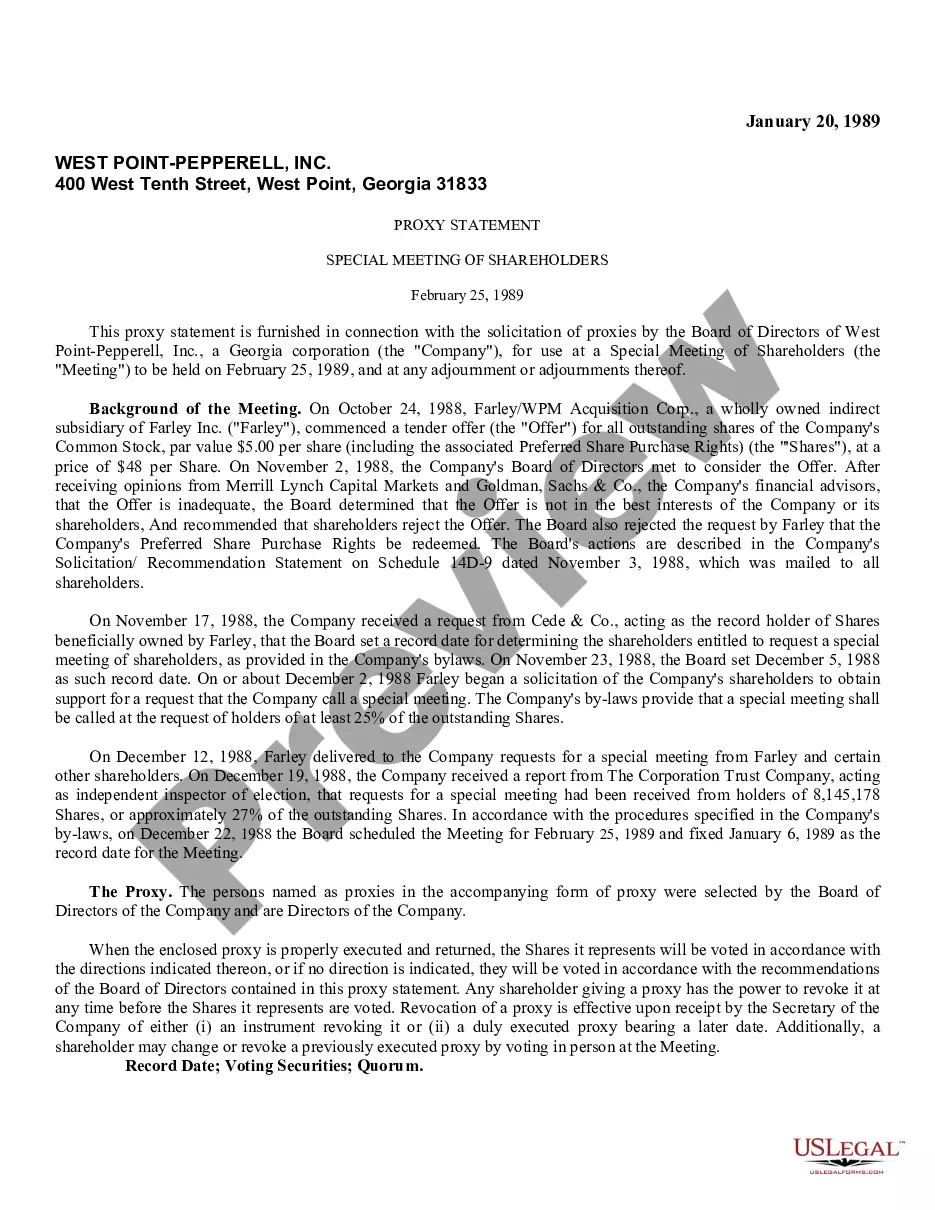

New York Proposal to Approve Adoption of Employees' Stock Option Plan

Description

How to fill out Proposal To Approve Adoption Of Employees' Stock Option Plan?

