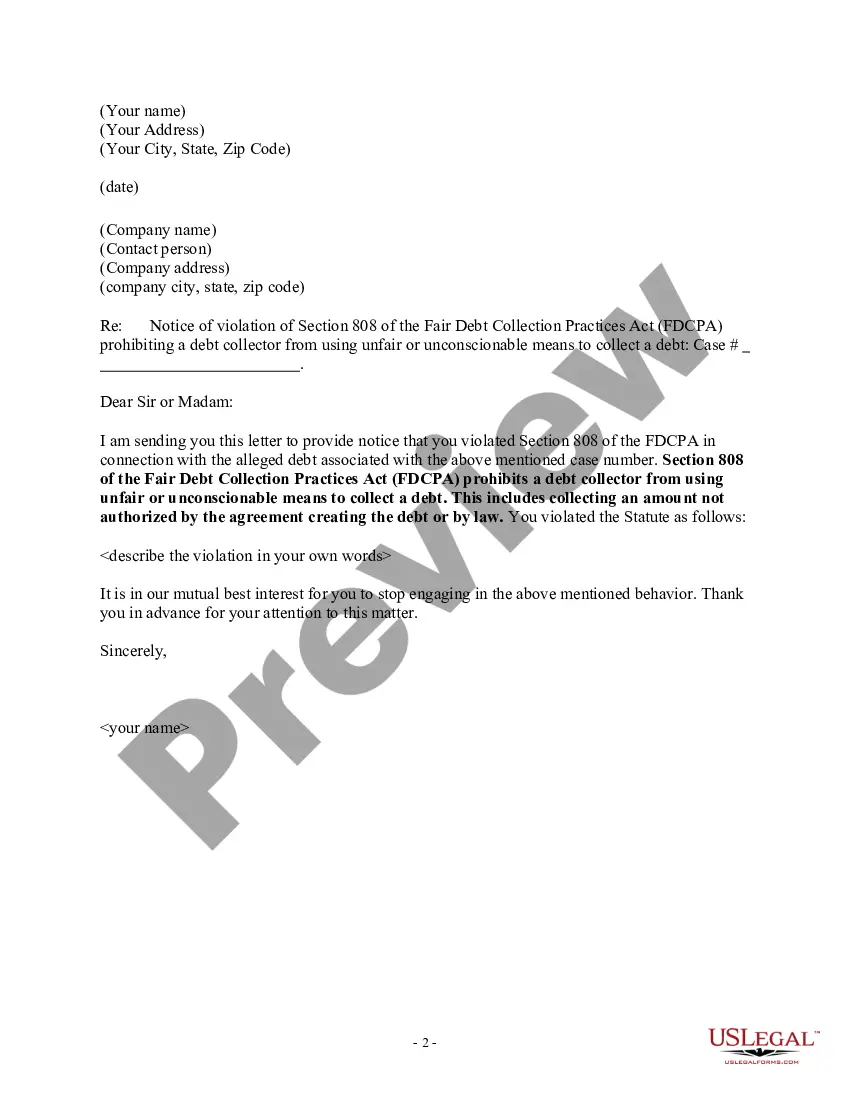

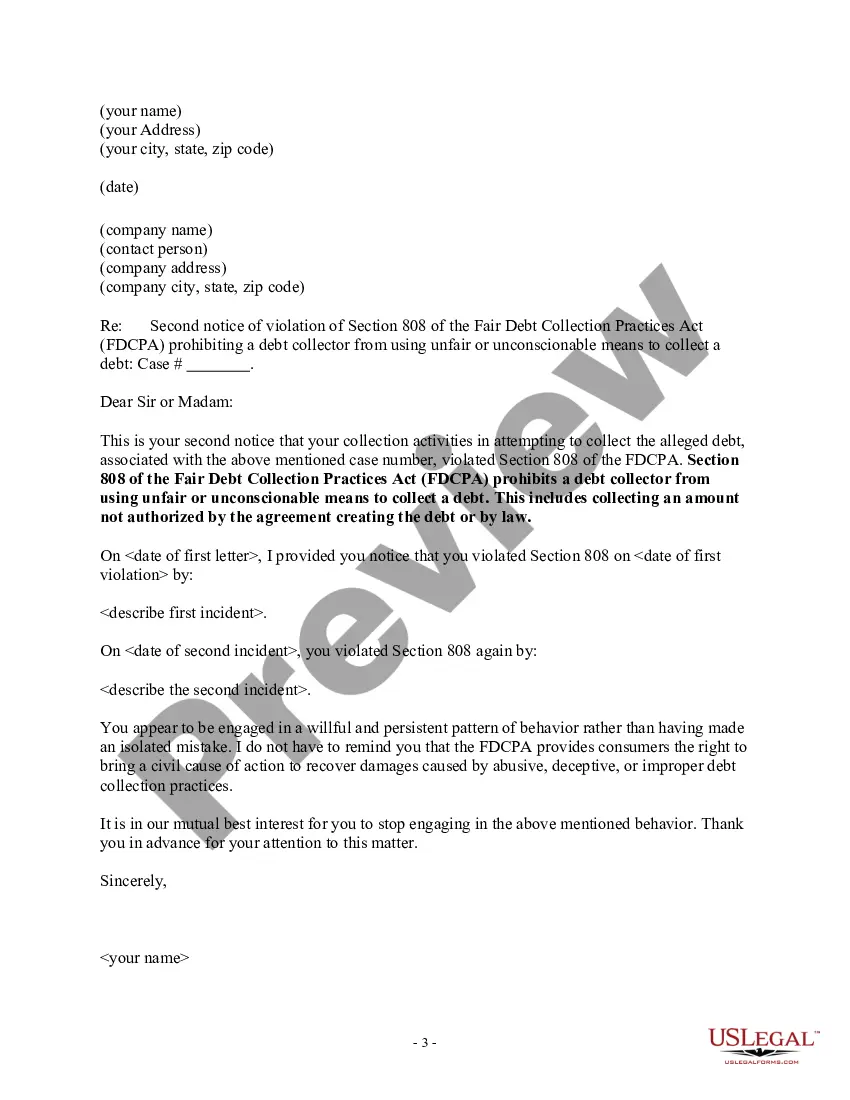

