New York Creditors Holding Unsecured Priority Claims - Schedule E - Form 6E - Post 2005

Description

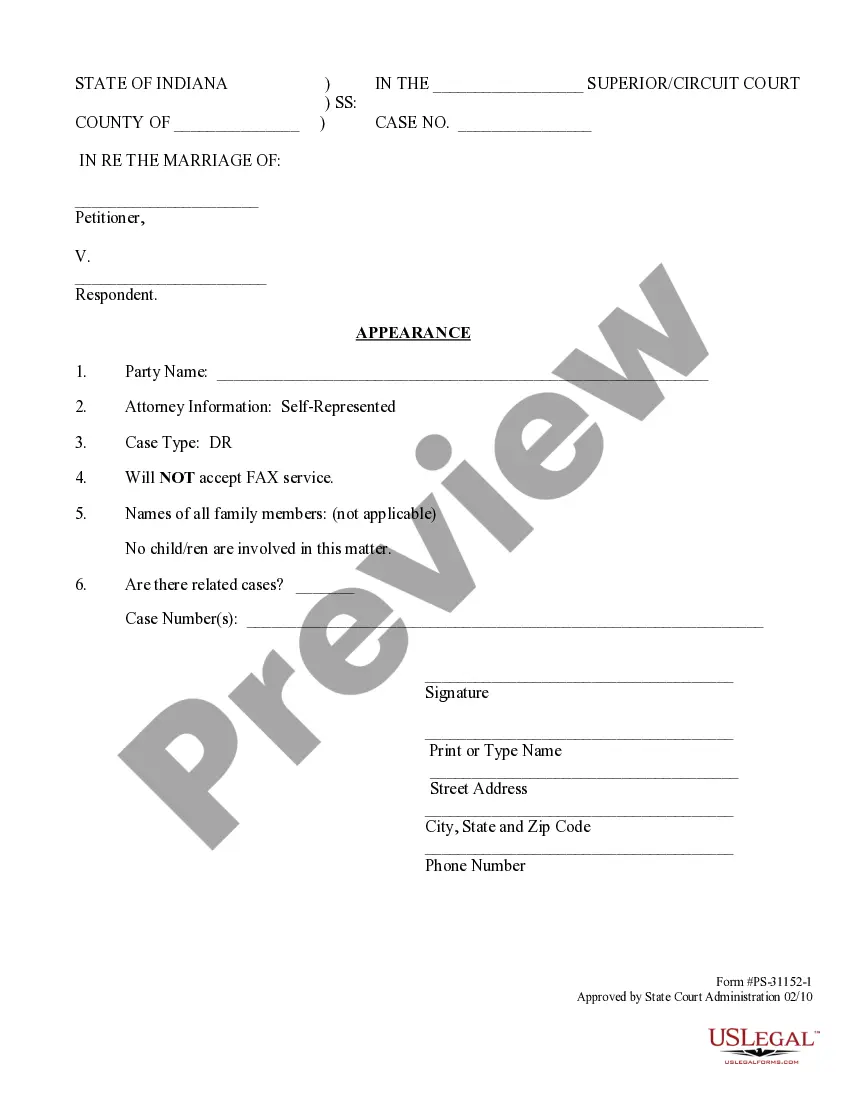

How to fill out Creditors Holding Unsecured Priority Claims - Schedule E - Form 6E - Post 2005?

Are you presently in the situation in which you require documents for sometimes enterprise or specific functions almost every working day? There are plenty of legitimate record templates available on the net, but locating versions you can rely on isn`t easy. US Legal Forms provides 1000s of form templates, like the New York Creditors Holding Unsecured Priority Claims - Schedule E - Form 6E - Post 2005, which are written to fulfill state and federal demands.

Should you be already knowledgeable about US Legal Forms site and possess a merchant account, just log in. Afterward, you are able to download the New York Creditors Holding Unsecured Priority Claims - Schedule E - Form 6E - Post 2005 format.

Unless you come with an account and would like to begin to use US Legal Forms, follow these steps:

- Get the form you want and ensure it is for your right metropolis/region.

- Make use of the Preview key to examine the shape.

- Read the explanation to actually have chosen the appropriate form.

- In case the form isn`t what you are seeking, utilize the Research industry to get the form that suits you and demands.

- Whenever you obtain the right form, just click Purchase now.

- Choose the prices plan you want, complete the desired details to create your money, and buy your order with your PayPal or bank card.

- Pick a handy document structure and download your backup.

Locate each of the record templates you may have bought in the My Forms food list. You may get a further backup of New York Creditors Holding Unsecured Priority Claims - Schedule E - Form 6E - Post 2005 at any time, if required. Just go through the needed form to download or print out the record format.

Use US Legal Forms, one of the most extensive collection of legitimate kinds, to save lots of efforts and stay away from mistakes. The service provides expertly manufactured legitimate record templates that can be used for a variety of functions. Produce a merchant account on US Legal Forms and begin generating your lifestyle easier.

Form popularity

FAQ

Priority Unsecured Debts Creditors with priority unsecured claims are treated differently from general unsecured creditors. Examples of bankruptcy priority claims include most taxes, alimony, child support, restitution, and administrative claims.

A creditor with an unsecured claim has a promise to pay from the borrower but doesn't have a lien. There are two types of unsecured claims: Priority unsecured claims. These debts aren't dischargeable in bankruptcy, and, if money is available, the claim will get paid before nonpriority unsecured claims.

In general, secured creditors have the highest priority followed by priority unsecured creditors. The remaining creditors are often paid prior to equity shareholders.

Secured creditors generally get priority, while unsecured creditors are paid pro-rata on their claims. The intent of Chapter 7 is to give the debtor a ?fresh start? and for the creditors to recover as much as they otherwise would've been able to under non-bankruptcy law.

Priority Unsecured Debts Examples of bankruptcy priority claims include most taxes, alimony, child support, restitution, and administrative claims. In a Chapter 7 asset case, priority claims receive payment in full before any payments to general unsecured creditors. Priority debts are nondischargeable.

Preferred creditors take priority for payment during bankruptcy, but unsecured creditors are less likely to be paid out any assets.

Under Chapter 11 procedures, Secured Creditors will receive payment before the next class of Creditors?those with unsecured claims. Secured claims can be oversecured, meaning the collateral is worth more than the debt, or undersecured, meaning the debt is worth more than the value of the collateral.

The Bottom Line In general, secured creditors have the highest priority followed by priority unsecured creditors. The remaining creditors are often paid prior to equity shareholders.