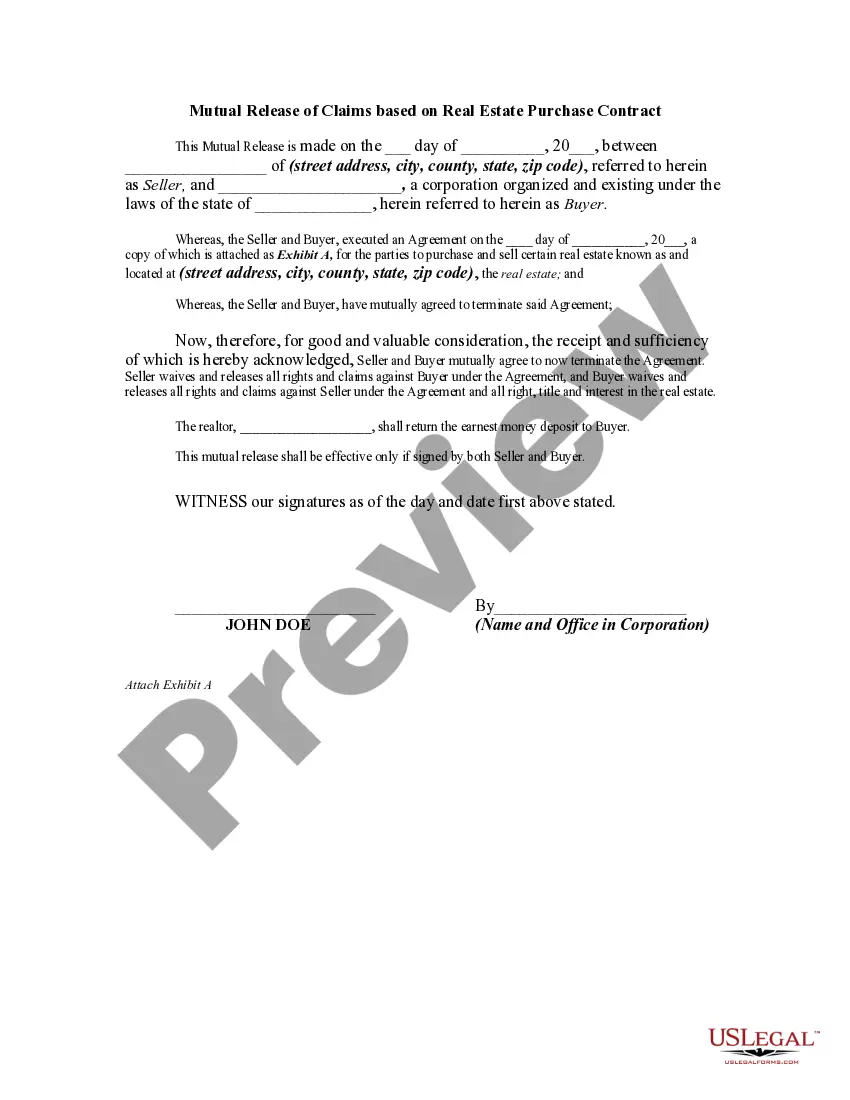

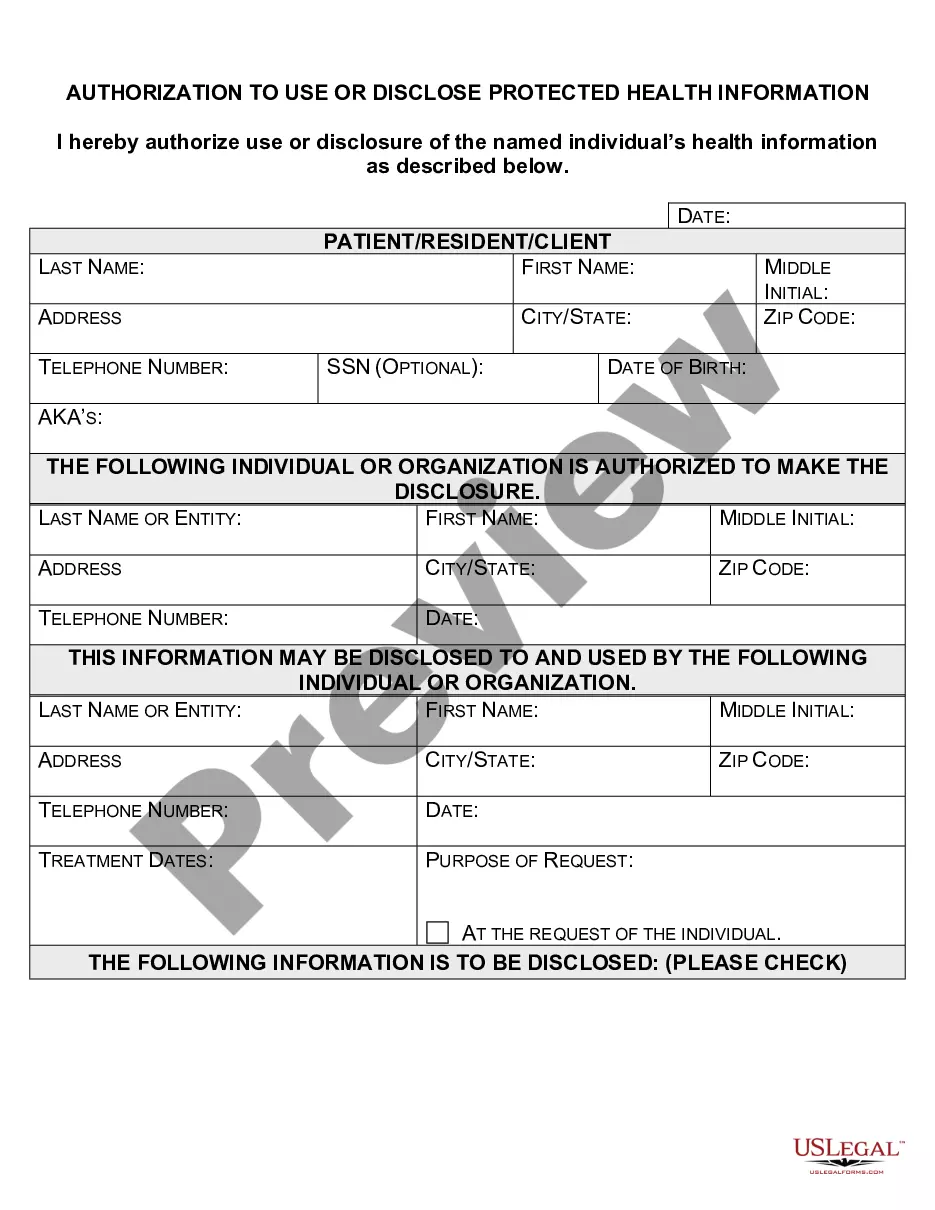

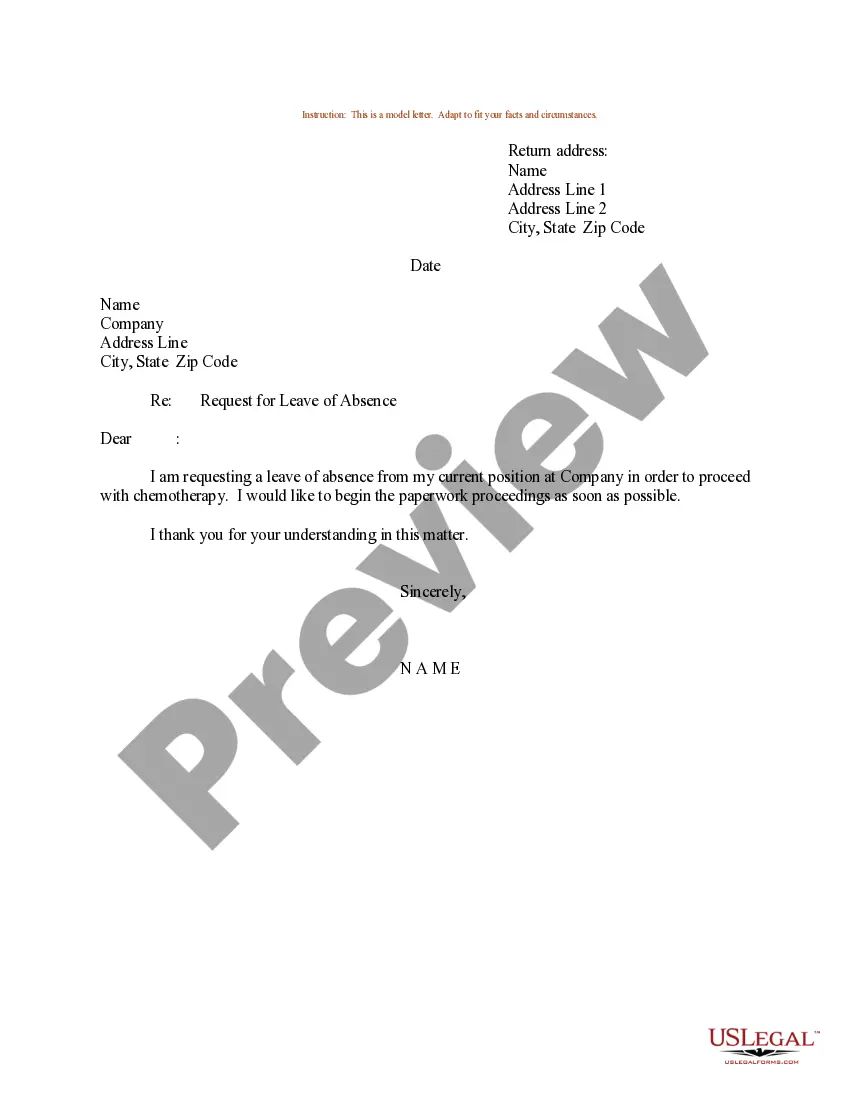

Finding the right authorized record design could be a have a problem. Naturally, there are tons of layouts accessible on the Internet, but how would you find the authorized kind you require? Use the US Legal Forms website. The support delivers 1000s of layouts, for example the New York Proposal to Approve Adoption of Employees' Stock Option Plan, which can be used for organization and personal requires. All the forms are checked by pros and meet up with federal and state requirements.

When you are already registered, log in to the bank account and click the Obtain key to get the New York Proposal to Approve Adoption of Employees' Stock Option Plan. Make use of your bank account to check throughout the authorized forms you may have ordered earlier. Visit the My Forms tab of your respective bank account and obtain an additional backup of your record you require.

