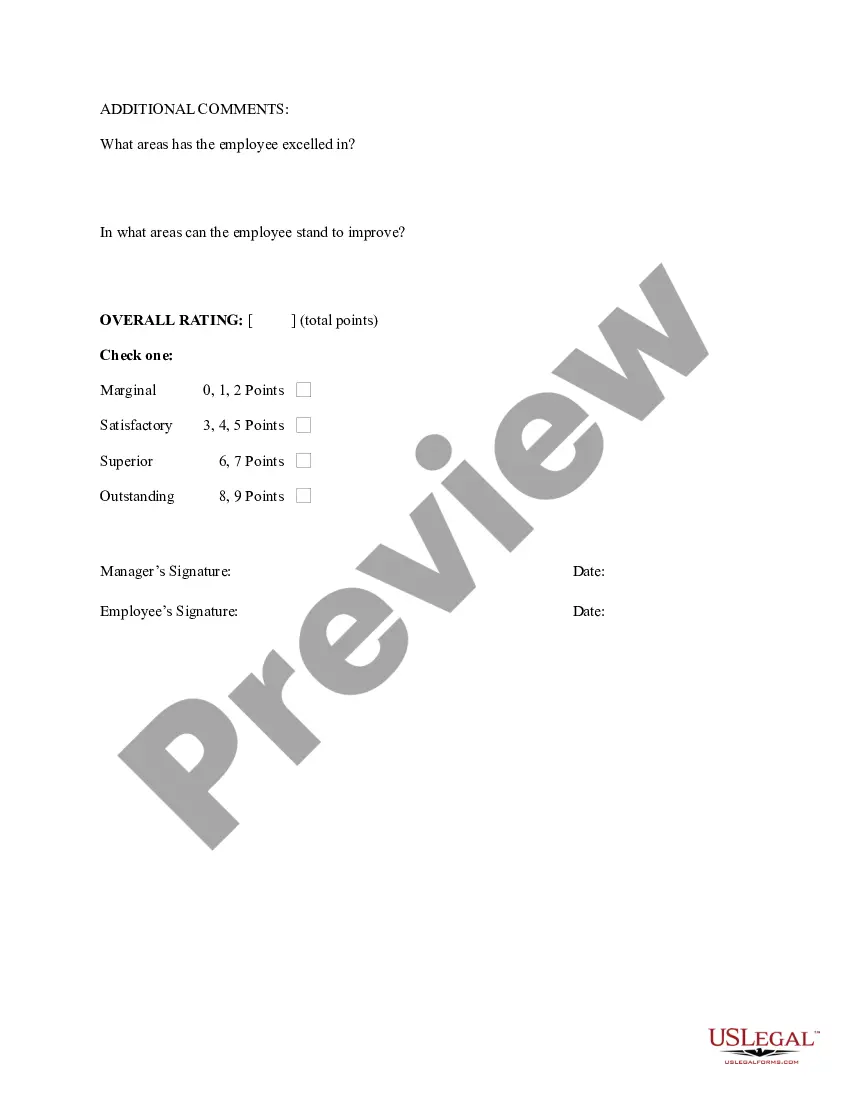

New York Hourly Employee Evaluation

Description

How to fill out Hourly Employee Evaluation?

Finding the appropriate legitimate document template can be a challenge.

Indeed, there are numerous templates accessible online, but how can you locate the specific document you require.

Utilize the US Legal Forms website.

First, make sure you have selected the appropriate form for your locality. You can preview the form using the Preview button and review the form description to ensure it is the correct one for you. If the form does not meet your needs, use the Search field to find the right form. Once you are confident the form is suitable, click the Buy now button to purchase it. Select the payment option you prefer and enter the necessary information. Create your account and pay for your order using your PayPal account or Visa or Mastercard. Choose the document format and download the legal document template to your device. Complete, edit, print, and sign the obtained New York Hourly Employee Evaluation. US Legal Forms is the largest collection of legal forms where you can find various document templates. Take advantage of the service to acquire professionally created documents that adhere to state requirements.

- The service offers a vast array of templates, such as the New York Hourly Employee Evaluation, which can be utilized for both business and personal purposes.

- All forms are verified by professionals and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to obtain the New York Hourly Employee Evaluation.

- Use your account to browse the legal forms you may have purchased previously.

- Visit the My documents tab of your profile to download an extra copy of the document you require.

- If you are a new user of US Legal Forms, here are simple steps to follow.

Form popularity

FAQ

Can employers decrease the salaries of their employees? Since salaries are based on contracts, employers cannot decrease the salaries unilaterally.

Unless you work under a collective bargaining agreement or an employment contract, your employer is generally allowed to cut your hours and pay. However, there are some situations in which reductions in work hours and pay are illegal.

Can they do this? Yes. If you are not in a union and do not have an employment contract, an employer may change the conditions of employment, including salary, provided that he or she pays at least the minimum wage and any required overtime, and continues to follow any other applicable laws.

So, can you legally reduce employee hours? Yes, it's legalso long as you can justify your need to do so. For the reduction in working hours, employment law does require you to provide a legitimate reason. And it's important to remember you keep your employees well informed during the process.

Nearly all covered employees are entitled to overtime pay for all hours worked beyond 40 hours in the workweek. For residential employees, entitlement to overtime pay occurs for all hours worked beyond 44 hours in the workweek.

An employer is generally not entitled to unilaterally impose on an employee a pay cut or reduced hours without your consent.

Generally, Employers define full-time Employees as those who work at least 35-40 hours during a seven-day workweek. Employers may choose to provide benefits, such as paid time off, only to full time Employees.

What a part-time worker is. A part-time worker is someone who works fewer hours than a full-time worker. There's no specific number of hours that makes someone full or part-time, but a full-time worker will usually work 35 hours or more a week.

The Wage Theft Prevention Act (WTPA) took effect on April 9, 2011. The law requires employers to give written notice of wage rates to each new hire. The notice must include: Rate or rates of pay, including overtime rate of pay (if it applies)

According to the IRS, an employee is considered full-time if they: Work 130 hours in a month -OR- Average a minimum of 30 hours per week.