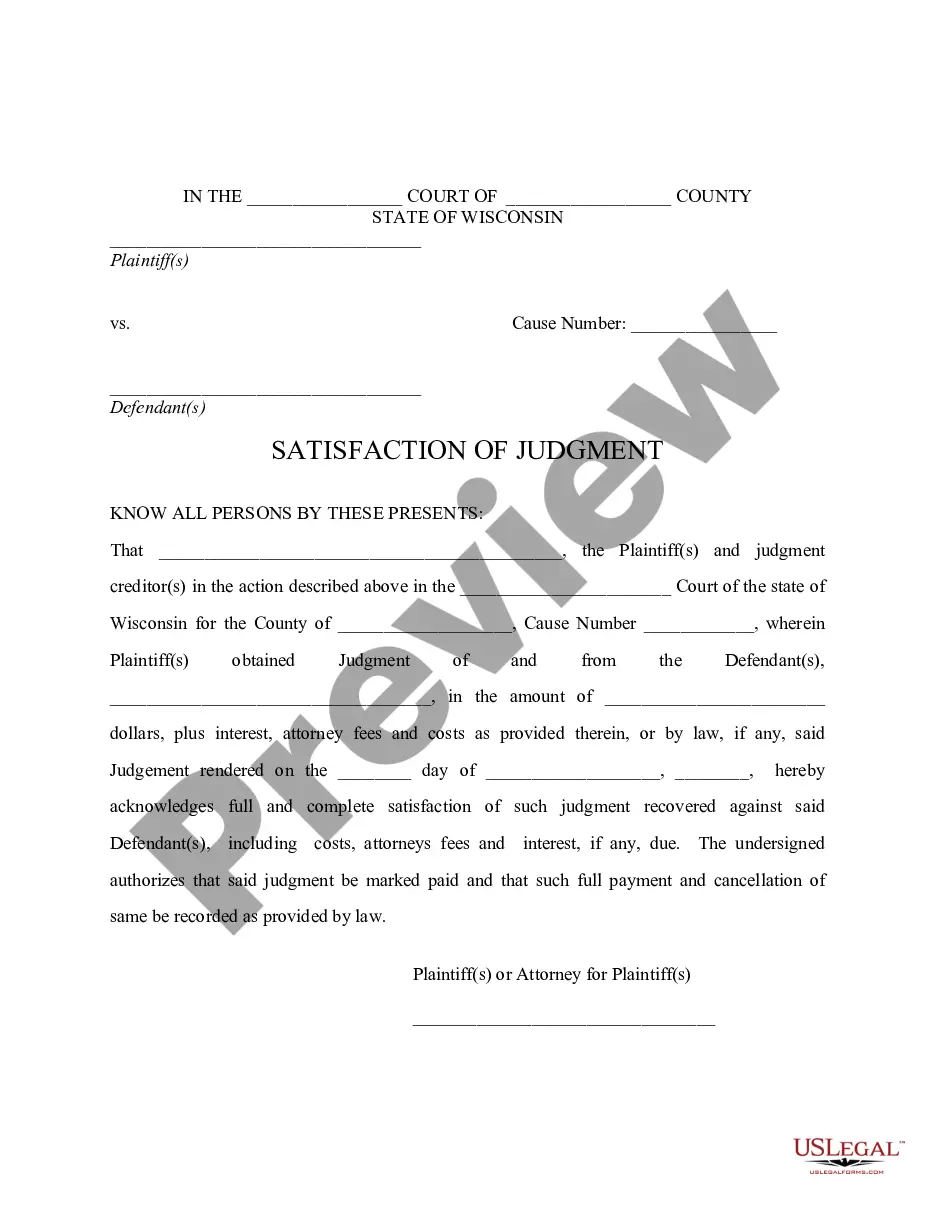

A debt collector may not use unfair or unconscionable means to collect a debt. This includes collecting an amount not authorized by the agreement creating the debt or by law.