When you are a fresh user of US Legal Forms, listed below are straightforward guidelines that you can comply with:

- Initial, ensure you have chosen the correct kind to your metropolis/region. It is possible to look through the shape making use of the Review key and study the shape outline to ensure this is the best for you.

- If the kind fails to meet up with your requirements, utilize the Seach discipline to discover the correct kind.

- Once you are certain the shape would work, click on the Buy now key to get the kind.

- Pick the prices program you would like and enter in the needed information. Create your bank account and pay for an order using your PayPal bank account or bank card.

- Choose the file format and download the authorized record design to the device.

- Full, edit and print and sign the acquired New York Proposal to Approve Adoption of Employees' Stock Option Plan.

US Legal Forms is definitely the largest library of authorized forms for which you can find a variety of record layouts. Use the company to download appropriately-manufactured documents that comply with status requirements.

Form popularity

FAQ

ESOP rules set a limit of 25% of salary as the maximum amount that can be contributed to a participant's account annually, though most companies contribute between 6-10% of salary annually. The 25% is a combined limit that includes ESOPs, 401(k)s, profit sharing, and stock bonus plans offered by the company.

Making ESO Offers Declare the type of stock options employees will receive (ISOs or NSOs). Explain the value in terms of the number of shares rather than the percentage of the company. State that the board must approve all stock option grant amounts before the offer letter becomes valid.

Also, exercising a stock option merely means an employee is purchasing stock, and stocks themselves don't generate tax liabilities ? selling them does. So, there are ordinary income tax and capital gains taxes to take into account, too.

