New York Deferred Compensation Agreement by First Florida Bank, Inc. for Key Employees

Description

How to fill out Deferred Compensation Agreement By First Florida Bank, Inc. For Key Employees?

US Legal Forms - one of many largest libraries of legitimate types in the USA - offers a wide array of legitimate document templates you are able to down load or print out. Making use of the website, you can find thousands of types for company and person uses, categorized by groups, suggests, or key phrases.You can find the most recent variations of types much like the New York Deferred Compensation Agreement by First Florida Bank, Inc. for Key Employees in seconds.

If you already possess a membership, log in and down load New York Deferred Compensation Agreement by First Florida Bank, Inc. for Key Employees in the US Legal Forms local library. The Obtain button can look on every kind you see. You have access to all earlier delivered electronically types in the My Forms tab of your respective account.

If you wish to use US Legal Forms initially, listed here are basic recommendations to help you started off:

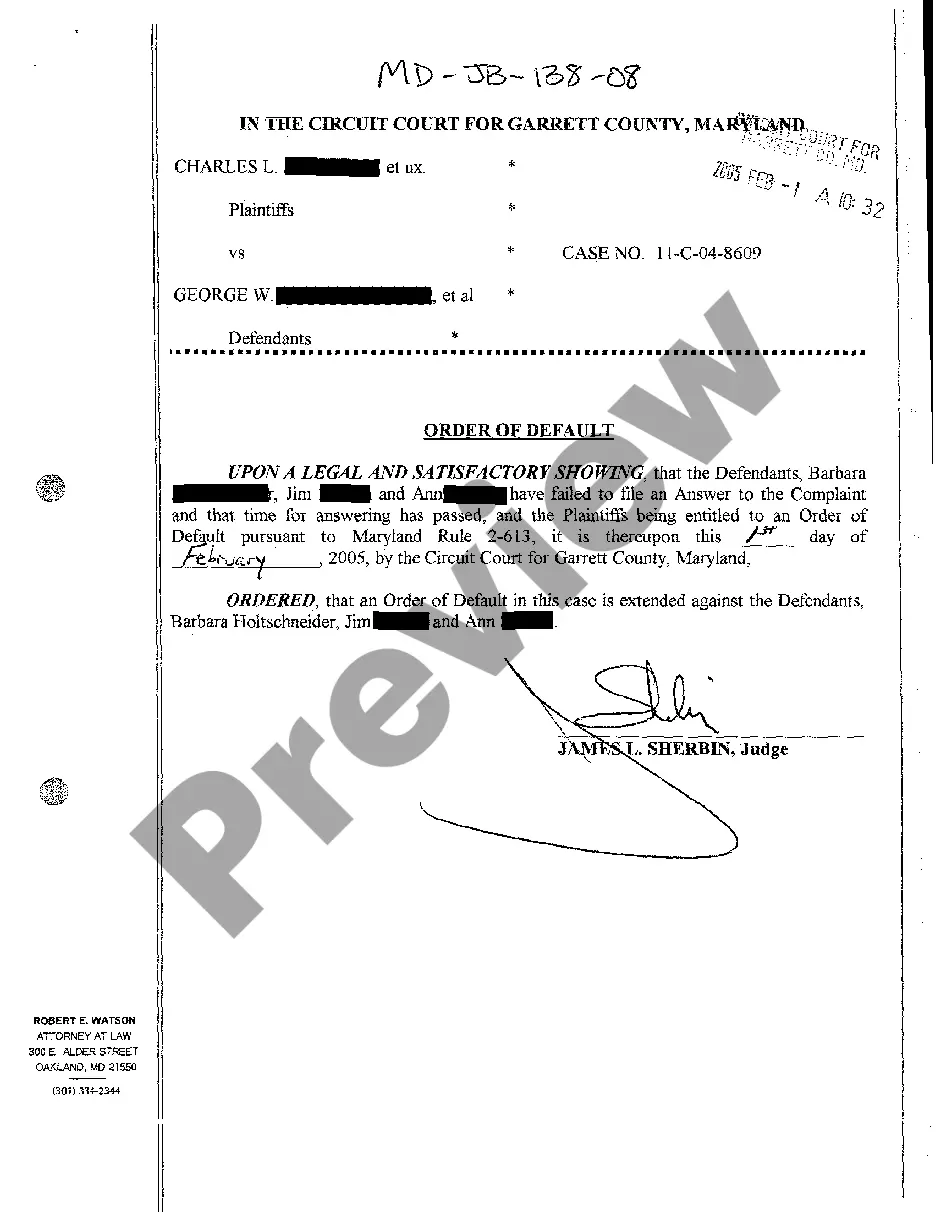

- Be sure you have picked the correct kind for the city/county. Click on the Preview button to analyze the form`s content. See the kind outline to actually have chosen the appropriate kind.

- In case the kind does not fit your needs, utilize the Look for area on top of the display to discover the one who does.

- If you are pleased with the form, confirm your option by clicking the Get now button. Then, pick the rates plan you want and offer your references to register for an account.

- Method the financial transaction. Utilize your Visa or Mastercard or PayPal account to perform the financial transaction.

- Find the format and down load the form on the device.

- Make modifications. Fill out, change and print out and indicator the delivered electronically New York Deferred Compensation Agreement by First Florida Bank, Inc. for Key Employees.

Each and every format you included in your account lacks an expiry day and is also the one you have permanently. So, if you would like down load or print out one more version, just visit the My Forms section and then click around the kind you want.

Obtain access to the New York Deferred Compensation Agreement by First Florida Bank, Inc. for Key Employees with US Legal Forms, probably the most substantial local library of legitimate document templates. Use thousands of skilled and state-certain templates that satisfy your organization or person needs and needs.

Form popularity

FAQ

Deferred compensation plans don't have required minimum distributions, either. Based upon your plan options, generally, you may choose 1 of 2 ways to receive your deferred compensation: as a lump-sum payment or in installments.

A 457(b) plan's annual contributions and other additions (excluding earnings) to a participant's account cannot exceed the lesser of: 100% of the participant's includible compensation, or. the elective deferral limit ($22,500 in 2023; $20,500 in 2022; $19,500 in 2020 and in 2021).

Deferred compensation plans are an incentive that employers use to hold onto key employees. Deferred compensation can be structured as either qualified or non-qualified under federal regulations. Some deferred compensation is made available only to top executives.

Section 457(b) of the Internal Revenue Code and related IRS Regulations govern public employer deferred compensation plans and outlines the general requirements to sponsor a plan, establishes the maximum salary amount that may be deferred in each year, when the employee has access to his or her salary deferrals, the ...

The Plan is a voluntary retirement savings plan offered by New York State and your employer, to allow public employees like you to put aside money from each paycheck toward retirement. The Plan can help bridge the gap between what you have in your pension and Social Security, and how much you'll need in retirement.

Your plan may allow you to schedule ?in-service? withdrawals or distributions so you can access your deferred income prior to retirement to meet other financial goals or obligations. For example, at different points over the years, you may want to buy a new home or pay your child's college expenses.

The New York City Deferred Compensation Plan (DCP) allows eligible New York City employees a way to save for retirement through convenient payroll deductions. DCP is comprised of two programs: a 457 Plan and a 401(k) Plan, both of which offer pre-tax and Roth (after-tax) options.

The Plan is a voluntary retirement savings plan offered by New York State and your employer, to allow public employees like you to put aside money from each paycheck toward retirement. The Plan can help bridge the gap between what you have in your pension and Social Security, and how much you'll need in retirement.