New York Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law

Description

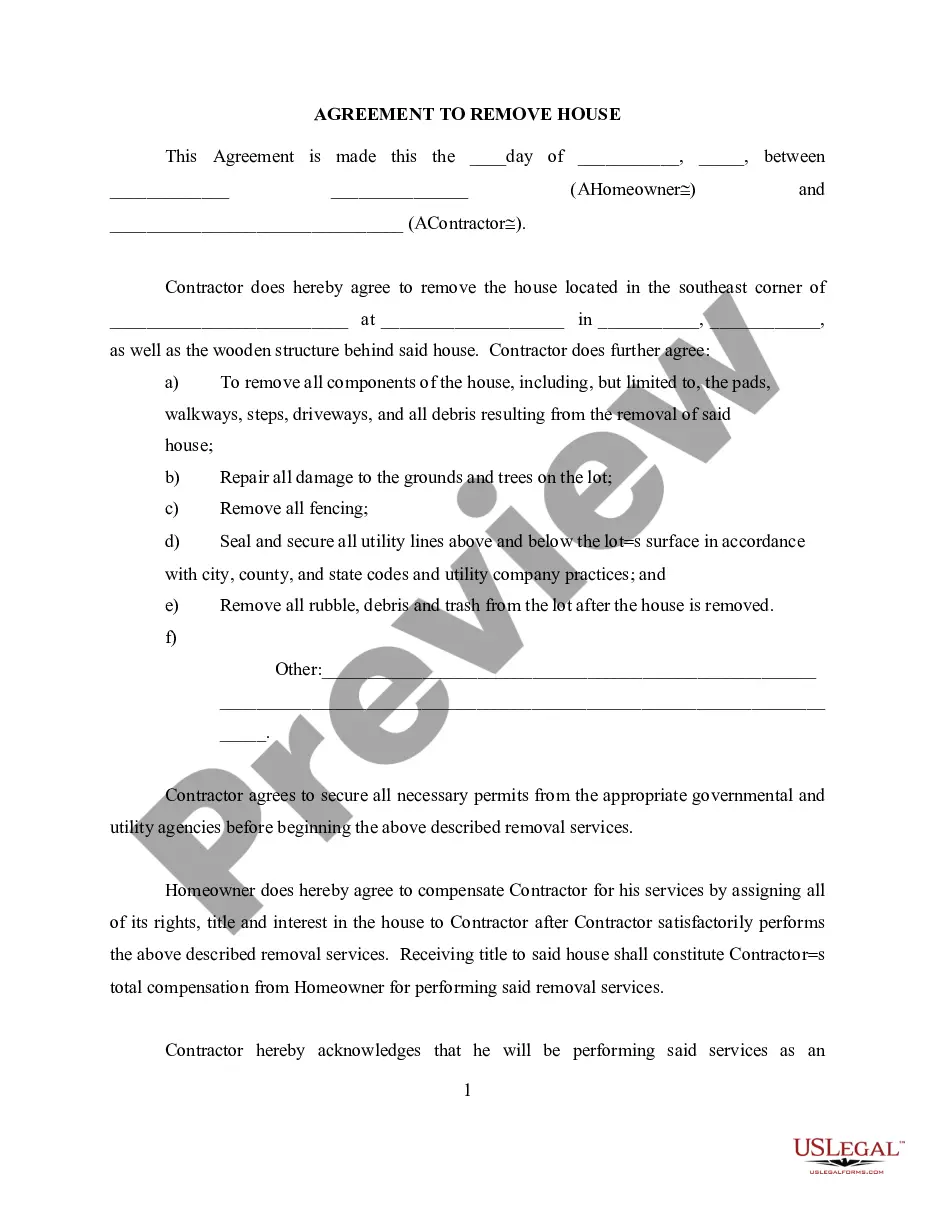

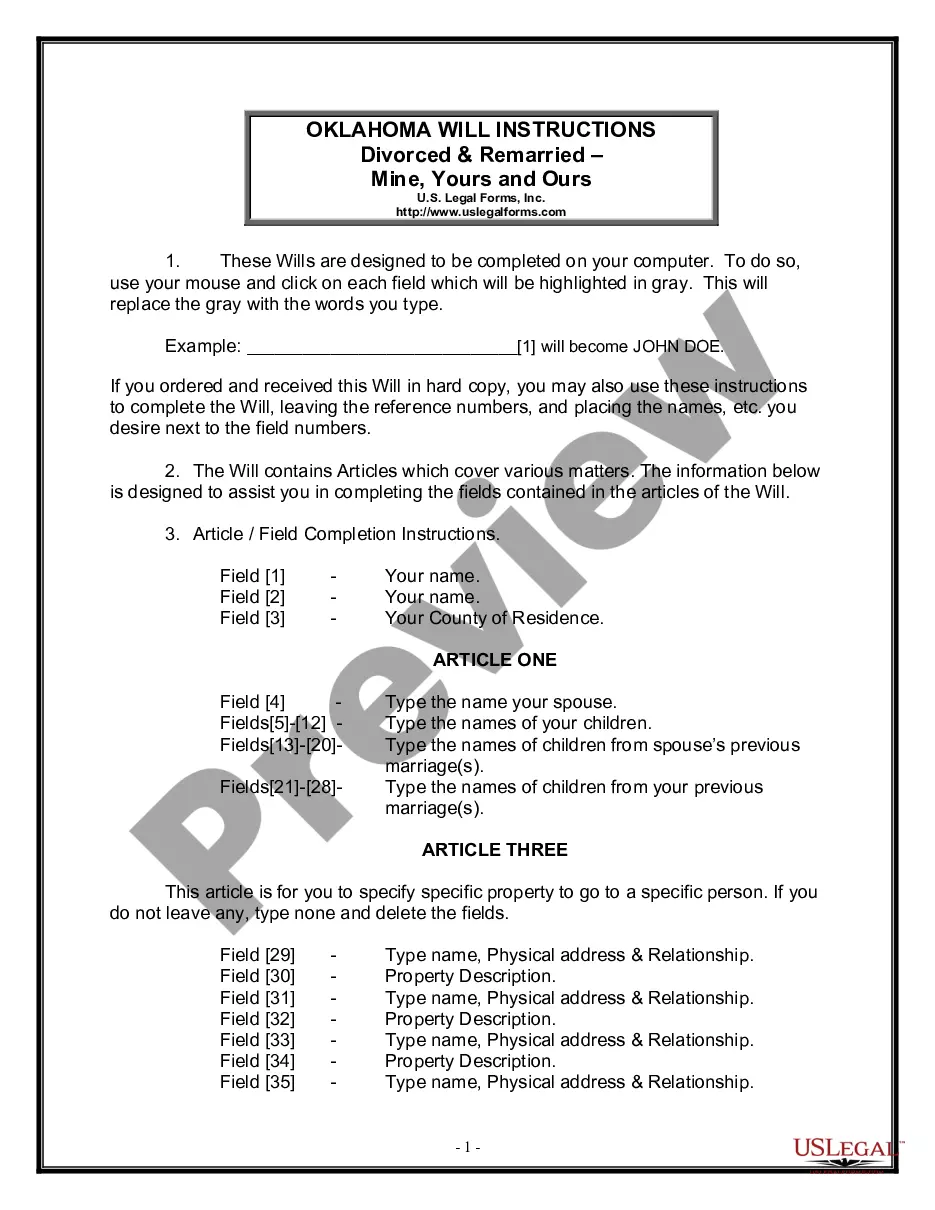

How to fill out Notice To Debt Collector - Collecting An Amount Not Authorized By Agreement Or By Law?

If you want to finalize, retrieve, or print sanctioned document templates, use US Legal Forms, the most extensive collection of legal forms available online.

Utilize the website’s simple and user-friendly search function to find the documents you require.

A selection of templates for business and personal uses are categorized by type and region, or keywords.

Step 4. Once you have found the form you need, click the Purchase now button. Choose the pricing plan you prefer and enter your details to register for the account.

Step 5. Process the transaction. You may use your credit card or PayPal account to complete the payment.

- Leverage US Legal Forms to acquire the New York Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law in just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click the Download button to get the New York Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for your correct city/state.

- Step 2. Utilize the Preview feature to review the form’s details. Remember to read the description.

- Step 3. If you are not satisfied with the form, make use of the Search box at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

For most debts, the time limit is 6 years since you last wrote to them or made a payment. The time limit is longer for mortgage debts.

If a debt collector fails to verify the debt but continues to go after you for payment, you have the right to sue that debt collector in federal or state court. You might be able to get $1,000 per lawsuit, plus actual damages, attorneys' fees, and court costs.

Debts that may not be covered are those that are not incurred voluntarily, such as income taxes, parking and speeding tickets, and domestic support obligations like child support and alimony, or spousal support.

Does debt go away after 7 years? In the UK, for most people, unsecured debts go away after a period of 6 years from the point when they started or 6 years from the point when they last made a payment to, or had contact with, their creditor. This period can be 12 years for some mortgage debts.

The document must include the credit limit, the interest rate and details of how and when a debtor is to discharge his payment obligations. A failure to produce such a document is still capable of rendering the agreement irredeemably unenforceable.

In New York, the law that governs the statute of limitations states that a creditor has up to six years to seek repayment for a debt. After this time elapses, the creditor can't sue a debtor to collect the debt.

