New York Checklist for Proving Entertainment Expenses

Description

How to fill out Checklist For Proving Entertainment Expenses?

US Legal Forms - one of the most prominent collections of legal templates in the USA - offers a vast selection of legal document formats that you can download or print.

By using the site, you will access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can find the latest forms like the New York Checklist for Documenting Entertainment Expenses in no time.

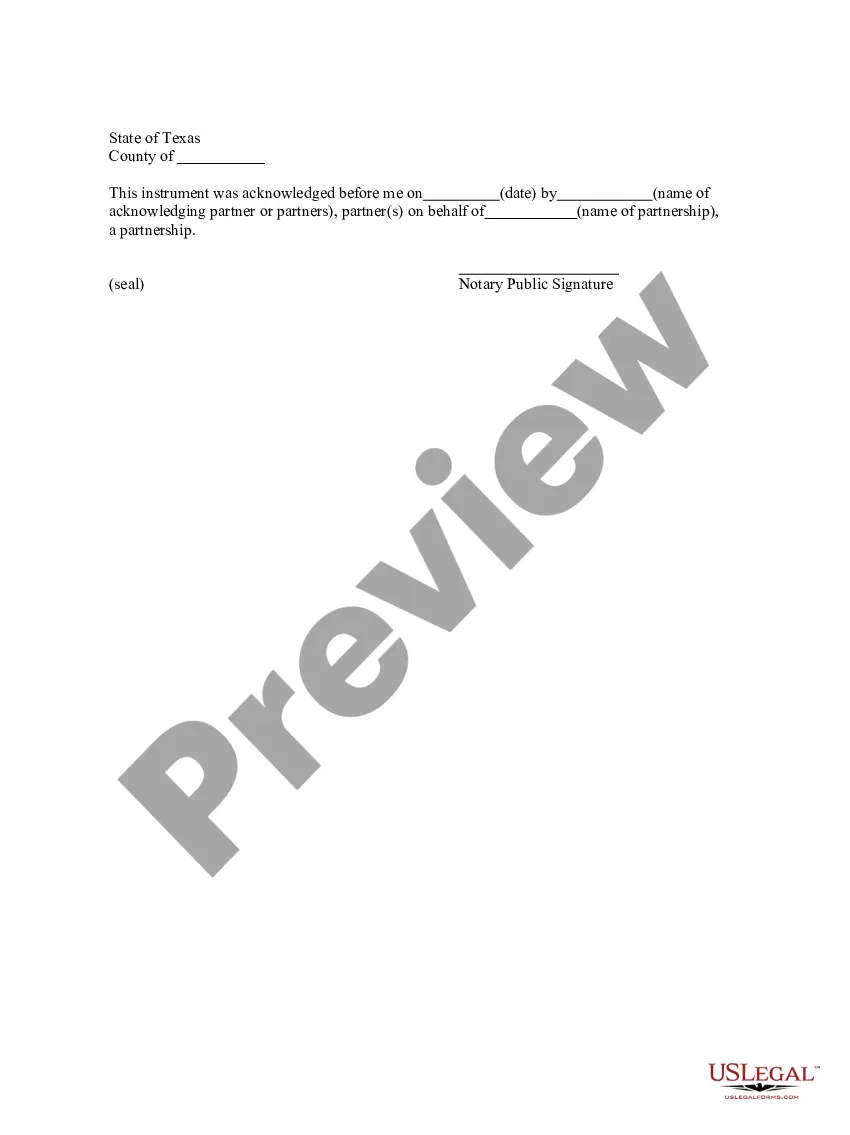

Click on the Preview button to review the form's content. Check the form details to confirm that you have selected the appropriate template.

If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

- If you already have an account, sign in and retrieve the New York Checklist for Documenting Entertainment Expenses from the US Legal Forms collection.

- The Download button will appear on every form you view.

- You can find all previously acquired forms in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are simple instructions to get you started.

- Ensure you have selected the correct form for your locality.

Form popularity

FAQ

When itemizing your tax return you will need to provide accurate records. Documents needed to itemize deductions need to prove the following: You paid the expenses during the year that you're itemizing. The expenses were deductible.

In an increasingly electronic world, taxpayers often have alternatives to receipts. Generally speaking, canceled checks, credit card transaction records and bills can be sufficient proof of an expense. Many people have online access to these records. You may also be able to access receipts for purchases made online.

Work-related expenses refer to car expenses, travel, clothing, phone calls, union fees, training, conferences and books. So really anything you spend for work can be claimed back, up to $300 without having to show any receipts.

Keep in mind, however, that expenses for entertainment, amusement, or recreation in the course of business are not deductible. For example, if you want to treat your client to dinner plus tickets to a show, only 50 percent of the meal expenses would be deductible.

Businesses can fully deduct the cost of: Office parties and outings held for the benefit of its employees (other than highly-compensated employees) Meals and entertainment provided to employees as compensation and reported as taxable wages. Meals provided by a restaurant.

Entertainment expenses include the cost of meals you provide to customers or clients, whether the meal alone is the entertainment or it's a part of other entertainment (for example, refreshments at a football game). A meal expense includes the cost of food, beverages, taxes, and tips.

Here's what you can still deduct:Gambling losses up to your winnings.Interest on the money you borrow to buy an investment.Casualty and theft losses on income-producing property.Federal estate tax on income from certain inherited items, such as IRAs and retirement benefits.More items...

If you choose to claim an expense without a receipt, make sure you have other proof of the transaction, either on a bank statement or as detailed notes. You need to be able to demonstrate that the expense is solely for business use, and the amounts have been recorded and calculated accurately.

Providing entertainment means: providing entertainment by way of food, drink or recreation....What is tax-exempt body entertainment?the cost of meals provided to employees in a staff cafeteria (not including social functions)the cost of meals at certain business seminars.meals on business travel overnight.

Documents for expenses include the following: Canceled checks or other documents reflecting proof of payment/electronic funds transferred. Cash register tape receipts....Documents for gross receipts include the following:Cash register tapes.Deposit information (cash and credit sales)Receipt books.Invoices.Forms 1099-MISC.