North Carolina Triple-Net Office Lease of Commercial Building

Description

How to fill out Triple-Net Office Lease Of Commercial Building?

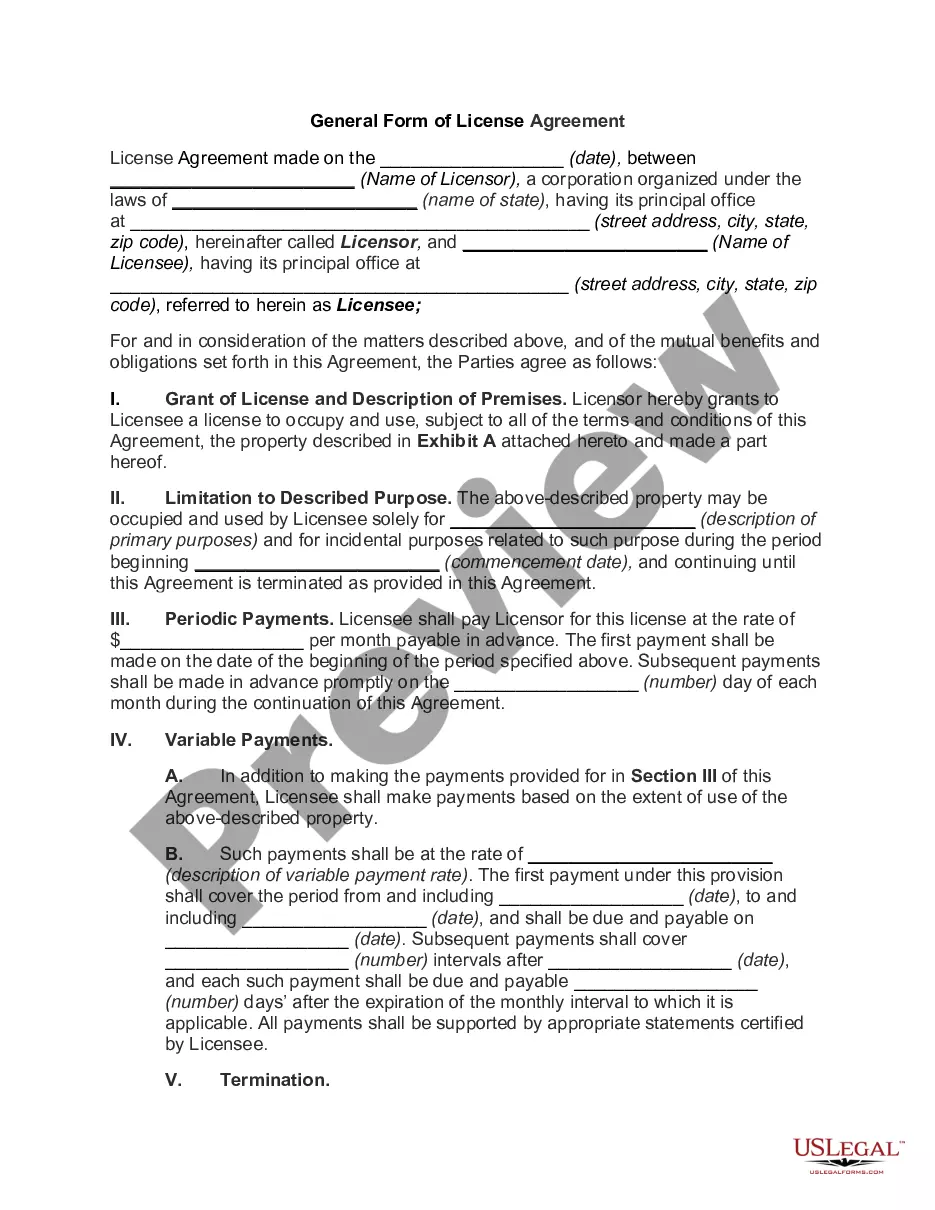

Choosing the best lawful papers template can be quite a struggle. Naturally, there are plenty of templates available on the Internet, but how will you obtain the lawful develop you need? Make use of the US Legal Forms web site. The services delivers a huge number of templates, including the North Carolina Triple-Net Office Lease of Commercial Building, which you can use for company and private requires. All of the types are examined by specialists and satisfy state and federal demands.

Should you be currently authorized, log in to the bank account and click on the Acquire option to find the North Carolina Triple-Net Office Lease of Commercial Building. Utilize your bank account to appear throughout the lawful types you might have bought earlier. Proceed to the My Forms tab of the bank account and have one more version of the papers you need.

Should you be a whole new consumer of US Legal Forms, here are straightforward recommendations for you to adhere to:

- Very first, make certain you have selected the proper develop for the town/state. It is possible to check out the shape making use of the Preview option and browse the shape outline to make sure it will be the best for you.

- In case the develop fails to satisfy your needs, make use of the Seach field to find the proper develop.

- Once you are certain that the shape would work, go through the Get now option to find the develop.

- Select the costs plan you desire and type in the essential information. Build your bank account and pay money for the transaction using your PayPal bank account or credit card.

- Select the document file format and acquire the lawful papers template to the device.

- Comprehensive, modify and produce and sign the attained North Carolina Triple-Net Office Lease of Commercial Building.

US Legal Forms is the largest local library of lawful types that you will find numerous papers templates. Make use of the service to acquire expertly-produced papers that adhere to express demands.

Form popularity

FAQ

With a triple net lease (NNN), the tenant agrees to pay the property expenses such as real estate taxes, building insurance, and maintenance in addition to rent and utilities. Triple net leases are commonly found in commercial real estate. Triple Net Lease (NNN) Meaning, Uses, and Benefits for Investors investopedia.com ? terms ? triple-net-lease-n... investopedia.com ? terms ? triple-net-lease-n...

How to calculate a triple net lease. For a triple net lease, the lessee must pay the base rent, property taxes, insurance, and common area maintenance (CAM) expenses. These charges are often lumped into one estimated annual rate that the lessee is required to pay. How to account for single, double, and triple net leases - Binary Stream binarystream.com ? blog ? how-to-account-for-si... binarystream.com ? blog ? how-to-account-for-si...

How do you calculate the triple net lease? The NNN lease is computed as the sum of base rent amount, property maintenance charges, tax, and insurance divided by the total number of months in the year, i.e., 12. Triple Net Lease - Meaning, Example, Sale, What is it? - WallStreetMojo wallstreetmojo.com ? triple-net-lease wallstreetmojo.com ? triple-net-lease

NNN leases are computed by multiplying the total annual property taxes and insurance for the area by the entire rental square footage of the building. When a whole building is leased to one tenant, the procedure of computing a triple net lease is simpler.

NNN ? Triple Net ?This type of lease rate includes the base rental rate plus the three N's. One ?N? stands for property taxes, one for property insurance, and the final ?N? stands for common area maintenance (CAMs).

The triple net (NNN) lease is a lease agreement structure where the tenant pays all of the operating expenses for the property. Therefore, they handle building insurance, property insurance, and real estate taxes on top of paying rent.

Triple net leases, though popular in commercial real estate, aren't without a few drawbacks. The main concern for a tenant is the higher monthly costs as opposed to those in double or single net lease structures.

Primary tabs. Triple net lease (NNN) is normally a commercial lease where the lessee pays rent and utilities as well as three other types of property expenses: insurance, maintenance, and taxes. triple net lease | Wex | US Law | LII / Legal Information Institute cornell.edu ? wex ? triple_net_lease cornell.edu ? wex ? triple_net_lease