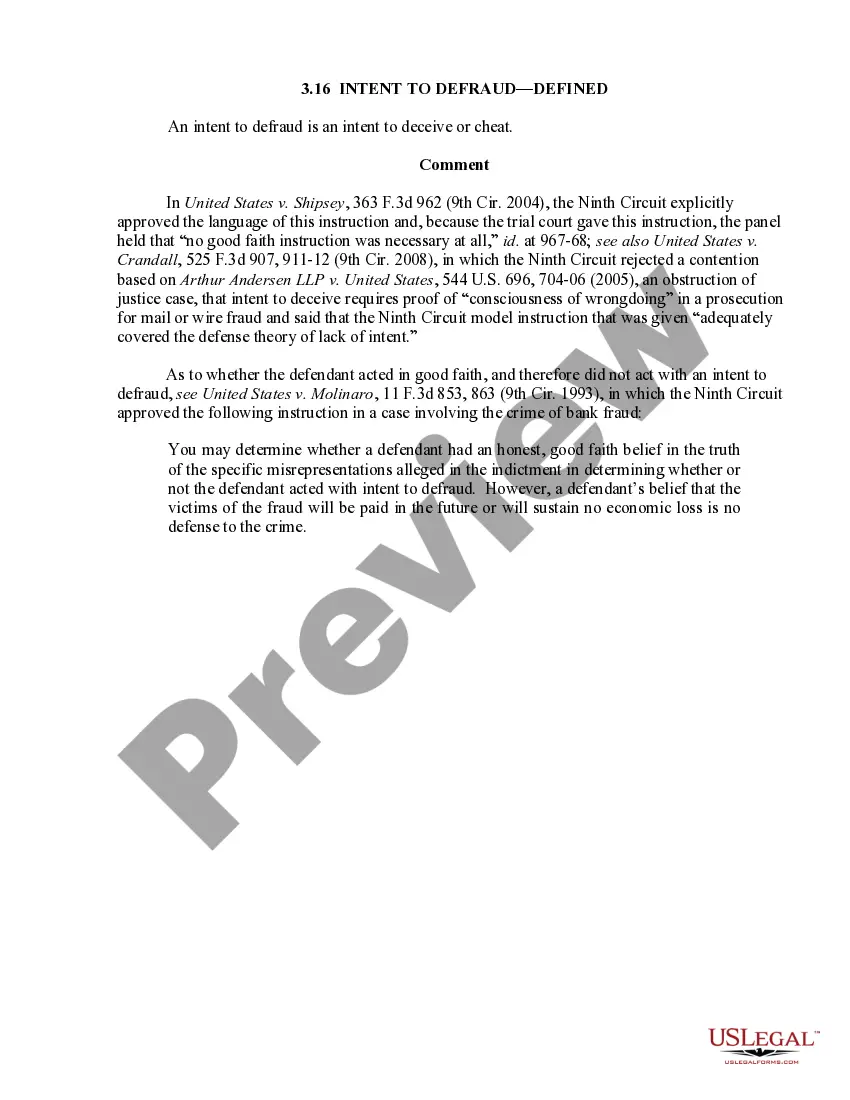

The Fair Debt Collection Practices Act (FDCPA) The FDCPA prohibits debt collection companies from using abusive, unfair or deceptive practices to collect debts from you.

The FDCPA broadly prohibits a debt collector from using 'any false, deceptive, or misleading representation or means in connection with the collection of any debt. ' 15 U.S.C. § 1692e. The statute enumerates several examples of such practices, 15 U.S.C.

A credit agreement is a legally-binding contract documenting the terms of a loan agreement; it is made between a person or party borrowing money and a lender. The credit agreement outlines all of the terms associated with the loan. Credits agreements are created for both retail and institutional loans.

If a creditor waits too long to take court action, the debt will become 'unenforceable' or statute barred. This means the debt still exists but the law (statute) can be used to prevent (bar) the creditor from getting a court judgment or order to recover it.