The price that you will pay for those options is set in the contract that you signed when you started. You may hear people refer to this price as the grant price, strike price or exercise price. No matter how well (or poorly) the company does, this price will not change.

A stock option gives an investor the right, but not the obligation, to buy or sell a stock at an agreed-upon price and date. Learn more about how they work. Stock compensation refers to the practice of rewarding employees with stock options that will vest, or become available for purchase, at a later date.

The employee is under no obligation to purchase all or part of the number of shares noted in the option. The choice is theirs and they can normally purchase stock at any point during the time period between the offer and last exercise date.

There are two main ways to allocate options to your team: As a percentage of the salary - companies offer options to their team based on their salary, seniority, and type of role. As a percentage of the company - in this case, key people might get allocated a fixed % of the company's total equity.

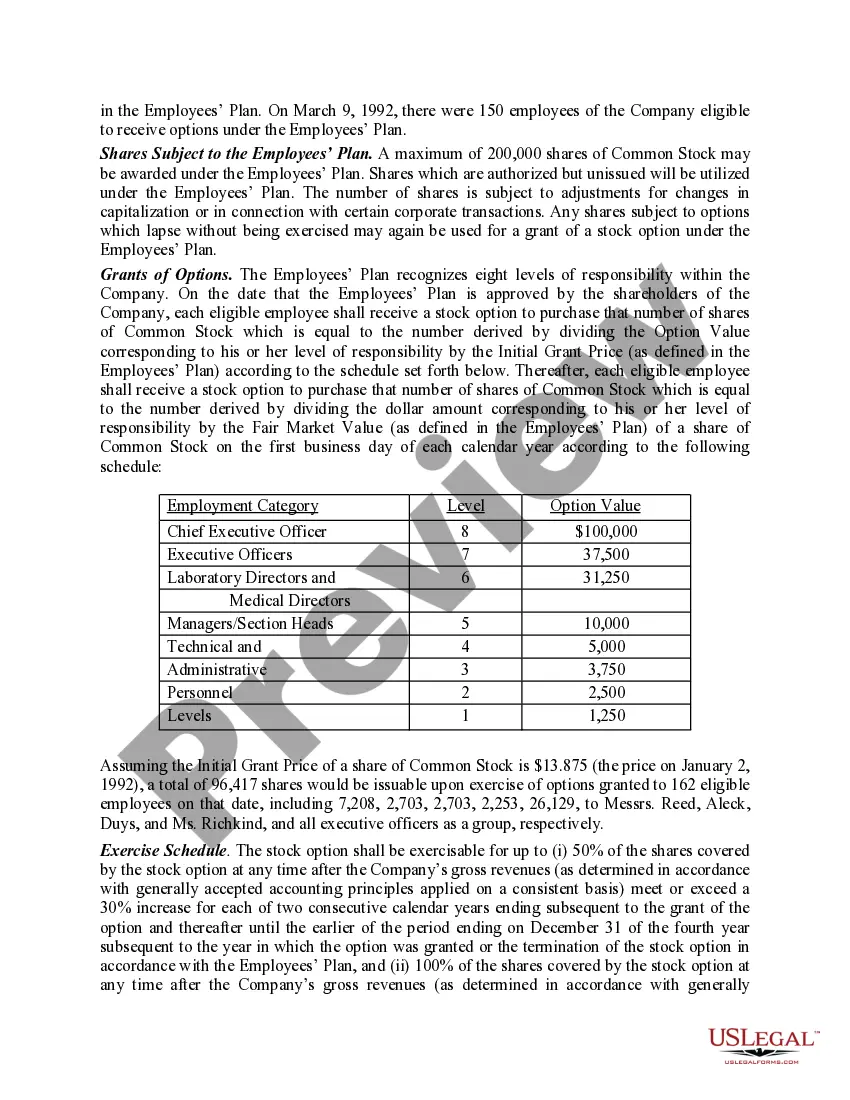

What is a stock option grant? Stock option grants are how your company awards stock options. This document usually includes details about: The type of stock options you'll receive (ISOs or NSOs) The number of shares you can purchase.