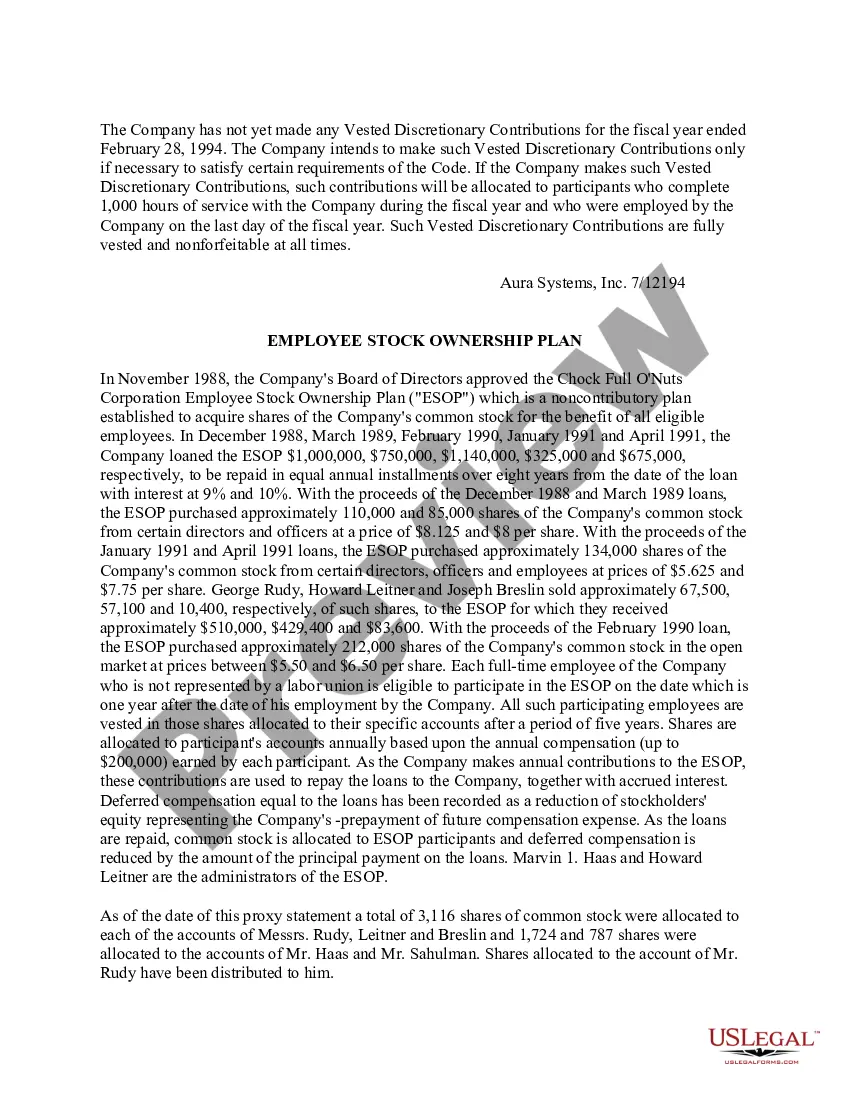

New York Employee Stock Ownership Plan of Aura Systems, Inc.

Description

How to fill out Employee Stock Ownership Plan Of Aura Systems, Inc.?

You are able to devote hours online searching for the legitimate document design that meets the state and federal requirements you need. US Legal Forms supplies a huge number of legitimate types which can be analyzed by professionals. You can easily down load or printing the New York Employee Stock Ownership Plan of Aura Systems, Inc. from our service.

If you have a US Legal Forms bank account, you may log in and click on the Obtain switch. Afterward, you may complete, change, printing, or indicator the New York Employee Stock Ownership Plan of Aura Systems, Inc.. Every single legitimate document design you acquire is the one you have for a long time. To get one more duplicate for any bought form, go to the My Forms tab and click on the corresponding switch.

If you work with the US Legal Forms web site for the first time, stick to the basic directions under:

- Very first, make sure that you have chosen the best document design to the region/town of your liking. Read the form explanation to make sure you have picked the proper form. If available, take advantage of the Review switch to look with the document design also.

- If you would like find one more version from the form, take advantage of the Lookup field to find the design that meets your requirements and requirements.

- Upon having located the design you want, click on Buy now to continue.

- Select the rates program you want, key in your qualifications, and register for a free account on US Legal Forms.

- Comprehensive the financial transaction. You may use your Visa or Mastercard or PayPal bank account to cover the legitimate form.

- Select the formatting from the document and down load it in your gadget.

- Make modifications in your document if necessary. You are able to complete, change and indicator and printing New York Employee Stock Ownership Plan of Aura Systems, Inc..

Obtain and printing a huge number of document templates while using US Legal Forms Internet site, which provides the biggest variety of legitimate types. Use expert and status-distinct templates to handle your company or personal requirements.

Form popularity

FAQ

In 2018, Employee Stock Ownership Plans Distributed a total of $126.7 billion. An estimated $1.37 trillion in value is held by ESOPs in the US, that's an average of $129,521 per employee owner.

There are many advantages to ESOPs, including the following: Flexibility: Shareholders have the option of withdrawing funds slowly over time or only selling a portion of their shares. They can stay active even after releasing their portion of the company.

An employee stock ownership plan (ESOP) is an employee benefit plan that gives workers ownership interest in the company in the form of shares of stock. ESOPs encourage employees to give their all as the company's success translates into financial rewards.

ESOPs are expensive to set up, and expensive to maintain as an appraisal is required annually to stay in compliance. If the cash flow dedicated to the ESOP will greatly limit the cash available to reinvest in the business over the long-term, an ESOP is unlikely to be a good fit.

An ESOP is an employee benefit plan that enables employees to own part or all of the company they work for. at fair market value (unless there's a public market for the shares). So, the employee receives the value of his or her shares from the trust, usually in the form of cash.

For example, contributions made to an ESOP are tax-deductible, within limits. Contributions may include new shares of stock, company cash to buy existing shares or borrowed money to buy stock. If you borrow from an ESOP, both principal and interest paid back are deductible.

1.Exit without exercising stock options Employees who leave the organization before completing the vesting period forfeit the right to own any stock. Even if the contract offers a partial vesting option, and they do not complete any of the conditions, they still forfeit the rights to own the stock.

ESOP rules set a limit of 25% of salary as the maximum amount that can be contributed to a participant's account annually, though most companies contribute between 6-10% of salary annually. The 25% is a combined limit that includes ESOPs, 401(k)s, profit sharing, and stock bonus plans offered by the company.